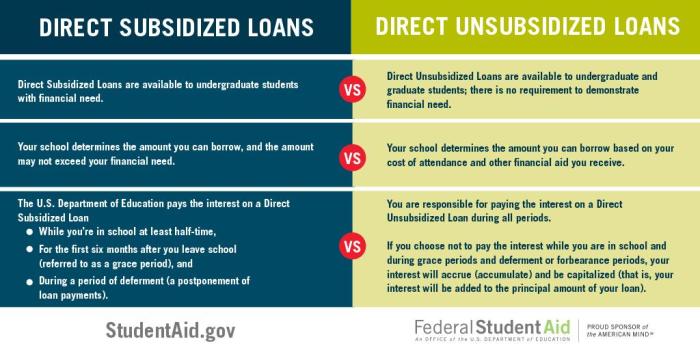

Navigating the world of student loans can feel overwhelming, especially when faced with the intricacies of unsubsidized loans. Understanding how these loans function—from eligibility requirements to repayment options—is crucial for responsible financial planning during and after your education. This guide will demystify the process, providing a clear understanding of unsubsidized federal student loans and equipping you with the knowledge to make informed decisions about your financial future. This exploration will cover key aspects, including eligibility criteria, interest accrual, loan limits and fees, the potential consequences of default, and a comparison with private loan options. We’ll also delve into the application Read More …