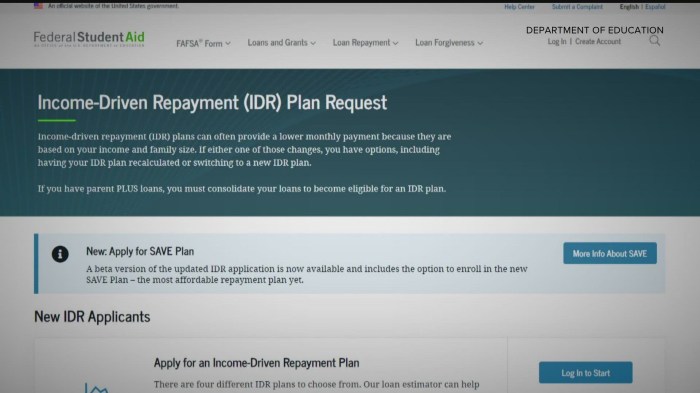

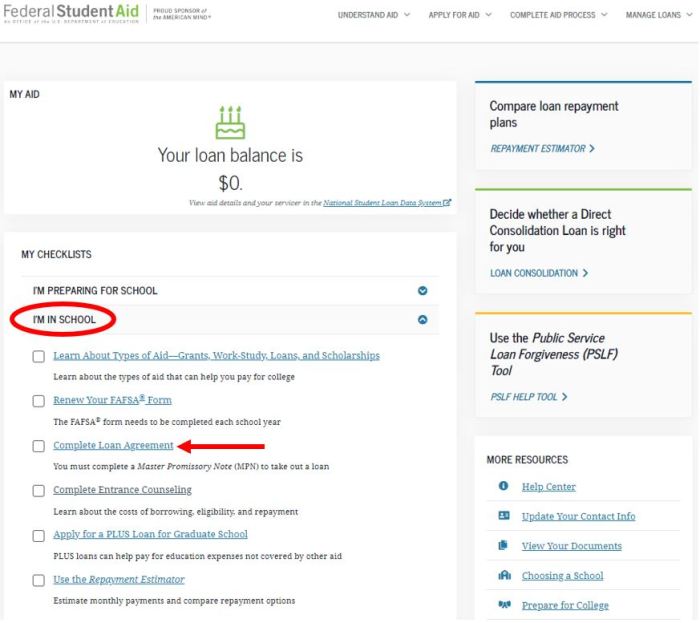

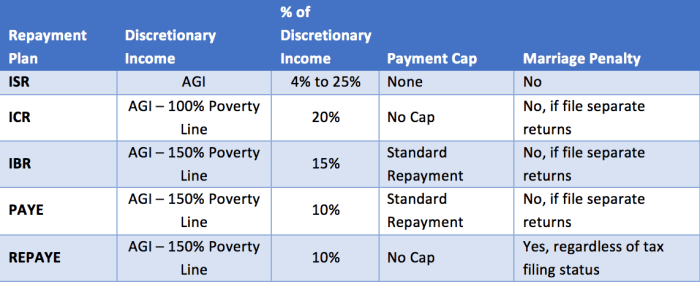

Navigating the complexities of higher education often involves the crucial decision of securing a student loan. While the prospect of debt can be daunting, student loans can unlock significant opportunities, paving the way for career advancement, personal growth, and improved financial well-being. This guide explores the multifaceted nature of student loans, examining both their potential benefits and inherent risks. We’ll delve into real-world examples, explore various loan types, and offer strategies for responsible borrowing and debt management. Understanding the true value of a student loan requires a balanced perspective. It’s not simply about the immediate financial burden but also the Read More …