Navigating the complexities of higher education financing can be daunting, particularly when understanding the nuances of state-specific loan programs. This guide delves into the world of Texas state student loans, providing a clear and concise overview of available options, application processes, repayment strategies, and potential forgiveness programs. We aim to equip Texas students and prospective borrowers with the knowledge necessary to make informed decisions about their educational funding.

From understanding the various loan types and eligibility criteria to exploring repayment plans and available resources, we cover all the essential aspects of Texas state student loans. This comprehensive resource will empower you to manage your student loan debt effectively and achieve your educational goals with greater financial clarity.

Types of Texas State Student Loans

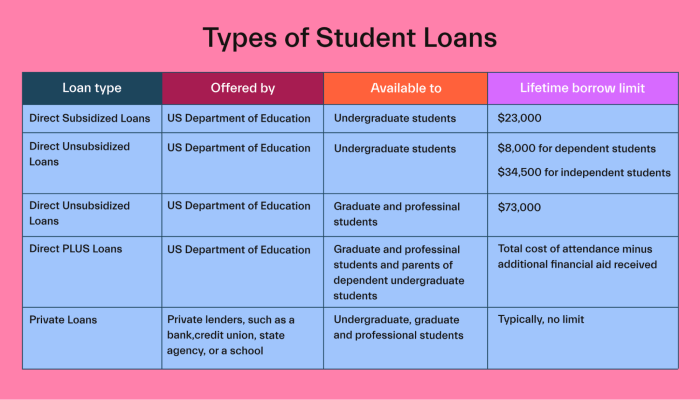

The Texas Higher Education Coordinating Board (THECB) doesn’t directly offer student loans. Instead, it oversees and regulates the state’s financial aid programs, many of which involve partnerships with private lenders. Understanding the various loan options available to Texas students requires looking beyond a single “Texas State Student Loan” and examining the different programs and lenders involved. This information will help clarify the landscape of student financing in Texas.

Texas Guaranteed Student Loan Program (TGSLP)

The TGSLP is a crucial program, though it’s not a loan itself. It’s a state-sponsored program that guarantees student loans made by private lenders. This guarantee reduces the risk for lenders, allowing them to offer more favorable terms to Texas students. Eligibility generally requires enrollment in a Texas-approved institution, demonstrating financial need, and maintaining satisfactory academic progress. Interest rates and repayment terms vary based on the lender and the specific loan product offered through the TGSLP. These loans often offer options for fixed or variable interest rates and various repayment plans (e.g., graduated, extended).

Federal Student Loans

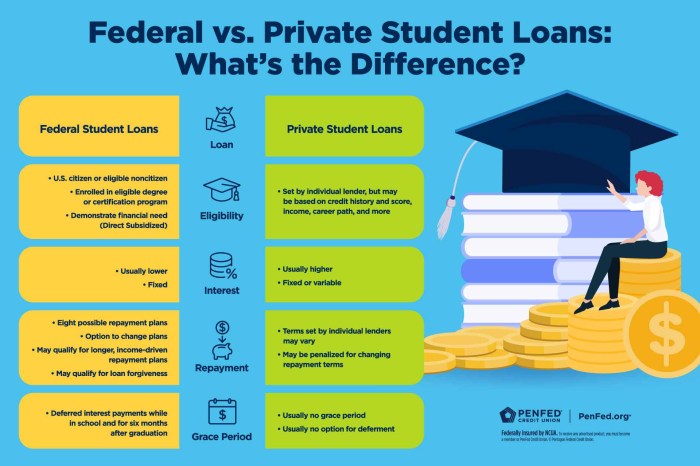

While not explicitly “Texas State” loans, federal student loans are a significant source of funding for Texas students. These loans are offered by the federal government through programs like the Federal Direct Loan Program. Eligibility criteria are determined by the federal government and include factors such as enrollment status, financial need (for subsidized loans), and credit history (for unsubsidized loans). Interest rates are set annually by the federal government, and repayment terms are generally standardized, though income-driven repayment plans are available.

Private Student Loans

Many private lenders offer student loans to Texas residents. These loans are not guaranteed by the state or federal government, and eligibility criteria are set by each individual lender. Generally, private lenders will consider factors such as credit score (often requiring a co-signer for students with limited or no credit history), income, and debt-to-income ratio. Interest rates and repayment terms for private loans are highly variable, depending on the lender, the student’s creditworthiness, and the loan amount.

