Navigating the world of higher education often involves the crucial decision of financing your studies. While federal student loans offer a well-defined path, private student loans present a distinct alternative with its own set of advantages and disadvantages. This guide delves into the complexities of securing a private student loan, exploring the application process, repayment strategies, and potential risks involved. We’ll equip you with the knowledge to make informed decisions, ensuring a smoother journey towards your academic goals.

Understanding the nuances of private student loans is paramount. From comparing interest rates and repayment terms across different lenders to comprehending the implications of your credit history, this guide provides a clear and comprehensive overview. We will also examine alternative funding sources and offer practical advice on budgeting and managing your loan effectively, empowering you to navigate this financial landscape with confidence.

Understanding Private Student Loan Options

Securing a private student loan can be a significant step in financing your education. Understanding the various options available and the implications of each is crucial for making an informed decision that aligns with your financial circumstances and long-term goals. This section will detail the key aspects of private student loans to help you navigate the process effectively.

Types of Private Student Loans

Private student loans are offered by various financial institutions, including banks, credit unions, and online lenders. These loans generally fall into two main categories: undergraduate loans, designed to fund undergraduate studies, and graduate loans, specifically for graduate-level programs. Some lenders may also offer loans for specific professional programs or even for refinancing existing student loans. The terms and conditions, including interest rates and repayment options, can vary significantly between these loan types and even within the same lender’s offerings.

Eligibility Requirements for Private Student Loans

Eligibility for private student loans typically hinges on several factors. Lenders will assess your creditworthiness, considering your credit history, credit score, and existing debt. A co-signer, usually a parent or guardian with a strong credit history, is often required if the applicant lacks sufficient credit history or has a low credit score. Proof of enrollment in an eligible educational program is also necessary, typically requiring submission of an acceptance letter or enrollment verification. The lender may also review your income and debt-to-income ratio to determine your ability to repay the loan.

Interest Rates and Repayment Terms

Private student loan interest rates are variable, meaning they fluctuate based on market conditions, or fixed, remaining constant throughout the loan term. Variable rates typically start lower than fixed rates but can increase over time, leading to higher overall costs. Repayment terms typically range from five to 20 years, with shorter terms resulting in higher monthly payments but lower overall interest paid. The length of the repayment period significantly impacts the total cost of the loan. For example, a 10-year repayment plan will have higher monthly payments but lower total interest compared to a 20-year plan.

Common Fees Associated with Private Student Loans

Several fees are commonly associated with private student loans. Origination fees are charged by the lender to process the loan application. Late payment fees are incurred if payments are not made on time. Prepayment penalties may apply if you pay off the loan early, although these are becoming less common. Some lenders may also charge fees for returned payments or other administrative charges. It’s crucial to carefully review the loan agreement to understand all associated fees.

Comparison of Private Student Loan Lenders

The following table compares four hypothetical private student loan lenders, highlighting their interest rates, fees, and repayment options. Note that these are examples and actual rates and fees will vary depending on individual circumstances and market conditions.

| Lender | Interest Rate (Variable) | Origination Fee | Repayment Options |

|---|---|---|---|

| Lender A | 6.5% – 10.5% | 1% of loan amount | 5, 10, 15 years |

| Lender B | 7% – 11% | 0% | 7, 10, 15 years |

| Lender C | 6% – 9% | 2% of loan amount | 10, 15 years |

| Lender D | 7.5% – 12% | 1.5% of loan amount | 5, 10, 15, 20 years |

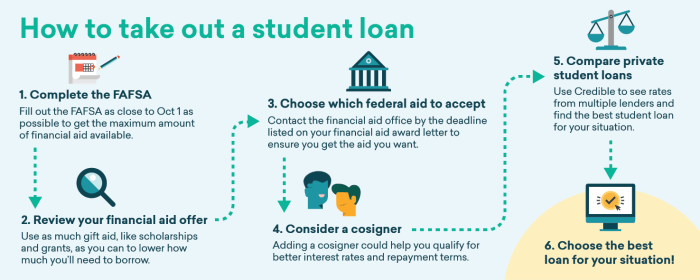

The Application and Approval Process

Securing a private student loan involves a multi-step process that requires careful preparation and attention to detail. Understanding each stage will significantly improve your chances of a successful application and obtaining the funding you need for your education. This section Artikels the key steps, required documentation, and credit considerations.

Application Steps

The application process for a private student loan typically follows a structured sequence. Completing each step accurately and efficiently is crucial for a timely approval.

- Pre-qualification: Before formally applying, many lenders offer pre-qualification tools. This allows you to get an estimate of your potential loan amount and interest rate without impacting your credit score. This is a good opportunity to compare offers from different lenders.

