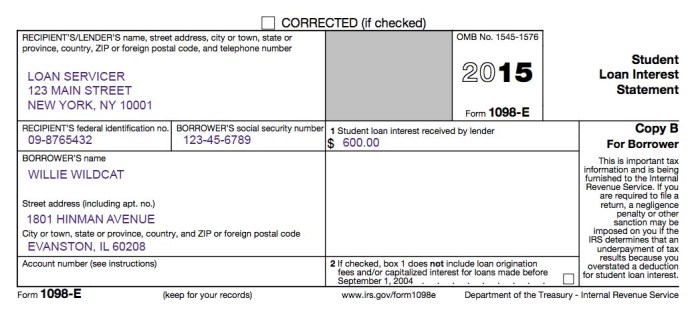

Navigating the complexities of student loan repayment is a significant undertaking for many. Understanding the tax implications, however, can significantly ease the burden. This guide delves into the intricacies of Form 1098-e, specifically focusing on the student loan interest deduction, providing clarity on eligibility, claiming the deduction, and the impact on various loan types and filing statuses. We’ll explore the nuances of this deduction, offering practical examples and addressing common questions to empower you with the knowledge needed to maximize your tax benefits. From deciphering the information presented on your 1098-e form to understanding the eligibility criteria and AGI limitations, Read More …