Navigating the complex landscape of student loan debt often feels like deciphering a financial code. Understanding the tax implications adds another layer of complexity, impacting repayment strategies and overall financial well-being. This guide explores the multifaceted relationship between taxes and student loans, examining how various tax policies affect borrowers across different income levels and repayment plans.

From deductibility of interest payments to the tax consequences of loan forgiveness programs, we’ll delve into the intricacies of tax planning for student loan debt. We’ll also analyze the potential impact of future policy changes and offer strategies for minimizing your tax burden. The goal is to equip you with the knowledge necessary to make informed financial decisions regarding your student loans.

The Current Tax Landscape for Student Loan Borrowers

Navigating the tax implications of student loans can be complex, varying based on your repayment plan, loan forgiveness programs, and your individual tax bracket. Understanding these nuances is crucial for effective financial planning. This section will clarify the key tax aspects related to student loan debt.

Student Loan Interest Deduction

The student loan interest deduction allows eligible taxpayers to deduct the amount of interest they paid on qualified student loans during the tax year. This deduction can reduce your taxable income, ultimately lowering your tax bill. To qualify, the loan must be used to pay for qualified education expenses (tuition, fees, room and board) for yourself, your spouse, or a dependent. The deduction is limited to the actual interest paid, up to a maximum amount annually (this amount is subject to change and should be verified with the IRS). Additionally, your modified adjusted gross income (MAGI) must be below a certain threshold; exceeding this threshold may limit or eliminate the deduction. For example, a taxpayer who paid $2,000 in student loan interest and meets all eligibility requirements could deduct this full amount, potentially reducing their tax liability. The impact of this deduction is directly related to the taxpayer’s marginal tax bracket; a higher tax bracket means a larger tax savings from the deduction.

Tax Implications of Loan Forgiveness Programs

Loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or income-driven repayment (IDR) plans that lead to forgiveness after a certain period, have significant tax implications. Generally, forgiven student loan debt is considered taxable income in the year it’s forgiven. This means that the amount forgiven is added to your gross income and taxed at your ordinary income tax rate. For instance, if $20,000 of student loan debt is forgiven, this amount will be added to your income, potentially pushing you into a higher tax bracket and resulting in a higher tax liability. However, there are exceptions. For example, certain types of loan forgiveness programs may not be subject to this tax, such as those related to total and permanent disability. It’s essential to consult with a tax professional to understand the specific tax implications of your particular loan forgiveness program.

Tax Treatment of Different Student Loan Repayment Plans

The type of repayment plan you choose for your student loans does not directly impact your tax liability in terms of deductions. The interest paid remains deductible (subject to the limitations mentioned earlier) regardless of whether you are on a standard repayment plan, an income-driven repayment (IDR) plan, or another type of plan. However, the amount of interest paid annually will vary depending on the repayment plan. IDR plans generally result in lower monthly payments, potentially leading to less interest paid in the short term, but potentially more interest paid over the life of the loan. Standard repayment plans typically involve higher monthly payments and less total interest paid overall. The choice between these plans depends on your financial situation and long-term goals, with tax implications being secondary but still relevant to the overall cost.

Tax Brackets and the Net Cost of Student Loans

A taxpayer’s marginal tax bracket significantly influences the net cost of student loans after considering deductions. A higher tax bracket translates to a larger tax savings from the student loan interest deduction. For example, consider two taxpayers who both paid $2,000 in student loan interest. Taxpayer A is in the 12% tax bracket, while Taxpayer B is in the 22% tax bracket. Taxpayer A saves $240 (12% of $2,000), while Taxpayer B saves $440 (22% of $2,000). This difference highlights how the tax bracket directly impacts the net cost of student loans. The forgiven amount in loan forgiveness programs is also subject to this same principle; higher tax brackets mean a larger tax burden from forgiven amounts. Careful planning, considering both the repayment plan and tax bracket, is essential for minimizing the overall cost of student loans.