Table Summarizing Key Features

| Loan Name | Eligibility | Interest Rate | Repayment Options |

|---|---|---|---|

| TGSLP (Loans from Participating Lenders) | Enrollment in Texas institution, financial need, satisfactory academic progress | Variable; depends on lender and market conditions | Variable; depends on lender (e.g., standard, graduated, extended) |

| Federal Direct Loans (e.g., Subsidized/Unsubsidized) | Enrollment status, financial need (for subsidized), credit history (for unsubsidized) | Fixed; set annually by the federal government | Standard, graduated, income-driven repayment plans |

| Private Student Loans | Credit score, income, debt-to-income ratio (often requires co-signer) | Variable; depends on lender and borrower’s creditworthiness | Variable; depends on lender (e.g., standard, graduated, extended) |

Application Process and Requirements

Applying for a Texas state student loan involves several key steps and requires the submission of specific documentation. The process is designed to ensure that applicants meet eligibility criteria and that the loan funds are used appropriately for educational expenses. Careful attention to detail during each stage is crucial for a smooth and successful application.

Application Steps

The application process for Texas state student loans typically involves these sequential steps:

- Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is the first step. This application gathers your financial information and determines your eligibility for federal and state aid, including student loans. Accurate and complete information is vital for processing.

- Apply for the Texas State Grant Program (if applicable): If you qualify for a Texas State Grant, applying for it concurrently with your loan application can simplify the process and potentially reduce the amount you need to borrow.

- Choose a Loan Program and Lender: Texas offers various state-sponsored loan programs. Research the options available to determine which best suits your needs and financial circumstances. Some programs may require you to use a specific lender.

- Complete the Loan Application: After selecting your loan program and lender, you’ll complete the lender’s application. This form will require additional financial and personal information. Review all instructions carefully before submitting.

- Submit Required Documents: Gather and submit all necessary supporting documentation, such as tax returns, proof of enrollment, and other financial information. Failure to provide all required documents will delay processing.

- Verification: The lender will verify the information provided in your application. This may involve requesting additional documentation or contacting your school. Respond promptly to any requests for information.

- Loan Approval and Disbursement: Once your application is approved and verified, the loan funds will be disbursed to your school according to your enrollment schedule. You’ll receive notification of the disbursement dates.

Required Documents

The specific documents required may vary slightly depending on the lender and loan program. However, common documents include:

- Completed FAFSA

- Proof of enrollment (acceptance letter or enrollment verification from your school)

- Tax returns (yours and your parents’, if applicable)

- Social Security number

- Driver’s license or other government-issued identification

- Bank statements (may be required)

- Proof of income (may be required)

Verification Process

The verification process is designed to ensure the accuracy of the information provided in your loan application. Lenders may request additional documentation to verify your income, assets, and enrollment status. This process is essential to prevent fraud and ensure that only eligible students receive loans. Expect to provide prompt responses to any verification requests to avoid delays in loan processing. Failure to provide requested documentation may result in loan denial.

Loan Repayment Options and Plans

Choosing the right repayment plan for your Texas State student loans is crucial for managing your debt effectively and avoiding financial hardship. Several options are available, each with its own advantages and disadvantages depending on your individual financial circumstances. Understanding these options and their implications will allow you to make an informed decision that best suits your needs.

The repayment plan you select will significantly impact your monthly payment amount, the total interest paid over the life of the loan, and the length of time it takes to repay the debt. Factors such as your income, family size, and loan amount will influence which plan is most suitable. It’s advisable to carefully consider all options before making a commitment.

Standard Repayment Plan

The Standard Repayment Plan is the most straightforward option. It involves fixed monthly payments over a 10-year period. This plan results in the lowest total interest paid over the life of the loan because of the shorter repayment period. However, monthly payments may be higher than under other plans. This plan is ideal for borrowers who can comfortably afford higher monthly payments and prioritize paying off their loans quickly.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years. Consequently, monthly payments are lower than under the Standard Repayment Plan. However, the total interest paid over the life of the loan will be significantly higher due to the extended repayment period. This plan is suitable for borrowers who need lower monthly payments to manage their budget more effectively.

