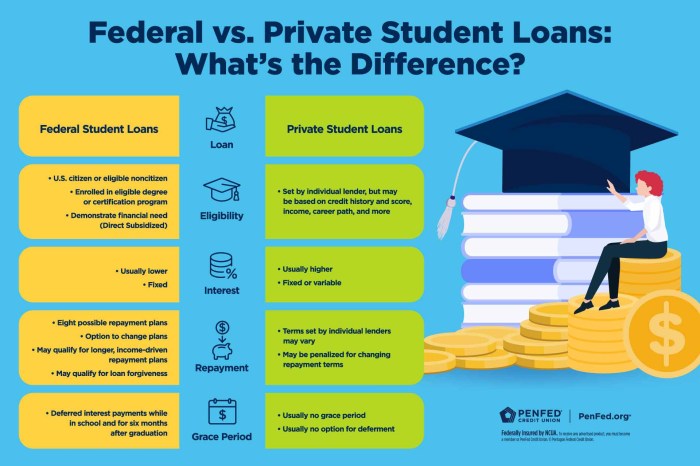

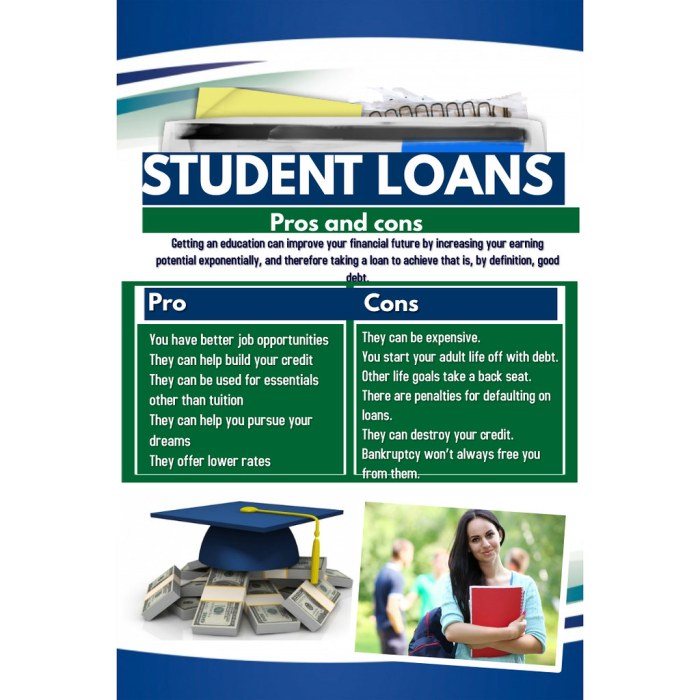

Navigating the complex world of student loans can feel overwhelming, especially with the myriad of options available. Understanding the differences between federal and private loans, the various repayment plans, and the potential for loan forgiveness is crucial for responsible borrowing and long-term financial well-being. This guide aims to demystify the process, providing a clear and concise overview of the different types of student loans and their implications. From subsidized and unsubsidized federal loans to the intricacies of private loan options and consolidation strategies, we’ll explore the key aspects to consider when planning for higher education financing. We’ll also address the Read More …

Tag: student loans

Undergraduate Student Loan Options Explained

Navigating the world of undergraduate student loans can feel overwhelming, a complex maze of federal programs, private lenders, and repayment plans. Understanding your options is crucial for securing your education without jeopardizing your financial future. This guide provides a clear and concise overview of the various loan types available, the application processes involved, and strategies for managing your debt effectively. We’ll explore the nuances of federal versus private loans, different repayment schedules, and even options for loan forgiveness. By the end, you’ll be better equipped to make informed decisions about financing your higher education. The path to a college degree Read More …

TD Bank Student Loan A Comprehensive Guide

Navigating the world of student loans can be daunting, but understanding your options is key to a successful educational journey. This guide delves into the specifics of TD Bank student loans, providing a comprehensive overview of interest rates, eligibility requirements, the application process, repayment options, and more. We’ll compare TD Bank’s offerings to those of other lenders, helping you make informed decisions about financing your education. From understanding eligibility criteria and navigating the application process to exploring various repayment plans and managing your loan effectively, we aim to equip you with the knowledge necessary to confidently manage your TD Bank Read More …

Subsidized vs Unsubsidized Student Loans

Navigating the world of student loans can feel overwhelming, especially when faced with the choice between subsidized and unsubsidized options. Understanding the nuances of each loan type is crucial for responsible financial planning and long-term success. This guide will illuminate the key differences, helping you make informed decisions about your educational financing. This exploration will delve into interest rates, eligibility criteria, repayment options, and the long-term financial implications of each loan type. We’ll examine how these loans affect your credit score and explore strategies for responsible repayment. By the end, you’ll have a clearer understanding of which loan best suits Read More …

