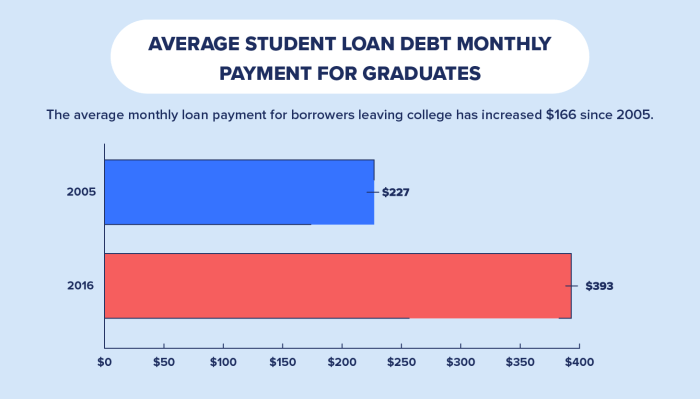

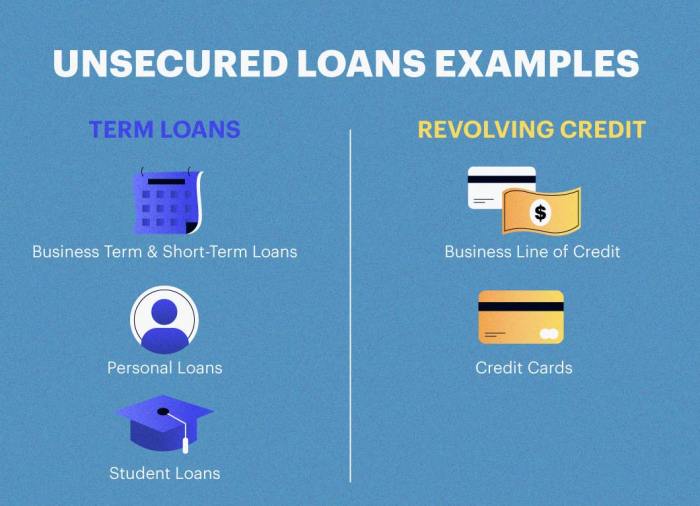

Navigating the complexities of higher education often involves the significant financial commitment of student loans. Understanding the intricacies of these loans is crucial for successful repayment and long-term financial well-being. This guide delves into the specifics of ACC student loan programs, offering a clear and concise overview to empower borrowers with the knowledge they need to make informed decisions. From exploring various loan types and eligibility criteria to mastering repayment strategies and understanding government regulations, we aim to provide a comprehensive resource. We’ll examine potential challenges, solutions for managing debt, and valuable resources to ensure financial literacy and responsible borrowing Read More …