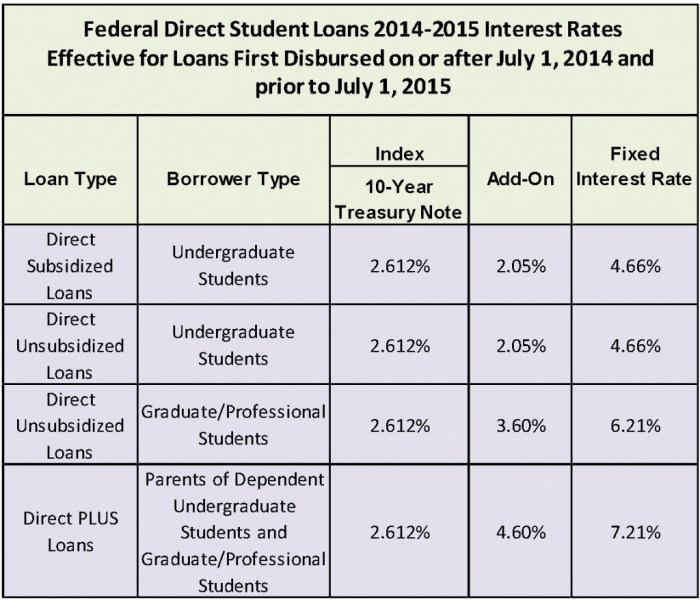

Navigating the world of student loans can feel overwhelming, especially when understanding the differences between federal and private options. This exploration delves into the specifics of Stafford Loans, clarifying their place within the federal student aid system. We’ll examine eligibility requirements, application processes, repayment plans, and how Stafford Loans compare to other federal loan programs. Understanding these nuances is crucial for making informed decisions about financing your education. The Stafford Loan program, a cornerstone of federal student financial assistance, offers a pathway to higher education for millions. This guide aims to demystify the process, providing a clear understanding of the Read More …