Navigating the world of student loans can be daunting, but understanding your options is key to a successful educational journey. This guide delves into the specifics of TD Bank student loans, providing a comprehensive overview of interest rates, eligibility requirements, the application process, repayment options, and more. We’ll compare TD Bank’s offerings to those of other lenders, helping you make informed decisions about financing your education.

From understanding eligibility criteria and navigating the application process to exploring various repayment plans and managing your loan effectively, we aim to equip you with the knowledge necessary to confidently manage your TD Bank student loan. We’ll also address potential challenges and offer solutions to help you stay on track towards financial success.

TD Bank Student Loan Interest Rates and Fees

Understanding the interest rates and fees associated with a TD Bank student loan is crucial for responsible financial planning. These costs directly impact the overall cost of your education and your repayment schedule. It’s essential to carefully review these details before committing to a loan.

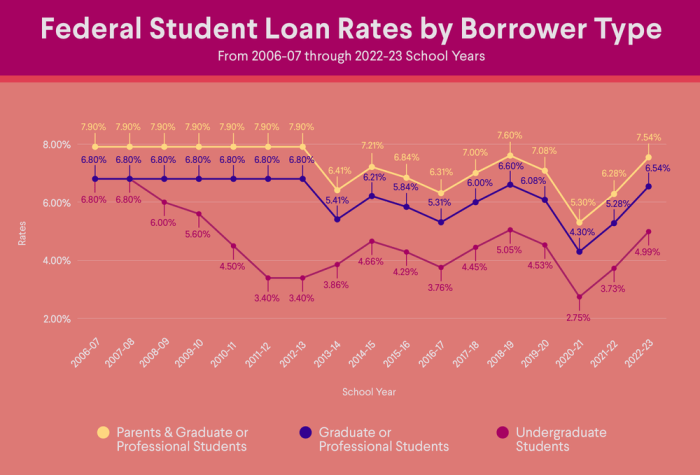

Interest Rates for TD Bank Student Loans

TD Bank offers various student loan options, and interest rates vary depending on the loan type (undergraduate, graduate, or parent), the borrower’s creditworthiness, and the prevailing market interest rates. Generally, graduate student loans may have slightly higher interest rates than undergraduate loans due to the increased loan amount and potentially longer repayment period. Parent loans often carry interest rates that reflect the parent’s credit profile. Specific rates are not publicly listed on a single page and are determined on a case-by-case basis during the loan application process. It’s recommended to contact TD Bank directly or use their online loan application tool to obtain a personalized rate quote.

Fees Associated with TD Bank Student Loans

Several fees can be associated with TD Bank student loans. These fees can add to the overall cost, so understanding them is vital.

Comparison of Interest Rates and Fees Across Loan Terms

The following table provides a hypothetical comparison of interest rates and fees for different loan terms. Remember that these are examples and actual rates and fees may vary based on individual circumstances and market conditions. Always confirm the current rates and fees directly with TD Bank.

| Loan Type | Loan Term (Years) | Approximate Interest Rate (Annual Percentage Rate – APR) | Approximate Origination Fee |

|---|---|---|---|

| Undergraduate | 5 | 6.5% | $100 |

| Undergraduate | 10 | 7.0% | $100 |

| Graduate | 5 | 7.5% | $150 |

| Graduate | 10 | 8.0% | $150 |

| Parent | 5 | 7.0% – 9.0% (variable based on credit score) | $100 |

| Parent | 10 | 7.5% – 9.5% (variable based on credit score) | $100 |

Note: These rates and fees are illustrative examples only and are subject to change. Origination fees are typically a percentage of the loan amount, while late payment fees are usually a fixed dollar amount. TD Bank may or may not charge prepayment penalties; it’s crucial to check your loan agreement for details.

