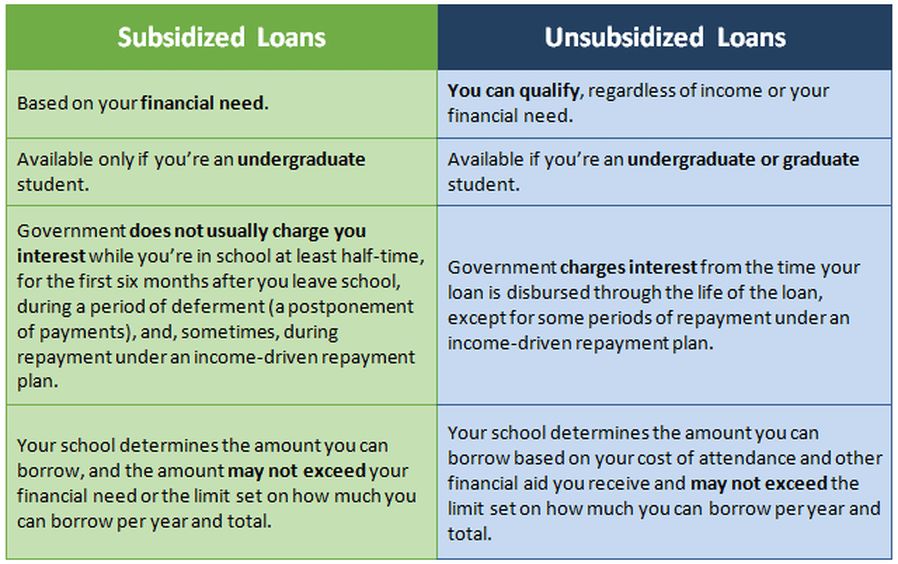

Navigating the world of higher education financing can be daunting, especially when securing a cosigner for student loans proves challenging. This guide delves into the intricacies of obtaining federal student loans without the need for a cosigner, outlining eligibility criteria, available loan types, the application process, and effective management strategies. We’ll explore the various paths available to fund your education independently and empower you to make informed financial decisions. Understanding the nuances of federal student loan programs is crucial for prospective students. This comprehensive resource aims to demystify the process, providing clear explanations and practical advice to help you successfully Read More …