Navigating the complex world of student loans can feel overwhelming, but with the right knowledge and strategies, you can effectively manage your debt and pave the way for a brighter financial future. This guide provides essential tips and insights to help you understand the various types of loans, repayment options, and resources available to ensure you’re equipped to handle your student loan journey confidently.

From understanding the nuances of federal versus private loans to exploring effective budgeting techniques and exploring repayment plan options, we’ll cover crucial aspects to empower you to make informed decisions. We’ll also delve into strategies for minimizing debt accumulation and maximizing your financial well-being post-graduation.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and diligent management. Understanding budgeting, repayment options, and the potential consequences of default are crucial for long-term financial health. This section Artikels effective strategies to minimize the burden of student loans and build a strong financial future.

Budgeting and Managing Student Loan Payments

Creating a realistic monthly budget is paramount to effectively managing student loan payments. This involves carefully tracking income and expenses to identify areas where savings can be maximized. A comprehensive budget should include all income sources, such as employment, scholarships, or grants, and meticulously list all expenses, from essential living costs (rent, utilities, groceries) to discretionary spending (entertainment, dining out). Allocating a specific amount each month for student loan payments ensures consistent repayment and avoids missed payments, which can negatively impact credit scores. Consider using budgeting apps or spreadsheets to simplify the process and track progress.

Sample Monthly Budget Incorporating Student Loan Payments

The following is an example of a monthly budget incorporating student loan payments. Remember, this is a sample, and your own budget will need to reflect your individual income and expenses.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Net Monthly Salary | $3000 | Rent | $1000 |

| Part-time Job Income | $500 | Utilities | $200 |

| Total Income | $3500 | Groceries | $300 |

| Transportation | $150 | ||

| Student Loan Payment | $500 | ||

| Other Expenses (phone, internet, etc.) | $250 | ||

| Savings | $100 | ||

| Discretionary Spending | $1000 | ||

| Total Expenses | $3500 |

This example demonstrates a balanced budget where income equals expenses, leaving no room for debt accumulation beyond the planned student loan payment. Adjusting the discretionary spending category can help manage unexpected expenses or increase savings.

Interest Capitalization on Student Loan Debt

Interest capitalization occurs when unpaid interest on a student loan is added to the principal loan amount. This increases the total amount owed, leading to higher future payments and ultimately a greater total cost of the loan. For example, if $1000 in interest accrues on a loan and is capitalized, the principal balance increases by $1000, meaning future interest will be calculated on a larger principal amount. Understanding when and how interest capitalization applies to your specific loan is crucial to managing the total cost of repayment. It’s essential to make consistent payments to minimize the impact of interest capitalization.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe repercussions. It damages your credit score significantly, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of your earnings is automatically deducted to repay the debt, is a possibility. Furthermore, the government can seize tax refunds and other assets to recover the debt. Defaulting can also impact your ability to secure future employment opportunities, as some employers conduct credit checks. In short, defaulting on student loans can have far-reaching and long-lasting negative consequences on your financial well-being.

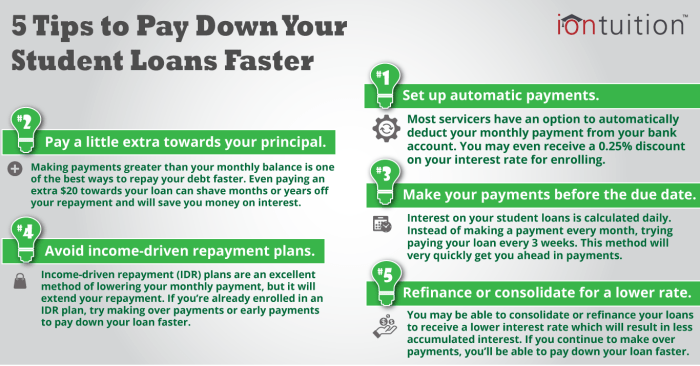

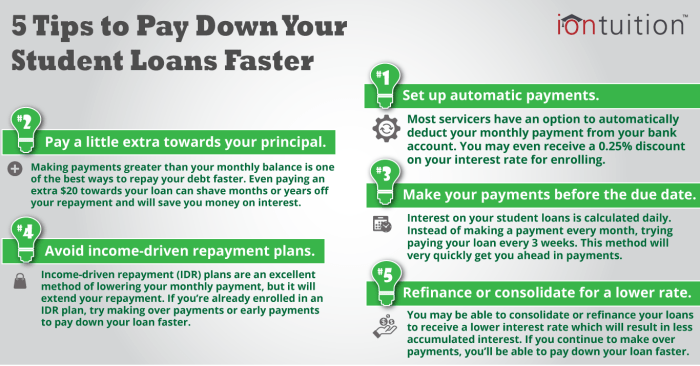

Exploring Repayment Options

Choosing the right student loan repayment plan is crucial for managing your debt effectively. Different plans offer varying monthly payments and total interest paid over the life of the loan. Understanding the nuances of each plan will allow you to make an informed decision that aligns with your financial situation and long-term goals.