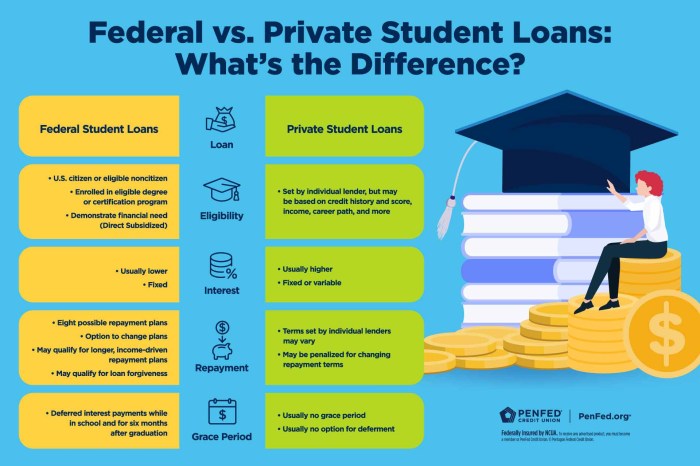

Eligibility Requirements for TD Bank Student Loans

Securing a TD Bank student loan requires meeting specific criteria. Understanding these requirements beforehand will help streamline the application process and increase your chances of approval. The eligibility process involves assessing your academic standing, financial situation, and credit history (if applicable).

Applicants must demonstrate a clear commitment to their education and possess the financial responsibility to manage a student loan. The necessary documentation plays a crucial role in verifying this commitment and responsibility. Failing to provide complete and accurate documentation may delay or prevent loan approval.

Required Documentation

Providing accurate and complete documentation is vital for a smooth application process. TD Bank will require specific documents to verify your identity, academic standing, and financial situation. This ensures they can properly assess your eligibility and manage risk.

- Completed Application Form: This form gathers essential personal and academic information.

- Proof of Identity: This typically involves providing a government-issued photo ID, such as a driver’s license or passport.

- Academic Transcripts: Official transcripts from your current or previously attended institution(s) are required to verify enrollment and academic progress. These transcripts should show your GPA and course history.

- Income Verification (for some loan types): Depending on the type of student loan and your co-signer’s involvement, income documentation might be necessary. This could include pay stubs, tax returns, or bank statements.

- Co-signer Information (if applicable): If a co-signer is required, they will need to provide similar documentation, including their proof of identity and income verification.

Key Eligibility Requirements

Meeting these key requirements significantly increases your chances of approval for a TD Bank student loan. These criteria are designed to ensure responsible lending and protect both the borrower and the bank.

- Enrollment or Acceptance at an Eligible Institution: You must be enrolled or accepted at a college, university, or vocational school that TD Bank considers eligible for their student loan program.

- U.S. Citizenship or Permanent Residency: Generally, applicants must be a U.S. citizen or permanent resident.

- Satisfactory Academic Standing: Maintaining a minimum GPA (the specific requirement may vary) is usually a prerequisite. This demonstrates your ability to succeed academically and manage your studies effectively.

- Creditworthiness (for some loan types): For certain loan types, a credit check may be performed. A strong credit history can improve your chances of approval, particularly if you are not using a co-signer.

- Demonstrated Financial Need (for some loan types): Some student loan programs prioritize applicants who demonstrate a financial need for assistance with their education costs.

Application Process for TD Bank Student Loans

Applying for a TD Bank student loan involves a straightforward process designed to help students secure the funding they need for their education. The application itself is primarily completed online, making it convenient and accessible. You’ll need to gather certain documentation beforehand to ensure a smooth and efficient application process.

The application process is designed to be completed entirely online, offering convenience and efficiency. This minimizes the paperwork involved and allows for quicker processing times. Let’s Artikel the steps involved.

Required Information for the Application

The TD Bank student loan application requires specific information to assess your eligibility and determine the loan amount you qualify for. Providing accurate and complete information is crucial for a timely processing of your application. Incomplete applications may result in delays.

- Personal Information: This includes your full name, address, date of birth, social security number, and contact information.

- Educational Information: You will need to provide details about the school you are attending or plan to attend, including the school’s name, address, and your intended program of study. You’ll also need to specify the academic year for which you’re requesting funding and the estimated cost of your education.

- Financial Information: This section will require information about your income, assets, and existing debts. This helps TD Bank assess your ability to repay the loan. You may be asked to provide tax returns or pay stubs.

- Co-signer Information (if applicable): If you require a co-signer, you’ll need to provide their personal and financial information, similar to what’s required for the primary applicant.

Step-by-Step Application Procedure

The application process is designed for ease of use. Following these steps will ensure a smooth and efficient application submission.

- Visit the TD Bank Website: Begin by navigating to the TD Bank website and locating the student loan application portal. This is usually easily accessible through their main website’s menu.

