Navigating the complexities of student loan repayment can feel overwhelming, particularly when considering deferment options. Understanding whether interest accrues during a deferment period is crucial for responsible financial planning. This exploration delves into the intricacies of deferred student loans, examining different deferment types, their eligibility criteria, and the significant impact of interest capitalization on your overall loan balance. This guide aims to clarify the often-confusing aspects of interest accrual on deferred student loans, providing practical examples and strategies to help you make informed decisions about your repayment plan. We will cover both subsidized and unsubsidized loans, highlighting the key differences Read More …

Tag: subsidized loans

Do Deferred Student Loans Accrue Interest?

Navigating the complexities of student loan deferment can be daunting. Understanding whether or not your deferred student loans accrue interest is crucial for responsible financial planning. This impacts not only your immediate financial situation but also your long-term debt burden. This guide will delve into the intricacies of interest accrual during deferment, exploring various loan types, influencing factors, and strategies for managing your debt effectively. The implications of interest capitalization, the consequences of unpaid interest, and the benefits of proactive management are all critical considerations. By understanding these elements, you can make informed decisions to minimize your financial liability and Read More …

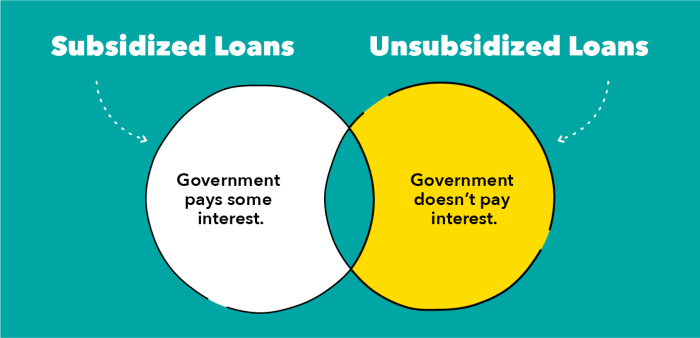

Subsidized vs. Unsubsidized Student Loans Key Differences

Navigating the world of student loans can be daunting, especially when faced with the choices between subsidized and unsubsidized options. Understanding the nuances of these loan types is crucial for responsible financial planning during and after your education. This guide will illuminate the key distinctions, helping you make informed decisions about your financial future. From interest rates and eligibility requirements to repayment plans and long-term credit implications, we will explore the practical differences between subsidized and unsubsidized federal student loans. We’ll delve into how these differences impact your overall borrowing costs and your credit score, equipping you with the knowledge Read More …

Do Graduate Students Get Subsidized Loans? A Comprehensive Guide

Navigating the complex world of graduate school financing can be daunting. A key question for many prospective students is whether subsidized federal loans are available. This guide delves into the intricacies of graduate student loan eligibility, exploring the various loan types, the role of graduate programs, and the impact of credit history. We’ll also examine alternative funding options and effective repayment strategies to help you make informed financial decisions for your graduate education. Understanding the differences between subsidized and unsubsidized loans is crucial for graduate students. While subsidized loans offer interest rate relief during schooling, eligibility criteria are more stringent Read More …

Understanding Subsidized Student Loan Interest Rates: A Comprehensive Guide

Navigating the complexities of higher education often involves understanding the financial landscape, and a crucial element of this is the subsidized student loan interest rate. This guide delves into the intricacies of these loans, explaining how interest rates are calculated, the factors influencing them, and their long-term implications for borrowers. We’ll explore the differences between subsidized and unsubsidized loans, compare them to other borrowing options, and provide practical examples to illustrate the financial impact of interest rate variations. From eligibility criteria and government regulations to the potential consequences of high versus low interest rates, this comprehensive overview aims to equip Read More …

Navigating the Maze: Subsidized or Unsubsidized Student Loans

The decision between subsidized and unsubsidized student loans is a pivotal one for prospective college students and their families. Understanding the nuances of each loan type is crucial for responsible financial planning and avoiding the potential pitfalls of overwhelming debt. This guide will dissect the key differences, eligibility requirements, and long-term implications of choosing between these two common funding options for higher education. From interest accrual during your studies to repayment plans and their impact on your credit score, we will explore the financial landscape of subsidized and unsubsidized student loans, empowering you to make informed decisions that align with Read More …

Student Loans: When Does Interest Start Accruing? A Comprehensive Guide

Navigating the complexities of student loans can feel overwhelming, especially understanding when those interest charges begin to mount. This guide delves into the intricacies of student loan interest accrual, exploring various loan types, grace periods, and factors influencing interest rates. We’ll demystify the process, empowering you to make informed decisions about your financial future. From the distinction between subsidized and unsubsidized federal loans to the impact of credit history on private loans, we’ll cover key aspects of interest calculation, deferment, and forbearance options. Understanding these elements is crucial for effective loan management and minimizing long-term debt burden. Types of Student Read More …

Understanding Interest on Subsidized Student Loans: A Comprehensive Guide

Navigating the complexities of student loan repayment can feel daunting, especially when understanding the nuances of subsidized loans. This guide delves into the intricacies of interest on subsidized student loans, providing clarity on how it accrues, the factors influencing rates, and strategies for effective management. We’ll explore the impact on long-term financial planning and examine relevant government policies. Understanding these aspects empowers borrowers to make informed decisions and achieve their financial goals. From the difference between subsidized and unsubsidized loans to the long-term implications of interest capitalization, we aim to provide a comprehensive resource for anyone seeking to navigate the Read More …

Securing Your Education: A Guide to Federal Student Loans Without a Cosigner

Navigating the world of higher education financing can be daunting, especially when securing a cosigner for student loans proves challenging. This guide delves into the intricacies of obtaining federal student loans without the need for a cosigner, outlining eligibility criteria, available loan types, the application process, and effective management strategies. We’ll explore the various paths available to fund your education independently and empower you to make informed financial decisions. Understanding the nuances of federal student loan programs is crucial for prospective students. This comprehensive resource aims to demystify the process, providing clear explanations and practical advice to help you successfully Read More …

Understanding Federal Subsidized Stafford Student Loans: A Comprehensive Guide

Navigating the complexities of higher education financing can feel daunting, especially when confronted with the intricacies of federal student loan programs. This guide aims to demystify the Federal Subsidized Stafford Student Loan, a crucial financial aid option for millions of students pursuing higher education. We’ll explore eligibility criteria, interest rates, repayment plans, and the crucial implications of the government subsidy, providing a clear and concise understanding of this vital resource. From understanding the application process and loan limits to managing repayment and avoiding the pitfalls of default, we’ll cover all the essential aspects. This comprehensive overview will empower you to Read More …