Navigating the complexities of student loan debt can be daunting, especially in a state like Tennessee with its unique legal framework. This guide provides a comprehensive overview of Tennessee student loan laws, covering various loan types, repayment options, and legal recourse available to borrowers. We’ll explore the differences between federal and private loans, discuss strategies for managing debt, and highlight resources to help you successfully navigate this crucial financial journey.

From understanding your rights and responsibilities as a borrower to learning about available debt management strategies and legal options, this guide aims to empower Tennessee residents to make informed decisions about their student loan debt. We will delve into the potential long-term financial implications of student loan debt and offer practical advice for building a sustainable financial future.

Understanding Tennessee Student Loan Laws

Navigating the complexities of student loan debt can be challenging, particularly in understanding the specific legal framework governing these loans within a state like Tennessee. This section provides a clear overview of Tennessee’s student loan laws, encompassing various loan types, borrower rights, and potential pitfalls to avoid.

Types of Student Loans Available in Tennessee

Tennessee residents have access to a range of federal and private student loan options. Federal loans, administered by the U.S. Department of Education, generally offer more borrower protections and flexible repayment plans. These include subsidized and unsubsidized Stafford Loans, PLUS Loans for parents and graduate students, and Perkins Loans (though these are less common now). Private student loans, offered by banks and credit unions, are subject to varying terms and conditions, often with higher interest rates and fewer protections. The choice between federal and private loans depends heavily on individual financial circumstances and creditworthiness.

Rights and Responsibilities of Student Loan Borrowers in Tennessee

Tennessee law, mirroring federal regulations, affords borrowers several key rights. These include the right to clear and concise loan disclosures, the right to understand repayment options, and the right to seek assistance in case of default. Borrowers also have a responsibility to make timely payments, to understand the terms of their loan agreements, and to proactively contact their lender if facing financial hardship. Failure to fulfill these responsibilities can lead to negative consequences, such as damage to credit scores and potential legal action.

Comparison of Federal and Private Student Loans in Tennessee

Federal student loans typically offer lower interest rates, more flexible repayment plans (including income-driven repayment options), and robust borrower protections such as forbearance and deferment options in times of financial difficulty. Private loans, conversely, often come with higher interest rates, less flexible repayment terms, and fewer borrower protections. While private loans might be necessary to fill funding gaps, borrowers should carefully weigh the risks and benefits before opting for them. Creditworthiness plays a significant role in securing private loans and influencing the interest rate offered.

Common Student Loan Scams Targeting Tennessee Residents

Tennessee residents, like those in other states, are vulnerable to various student loan scams. Common examples include fraudulent loan forgiveness programs promising immediate debt relief for a fee, unsolicited offers for loan consolidation with predatory terms, and phishing attempts aiming to steal personal information. Borrowers should be wary of unsolicited offers, independently verify any program or company before engaging, and never share sensitive information unless initiating contact through official channels.

Key Provisions of Tennessee’s Student Loan Laws

| Loan Type | Interest Rate | Repayment Options | Legal Protections |

|---|---|---|---|

| Federal Stafford Loan (Subsidized) | Variable, set by the government | Standard, graduated, extended, income-driven | Forbearance, deferment, default counseling |

| Federal Stafford Loan (Unsubsidized) | Variable, set by the government | Standard, graduated, extended, income-driven | Forbearance, deferment, default counseling |

| Federal PLUS Loan | Variable, set by the government | Standard, extended | Forbearance, deferment, default counseling |

| Private Student Loan | Variable, set by the lender; often higher than federal loans | Varies by lender; may have fewer options | Fewer protections than federal loans; terms vary widely |

Repayment Options and Debt Management Strategies

Navigating student loan repayment can feel overwhelming, but understanding the available options and strategies can significantly ease the process. Tennessee offers various repayment plans and resources to help borrowers manage their debt effectively. This section will explore income-driven repayment plans, loan consolidation and refinancing, student loan forgiveness programs, and various debt management strategies.

