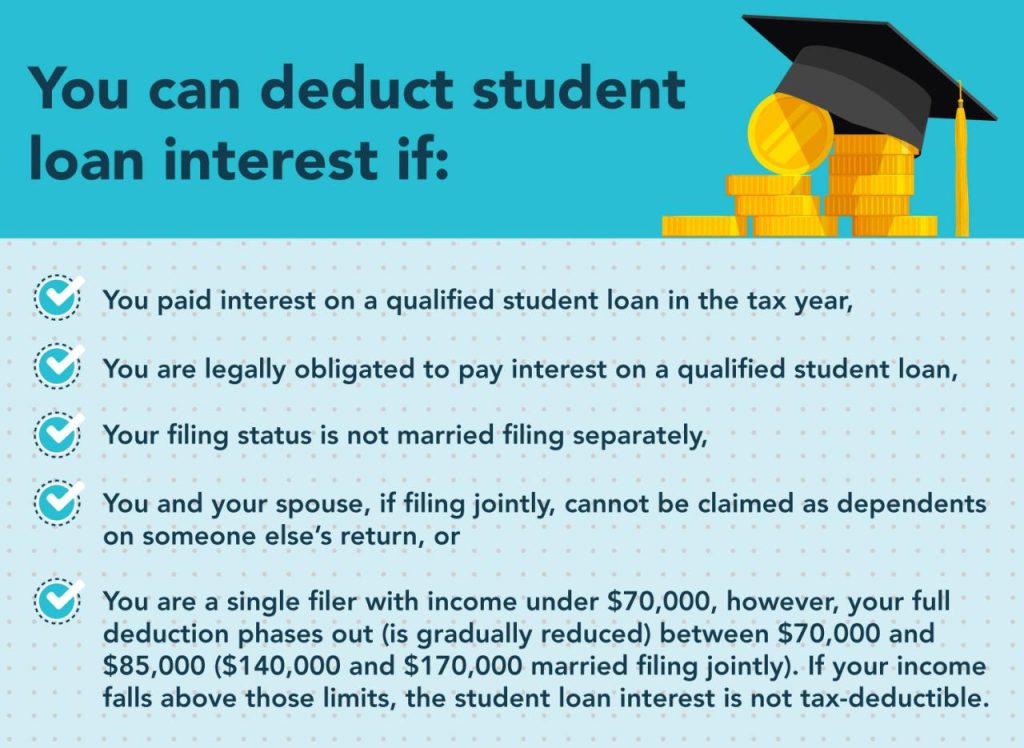

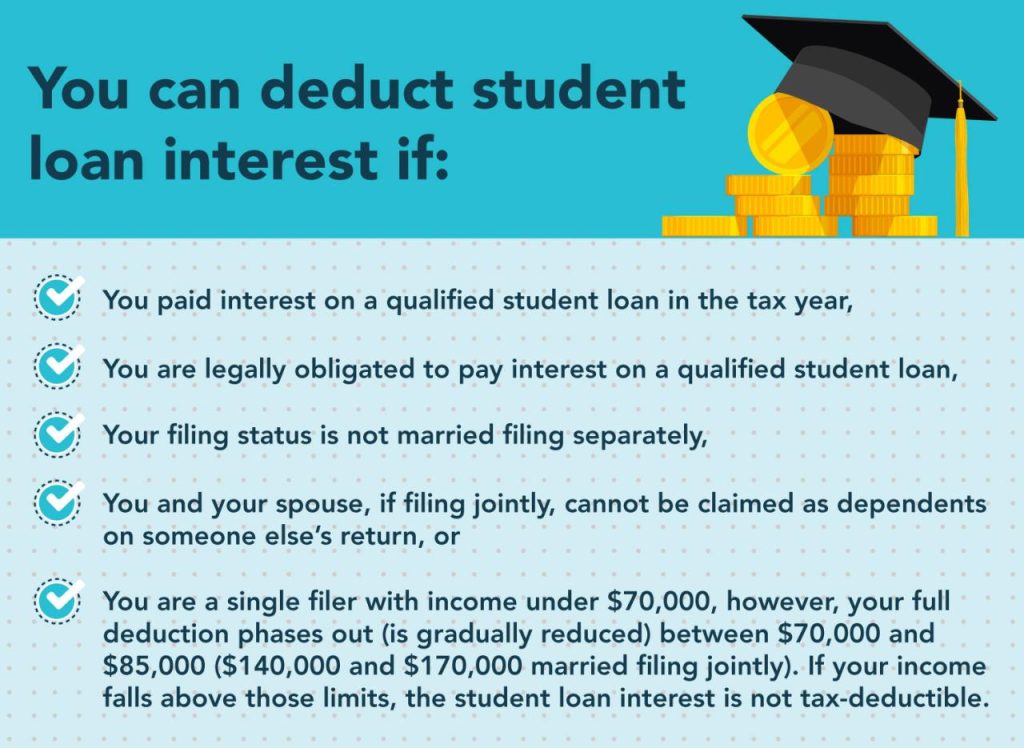

Navigating the complexities of student loan repayment often leaves borrowers questioning the intricacies of tax implications. Understanding Form 1098-E, the document reporting your student loan interest payments, is crucial for accurately filing your taxes and potentially claiming valuable deductions. This guide unravels the mysteries surrounding student loan interest, the 1098-E form, and how it impacts your financial well-being. From deciphering the information on your 1098-E to maximizing the student loan interest deduction, we’ll cover key aspects like repayment strategies, refinancing implications, and essential record-keeping practices. By the end, you’ll be equipped with the knowledge to confidently manage your student loan Read More …