- Gather basic information: This usually includes your intended school, degree program, estimated cost of attendance, and your credit score (if known).

- Compare pre-qualification offers: Review interest rates, loan terms, and fees from several lenders to find the most favorable option.

- Formal Application: Once you’ve chosen a lender, you’ll need to complete a formal application. This usually involves an online form requiring detailed personal and financial information.

- Complete the application accurately and thoroughly: Inaccuracies can delay the process or lead to rejection.

- Provide supporting documentation: This may include tax returns, bank statements, and proof of enrollment (more details below).

- Credit Check and Verification: The lender will conduct a credit check to assess your creditworthiness. This is a critical step in the approval process. They will also verify the information provided in your application.

- Review your credit report for accuracy: Address any errors or discrepancies before applying.

- Be prepared for verification calls: The lender may contact your employer or bank to verify your income and assets.

- Loan Approval or Denial: After reviewing your application and credit report, the lender will notify you of their decision. If approved, you’ll receive loan terms and conditions. If denied, you’ll typically receive an explanation of the reasons for denial.

- Review loan terms carefully: Understand the interest rate, repayment schedule, and any fees before accepting the loan.

- Explore options if denied: If your application is rejected, understand the reasons and explore strategies to improve your creditworthiness or consider alternative funding options.

- Loan Disbursement: Once you accept the loan terms, the funds will be disbursed according to the lender’s schedule, often directly to your educational institution.

Required Documentation

Lenders typically require various documents to verify your identity, income, and creditworthiness. Providing complete and accurate documentation expedites the approval process. Examples include:

- Government-issued photo identification: Such as a driver’s license or passport.

- Social Security number: Essential for verifying your identity and credit history.

- Proof of enrollment: An acceptance letter or enrollment verification from your educational institution.

- Tax returns (or W-2s): To verify your income and financial history.

- Bank statements: Demonstrating your financial stability and available funds.

- Co-signer information (if applicable): If you require a co-signer, their documentation will also be needed.

Credit Check Process and Impact

Private student loan lenders perform a credit check to assess your creditworthiness. A strong credit score significantly increases your chances of approval and can result in more favorable loan terms (lower interest rates). Conversely, a poor credit history may lead to denial or higher interest rates.

Strategies for Improving Loan Approval Chances

Improving your credit score before applying for a private student loan can significantly enhance your chances of approval. Strategies include:

- Paying bills on time: Consistent on-time payments demonstrate responsible financial behavior.

- Keeping credit utilization low: Maintaining a low credit utilization ratio (the amount of credit used compared to the total available credit) is crucial.

- Addressing negative marks on your credit report: Work to resolve any errors or negative entries on your credit report.

- Building a positive credit history: If you have limited credit history, consider becoming an authorized user on a credit card with a good payment history.

- Seeking a co-signer: If you have a poor credit history, a co-signer with good credit can significantly improve your chances of approval.

Managing and Repaying Your Loan

Successfully navigating the repayment of your private student loan requires understanding your options and developing a robust financial plan. This section Artikels various repayment strategies, potential consequences of default, budgeting techniques, and the considerations surrounding loan refinancing.

Private Student Loan Repayment Plans

Private student loan lenders offer a range of repayment plans, often less standardized than federal loan programs. These plans typically vary in terms of payment amounts and loan durations. Common options include fixed-payment plans, which maintain a consistent monthly payment throughout the loan term, and graduated repayment plans, where payments start lower and gradually increase over time. Some lenders may also offer income-driven repayment plans, where monthly payments are tied to a percentage of your income. It’s crucial to carefully review the terms of each plan offered by your lender to determine which best aligns with your financial situation and long-term goals. For example, a fixed-payment plan might be preferable for those seeking predictable monthly expenses, while a graduated plan may be more suitable for recent graduates anticipating income growth.

Consequences of Loan Default

Failing to make timely payments on your private student loan can lead to serious financial consequences. These consequences can include damaged credit scores, negatively impacting your ability to secure loans, credit cards, or even rent an apartment in the future. Late payment fees can significantly increase your overall debt burden. Furthermore, lenders may pursue legal action to recover the outstanding debt, potentially leading to wage garnishment or the seizure of assets. In some cases, defaulting on a private student loan can also affect your ability to obtain future student loans or other forms of credit. For instance, a default could result in an increase in interest rates on subsequent loans or even a denial of credit altogether. The impact of default can be far-reaching and long-lasting, significantly hindering your financial well-being.