Income-Driven Repayment Plans in Tennessee

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. Several federal IDR plans are available to Tennessee student loan borrowers, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Eligibility criteria vary slightly between plans, but generally involve demonstrating financial need. These plans often lead to loan forgiveness after a specified period of qualifying payments, typically 20 or 25 years, depending on the plan. It’s crucial to carefully compare the plans and determine which best suits individual circumstances, considering the potential for longer repayment periods and accrued interest. The specific terms and conditions for each plan can be found on the Federal Student Aid website.

Loan Consolidation and Refinancing in Tennessee

Consolidation combines multiple federal student loans into a single loan, simplifying repayment. This can result in a lower monthly payment, but it’s important to note that the overall interest paid may increase depending on the interest rate of the new loan. Refinancing, on the other hand, involves replacing your existing student loans with a new loan from a private lender. This can potentially lower your interest rate and monthly payments, but it often requires a strong credit history and may eliminate federal protections, such as IDR plans and loan forgiveness programs. Borrowers should carefully weigh the pros and cons of each option before proceeding.

Student Loan Forgiveness Programs in Tennessee

Several federal programs offer potential student loan forgiveness, though eligibility requirements are often stringent. These programs are not specific to Tennessee but are available to Tennessee residents who meet the necessary criteria. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on federal Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Teacher Loan Forgiveness programs also exist, offering forgiveness for teachers who meet specific requirements. A step-by-step guide for borrowers exploring these programs would involve:

- Identifying potential programs: Research federal loan forgiveness programs to determine eligibility based on your career and loan type.

- Verifying eligibility: Carefully review the specific requirements of each program to confirm eligibility.

- Gathering necessary documentation: Collect all required documents, such as employment verification and loan details.

- Submitting the application: Complete and submit the application through the appropriate channels, ensuring all information is accurate and complete.

- Monitoring progress: Regularly check the status of your application and maintain communication with the relevant agencies.

Comparison of Debt Management Strategies

Several strategies can assist in managing student loan debt. Debt consolidation, as mentioned, simplifies repayment by combining multiple loans. Balance transfers, while not directly applicable to federal student loans, can be used for private loans to potentially lower interest rates. Budgeting is crucial for all strategies; it allows borrowers to allocate funds effectively for loan repayments while meeting other financial obligations.

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| Debt Consolidation | Combining multiple loans into one. | Simplified repayment, potentially lower monthly payment. | May increase total interest paid, loss of federal protections if refinancing with a private lender. |

| Balance Transfer | Transferring a loan balance to a new account with a lower interest rate. | Lower interest rate, potential for savings. | Limited to private loans, balance transfer fees may apply, requires good credit. |

| Budgeting | Creating a plan to allocate funds for expenses and loan payments. | Improved financial control, ensures loan payments are prioritized. | Requires discipline and careful tracking of expenses. |

Sample Student Loan Budget

A sample budget illustrates how to manage student loan payments alongside other expenses. This is a simplified example and should be adjusted to reflect individual circumstances.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Monthly Net Income | $3000 | Rent/Mortgage | $1000 |

| Utilities | $200 | ||

| Groceries | $400 | ||

| Transportation | $300 | ||

| Student Loan Payment | $500 | ||

| Other Expenses (Entertainment, Savings, etc.) | $600 |

Legal Recourse for Borrowers in Tennessee

Navigating the complexities of student loan debt can be challenging, and Tennessee borrowers facing difficulties have several legal avenues for recourse. Understanding these options and how to effectively utilize them is crucial for protecting your rights and achieving a fair resolution. This section Artikels common legal issues, the complaint process, successful case examples, available resources, and effective communication strategies.

