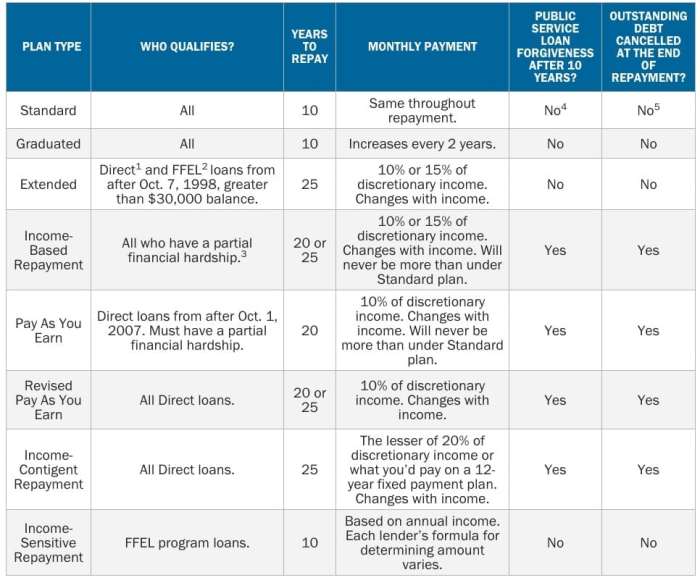

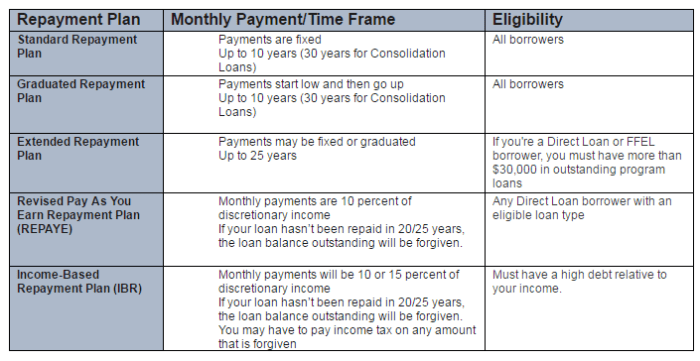

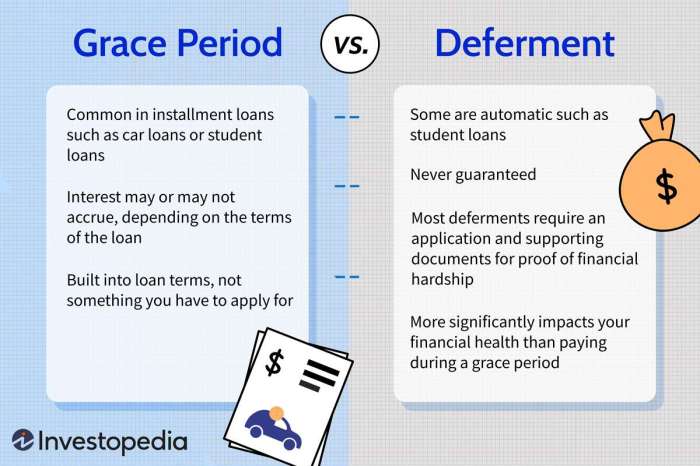

Navigating the complex world of student loan debt is a significant challenge for many, and Reddit provides a unique platform for borrowers to share their experiences, strategies, and concerns. This analysis delves into the collective sentiment surrounding student loan interest on Reddit, examining the prevalent themes, repayment approaches, and the impact of government policies. We explore both the financial and emotional repercussions of high interest rates, offering insights into the diverse perspectives and challenges faced by those grappling with student loan debt. From discussions on federal versus private loan options and their associated interest rates to the psychological toll of Read More …