Impact of Tax Policies on Student Loan Debt

Tax policies significantly influence student loan borrowing behavior and the accessibility of higher education. Changes in tax laws regarding student loan interest deductions, repayment plans, and forgiveness programs can directly impact the financial burden on borrowers and, consequently, their decisions about pursuing higher education. Understanding these impacts is crucial for policymakers and individuals alike.

Tax policies can either incentivize or discourage student loan borrowing. For example, generous tax deductions for student loan interest payments can make borrowing more attractive, potentially leading to increased levels of student loan debt. Conversely, the absence of such deductions or the implementation of stricter eligibility criteria might discourage borrowing and promote more cautious financial planning for higher education. This interplay between tax incentives and borrowing behavior necessitates careful consideration of the potential consequences.

Effects of Tax Law Changes on Borrowing Behavior

Changes in tax laws related to student loans directly affect borrowers’ decisions. For instance, reducing or eliminating the student loan interest deduction could make borrowing more expensive, potentially deterring some individuals from pursuing higher education or encouraging them to borrow less. Conversely, increasing the deduction or introducing new tax credits could make borrowing more affordable and accessible, potentially leading to increased borrowing. The magnitude of these effects will depend on factors such as the size of the tax benefit, the borrower’s income level, and the overall cost of higher education. For example, a significant increase in the tax deduction could offset a portion of the interest payments, thereby reducing the overall cost of borrowing. This could lead to a rise in student loan applications and higher levels of debt. Conversely, the removal of the deduction could drastically increase the cost of borrowing, thereby discouraging students from taking on loans.

Influence of Tax Policies on Higher Education Accessibility

Tax policies play a significant role in shaping the accessibility of higher education. Tax incentives, such as deductions for student loan interest or tax credits for tuition payments, can make higher education more affordable for some individuals, thereby increasing accessibility. However, these incentives may disproportionately benefit higher-income individuals, potentially exacerbating existing inequalities in access to higher education. Moreover, the design of these policies is crucial; poorly designed incentives might lead to unintended consequences, such as increased borrowing without a corresponding increase in educational attainment. A well-structured tax credit targeted at low- and middle-income families, for instance, could significantly improve access to higher education for those who might otherwise be financially constrained.

Unintended Consequences of Tax Incentives

While tax incentives aim to promote access to higher education, they can have unintended consequences. For instance, generous tax deductions for student loan interest might encourage excessive borrowing, leading to higher levels of student loan debt and potentially impacting borrowers’ financial well-being in the long run. Additionally, these incentives may not necessarily lead to improved educational outcomes. Students might take on more debt without necessarily achieving higher levels of education or improved employment prospects. This could lead to a situation where individuals are burdened with substantial debt without a commensurate return on their investment in education. Furthermore, the focus on tax incentives might overshadow other crucial aspects of higher education affordability, such as controlling tuition costs and increasing the availability of financial aid.

Comparison of Tax Benefits for Different Debt Types

The tax benefits associated with different types of debt vary significantly. Understanding these differences is crucial for making informed financial decisions.

| Debt Type | Tax Deductibility | Interest Rate Implications | Overall Tax Impact |

|---|---|---|---|

| Student Loans | Interest may be deductible (subject to income limits and other restrictions) | Interest rates can vary significantly depending on the loan type and borrower’s creditworthiness. | Can reduce taxable income, but the overall impact depends on the individual’s tax bracket and the amount of interest paid. |

| Mortgages | Mortgage interest is often deductible (subject to limitations) | Interest rates typically lower than student loans, but vary based on factors such as credit score and loan term. | Significant tax benefit due to the deductibility of mortgage interest, often resulting in substantial tax savings. |

| Credit Cards | Credit card interest is generally not deductible | Interest rates are typically high and can vary widely. | No direct tax benefit; interest payments increase the overall cost of borrowing. |

Tax Implications for Different Income Levels

The tax burden associated with student loan debt isn’t uniform; it significantly varies depending on a borrower’s income level. Higher earners often face a different set of tax implications than lower earners, impacting their ability to manage debt and utilize available tax benefits. This section will explore how income brackets influence the tax landscape for student loan borrowers.