Income-Driven Repayment (IDR) Plans

IDR plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, tie your monthly payments to your income and family size. Your monthly payment is calculated as a percentage of your discretionary income (income above a certain threshold). If your income is low, your monthly payments could be very low or even $0. However, any remaining loan balance after a set period (typically 20 or 25 years) may be forgiven, though this forgiveness is considered taxable income. These plans are beneficial for borrowers with lower incomes or unexpected financial difficulties. It’s important to note that the longer repayment period will likely result in higher overall interest paid.

Strategies for Managing Student Loan Debt Effectively

Effective student loan debt management requires proactive planning and consistent effort. Creating a realistic budget that accounts for loan repayments is paramount. Prioritizing loan payments and exploring options for extra payments when possible can significantly reduce the total interest paid and shorten the repayment period. Regularly reviewing your repayment plan and making adjustments as needed based on your financial situation is crucial. Seeking professional financial advice can also be beneficial in developing a personalized debt management strategy.

Sample Repayment Schedule

The following table illustrates the impact of different repayment amounts on the total repayment period, assuming a $20,000 loan at a 5% annual interest rate. Note that this is a simplified example and actual repayment schedules may vary.

| Monthly Payment | Total Repayment Period (Years) | Total Interest Paid |

|---|---|---|

| $200 | 12 | $2,640 |

| $150 | 18 | $4,600 |

| $100 | 30 | $8,600 |

Loan Forgiveness and Cancellation Programs

Navigating the complexities of student loan repayment can be daunting, but several programs offer pathways to loan forgiveness or cancellation for eligible Texas state student loan borrowers. Understanding these programs and their eligibility criteria is crucial for effective financial planning. These programs are designed to incentivize specific career paths or address hardship situations.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program is a federal program, not specifically a Texas state program, but it’s available to borrowers with federal Direct Loans who work full-time for qualifying government or non-profit organizations. After making 120 qualifying monthly payments under an income-driven repayment plan, the remaining balance may be forgiven. Eligibility requires consistent employment in a qualifying role and adherence to the specific payment plan requirements. Failure to meet these requirements can result in ineligibility for forgiveness. Examples of qualifying employers include government agencies at all levels (federal, state, local), and non-profits that serve the public interest.

Teacher Loan Forgiveness Program

This federal program provides forgiveness for qualified teachers who teach full-time for at least five consecutive academic years in a low-income school or educational service agency. Borrowers must meet specific income requirements and teach in designated schools. The program forgives a portion of the loan, up to a certain amount. The benefits are significant for educators committed to working in underserved communities, but the eligibility criteria are strict and require verification of employment and school designation.

Income-Driven Repayment Plans

While not strictly loan forgiveness, income-driven repayment (IDR) plans can significantly reduce monthly payments based on income and family size. These plans extend the repayment period, potentially leading to a lower overall amount paid, though interest will still accrue. Several IDR plans exist, each with its own eligibility criteria and calculation methods. The benefit lies in affordability, but the drawback is a longer repayment timeline and the potential for a larger total repayment amount due to accumulated interest over the extended period. For example, a borrower with a low income might see their monthly payment reduced to a manageable amount, but this comes at the cost of a longer repayment period.

State-Specific Programs

While Texas doesn’t have a comprehensive state-level loan forgiveness program comparable to the federal programs mentioned above, it’s crucial to check with the Texas Higher Education Coordinating Board for any updates or potential state-sponsored initiatives that might offer assistance with loan repayment. These programs may be limited or targeted towards specific demographics or fields of study.

Impact of Texas State Student Loans on Student Debt

Texas State student loans play a significant role in financing higher education for many Texans, but their impact on overall student debt levels requires careful examination. While these loans provide access to education, they also contribute to the growing burden of student loan debt in the state. Understanding this impact necessitates analyzing average debt amounts, long-term financial implications, and the historical trend of student loan debt accumulation.

The overall impact of Texas State student loans on student debt levels is complex. While the loans enable many students to pursue higher education who otherwise might not be able to afford it, they also contribute to the rising average student loan debt in Texas. This increase is influenced by various factors including rising tuition costs, increased borrowing by students, and the availability of various loan programs. The net effect is a rise in overall student debt, with Texas State student loans forming a portion of this larger picture.

