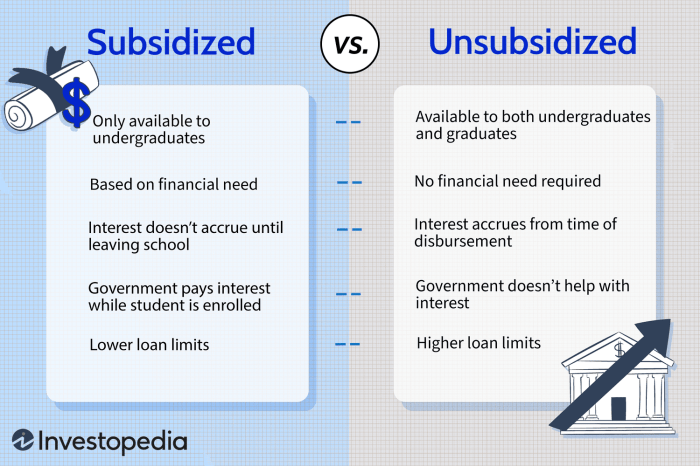

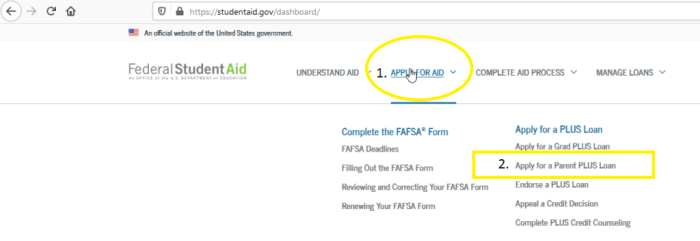

Navigating the world of student loans can be daunting, especially for students lacking a cosigner. The traditional reliance on a cosigner to secure a loan often leaves many feeling limited in their educational pursuits. This guide offers a comprehensive exploration of how to successfully obtain a student loan without a cosigner, addressing eligibility criteria, loan types, the application process, and effective debt management strategies. We’ll delve into the specifics, providing you with the knowledge to confidently pursue your educational goals. Understanding the nuances of cosigner-less loans is crucial for financial planning. This involves not only recognizing the eligibility requirements and Read More …