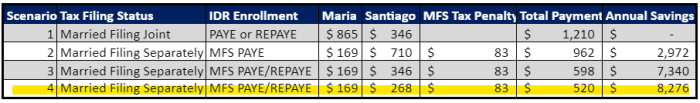

Navigating the complexities of student loan repayment and tax filing can feel overwhelming, especially when considering the implications of filing jointly versus separately. The decision of whether to file separate tax returns while managing student loan debt significantly impacts your tax liability, eligibility for repayment plans, and even future financial aid opportunities. This guide explores the multifaceted considerations involved in making this crucial decision. Understanding your income, debt, and repayment plan is paramount. Your spouse’s income, your student loan debt amount, and the type of repayment plan you’re on all play a role in determining the most advantageous filing status. Read More …