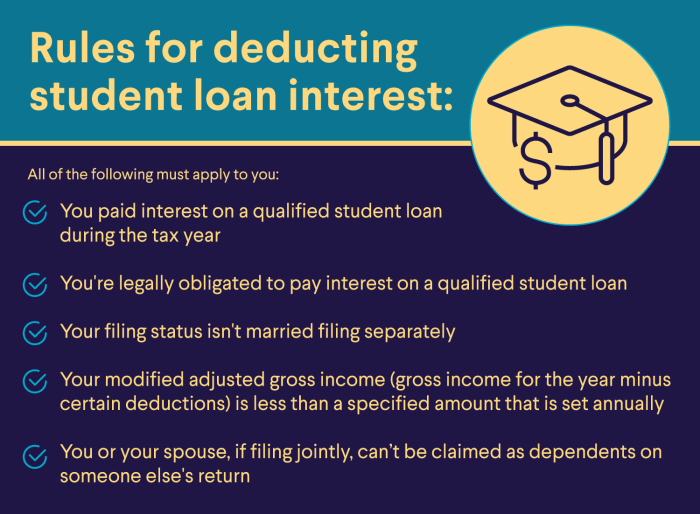

The student loan interest deduction, a seemingly straightforward tax break, reveals a complex landscape of limitations and eligibility requirements. Understanding these nuances is crucial for borrowers seeking to minimize their tax burden and effectively manage their student loan debt. This guide delves into the history, current limitations, and potential future of this vital deduction, providing clarity and insight for both current and prospective borrowers. From its inception, the student loan interest deduction has aimed to ease the financial strain of higher education. However, the ever-evolving landscape of federal tax policy has introduced significant changes, including income limitations and restrictions on Read More …