Navigating the complexities of student loan repayment can feel daunting, especially when understanding how interest accrues. This guide demystifies the student loan interest formula, breaking down the calculations and factors that influence your total repayment amount. We’ll explore both simple and compound interest, examining how different interest rates, loan terms, and repayment plans impact your overall debt. Understanding these concepts empowers you to make informed decisions about your financial future. From fixed versus variable interest rates to the effects of capitalization and various repayment strategies, we provide a comprehensive overview. We’ll equip you with the knowledge to calculate interest manually, Read More …

Tag: variable interest rate

How Is Interest Calculated Student Loan?

Understanding how interest is calculated on student loans is crucial for responsible financial planning. The seemingly simple process involves several key factors, including the type of interest rate (fixed or variable), the method of calculation (simple or compound), and the chosen repayment plan. Navigating these elements empowers borrowers to make informed decisions, potentially saving significant money over the loan’s lifespan. This guide will unravel the complexities of student loan interest calculations, providing a clear understanding of the factors influencing your repayment journey. From the initial loan disbursement to the final payment, interest significantly impacts the total cost. This exploration will Read More …

Is Student Loan Interest Rate Monthly or Yearly?

Understanding how student loan interest is calculated is crucial for effective financial planning. The seemingly simple question of whether interest accrues monthly or yearly significantly impacts the total amount you’ll repay. This exploration delves into the intricacies of student loan interest, examining different interest rate types, repayment plans, and the factors influencing the overall cost of borrowing. We’ll unpack the differences between simple and compound interest, illustrating how these calculations affect your loan balance over time. We will also compare fixed versus variable interest rates, showing how these choices can lead to vastly different outcomes depending on market fluctuations. Finally, Read More …

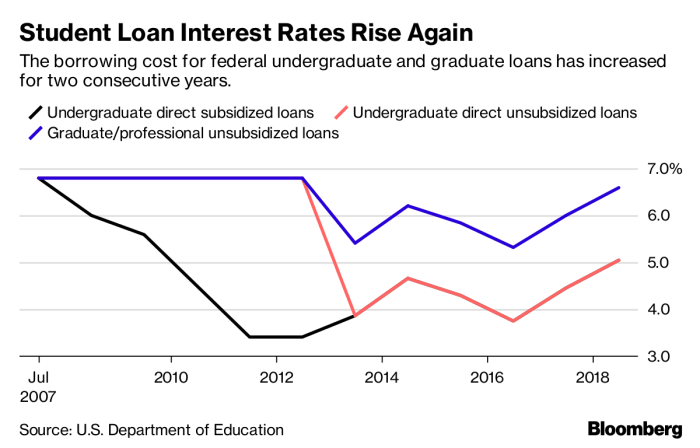

Fixed vs. Variable Interest Student Loans: A Comprehensive Guide to Choosing the Right Loan

Navigating the world of student loans can feel overwhelming, especially when faced with the decision between fixed and variable interest rates. Understanding the nuances of each option is crucial for making an informed choice that aligns with your financial goals and risk tolerance. This guide will dissect the key differences, exploring the potential long-term implications of each interest rate type and providing practical strategies to help you make the best decision for your unique circumstances. Choosing between a fixed and variable interest rate student loan significantly impacts your overall repayment costs. A fixed rate offers predictable monthly payments, while a Read More …

Navigating the Maze: Fixed or Variable Interest Rate Student Loans

The decision between a fixed or variable interest rate student loan is a crucial one, impacting your finances for years to come. Understanding the nuances of each option is paramount to making an informed choice that aligns with your financial goals and risk tolerance. This guide delves into the mechanics of both fixed and variable rates, highlighting the advantages and disadvantages to help you navigate this important financial decision. Choosing the right student loan can feel overwhelming, but by carefully considering the long-term implications of interest rate fluctuations and repayment plans, you can make a choice that best suits your Read More …