Understanding the differences between standard, extended, and income-driven repayment plans is essential for effective student loan management. Each plan has unique eligibility requirements and impacts both your monthly payments and the total interest you will pay. Careful consideration of these factors is key to minimizing your overall debt burden.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeline, leading to lower total interest paid compared to other plans. However, monthly payments can be higher.

* Eligibility: This plan is generally available to all federal student loan borrowers.

* Monthly Payments: Calculated based on your loan principal and a fixed interest rate, resulting in consistent monthly payments over 10 years.

* Total Interest Paid: Generally the lowest among repayment plans due to the shorter repayment period.

* Example: A $30,000 loan at 5% interest would have a monthly payment of approximately $317 and a total interest paid of around $7,000 over 10 years.

Extended Repayment Plan

The Extended Repayment Plan offers longer repayment periods than the standard plan, resulting in lower monthly payments. While this provides immediate financial relief, it also leads to higher total interest paid over the loan’s lifetime.

* Eligibility: Available for federal student loans with a total principal balance exceeding $30,000.

* Monthly Payments: Lower than the Standard Repayment Plan due to the extended repayment period (up to 25 years).

* Total Interest Paid: Significantly higher than the Standard Repayment Plan due to the longer repayment period.

* Example: The same $30,000 loan at 5% interest, under an extended plan with a 25-year repayment period, would have a monthly payment of approximately $160, but total interest paid would exceed $16,000.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base your monthly payments on your income and family size. These plans are designed to make repayment more manageable for borrowers with lower incomes. While monthly payments are typically lower, repayment periods are often longer (potentially up to 20 or 25 years), leading to higher overall interest paid. Several types of IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Eligibility requirements and payment calculations vary slightly among these plans.

* Eligibility: Eligibility criteria vary by plan but generally require borrowers to demonstrate financial need based on income and family size.

* Monthly Payments: Payments are calculated as a percentage of your discretionary income (income above a certain poverty guideline).

* Total Interest Paid: Generally the highest among repayment plans due to the extended repayment periods.

* Example: A borrower earning $40,000 annually with a $30,000 loan might see a monthly payment of $150-$200 under an IDR plan, but the total interest paid would be substantially higher than the Standard Repayment Plan due to the extended repayment period. The exact amount would depend on the specific IDR plan chosen and the individual’s income and family size.

Seeking Assistance with Student Loans

Navigating the complexities of student loan repayment can be challenging, but numerous resources are available to help borrowers manage their debt effectively and avoid default. Understanding these resources and actively seeking assistance when needed is crucial for long-term financial well-being. This section Artikels various avenues for support, from government programs to private counseling services.

Available Resources for Students Struggling with Loan Repayment

Many resources exist to assist students facing difficulties with their student loan repayments. These resources offer guidance, support, and potential solutions tailored to individual circumstances. The federal government provides several key programs, including income-driven repayment plans and loan forgiveness programs for specific professions. Additionally, numerous non-profit organizations and private companies offer free or low-cost counseling services to help borrowers understand their options and create a manageable repayment plan. These services can be invaluable in navigating the complexities of the student loan system. For example, the National Foundation for Credit Counseling (NFCC) offers certified credit counselors who can provide personalized guidance.

Applying for Student Loan Forgiveness Programs

Student loan forgiveness programs offer the potential for complete or partial cancellation of student loan debt under specific circumstances. Eligibility criteria vary significantly depending on the program. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. The process typically involves completing an application, providing documentation of employment and loan repayment history, and ensuring that all payments are made under a qualifying repayment plan. Careful review of program requirements is essential, as failure to meet all criteria can result in ineligibility. Applicants should meticulously track their payments and maintain accurate records to support their application.

Negotiating with Loan Servicers

Effective communication with your loan servicer is crucial for resolving repayment issues. Before initiating contact, gather all relevant information, including your loan details, payment history, and any supporting documentation for hardship claims. Clearly articulate your financial situation and propose specific solutions, such as a temporary forbearance or an income-driven repayment plan. Maintain a professional and respectful tone throughout the negotiation process. Document all communication, including dates, times, and the outcomes of each conversation. If an agreement is reached, ensure it is documented in writing. If negotiations are unsuccessful, consider seeking assistance from a student loan counselor or a consumer protection agency. Remember, perseverance and clear communication are key to a successful negotiation.