Tax benefits related to student loan interest deductions, for example, are often phased out at higher income levels. This means that while lower-income borrowers may fully benefit from these deductions, higher-income borrowers may see a reduced or nonexistent benefit, effectively increasing their tax burden. Conversely, certain tax credits may be more accessible to lower-income individuals, providing crucial financial relief.

Student Loan Interest Deduction and Income Brackets

The student loan interest deduction allows taxpayers to deduct the amount of interest they paid on qualified student loans during the tax year. However, this deduction is subject to income limitations. For the 2023 tax year, the deduction is phased out for single filers with modified adjusted gross incomes (MAGI) above $85,000 and for married couples filing jointly with MAGI above $170,000. This means a single filer earning $90,000 annually might not be able to deduct any student loan interest, while a single filer earning $70,000 might be able to deduct the full amount. This disparity directly impacts the tax liability for borrowers in different income brackets. For instance, a borrower with a $1,000 student loan interest payment and a marginal tax rate of 22% would save $220 in taxes if eligible for the full deduction. This savings is lost for those exceeding the income limits.

Tax Credits and Low-Income Borrowers

Several tax credits, such as the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), can help offset the cost of higher education. However, these credits are often more beneficial to low-income borrowers. The AOTC, for example, is only available for the first four years of post-secondary education and has income limitations. While it can provide significant tax relief for those who qualify, higher-income individuals may not meet the eligibility requirements. Low-income borrowers might find these credits crucial in reducing their overall tax burden and managing their student loan debt more effectively.

Challenges Faced by Low-Income Borrowers

Low-income borrowers often face a double burden: managing substantial student loan debt while navigating a complex tax system with limited access to tax benefits or professional tax advice. The lack of financial literacy and resources can further exacerbate these challenges. They may struggle to understand and utilize available tax deductions and credits, leading to a higher tax liability than necessary. Additionally, the weight of student loan debt can limit their ability to save for retirement or other financial goals, potentially leading to long-term financial instability. For example, a low-income borrower with a large student loan payment might prioritize paying off debt over contributing to a retirement account, impacting their financial security in the long run.

Comparative Analysis of Tax Implications Across Income Tiers

To illustrate, let’s consider three borrowers: Alice (low-income, $35,000 MAGI), Bob (middle-income, $75,000 MAGI), and Carol (high-income, $100,000 MAGI). All three have $2,000 in student loan interest payments. Alice, due to her income level, may fully benefit from the student loan interest deduction, reducing her tax liability significantly. Bob might partially benefit, while Carol, exceeding the income threshold, receives no deduction. This difference showcases how income significantly influences the tax advantages related to student loan debt. Further, Alice might also qualify for additional tax credits, providing further financial relief, unavailable to Bob and Carol. This highlights the disproportionate impact of tax policies on borrowers across different income levels.

The Role of Student Loan Interest in Tax Planning

Student loan interest payments can significantly impact your tax liability, offering opportunities for tax savings if handled strategically. Understanding the rules and employing effective planning can reduce your overall tax burden and free up more of your finances. This section explores strategies for minimizing your tax burden related to student loan interest, including claiming deductions and integrating these payments into a comprehensive tax plan.

Minimizing your tax burden associated with student loan interest primarily revolves around maximizing the student loan interest deduction. This deduction allows you to reduce your taxable income by the amount of interest you paid during the year, potentially leading to a lower tax bill. However, eligibility requirements and limitations exist, making careful planning crucial.

