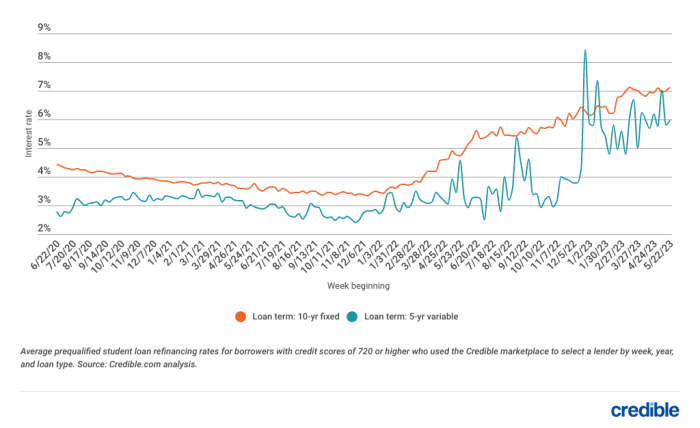

Navigating the world of student loan refinancing can feel overwhelming, especially when considering fixed interest rates. Understanding the nuances of fixed-rate refinancing is crucial for borrowers seeking to manage their debt effectively and potentially save money over the life of their loan. This guide explores the factors influencing these rates, compares lender offers, and provides strategies to help you secure the best possible terms. From assessing your creditworthiness and understanding the impact of loan amounts and repayment terms to comparing lenders and negotiating rates, we’ll equip you with the knowledge to make informed decisions. We’ll also delve into potential risks Read More …