- Create an Account (if needed): If you don’t already have an online banking account with TD Bank, you may need to create one to access the application.

- Complete the Application Form: Carefully fill out all required fields on the application form, ensuring accuracy in all provided information. Review the information before submitting.

- Upload Supporting Documents: You’ll likely need to upload supporting documents such as proof of enrollment, tax returns, or pay stubs. Ensure these documents are in a readily uploadable format (like PDF).

- Submit the Application: Once you’ve completed the form and uploaded all necessary documents, submit your application. You will likely receive a confirmation message or email.

- Review and Approval: TD Bank will review your application. This process may take several days or weeks. You will be notified of the decision via email or mail.

Repayment Options for TD Bank Student Loans

Understanding your repayment options is crucial for effectively managing your TD Bank student loan. Choosing the right plan depends on your individual financial situation and comfort level with monthly payments. TD Bank likely offers several repayment plans to accommodate varying needs and budgets. While specific details may vary based on your loan agreement, common options include standard, graduated, and extended repayment plans.

TD Bank’s student loan repayment plans allow borrowers to customize their monthly payments to fit their financial circumstances. Each plan offers a different approach to repayment, balancing the total amount paid over the life of the loan with the size of monthly payments. It’s essential to carefully consider the implications of each plan before making a selection.

Standard Repayment Plan

The standard repayment plan typically involves fixed monthly payments over a set period, often 10 years. This predictability is beneficial for budgeting, but monthly payments may be higher than other options. For example, a $20,000 loan with a 5% interest rate over 10 years would likely result in a monthly payment around $212. A $30,000 loan under the same conditions might have a monthly payment close to $318. These are estimates and actual amounts depend on the specific interest rate and loan terms.

Graduated Repayment Plan

A graduated repayment plan starts with lower monthly payments that gradually increase over time. This can be helpful for recent graduates who may have lower incomes initially. However, the total amount paid over the life of the loan may be higher due to the longer repayment period and accumulating interest. For instance, a $20,000 loan might start with a lower monthly payment, perhaps around $150, increasing annually. The final payments would be considerably higher than the initial ones. A $30,000 loan would follow a similar pattern, starting with a higher initial payment than the $20,000 example but still increasing over time.

Extended Repayment Plan

An extended repayment plan spreads the loan repayment over a longer period, resulting in lower monthly payments. This provides more flexibility but typically leads to a higher total interest paid over the loan’s life. For a $20,000 loan, an extended plan might stretch the repayment to 20 years, significantly reducing the monthly payment, potentially to around $106. A $30,000 loan under a similar extended plan might have a monthly payment near $159. Again, these are illustrative examples, and the actual figures depend on the interest rate and loan terms.

Sample Monthly Payment Amounts

The following table provides example monthly payment amounts for different loan amounts and repayment plans. Remember that these are estimates and your actual payments may vary based on your specific loan terms and interest rate. Always refer to your loan agreement for precise figures.

| Loan Amount | Standard Repayment (10 years) | Graduated Repayment (10 years) | Extended Repayment (20 years) |

|---|---|---|---|

| $20,000 | ~$212 | ~$150 (initial), increasing annually | ~$106 |

| $30,000 | ~$318 | ~$225 (initial), increasing annually | ~$159 |

| $40,000 | ~$424 | ~$300 (initial), increasing annually | ~$212 |

Comparing TD Bank Student Loans to Other Lenders

Choosing a student loan lender requires careful consideration of various factors. Understanding the differences in interest rates, fees, and repayment options between lenders is crucial for securing the best financial outcome. This section compares TD Bank’s student loan offerings with those of two other major lenders to help you make an informed decision. We’ll focus on key aspects to facilitate a clear comparison.

