Navigating the complex world of student loans can be daunting, especially when considering options beyond federal programs. Thrivent, a well-known financial services organization, offers student loans with potentially attractive features, but understanding their intricacies is crucial for making informed decisions. This guide delves into the specifics of Thrivent student loans, providing a clear and concise overview of eligibility, interest rates, repayment options, fees, customer service, and a comparison to federal loans.

We aim to equip prospective borrowers with the knowledge needed to assess whether a Thrivent student loan aligns with their individual financial circumstances and long-term goals. By comparing Thrivent’s offerings to other options, this guide helps you navigate the complexities of student loan financing and make the best choice for your educational journey.

Thrivent Student Loan Eligibility Requirements

Securing a student loan can be a significant step towards higher education. Understanding the eligibility requirements is crucial for a smooth application process. This section details the specific criteria for Thrivent student loans and compares them to other major providers.

Thrivent Student Loan Eligibility Criteria

To qualify for a Thrivent student loan, applicants generally need to meet several key requirements. These typically include being a U.S. citizen or permanent resident, enrolling at least half-time in an eligible degree program at an accredited institution, and demonstrating financial need. Specific requirements may vary based on the type of loan and the applicant’s circumstances. It’s important to check Thrivent’s official website for the most up-to-date information.

Comparison with Other Student Loan Providers

Thrivent’s eligibility requirements are generally comparable to other major student loan providers, such as Sallie Mae, Navient, and federal loan programs. All providers require enrollment in an eligible educational program and typically assess creditworthiness, though the specific criteria and weight given to various factors may differ. For example, some lenders may place more emphasis on credit history, while others may prioritize factors like co-signer availability or demonstrated financial need. Federal loan programs often have less stringent credit requirements but may have income-based limitations.

Thrivent Student Loan Application Process

Applying for a Thrivent student loan typically involves several steps. First, you’ll need to gather necessary documentation, including proof of enrollment, financial aid award letters, and personal identification. Next, you’ll complete the online application form, providing accurate information about your education, finances, and personal details. Thrivent will then review your application and may request additional documentation. Once approved, you’ll receive loan disbursement information, and the funds will be sent directly to your educational institution. Throughout the process, it’s advisable to maintain open communication with Thrivent’s loan servicing department to address any questions or concerns.

Key Eligibility Factors

| Factor | Requirement | Comparison to Other Lenders | Notes |

|---|---|---|---|

| U.S. Citizenship/Residency | Required | Generally required by most lenders | May vary slightly depending on loan type |

| Enrollment Status | At least half-time enrollment | Similar across most lenders | Specific definition of “half-time” may vary by institution |

| Credit Score | May be considered | Often a factor, but weight varies | A strong credit score may improve approval chances and interest rates. Co-signers can help. |

| Degree Program | Must be from an accredited institution | Generally required | Specific program eligibility may vary; check with Thrivent. |

Fees and Charges Associated with Thrivent Student Loans

Understanding the fees associated with a student loan is crucial for budgeting and accurately assessing the total cost of your education. While Thrivent strives to offer competitive rates, it’s important to be aware of all applicable charges to make informed financial decisions. This section details the various fees you might encounter with a Thrivent student loan.

Thrivent Student Loans, like those offered by other lenders, typically include several types of fees. These fees can add to the overall cost of borrowing, so it’s vital to understand what they are and how they might affect your repayment plan. Failure to understand these charges could lead to unexpected expenses down the line.

Origination Fees

Origination fees are charges levied by the lender to cover the administrative costs of processing your loan application. These fees are usually a percentage of the total loan amount and are deducted from the loan proceeds before you receive the funds. For example, a 1% origination fee on a $10,000 loan would result in a $100 fee, meaning you would receive $9,900.

Late Payment Fees

Late payment fees are penalties imposed when you fail to make your loan payments on time. The specific amount of the late fee varies depending on the lender and the loan agreement. These fees can significantly increase the total cost of borrowing if payments are consistently late. It is essential to adhere to the payment schedule to avoid incurring these additional costs. For instance, a late fee of $25 per missed payment can quickly accumulate if several payments are delayed.

