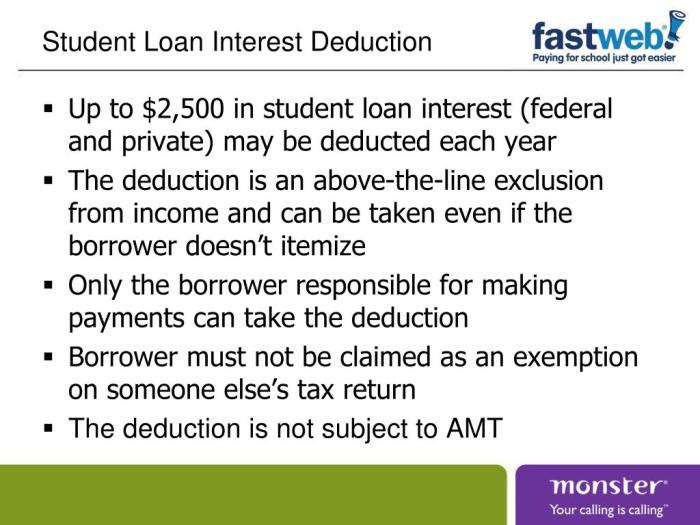

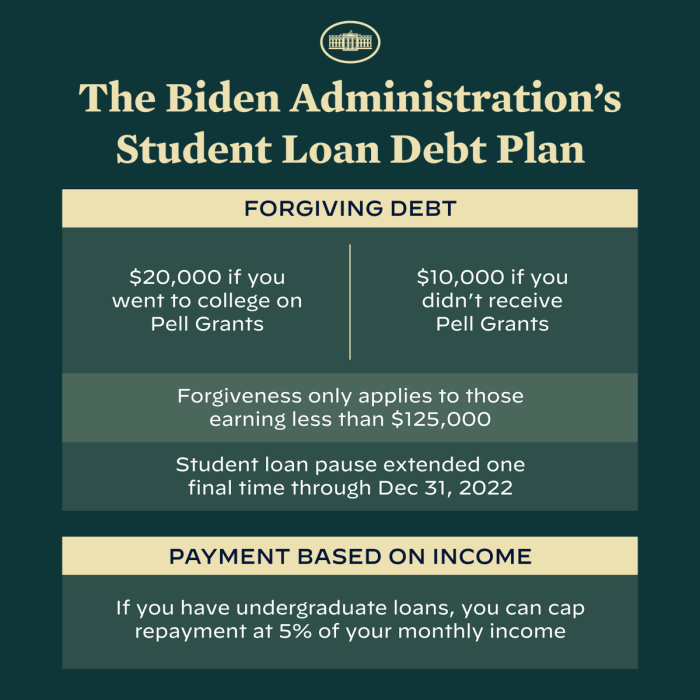

Navigating the complexities of higher education often involves significant student loan debt. However, understanding the often-overlooked tax benefits associated with these loans can significantly alleviate the financial burden. This guide delves into the various tax advantages available to student loan borrowers, from deductions on interest payments to the tax implications of loan forgiveness programs. We’ll explore strategies to maximize these benefits and minimize your tax liability, empowering you to make informed financial decisions. From the student loan interest deduction, a potentially valuable tax break for eligible borrowers, to the sometimes-unexpected tax consequences of loan forgiveness programs like Public Service Loan Read More …