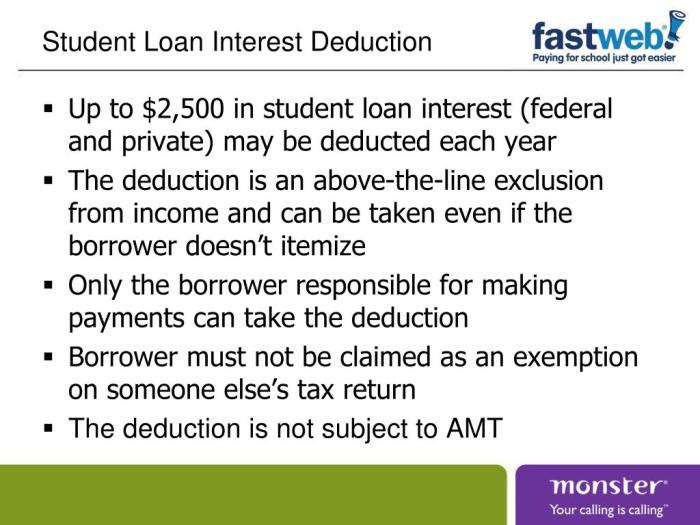

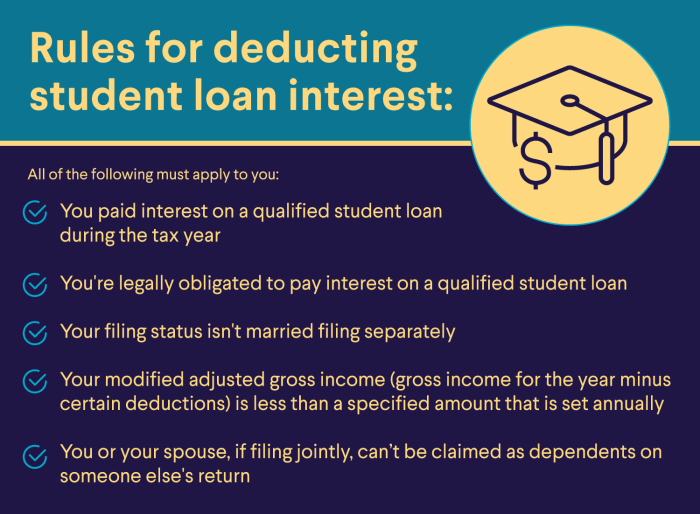

Navigating the complexities of student loan repayment can feel overwhelming, but understanding the potential tax benefits can significantly ease the burden. The student loan interest deduction offers a valuable opportunity to reduce your tax liability, potentially saving you hundreds or even thousands of dollars. This guide provides a clear and concise explanation of the eligibility requirements, calculation methods, and filing procedures associated with this crucial tax break. This deduction isn’t a one-size-fits-all solution; eligibility hinges on factors such as your modified adjusted gross income (MAGI) and the type of student loan you hold. We’ll explore these criteria in detail, providing Read More …