Strategies for Effective Student Loan Debt Management

Effective management of student loan debt involves careful budgeting and proactive repayment strategies. Creating a detailed monthly budget is essential to track income and expenses, ensuring sufficient funds are allocated for loan payments. Prioritizing high-interest loans for repayment can help minimize overall interest costs. Exploring options like loan consolidation or refinancing can potentially lower monthly payments or shorten the repayment period. Regularly reviewing your budget and adjusting it as needed is crucial to maintaining financial stability. Consider utilizing online budgeting tools or seeking advice from a financial advisor to develop a personalized debt management plan. For example, a simple budgeting method involves tracking income, allocating funds for essential expenses (housing, food, transportation), and then designating a specific amount for student loan repayment. Any remaining funds can be allocated to savings or discretionary spending.

Private Student Loan Refinancing

Refinancing a private student loan involves replacing your existing loan with a new one, often at a lower interest rate. This can result in lower monthly payments and reduced overall interest costs. However, refinancing may lengthen the repayment period, potentially increasing the total amount paid over the life of the loan. Before refinancing, carefully compare interest rates, fees, and repayment terms offered by different lenders. Consider your financial situation and long-term goals to determine if refinancing is the right choice for you. For example, someone with excellent credit might qualify for a significantly lower interest rate through refinancing, offsetting the potential increase in total repayment amount. Conversely, someone with poor credit might not see a substantial benefit and could even face higher interest rates.

Sample Monthly Budget Incorporating Student Loan Repayment

| Income | Amount |

|---|---|

| Monthly Salary | $3,000 |

| Expenses | Amount |

| Rent | $1,000 |

| Groceries | $300 |

| Transportation | $200 |

| Utilities | $150 |

| Student Loan Payment | $400 |

| Savings | $150 |

| Other Expenses | $200 |

| Total Expenses | $2500 |

| Net Income | $500 |

This is a sample budget and should be adjusted to reflect your individual income and expenses. Remember to prioritize essential expenses before allocating funds for discretionary spending. Regularly review and adjust your budget as your financial circumstances change.

Potential Risks and Considerations

Taking out a private student loan can be a significant financial decision with potential long-term consequences. It’s crucial to carefully weigh the benefits against the risks before signing any loan agreement. A thorough understanding of the loan terms, your financial situation, and potential pitfalls is essential to avoid future difficulties.

Understanding Loan Terms Before Signing

Before committing to a private student loan, meticulously review all the terms and conditions. This includes the interest rate (both fixed and variable), repayment schedule, fees (origination fees, late payment fees, etc.), and any prepayment penalties. A clear understanding of these aspects will allow you to make an informed decision and avoid unexpected costs or repayment challenges down the line. Failure to understand these terms could lead to significant financial hardship. For example, a seemingly small difference in interest rate can translate into thousands of dollars in additional interest paid over the life of the loan. Similarly, overlooking late payment fees can quickly accumulate and significantly increase your debt burden.

Impact of Poor Credit History on Loan Terms

Your credit history plays a crucial role in determining the terms of your private student loan. A poor credit history, characterized by late payments, defaults, or high credit utilization, will likely result in less favorable loan terms. This could manifest as a higher interest rate, a shorter repayment period, or even loan denial. Lenders perceive borrowers with poor credit as higher risk, leading them to charge higher interest rates to compensate for this increased risk. For instance, a borrower with excellent credit might qualify for a loan with a 5% interest rate, while a borrower with poor credit might receive a loan with a 10% or higher interest rate, significantly increasing the total cost of borrowing.

Long-Term Financial Implications of Private vs. Federal Student Loans

Private student loans often come with higher interest rates and less flexible repayment options compared to federal student loans. Federal loans typically offer income-driven repayment plans, deferment options, and loan forgiveness programs, which provide a safety net in case of financial hardship. Private loans generally lack these protections. The long-term financial implications can be substantial. For example, a borrower with a $50,000 private loan at a 9% interest rate could end up paying significantly more in interest over the life of the loan compared to a borrower with a similar federal loan at a lower interest rate with more flexible repayment options. This difference could impact their ability to save for retirement, buy a house, or achieve other financial goals.

Potential Red Flags When Considering a Private Student Loan

It’s important to be aware of potential red flags that might indicate a predatory or unfavorable loan. Before signing any loan agreement, consider these points:

- Unusually high interest rates compared to market averages.

- Hidden fees or unclear loan terms.

- Aggressive sales tactics or pressure to borrow more than needed.

- Lack of transparency regarding repayment options.

- Difficulty contacting the lender or obtaining clear answers to your questions.

Alternatives to Private Student Loans

Securing funding for higher education can be a significant undertaking. While private student loans offer a viable option, exploring alternative financing methods is crucial to making an informed decision that best suits your financial circumstances. This section Artikels several alternatives, allowing you to compare their advantages and disadvantages to determine the most suitable path for your educational journey.