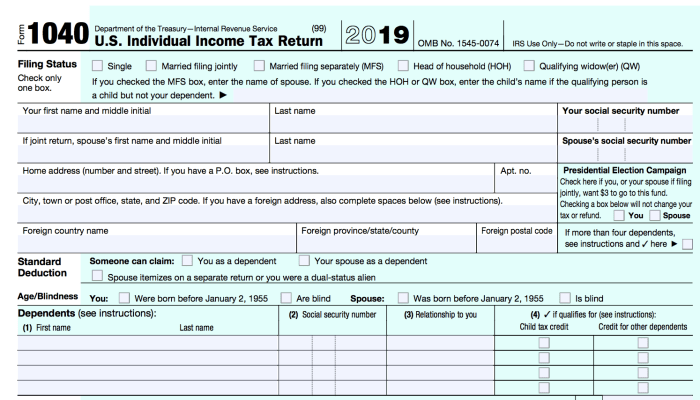

Student Loan Interest Deduction: Claiming the Deduction

To claim the student loan interest deduction, you’ll need to gather specific information and follow a structured process. First, you must have paid interest on a qualified student loan during the tax year. The loan must be taken out by you (or your spouse) to pay for qualified education expenses, including tuition, fees, room and board. Second, you need to obtain Form 1098-E, Student Loan Interest Statement, from your lender, which reports the total amount of interest you paid. This form will provide the necessary information to complete your tax return.

Next, you’ll need to complete Schedule 1 (Additional Income and Adjustments to Income) of Form 1040. You’ll enter the amount of student loan interest you paid on the appropriate line. The amount you can deduct is limited to the actual interest paid, up to a maximum deduction amount that is adjusted annually for inflation. For the 2023 tax year, this limit was $2,500. It’s important to note that you must be filing as single, married filing jointly, qualifying surviving spouse, or head of household to claim this deduction. Married filing separately is not eligible.

Incorporating Student Loan Interest Payments into a Comprehensive Tax Plan

Strategic tax planning considers all aspects of your financial situation, including student loan payments. For example, you might adjust your income throughout the year to maximize the deduction. If you anticipate a higher income in a particular year, consider making extra student loan payments in the preceding year to take advantage of the deduction in that lower income year. Conversely, if you anticipate a lower income year, consider delaying optional payments to the following year when you expect to be in a higher tax bracket.

Another strategy involves considering the timing of your loan payments. If you have a flexible repayment plan, you might adjust your payments to align with your tax bracket, maximizing the deduction’s benefit. For instance, if you expect a significant tax increase in the next year, you may choose to pay more of your student loans in the current year to utilize a higher deduction benefit. This requires careful analysis of your projected income and tax bracket for the current and following years.

Hypothetical Tax Scenario Illustrating Tax Planning Strategies

Let’s consider two individuals, both with $2,500 in student loan interest payments. Individual A does not actively manage their loan payments or tax planning. They pay the interest throughout the year and claim the standard deduction. Individual B, however, strategically plans their payments to maximize their deduction. They pay a larger portion of their student loans in a year when they anticipate a lower taxable income, maximizing their benefit from the deduction.

In a hypothetical scenario, let’s assume Individual A has a taxable income placing them in a 22% tax bracket. Their $2,500 student loan interest deduction reduces their taxable income by $2,500, resulting in a tax savings of $550 (22% of $2,500). Individual B, through strategic planning, manages to be in a 12% tax bracket during the year they claim the deduction. Their tax savings would be $300 (12% of $2,500). While the tax savings is less, the net impact of the strategic planning is a lower overall tax liability for the individual compared to the situation where no planning was done.

Future Trends and Policy Recommendations

The landscape of student loan debt and its tax implications is constantly evolving. Predicting future trends requires considering various factors, including economic conditions, political priorities, and the ongoing debate surrounding higher education affordability. Policymakers are increasingly recognizing the significant burden of student loan debt on individuals and the economy, leading to ongoing discussions about potential reforms.

The interplay between tax policy and student loan debt is complex and deserves careful consideration. Effective policy changes can significantly alleviate the financial strain on borrowers, while poorly designed policies could exacerbate existing problems. A multi-faceted approach, combining tax relief with broader strategies for improving access to affordable higher education, is likely to be the most effective long-term solution.