Common Legal Issues Faced by Tennessee Student Loan Borrowers

Tennessee student loan borrowers frequently encounter issues such as inaccurate account information, improper servicing practices (including failure to process payments correctly or apply payments to the correct loan), unfair debt collection tactics, and disputes regarding loan forgiveness programs or discharge options (like total and permanent disability discharge). These issues can significantly impact borrowers’ credit scores and financial well-being. The lack of transparency and responsiveness from some servicers often exacerbates these problems.

Filing a Complaint Against a Student Loan Servicer in Tennessee

Filing a formal complaint involves several steps. First, gather all relevant documentation, including loan agreements, payment history, and communication records with the servicer. Next, submit a written complaint to the servicer, clearly outlining the issue, providing supporting evidence, and specifying the desired resolution. If the servicer fails to adequately address the complaint, escalate the issue to the relevant regulatory agencies. These include the Tennessee Attorney General’s office, the Consumer Financial Protection Bureau (CFPB), and the U.S. Department of Education. Each agency has specific complaint procedures and timelines. Maintaining meticulous records throughout this process is crucial.

Examples of Successful Legal Cases Involving Student Loan Disputes in Tennessee

While specific case details are often confidential, successful legal actions frequently involve demonstrating clear violations of federal or state consumer protection laws. For example, cases involving deceptive or abusive debt collection practices, or instances where servicers failed to properly process loan modifications or forbearances, have resulted in favorable outcomes for borrowers. These outcomes often include debt reduction, removal of negative credit reporting, and compensation for damages. The success of such cases hinges on thorough documentation and a strong legal strategy.

Resources Available to Tennessee Student Loan Borrowers Facing Legal Challenges

Several resources can assist borrowers facing legal challenges. The Tennessee Attorney General’s office provides information and assistance with consumer complaints. Nonprofit organizations specializing in consumer rights and student loan advocacy often offer free or low-cost legal aid and counseling. Additionally, the CFPB website offers comprehensive resources on student loan rights and dispute resolution. Finally, legal aid societies in Tennessee may provide assistance to low-income borrowers.

Effectively Communicating with Student Loan Servicers to Resolve Disputes

Effective communication is paramount in resolving student loan disputes. Maintain a professional and respectful tone in all communications. Clearly and concisely articulate the issue, supporting your claims with verifiable evidence. Document all interactions, including dates, times, and the names of individuals contacted. Request written confirmation of any agreements or resolutions reached. If phone calls are necessary, consider keeping a detailed record of the conversation immediately after. Persistence and patience are often necessary to achieve a satisfactory outcome.

Impact of Student Loan Debt on Tennessee Residents

The escalating burden of student loan debt significantly impacts Tennessee residents, affecting their economic prospects, lifestyle choices, and overall well-being. This pervasive issue ripples through the state’s economy, influencing workforce participation, homeownership rates, and long-term financial stability. Understanding the extent of this impact is crucial for developing effective strategies to mitigate its consequences.

Economic Impact on Tennessee’s Workforce

High student loan debt can hinder Tennessee’s workforce in several ways. Graduates burdened with significant repayments may postpone major life decisions like starting a family or purchasing a home. Furthermore, the pressure of loan repayments can limit career choices, potentially pushing individuals towards higher-paying but less fulfilling jobs, or preventing them from pursuing entrepreneurial ventures. This can lead to underemployment, reduced economic mobility, and a less diversified workforce. The overall effect is a dampening of economic growth within the state. For example, a recent study showed that graduates in Tennessee with high student loan debt are less likely to start their own businesses compared to those with lower debt levels, limiting innovation and job creation.

Effects of Student Loan Debt on Homeownership Rates in Tennessee

The significant financial commitment required for student loan repayment directly competes with the resources needed for homeownership. The monthly payments, coupled with the need to save for a down payment and closing costs, can make homeownership unattainable for many Tennessee graduates. This contributes to a lower homeownership rate in the state compared to national averages, impacting community stability and overall economic growth. The inability to build equity through homeownership also limits the ability to build long-term wealth. This effect is particularly pronounced in higher-cost areas of the state where housing prices are already challenging.