Average Student Loan Debt for Texas Students

The average amount of student loan debt for Texas students varies depending on the source and year of the data. However, consistently, Texas students graduate with significantly higher levels of debt than the national average. Reports from organizations like the Institute for College Access & Success (TICAS) often provide data on this, revealing average debt figures for Texas graduates across various institutions and degree programs. For example, a recent TICAS report might show that the average Texas student graduates with $30,000 in student loan debt, while the national average is around $25,000. These figures highlight the relatively higher burden of student loan debt faced by Texas graduates. This difference can be attributed to various factors including the cost of living in Texas, the tuition rates at Texas universities, and the proportion of students relying on loans to finance their education.

Long-Term Financial Implications of Student Loan Debt

High levels of student loan debt have profound long-term financial implications for Texas graduates. These implications can impact major life decisions such as homeownership, starting a family, and retirement planning. The significant monthly payments required to repay these loans can constrain financial flexibility, limiting opportunities for saving, investing, and building wealth. Delayed homeownership is a common consequence, as substantial loan repayments can reduce the affordability of purchasing a home. Furthermore, the burden of student loan debt can affect career choices, potentially leading individuals to prioritize higher-paying jobs over those they might find more fulfilling. The long shadow of student loan debt can also impact credit scores, making it more difficult to secure loans for other purposes in the future.

Growth of Student Loan Debt in Texas (Visual Representation)

Imagine a bar graph charting the growth of student loan debt in Texas over the past decade. The horizontal axis represents the years, from 2013 to 2023. The vertical axis represents the total student loan debt in billions of dollars. The bars would show a clear upward trend, starting relatively low in 2013 and progressively increasing in height each year. The graph would visually demonstrate the substantial growth of student loan debt in Texas over the past decade, highlighting the increasing financial burden on Texas graduates. For example, the bar for 2013 might be significantly shorter than the bar for 2023, representing the considerable increase in total student loan debt over that period. The visual would clearly illustrate the magnitude of the problem and the need for addressing the rising cost of higher education in Texas.

Resources and Support for Borrowers

Navigating the complexities of student loan repayment can be challenging. Fortunately, numerous resources and support services are available to Texas student loan borrowers to help them understand their options and manage their debt effectively. These resources offer guidance on repayment plans, financial counseling, and potential loan forgiveness programs. Understanding these resources is crucial for successful debt management.

The Role of the Texas Higher Education Coordinating Board (THECB)

The Texas Higher Education Coordinating Board plays a central role in overseeing and supporting student financial aid programs in Texas, including student loans. While the THECB doesn’t directly manage individual loans, it establishes policies and guidelines for loan programs, monitors their effectiveness, and provides information and resources to borrowers. They also work to improve access to higher education and affordability, impacting the overall student loan landscape in Texas. The THECB’s website serves as a valuable hub for information on state-sponsored financial aid programs and related resources.

Financial Counseling Services

Many organizations offer free or low-cost financial counseling services to help borrowers create a budget, manage debt, and develop a repayment strategy. These services can be particularly helpful for borrowers who are struggling to make their loan payments or who are unsure about their repayment options. These counselors often provide personalized advice tailored to individual circumstances. For example, a counselor might help a borrower consolidate their loans, explore income-driven repayment plans, or develop a realistic budget to ensure loan payments are manageable.

- Nonprofit Credit Counseling Agencies: These agencies often offer free or low-cost credit counseling and debt management services. They can help borrowers create a budget, negotiate with creditors, and develop a plan to pay off their debt. Many are certified by the National Foundation for Credit Counseling (NFCC).

- Federal Student Aid (FSA): The federal government provides various resources and tools through the FSA website to help borrowers understand their loan options and manage their debt. This includes access to repayment calculators, information on income-driven repayment plans, and contact information for loan servicers.

- University Financial Aid Offices: Many Texas universities offer financial aid counseling services to their students and alumni. These services can provide personalized guidance on loan repayment, budgeting, and financial planning.

Debt Management and Repayment Assistance Programs

Several programs offer assistance with managing student loan debt and finding suitable repayment plans. These programs often provide guidance on available options and help borrowers navigate the complexities of the repayment process. Understanding these programs is key to finding the most suitable repayment strategy.

- Income-Driven Repayment (IDR) Plans: These federal plans adjust monthly payments based on income and family size, making them more manageable for borrowers with lower incomes. Several IDR plans exist, each with specific eligibility requirements and payment calculation methods.