Interest Rates, Fees, and Repayment Options Comparison

Interest rates, fees, and repayment options significantly influence the overall cost and manageability of a student loan. Variations exist between lenders, impacting the borrower’s long-term financial picture. A thorough comparison is essential before committing to a loan.

| Feature | TD Bank | Sallie Mae | Discover |

|---|---|---|---|

| Interest Rate (Variable) | Varies depending on creditworthiness and loan type; check TD Bank’s website for current rates. | Varies depending on creditworthiness and loan type; check Sallie Mae’s website for current rates. | Varies depending on creditworthiness and loan type; check Discover’s website for current rates. |

| Interest Rate (Fixed) | Varies depending on creditworthiness and loan type; check TD Bank’s website for current rates. | Varies depending on creditworthiness and loan type; check Sallie Mae’s website for current rates. | Varies depending on creditworthiness and loan type; check Discover’s website for current rates. |

| Origination Fees | May vary; check TD Bank’s website for current fees. | May vary; check Sallie Mae’s website for current fees. | May vary; check Discover’s website for current fees. |

| Late Payment Fees | May vary; check TD Bank’s website for current fees. | May vary; check Sallie Mae’s website for current fees. | May vary; check Discover’s website for current fees. |

| Repayment Options | Standard, graduated, and extended repayment plans are typically available. Specific options depend on loan type and amount. | Offers various repayment plans, including standard, graduated, and income-driven repayment options. | Provides standard repayment plans, and may offer other options depending on the loan type and borrower’s circumstances. |

Managing and Understanding Your TD Bank Student Loan

Successfully managing your TD Bank student loan requires proactive planning and consistent effort. Understanding your repayment schedule, interest accrual, and available resources is crucial to avoiding financial difficulties and ensuring timely repayment. This section will provide practical strategies for responsible loan management and guidance on accessing important account information.

Effective student loan management hinges on creating a realistic budget and adhering to it. This involves carefully tracking income and expenses to identify areas where savings can be maximized. Prioritizing loan payments and ensuring timely payments are essential to avoid late fees and negative impacts on your credit score. Late payments can significantly increase the overall cost of your loan and damage your financial standing, making future borrowing more challenging. Regularly reviewing your budget and adjusting it as needed allows for flexibility and helps maintain financial stability throughout your repayment period.

Accessing Account Statements and Customer Support

Accessing your TD Bank student loan account statements is straightforward. You can typically access your statements online through the TD Bank website or mobile app. This allows for convenient tracking of payments, interest accrual, and outstanding balances. Should you need to contact customer support, TD Bank offers multiple channels for assistance, including phone, email, and online chat. Their website usually provides contact information and frequently asked questions to help resolve common issues quickly.

Tips for Effective Student Loan Management

The following tips can help you effectively manage your student loan and ensure a smooth repayment process. Implementing these strategies will contribute to a more financially secure future.

- Create a detailed budget: Track all income and expenses to identify areas for potential savings and allocate funds for loan payments.

- Automate payments: Set up automatic payments to ensure on-time payments and avoid late fees. This also simplifies the repayment process.

- Explore repayment options: Understand the various repayment plans offered by TD Bank and choose the one that best suits your financial situation. This might include options like graduated repayment or income-driven repayment plans.

- Communicate with TD Bank: Contact customer support immediately if you anticipate difficulty making a payment. They may offer options to help you avoid delinquency.

- Monitor your credit report: Regularly check your credit report to ensure the accuracy of your loan information and identify any potential issues.

- Consider loan consolidation (if applicable): If you have multiple student loans, explore the possibility of consolidating them into a single loan with a potentially lower interest rate.

Potential Challenges and Solutions with TD Bank Student Loans

Securing a student loan can be a significant step towards higher education, but navigating the process and managing repayment can present challenges. Understanding potential difficulties and proactively developing strategies to address them is crucial for a successful loan experience. This section Artikels common challenges students may encounter with TD Bank student loans and offers practical solutions.

High Interest Rates and Loan Costs

High interest rates can significantly increase the total cost of a student loan over its lifespan. This can lead to a larger debt burden upon graduation. For example, a small difference in interest rates over a 10-year repayment period can result in thousands of dollars of extra interest paid.

| Challenge | Solution |

|---|---|

| High interest rates increasing the total loan cost. | Explore loan options with lower interest rates from other lenders or consider refinancing once interest rates decrease. Consider making extra payments to reduce principal faster. |

| Difficulty understanding loan terms and fees. | Carefully review the loan agreement, contact TD Bank’s customer service for clarification on any unclear aspects, and seek independent financial advice if needed. |

Difficulty in Repayment

Managing student loan repayments after graduation can be stressful, especially when faced with unexpected expenses or job loss. Delayed or missed payments can lead to penalties and negatively impact credit scores. For instance, a recent graduate may find it difficult to balance monthly loan payments with living expenses and unexpected car repairs.

