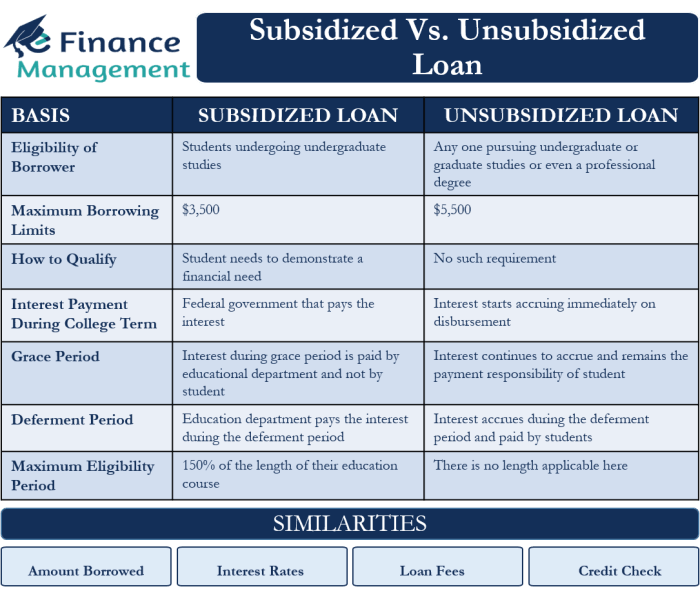

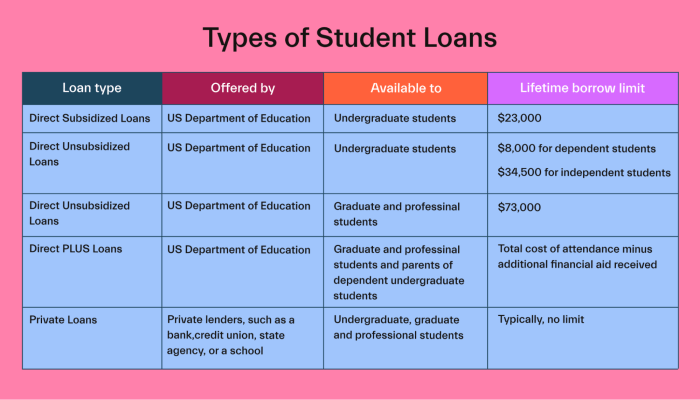

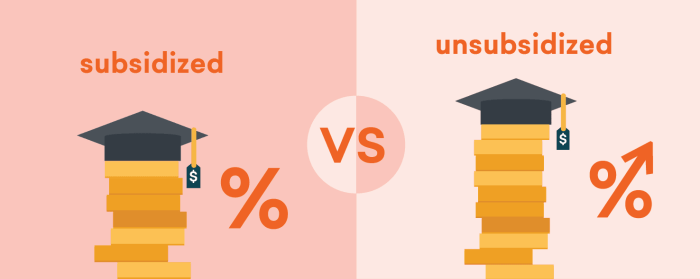

Navigating the world of student loans can feel overwhelming, especially when faced with the seemingly similar terms “subsidized” and “unsubsidized.” Understanding the key distinctions between these loan types is crucial for responsible financial planning during and after your education. This exploration will illuminate the core differences, empowering you to make informed decisions about your financial future. This guide will delve into the intricacies of subsidized and unsubsidized federal student loans, comparing interest rates, eligibility requirements, interest accrual, repayment options, loan forgiveness programs, and the impact on your credit score. By the end, you’ll possess a comprehensive understanding of how these Read More …

Tag: subsidized loans

Whats the Difference Between Subsidized and Unsubsidized Student Loans?

Navigating the complexities of student loans can feel overwhelming, especially when faced with the distinction between subsidized and unsubsidized options. Understanding these differences is crucial for making informed financial decisions that can significantly impact your future. This guide clarifies the key distinctions between these loan types, empowering you to choose the best path for your educational journey and long-term financial well-being. This exploration will delve into the nuances of interest rates, eligibility criteria, repayment plans, loan forgiveness programs, credit score implications, and comparisons with private loans. By the end, you’ll possess a comprehensive understanding of how subsidized and unsubsidized loans Read More …

What is the difference of subsidized and unsubsidized student loans?

Navigating the world of student loans can feel overwhelming, especially when faced with the terms “subsidized” and “unsubsidized.” Understanding the key distinctions between these loan types is crucial for responsible borrowing and long-term financial well-being. This guide will clarify the differences in eligibility, interest accrual, repayment options, and the overall impact on your financial aid package. Subsidized and unsubsidized federal student loans both offer financial assistance for higher education, but they differ significantly in how interest is handled and who is eligible. This comparison will delve into the specifics of each loan type, helping you make informed decisions about financing Read More …

What is the Difference in Subsidized and Unsubsidized Student Loans?

Navigating the world of student loans can feel overwhelming, especially when faced with the distinction between subsidized and unsubsidized options. Understanding the nuances of these loan types is crucial for responsible financial planning during and after your education. This guide will illuminate the key differences, helping you make informed decisions about your financial future. This exploration will cover eligibility criteria, interest rates and accrual, repayment options, government subsidies, the impact on credit scores, and potential loan forgiveness programs. By the end, you’ll have a clear understanding of which loan type best aligns with your individual circumstances and financial goals. Interest Read More …

What is the Difference in Subsidized and Unsubsidized Student Loans?