Teachers Federal Credit Union Student Loans

Navigating the complexities of student loan financing can be daunting. This guide delves into the specifics of Teachers Federal Credit Union’s student loan offerings, providing a comprehensive overview to help you make informed decisions about your educational funding. We’ll explore various loan types, application processes, repayment options, and compare them to other lenders, including federal loan programs. Understanding these details empowers you to choose the best path towards achieving your educational goals. From eligibility requirements and interest rates to repayment plans and customer support, we aim to provide a clear and concise understanding of Teachers Federal Credit Union’s student loan Read More …

TransUnion Student Loan Credit Score Impact

Navigating the complexities of student loan debt can be daunting, especially when understanding its impact on your credit score. TransUnion, one of the three major credit bureaus, plays a significant role in how your student loan repayment history is reflected in your credit report. This guide provides a comprehensive overview of TransUnion’s student loan reporting practices, offering insights into how your loans affect your creditworthiness and strategies for effective debt management. From understanding how TransUnion collects and reports your student loan information to effectively disputing inaccuracies and leveraging student loan forgiveness programs, this resource equips you with the knowledge to Read More …

Student Loans With Low Credit A Guide

Securing student loans can be a daunting task, especially when faced with a less-than-perfect credit score. The path to higher education shouldn’t be blocked by financial hurdles, and this guide navigates the complexities of obtaining student loans with low credit. We’ll explore various options, strategies for managing debt, and resources to improve your financial standing. This comprehensive resource examines the impact of credit scores on loan eligibility, detailing the different types of loans available to those with lower credit. We’ll compare interest rates and terms, offer practical advice on credit improvement, and delve into alternative loan options, including government-backed programs Read More …

Student Loans to Pay for Housing

The soaring cost of housing presents a significant challenge for students, often forcing them to make difficult financial choices. Securing adequate shelter is crucial for academic success, yet the increasing gap between housing costs and student budgets is widening, leading many to consider student loans as a means to cover rent and utilities. This exploration examines the complexities of using student loans for housing, weighing the potential benefits against the long-term financial implications. This analysis will delve into the current trends in student housing costs, exploring the percentage of students relying on loans for housing expenses and comparing this to Read More …

Student Loans With No Credit and No Cosigner

Securing student loans can be challenging, especially for students lacking established credit or a cosigner. Traditional lenders often rely heavily on credit history and cosigner guarantees to assess risk. This absence can create significant hurdles for those starting their higher education journey without a financial safety net. This guide navigates the complexities of obtaining student loans under these circumstances, exploring alternative options and strategies to improve your chances of approval. We’ll delve into the intricacies of federal loan programs, comparing their eligibility requirements, application processes, and the advantages and disadvantages they offer. We’ll also discuss methods for building credit, exploring Read More …

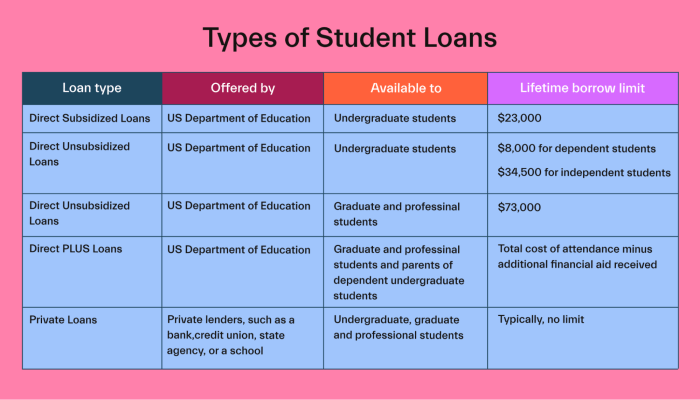

Student Loans Types A Comprehensive Guide

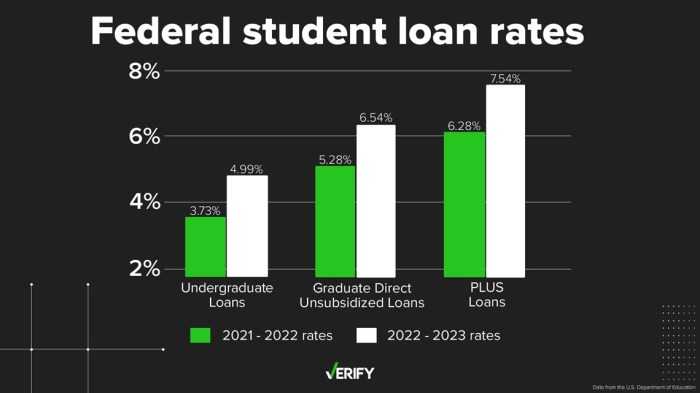

Navigating the complex world of student loans can feel overwhelming, but understanding the different types available is crucial for making informed financial decisions. From federal loan programs offering various repayment options to private loans with potentially higher interest rates, the landscape is vast. This guide aims to clarify the key distinctions between these loan types, helping you choose the best path for your educational journey and long-term financial well-being. This exploration will delve into the specifics of federal student loans, including Stafford, PLUS, and Perkins loans, examining their eligibility requirements, interest rates, and repayment plans. We’ll also contrast these with Read More …