Scholarships and Grants

Scholarships and grants represent forms of financial aid that do not require repayment. They are awarded based on merit, financial need, or specific criteria set by the awarding institution or organization. Securing these funds can significantly reduce or even eliminate the need for loans.

Using Savings or Family Contributions

Utilizing personal savings or receiving financial assistance from family members offers a debt-free approach to funding education. This method provides financial independence and avoids the long-term commitment of loan repayment.

Working Part-Time While Attending School

Earning income while studying allows students to cover a portion of their educational expenses. This strategy reduces reliance on loans and instills valuable work experience. Finding a balance between work and academic responsibilities is crucial to ensure academic success.

Resources for Finding Scholarships and Grants

Numerous resources exist to assist students in locating scholarships and grants. These include online scholarship databases, educational institutions, and professional organizations. Utilizing these platforms can broaden your search and increase the likelihood of securing financial aid.

| Funding Source | Pros | Cons |

|---|---|---|

| Scholarships and Grants | No repayment required; can significantly reduce educational costs. | Competitive application process; limited availability; may require specific qualifications. |

| Savings/Family Contributions | Debt-free education; financial independence; avoids interest payments. | Requires significant upfront savings; may limit educational choices due to financial constraints; relies on family support. |

| Part-Time Employment | Reduces reliance on loans; provides valuable work experience; builds financial responsibility. | Requires time management skills; can impact academic performance if workload is excessive; may limit extracurricular activities. |

Illustrative Scenario: Sarah’s Private Student Loan Journey

Sarah, a bright and ambitious 20-year-old, is starting her junior year at State University, majoring in computer science. She’s already received significant financial aid through grants and scholarships, but still needs additional funding to cover tuition, housing, and living expenses. Her parents are unable to contribute significantly to her education costs. Therefore, she’s exploring private student loans to bridge the gap.

Sarah’s financial situation is as follows: she works part-time at a local coffee shop, earning approximately $10,000 annually. Her monthly expenses include $500 for rent, $300 for food, $100 for transportation, and $50 for utilities. She has a limited credit history, having only recently opened a credit card with a small credit limit and consistently making on-time payments.

The Loan Application Process

Sarah begins researching private student loan options online, comparing interest rates, repayment terms, and lender reviews. She decides to apply for a loan with a reputable lender known for its student-friendly policies. The application process involves providing personal information, academic details, and financial documentation, including her tax returns and bank statements. The lender performs a credit check and assesses her creditworthiness based on her limited credit history and income. After submitting her application and supporting documents, she receives a loan offer with a specified interest rate, loan amount, and repayment terms. She carefully reviews the terms and conditions before accepting the loan.

Loan Repayment Management

Sarah receives her loan disbursement and uses it to cover her educational expenses. She understands the importance of responsible repayment and begins to budget meticulously to ensure she can afford her monthly loan payments. She opts for a standard repayment plan, which spreads her payments over a 10-year period. She uses a budgeting app to track her income and expenses, ensuring she allocates sufficient funds for her loan payments each month. Initially, the payments are manageable. However, during her senior year, unexpected car repairs cause a temporary financial strain. Sarah contacts her lender to explore options, such as a temporary deferment or forbearance, to avoid defaulting on her loan. The lender works with her to create a short-term repayment plan adjustment, allowing her to catch up on her payments once her financial situation stabilizes. After graduation, she secures a well-paying job in her field, allowing her to consistently make her monthly payments and gradually pay down her loan balance.

Final Review

Securing a private student loan is a significant financial commitment that requires careful consideration. By understanding the various loan options, navigating the application process effectively, and developing a robust repayment strategy, you can minimize potential risks and maximize your chances of success. Remember to explore all available resources and weigh the long-term implications before making a decision. This guide serves as a starting point for your journey, empowering you to make informed choices and achieve your educational aspirations responsibly.

Common Queries

What is the difference between a private and federal student loan?

Federal loans are backed by the government and generally offer more favorable terms and repayment options. Private loans are offered by banks and other financial institutions, and their terms vary widely based on creditworthiness.

What is a co-signer, and why would I need one?

A co-signer is someone with good credit who agrees to repay your loan if you default. Lenders often require co-signers for students with limited or poor credit history.

What happens if I can’t repay my private student loan?

Failure to repay can lead to negative impacts on your credit score, wage garnishment, and potential legal action. It’s crucial to explore repayment options with your lender if you face difficulties.

Can I refinance my private student loan?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it involves a new loan application and may have fees.

How can I improve my chances of loan approval?

Maintain a good credit score, have a co-signer with good credit, and provide complete and accurate documentation during the application process.