Other Potential Fees

While origination and late payment fees are the most common, other fees might apply depending on your specific loan terms and circumstances. These could include fees for returned payments, early repayment penalties (though less common with federal loans), or other administrative charges. It’s always advisable to carefully review your loan documents to fully understand all applicable fees.

Comparison to Competitor Institutions

Comparing Thrivent’s fee structure to that of other lenders requires researching specific loan products from competing institutions. Many banks, credit unions, and private lenders offer student loans with varying fee structures. Some may have higher origination fees but lower interest rates, while others might have lower origination fees but higher interest rates. A thorough comparison of all associated costs, including fees and interest rates, is essential before choosing a loan provider. Consider using online loan comparison tools to assist in this process.

Impact of Fees on Overall Borrowing Cost

The cumulative effect of all fees, combined with interest charges, significantly impacts the overall cost of borrowing. Even seemingly small fees can add up over the life of the loan, potentially increasing the total amount repaid by hundreds or even thousands of dollars. To illustrate, consider a $20,000 loan with a 1% origination fee ($200) and several late payment fees totaling $150. These fees, along with accrued interest, would increase the total cost significantly compared to a loan with no or lower fees. Therefore, minimizing fees through timely payments and careful loan selection is crucial.

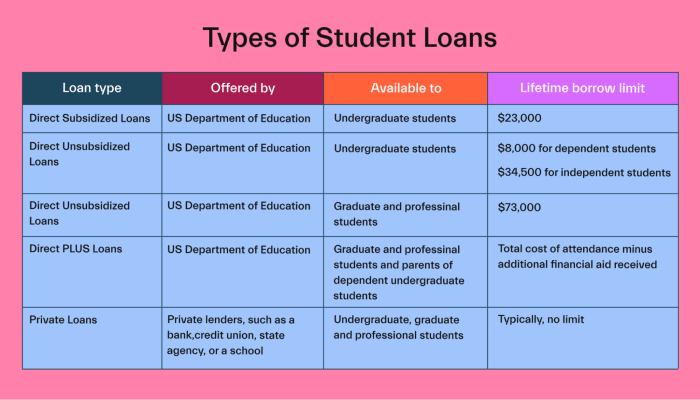

Thrivent Student Loan vs. Federal Student Loans

Choosing between a Thrivent student loan and a federal student loan is a significant decision impacting your financial future. Understanding the key differences in terms of interest rates, repayment options, and eligibility criteria is crucial for making an informed choice that aligns with your individual circumstances. This comparison will highlight the benefits and drawbacks of each loan type to aid in your decision-making process.

Comparison of Thrivent and Federal Student Loan Features

The following table summarizes key differences between Thrivent student loans and federal student loan programs. Remember that specific terms and conditions can vary depending on the lender and the type of federal loan obtained. Always consult the official websites for the most up-to-date information.

| Feature | Thrivent Student Loan | Federal Student Loan |

|---|---|---|

| Interest Rates | Variable or fixed rates, typically determined by market conditions and creditworthiness. Rates are generally higher than those offered on federal subsidized loans. | Variable or fixed rates, generally lower than private loans. Subsidized loans may offer 0% interest while in school. |

| Repayment Options | Repayment plans vary depending on the lender’s offerings, potentially including standard repayment, graduated repayment, or extended repayment. | Offers various repayment plans including standard, graduated, extended, and income-driven repayment (IDR) plans. IDR plans tie monthly payments to income. |

| Eligibility | Eligibility requirements vary but generally involve credit checks, co-signers may be required, and borrowers need to demonstrate creditworthiness. | Eligibility is based on enrollment status, financial need (for subsidized loans), and U.S. citizenship or eligible non-citizen status. Credit checks are not typically required. |

| Loan Forgiveness Programs | Generally does not offer loan forgiveness programs. | Offers various loan forgiveness programs depending on the type of loan and the borrower’s occupation (e.g., public service loan forgiveness). |

Long-Term Financial Implications

Choosing between Thrivent and federal student loans carries significant long-term financial implications. Federal loans often offer lower interest rates and more flexible repayment options, potentially leading to lower overall borrowing costs. Income-driven repayment plans can significantly reduce monthly payments for borrowers with lower incomes, making them more manageable. However, federal loans may have stricter eligibility requirements. Thrivent loans, while potentially having higher interest rates, may be accessible to borrowers who do not qualify for federal loans due to credit history or other factors. However, the higher interest rates could lead to a significantly larger total repayment amount over the life of the loan.