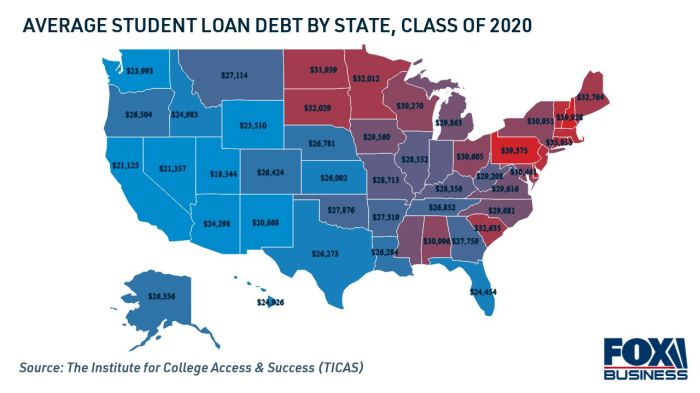

Comparison of Average Student Loan Debt in Tennessee to Other States

While precise rankings fluctuate yearly depending on the source and methodology, Tennessee consistently ranks within the mid-range of states in terms of average student loan debt. It’s crucial to note that the average figure masks significant disparities across different demographic groups and institutions within the state. A more detailed analysis would reveal that certain regions or universities may have significantly higher or lower average debt levels. Direct comparison with states like California or New York, which often have higher costs of living and tuition, requires careful consideration of these contextual factors. Comparing Tennessee’s average debt to neighboring states provides a more relevant picture of regional trends.

Long-Term Financial Implications of High Student Loan Debt on a Typical Tennessee Graduate

Let’s consider a hypothetical Tennessee graduate, Sarah, who incurred $50,000 in student loan debt at a 6% interest rate. With a standard 10-year repayment plan, her monthly payments would be approximately $590. Over the ten years, she would pay approximately $10,600 in interest alone. This significant financial burden impacts her ability to save for retirement, invest in other assets, or build emergency funds. If Sarah chooses a longer repayment plan to lower her monthly payments, she’ll pay significantly more interest over the life of the loan, delaying her financial independence. This scenario illustrates how high student loan debt can constrain long-term financial planning and wealth accumulation.

Student Loan Debt and Correlation with Key Economic Indicators in Tennessee

| State Indicator | Data Point | Year | Source |

|---|---|---|---|

| Average Student Loan Debt | $35,000 (estimated) | 2023 | National Center for Education Statistics (NCES) – estimates based on national averages and Tennessee specific data |

| Homeownership Rate | 65% (estimated) | 2022 | U.S. Census Bureau – estimates based on state-level data |

| Personal Bankruptcy Filings | [Insert Data] | 2022 | Administrative Office of the U.S. Courts – requires specific data retrieval for Tennessee |

| Unemployment Rate for Young Adults (25-34) | [Insert Data] | 2023 | Bureau of Labor Statistics (BLS) – requires specific data retrieval for Tennessee |

Resources and Support for Tennessee Student Loan Borrowers

Navigating the complexities of student loan debt can be challenging, but numerous resources are available to help Tennessee residents manage their loans and explore available repayment options. This section Artikels key organizations, government agencies, and online tools designed to provide support and guidance. Understanding these resources is crucial for borrowers seeking to effectively manage their student loan debt and achieve financial stability.

Reputable Non-profit Organizations Offering Assistance

Several non-profit organizations in Tennessee dedicate their efforts to assisting student loan borrowers. These organizations often provide free or low-cost counseling, workshops, and resources to help individuals navigate the complexities of student loan repayment. They can offer valuable support in developing personalized repayment strategies and exploring options like income-driven repayment plans. It’s important to verify the legitimacy and reputation of any organization before engaging their services.

- The National Foundation for Credit Counseling (NFCC): The NFCC has member agencies throughout the country, including Tennessee, that offer free or low-cost credit counseling services. These services can include guidance on student loan repayment strategies. Contact information for local NFCC member agencies can be found on their website.

