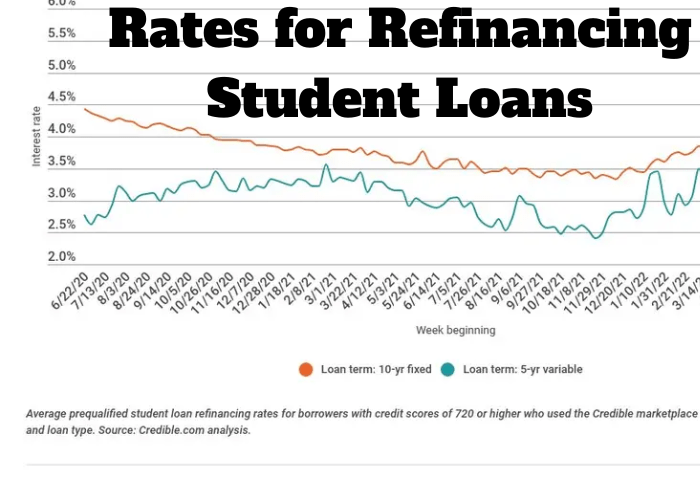

Navigating the landscape of student loan refinancing can feel overwhelming, especially with fluctuating interest rates. Understanding current rates is crucial for making informed decisions about your financial future. This guide explores the factors influencing these rates, helping you determine if refinancing is the right choice for your unique circumstances and potentially saving you thousands of dollars in interest over the life of your loan. We’ll delve into the various refinancing options available, comparing fixed versus variable interest rates, and examining the impact of loan amount and repayment terms on your monthly payments and overall cost. We’ll also address eligibility criteria, Read More …