Potential Future Changes in Tax Laws Related to Student Loan Debt

Several potential future changes in tax laws related to student loan debt are currently under discussion or being actively considered. These include expanding the existing tax benefits for student loan interest payments, potentially increasing the maximum amount deductible, or even exploring the creation of new tax credits specifically designed to offset the burden of student loan repayment. Another possibility is a greater focus on income-based repayment plans and their tax implications, potentially offering greater tax relief to borrowers enrolled in these plans. For example, a proposal might offer a tax credit proportional to the amount of loan payments made under an income-driven repayment plan. This could directly address the financial hardship faced by borrowers with low incomes, while also incentivizing responsible repayment.

Potential Policy Recommendations to Make Student Loan Debt More Manageable from a Tax Perspective

Several policy recommendations could make student loan debt more manageable from a tax perspective. These include expanding the tax deductibility of student loan interest payments to encompass a wider range of borrowers, adjusting the income thresholds for eligibility, and potentially creating a new tax credit for student loan repayment. Additionally, streamlining the tax reporting process for student loan payments could significantly reduce the administrative burden on borrowers. For instance, automating the transfer of relevant information from loan servicers to the IRS could make tax filing easier and less prone to errors. This would particularly benefit borrowers who struggle to keep track of their payments and associated tax documentation. A more holistic approach might also include increased funding for financial literacy programs to help borrowers understand and utilize available tax benefits effectively.

Areas Where Further Research on the Tax Implications of Student Loans is Needed

Further research is needed to fully understand the long-term economic and social consequences of various tax policies related to student loan debt. Specifically, more detailed analysis is needed to assess the impact of different tax relief measures on borrower behavior, repayment rates, and overall economic growth. A comprehensive understanding of the distributional effects of tax policies on student loan debt – how different income groups are affected – is also crucial for informed policymaking. This includes exploring the effectiveness of various tax relief options for specific demographic groups, such as minority borrowers or those from low-income backgrounds. Finally, research should explore the interaction between tax policies on student loan debt and other relevant policies, such as those related to higher education affordability and financial aid.

Potential Policy Changes and Their Expected Impact on Student Loan Borrowers

The following bulleted list Artikels potential policy changes and their anticipated impact on student loan borrowers:

- Increased Deduction for Student Loan Interest: This would provide greater tax relief for borrowers, potentially reducing their overall tax burden and freeing up more disposable income for repayment. This is especially beneficial for borrowers in higher tax brackets.

- New Tax Credit for Student Loan Repayment: A refundable tax credit would provide more direct financial assistance to borrowers, regardless of their income tax liability. This would be particularly helpful for lower-income borrowers who may not itemize deductions.

- Income-Based Repayment Tax Credit: A credit tied to income-driven repayment plans would incentivize participation in these plans, leading to more manageable repayment schedules for borrowers struggling with high debt loads. This could also improve repayment rates over time.

- Simplified Tax Reporting for Student Loan Payments: Streamlining the reporting process would reduce administrative burden on borrowers and reduce errors in tax filing. This would make it easier for borrowers to accurately claim tax benefits.

Summary

Successfully managing student loan debt requires a comprehensive understanding of its tax implications. This guide has provided a framework for navigating this complex terrain, highlighting the crucial interplay between tax policies, repayment plans, and individual income levels. By strategically planning and utilizing available tax benefits, borrowers can significantly reduce their overall financial burden and pave the way for a more secure financial future. Remember to consult with a qualified tax professional for personalized advice tailored to your specific circumstances.

Q&A

Can I deduct student loan interest even if I don’t itemize?

No, the student loan interest deduction is an itemized deduction. You must itemize deductions on your tax return to claim it.

What if I’m on an income-driven repayment plan? How does that affect my taxes?

Income-driven repayment plans may affect your tax liability indirectly, as your monthly payments are based on your income. However, the tax treatment of the interest itself generally remains the same.

Does loan forgiveness impact my taxes?

Generally, forgiven student loan debt is considered taxable income. However, there are some exceptions, such as certain types of public service loan forgiveness. Consult a tax professional for clarification.

What documents do I need to claim the student loan interest deduction?

You’ll need Form 1098-E, which your lender provides, showing the amount of student loan interest you paid during the year. Keep accurate records of your payments as well.