| Challenge | Solution |

|---|---|

| Difficulty budgeting for monthly loan payments. | Create a detailed budget, prioritizing loan payments, and exploring options like income-driven repayment plans offered by TD Bank or the government. |

| Unexpected life events impacting repayment ability. | Contact TD Bank immediately to discuss options such as deferment or forbearance if facing temporary financial hardship. |

Lack of Financial Literacy

A lack of understanding of personal finance and loan management can lead to poor financial decisions. This includes not understanding the implications of interest capitalization or the long-term effects of missed payments. For example, a student might not realize the impact of consistently making minimum payments only, extending the repayment period and increasing the total interest paid.

| Challenge | Solution |

|---|---|

| Insufficient understanding of loan terms and repayment strategies. | Utilize TD Bank’s educational resources, seek guidance from a financial advisor, and take advantage of free online resources for improving financial literacy. |

| Difficulty tracking loan payments and managing finances. | Use budgeting apps or spreadsheets to track expenses and loan payments effectively. |

Illustrative Example: Sarah’s Journey with a TD Bank Student Loan

Sarah, a bright and ambitious student pursuing a degree in Computer Science, found herself facing the daunting task of financing her education. After researching various options, she decided to apply for a TD Bank student loan, drawn to its competitive interest rates and flexible repayment options.

The Application Process

Sarah began the application process online. The TD Bank website provided a clear and straightforward application form, requiring her to input personal information, academic details, and her desired loan amount. She found the process relatively easy to navigate, uploading necessary documents such as her acceptance letter and transcript with minimal difficulty. She experienced some initial anxiety about providing sensitive financial information, but the website’s security assurances eased her concerns. The application was processed quickly, and within a week, she received a pre-approval notification. This initial acceptance boosted her confidence and reduced her stress significantly.

Loan Approval and Disbursement

Following the pre-approval, Sarah finalized her loan application, specifying the loan amount she needed for tuition, fees, and living expenses. The final approval process took a few more days, but the communication from TD Bank was excellent. She received regular updates via email and was able to track her application’s progress online. Once approved, the funds were disbursed directly to her university account, ensuring timely payment of her tuition fees. This seamless process allowed Sarah to focus on her studies without the added worry of managing finances.

Choosing a Repayment Plan

After graduation, Sarah carefully reviewed the different repayment options offered by TD Bank. She considered her post-graduation employment prospects and decided on a graduated repayment plan, which started with lower monthly payments and gradually increased over time as her income was expected to rise. This plan provided her with financial flexibility during the initial years of her career. She appreciated the clarity of the repayment schedule provided by TD Bank, which allowed her to budget effectively.

Managing and Repaying the Loan

Sarah diligently made her monthly payments on time, utilizing TD Bank’s online banking platform for ease of access and payment tracking. The online portal provided clear statements, allowing her to monitor her loan balance and repayment progress. She occasionally contacted customer service with minor queries and found their representatives to be helpful and responsive. She felt a sense of accomplishment with each payment made, knowing she was steadily reducing her debt. The overall experience with TD Bank, from application to repayment, was positive and efficient. She felt supported throughout the entire process, which significantly reduced her financial anxieties.

Outcome Summary

Securing a student loan is a significant step, and choosing the right lender is crucial. This guide has provided a detailed exploration of TD Bank student loans, covering key aspects from interest rates and fees to repayment options and managing your account. By understanding the intricacies of the application process, eligibility requirements, and available repayment plans, you can make an informed decision that aligns with your financial goals and sets you up for a smoother path to higher education.

Questions and Answers

What credit score is needed for a TD Bank student loan?

While TD Bank doesn’t publicly state a minimum credit score requirement, a good credit score will generally improve your chances of approval and securing a favorable interest rate. A co-signer with good credit can also help.

Can I refinance my existing student loans with TD Bank?

TD Bank does not currently offer student loan refinancing. You would need to explore refinancing options with other lenders.

What happens if I miss a student loan payment?

Missing a payment will likely result in late fees and negatively impact your credit score. Contact TD Bank immediately if you anticipate difficulty making a payment to explore options like forbearance or deferment.

Does TD Bank offer any student loan forgiveness programs?

TD Bank itself does not offer loan forgiveness programs. Eligibility for government loan forgiveness programs depends on your loan type and employment.