- Deferment and Forbearance: These temporary pauses in loan payments can provide relief during periods of financial hardship. However, interest may continue to accrue during deferment or forbearance, potentially increasing the total loan amount over time.

- Loan Consolidation: Combining multiple loans into a single loan can simplify repayment and potentially lower monthly payments. However, it’s crucial to understand the terms and conditions of consolidation before proceeding.

Contact Information and Services

For specific contact information and services, it is best to consult the websites of the organizations mentioned above (THECB, NFCC-certified credit counseling agencies, FSA, and individual university financial aid offices). These websites typically provide detailed contact information, including phone numbers, email addresses, and online forms. Additionally, searching online for “student loan assistance Texas” will yield many relevant resources.

Comparison with Federal Student Loans

Choosing between Texas state student loans and federal student loans requires careful consideration of several factors. Both offer financial assistance for higher education, but they differ significantly in eligibility criteria, interest rates, and repayment options. Understanding these differences is crucial for making informed decisions about financing your education.

Texas state student loans and federal student loans each present distinct advantages and disadvantages. Federal loans generally offer broader eligibility and more robust borrower protections, while state loans may have more specific eligibility requirements but potentially lower interest rates in certain circumstances. The best choice depends on individual financial circumstances and eligibility for specific programs.

Eligibility Requirements

Eligibility for Texas state student loans is typically restricted to Texas residents attending eligible Texas institutions. Federal student loans, conversely, have broader eligibility criteria, encompassing students from all states attending accredited institutions nationwide. Federal loan programs, such as the Stafford Loan and Perkins Loan, often have income-based eligibility requirements. The Texas Guaranteed Student Loan Program, for instance, has specific requirements relating to residency and enrollment.

Interest Rates and Fees

Interest rates for both Texas state and federal student loans fluctuate. Federal loan interest rates are set annually by Congress and are generally fixed for the life of the loan. Texas state loan interest rates can vary depending on the specific program and the prevailing market conditions; they may be fixed or variable. It’s important to compare the current interest rates offered by both federal and state programs to determine the most cost-effective option. Additionally, both federal and state loans may have associated origination fees, impacting the overall cost of borrowing.

Repayment Options

Both federal and state loan programs provide various repayment options. Federal student loans offer a range of repayment plans, including standard, graduated, extended, and income-driven repayment plans. Income-driven repayment plans adjust monthly payments based on income and family size, making them more manageable for borrowers with lower incomes. Texas state loan repayment plans may be more limited, often mirroring the standard repayment plans offered by federal programs. The availability and specific terms of repayment plans will vary depending on the lender and the type of loan.

| Loan Type | Eligibility | Interest Rate | Repayment Options |

|---|---|---|---|

| Texas State Student Loans (e.g., Texas Guaranteed Student Loan Program) | Texas residency, enrollment in eligible Texas institution | Variable or fixed; depends on the program and market conditions. | Standard, potentially other options depending on the lender. |

| Federal Student Loans (e.g., Stafford Loans, Perkins Loans) | US citizenship or eligible non-citizen status, enrollment in eligible institution | Fixed; set annually by Congress. | Standard, graduated, extended, income-driven repayment plans. |

Final Conclusion

Securing a higher education requires careful financial planning. Understanding the intricacies of Texas state student loans is a crucial step in this process. By leveraging the information presented in this guide—from application procedures to repayment options and forgiveness programs—Texas students can confidently navigate the path to academic success while mitigating the long-term financial implications of student loan debt. Remember to explore all available resources and seek personalized guidance when necessary.

Key Questions Answered

What is the Texas Higher Education Coordinating Board’s role in student loans?

The THECB oversees and coordinates Texas’s higher education system, including providing information and resources related to student financial aid, including state-based loan programs.

Can I consolidate my Texas state student loans with federal loans?

Generally, consolidation options depend on the specific loan types. It’s best to contact the loan servicer to explore consolidation possibilities.

What happens if I default on my Texas state student loan?

Defaulting on a student loan has serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Contact your loan servicer immediately if you’re facing difficulties.

Are there any income-based repayment plans for Texas state student loans?

The availability of income-driven repayment plans varies depending on the specific loan program. Check with your loan servicer for details on available options.