For example, a borrower with a $50,000 loan at a 5% interest rate (similar to a federal unsubsidized loan) versus a 7% interest rate (common for private loans) would pay substantially more in interest over the loan term. The exact difference depends on the repayment plan, but the higher interest rate can significantly increase the total amount repaid. Careful consideration of these long-term costs is crucial before making a decision.

Illustrative Scenarios

Understanding the impact of different loan choices is crucial for successful student loan repayment. The following scenarios illustrate how various factors, including loan amount, interest rate, and repayment plan, can significantly influence the overall cost and long-term financial implications of borrowing for education through Thrivent. These are illustrative examples and actual results may vary based on individual circumstances and prevailing interest rates.

Scenario 1: Undergraduate Student with Federal Loan Options

This scenario depicts a typical undergraduate student, Maria, pursuing a four-year degree in nursing. She borrows $30,000 in federal student loans at a fixed interest rate of 5% and a further $10,000 through a Thrivent student loan at a fixed rate of 7%. She chooses a standard 10-year repayment plan for both loans. The total cost of her federal loans over 10 years, including interest, will be approximately $38,288. The total cost of her Thrivent loan will be approximately $15,000. This results in a total repayment of approximately $53,288. The higher interest rate on the Thrivent loan significantly increases its overall cost. Maria’s monthly payments will be manageable, but this debt could impact her ability to save for a down payment on a house or invest in retirement for several years after graduation.

Scenario 2: Graduate Student with High Income Potential

David, a graduate student pursuing an MBA, borrows $60,000 through Thrivent at a fixed interest rate of 6.5%. He anticipates a high-earning potential after graduation and opts for a shorter, 5-year repayment plan. The total cost of his loan, including interest, will be approximately $75,000. Although this represents a significant amount, David’s higher income post-graduation should allow him to comfortably manage the monthly payments and still achieve his financial goals, such as investing and paying off the loan early. The aggressive repayment plan, while requiring higher monthly payments, minimizes the overall interest paid.

Scenario 3: Low-Income Undergraduate Student with Limited Options

Sarah, an undergraduate student from a low-income background, needs to borrow $25,000 for her education. Due to her financial circumstances, she qualifies only for a Thrivent student loan at a fixed interest rate of 8%. She selects an extended 15-year repayment plan to keep her monthly payments affordable. The total cost of her loan, including interest, will be approximately $42,000. While the monthly payments are manageable, the extended repayment period significantly increases the total interest paid. This may delay her ability to achieve other financial goals, such as purchasing a car or saving for a down payment on a home, considerably. Careful budgeting and financial planning will be crucial for Sarah to navigate her post-graduation financial life.

Final Summary

Securing funding for higher education requires careful consideration of various factors. This exploration of Thrivent student loans highlights the importance of understanding eligibility criteria, interest rates, repayment plans, and associated fees. By comparing Thrivent’s offerings with federal loan programs and analyzing illustrative scenarios, prospective borrowers can make well-informed decisions that align with their financial realities and future aspirations. Remember to thoroughly research and compare all available options before committing to a student loan.

Query Resolution

What credit score is required for a Thrivent student loan?

Thrivent’s credit score requirements vary depending on the loan type and applicant’s circumstances. It’s best to check their website or contact them directly for specific requirements.

Can I refinance my existing student loans with Thrivent?

Thrivent may offer refinancing options; however, eligibility criteria and available terms are subject to change. Contact Thrivent directly to inquire about refinancing possibilities.

What happens if I miss a student loan payment with Thrivent?

Missing payments will likely result in late fees and may negatively impact your credit score. Contact Thrivent immediately if you anticipate difficulty making a payment to explore potential solutions.

Does Thrivent offer any loan forgiveness programs?

Thrivent does not typically offer loan forgiveness programs in the same way as some federal loan programs. Check their website for the most up-to-date information on any available programs.