Navigating the world of student loans can feel overwhelming, especially when faced with the choices between subsidized and unsubsidized options. Understanding the nuances of each loan type is crucial for responsible financial planning during and after your education. This guide will illuminate the key differences, helping you make informed decisions that align with your financial goals. From interest rates and repayment schedules to eligibility criteria and government involvement, we’ll explore the critical aspects that distinguish subsidized and unsubsidized student loans. We will also examine the long-term impact on your credit score and explore various scenarios to illustrate the practical implications Read More …

Subsidized vs Unsubsidized Student Loans

Navigating the world of student loans can feel overwhelming, especially when faced with the choice between subsidized and unsubsidized options. Understanding the nuances of each loan type is crucial for responsible financial planning and long-term success. This guide will illuminate the key differences, helping you make informed decisions about your educational financing. This exploration will delve into interest rates, eligibility criteria, repayment options, and the long-term financial implications of each loan type. We’ll examine how these loans affect your credit score and explore strategies for responsible repayment. By the end, you’ll have a clearer understanding of which loan best suits Read More …

How Do Subsidized Student Loans Work?

Navigating the complexities of higher education often involves understanding the intricacies of student financing. Subsidized student loans, a cornerstone of federal financial aid, offer a crucial pathway to academic success for many. This guide unravels the mechanics of these loans, exploring eligibility, repayment options, and the broader economic implications, empowering you to make informed decisions about your educational journey. From understanding eligibility requirements based on income and academic level to navigating the application process and various repayment plans, this exploration aims to demystify the world of subsidized student loans. We will delve into the role of the federal government, explore Read More …

Subsidized vs. Unsubsidized Student Loans Key Differences

Navigating the world of student loans can feel overwhelming, especially when faced with the seemingly similar yet distinctly different options of subsidized and unsubsidized federal loans. Understanding the nuances between these loan types is crucial for responsible borrowing and minimizing long-term financial burdens. This exploration will illuminate the key distinctions, empowering you to make informed decisions about your educational funding. This guide will delve into the core differences between subsidized and unsubsidized federal student loans, examining interest rates, eligibility requirements, repayment options, credit impact, and the role of government subsidies. Through clear explanations and practical examples, we aim to provide Read More …

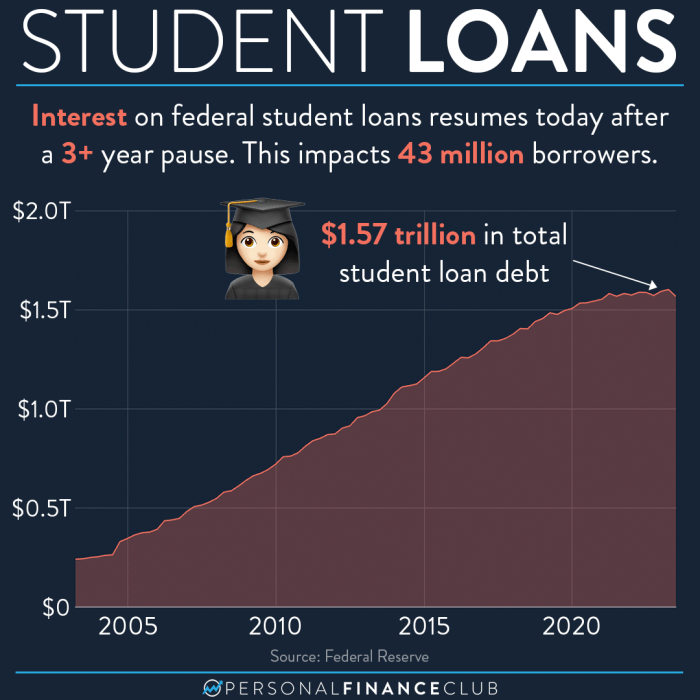

Where Does Student Loan Interest Go?

Navigating the complexities of student loan repayment can feel overwhelming, especially understanding where your interest payments actually go. This journey into the world of student loan interest will demystify the process, exploring how interest accrues, where it’s directed, and ultimately, how it impacts your overall repayment journey. We’ll examine the mechanics behind interest calculations, different loan types, and strategies to mitigate the financial burden. From understanding the role of your loan servicer to exploring the implications of interest capitalization and government subsidies, we aim to provide a comprehensive overview. This information empowers you to make informed decisions about your student Read More …

Unsubsidized Student Loan vs Subsidized A Comparison

Navigating the complexities of higher education often involves the crucial decision of choosing between subsidized and unsubsidized student loans. Understanding the nuances of each loan type is paramount to responsible borrowing and long-term financial well-being. This comparison delves into the key differences, helping students make informed choices that align with their individual financial circumstances and future goals. We’ll explore interest rates, eligibility requirements, repayment options, and the long-term impact on credit and overall financial health. The choice between these loan types significantly impacts your post-graduation financial landscape. Subsidized loans offer interest-free periods, making them more attractive for those who qualify, Read More …