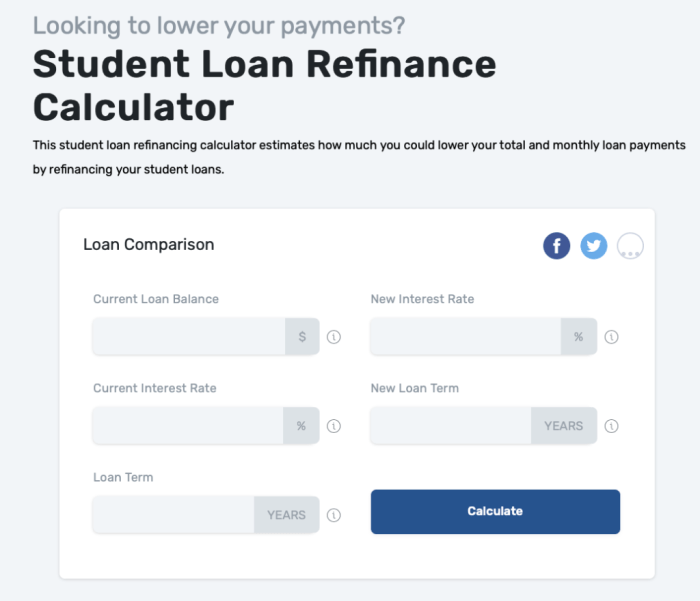

Navigating the complexities of student loan debt can feel overwhelming, but refinancing offers a potential pathway to lower monthly payments and faster debt repayment. This guide delves into the specifics of Citibank’s student loan refinancing program, examining eligibility requirements, interest rates, the application process, and the advantages and disadvantages compared to other lenders. We’ll explore various scenarios to illustrate the potential impact on your financial future. Understanding the nuances of refinancing is crucial for making informed decisions. This in-depth analysis will equip you with the knowledge necessary to determine if Citibank’s refinancing options align with your individual financial goals and Read More …