- Local Community Action Agencies: Many community action agencies across Tennessee provide assistance with a range of financial issues, including student loan debt management. These agencies often offer free financial literacy workshops and one-on-one counseling. Contact information for local agencies can typically be found through online searches or by contacting your local government.

Government Agencies Providing Student Loan Assistance in Tennessee

Tennessee residents can access assistance through various government agencies at both the state and federal levels. These agencies provide information, resources, and in some cases, direct assistance programs related to student loan repayment.

- Tennessee Higher Education Commission (THEC): THEC is the state agency responsible for overseeing higher education in Tennessee. While they don’t directly manage student loans, they offer resources and information on student financial aid and repayment options. Their website is a valuable resource for general information.

- Federal Student Aid (FSA): FSA, a part of the U.S. Department of Education, manages federal student loan programs. Their website is a comprehensive resource for understanding federal loan programs, repayment plans, and available forms of assistance. They also offer a student loan repayment calculator.

Websites and Online Resources for Student Loan Management and Debt Relief

Numerous websites and online resources offer valuable information and tools to help manage student loan debt. These resources can provide guidance on repayment strategies, debt consolidation options, and other relevant information. It’s crucial to carefully evaluate the credibility of any website before using its information.

- Federal Student Aid (FSA) Website: This website offers comprehensive information on federal student loan programs, repayment options, and available assistance programs. It’s an excellent starting point for understanding your federal loans.

- StudentAid.gov: This website is the official U.S. Department of Education website for student aid. It provides a wealth of information and tools for managing student loans.

- Consumer Financial Protection Bureau (CFPB) Website: The CFPB offers resources and information on various consumer financial issues, including student loan debt. They provide tools and guidance to help consumers understand their rights and protect themselves from predatory lending practices.

Flyer Outlining Available Resources and Support

[This section would contain a description of a flyer. Since I cannot create images, I will describe the flyer’s content.]

The flyer would be titled “Support for Tennessee Student Loan Borrowers.” It would feature a visually appealing design with a color scheme that is both professional and reassuring. The top section would prominently display the title and a brief, encouraging message. The main body would be divided into sections:

* Section 1: Non-profit Organizations: This section would list at least two reputable non-profit organizations with their contact information (phone numbers, email addresses, and websites).

* Section 2: Government Agencies: This section would list the Tennessee Higher Education Commission (THEC) and the Federal Student Aid (FSA) with their respective websites and contact information.

* Section 3: Helpful Websites: This section would list the websites mentioned above (FSA, StudentAid.gov, and CFPB).

* Section 4: Call to Action: This section would encourage borrowers to explore the listed resources and seek help if needed, emphasizing that assistance is available.

The flyer would conclude with a footer containing copyright information and contact details for a relevant state agency or a coalition of organizations supporting student loan borrowers in Tennessee. The overall design would be clean, easy to read, and visually appealing to encourage borrowers to seek assistance.

Outcome Summary

Successfully managing student loan debt requires knowledge, planning, and proactive engagement. This guide has provided a foundational understanding of Tennessee’s student loan laws, equipping you with the information needed to make informed choices. Remember to utilize the available resources and seek professional guidance when necessary. By understanding your options and actively managing your debt, you can pave the way for a brighter financial future.

FAQ Resource

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

Can I consolidate my federal and private student loans?

You can consolidate federal loans, but private loans typically cannot be consolidated with federal loans. Refinancing is an option for private loans, but be sure to compare interest rates and fees carefully.

Where can I find free credit counseling in Tennessee?

Several non-profit credit counseling agencies operate in Tennessee. The National Foundation for Credit Counseling (NFCC) website is a good place to start your search for reputable organizations.

What is the statute of limitations on student loan debt in Tennessee?

The statute of limitations varies depending on the type of loan and whether the loan is in default. It’s best to consult with a legal professional for specific guidance.