Contacting a Student Loan Counselor: A Step-by-Step Guide

Seeking professional guidance from a student loan counselor can significantly improve your ability to manage your debt. The process typically involves several steps. First, research reputable counseling organizations, such as the NFCC or the U.S. Department of Education’s list of approved counselors. Second, review counselor profiles to identify one specializing in student loan debt management. Third, contact the counselor via phone or email to schedule a consultation. During the consultation, provide a comprehensive overview of your financial situation and loan details. Fourth, actively participate in the counseling session, asking questions and clarifying any uncertainties. Finally, follow the counselor’s recommendations and maintain consistent communication throughout the debt management process. Remember to verify the counselor’s credentials and legitimacy before sharing sensitive financial information.

The Impact of Student Loan Debt on Future Financial Planning

Student loan debt can significantly impact your financial future, influencing major life decisions and long-term financial stability. Understanding these potential effects is crucial for proactive planning and mitigating potential negative consequences. The weight of student loan repayments can affect everything from your ability to save for a down payment on a house to your capacity to comfortably raise a family.

The presence of significant student loan debt can create considerable financial constraints. This debt acts as a significant ongoing expense, reducing the disposable income available for other crucial financial goals.

Major Life Decisions and Student Loan Debt

Carrying a substantial student loan balance can delay or even prevent major life milestones. For instance, the monthly payments can make saving for a down payment on a home significantly more challenging. Similarly, starting a family may be postponed due to the financial burden of loan repayments and the added expenses associated with raising children. The need to prioritize loan payments can limit the funds available for childcare, education, and other essential family expenses. For example, a couple carrying $50,000 in student loan debt with a 6% interest rate might find their monthly payments exceeding $300, considerably impacting their ability to save for a down payment or other significant purchases. This situation highlights the need for careful financial planning and potentially delaying major life decisions until loan repayments are better managed.

The Importance of Building Good Credit After Graduation

Establishing and maintaining good credit is paramount after graduation, especially when dealing with student loan debt. A strong credit score opens doors to better interest rates on future loans (such as mortgages or auto loans), potentially saving thousands of dollars over time. Conversely, a poor credit score can lead to higher interest rates and limited access to credit, exacerbating the financial strain of student loan repayments. Responsible credit card use, timely loan payments, and avoiding excessive debt are crucial steps in building a positive credit history. For example, a person with a high credit score might qualify for a mortgage with a 3% interest rate, while someone with a low credit score might face a rate of 6% or more, leading to significantly higher overall costs.

Managing Student Loan Debt While Saving for Retirement

Balancing student loan repayments with retirement savings can seem daunting, but it’s crucial for long-term financial well-being. Prioritizing both is essential; delaying retirement savings solely to focus on student loan repayment can lead to significant financial hardship in later life. Strategies such as contributing to a retirement account even with small amounts, exploring employer-sponsored retirement plans, and gradually increasing contributions as loan repayments decrease can help achieve both goals. For instance, allocating even 5% of income to a retirement account, while diligently managing student loan payments, establishes a foundation for future financial security. The power of compounding interest over time makes even small, consistent contributions impactful in the long run.

Long-Term Financial Implications of High Student Loan Debt

High student loan debt can have profound long-term financial consequences. It can restrict career choices, limiting opportunities that may require relocation or further education. The persistent financial pressure can lead to increased stress and potentially impact overall health and well-being. Furthermore, high debt levels can delay significant life purchases and reduce overall financial flexibility. For example, someone burdened with substantial student loan debt might forgo entrepreneurial ventures due to the risk and financial commitment involved, limiting their earning potential and future financial prospects. This situation emphasizes the importance of proactive debt management and planning to minimize long-term negative impacts.

Understanding Deferment and Forbearance

Navigating student loan repayment can be challenging, and understanding the options available for temporary pauses in payments is crucial. Deferment and forbearance are two such options, offering temporary relief from making loan payments, but they differ significantly in their eligibility criteria and consequences. This section clarifies the distinctions between these two approaches and explores their potential impact on your long-term repayment strategy.

Deferment and forbearance are both temporary pauses in your student loan payments, but they differ in their eligibility requirements and the impact on your loan. Deferment is generally granted based on specific circumstances, such as unemployment or enrollment in school, and usually doesn’t accrue interest on subsidized loans (though unsubsidized loans will still accrue interest). Forbearance, on the other hand, is often granted for a wider range of reasons, but typically accrues interest on both subsidized and unsubsidized loans. This difference in interest accrual can significantly affect the total cost of your loan over time.

Deferment Eligibility and Conditions

Deferment is typically available to borrowers facing specific financial hardships or life events. Examples include unemployment, enrollment in school at least half-time, or serving in the military. The specific requirements and length of deferment vary depending on the type of loan and the lender. It’s essential to contact your loan servicer to determine your eligibility and the terms of your deferment. The duration of a deferment is usually limited, and you will need to reapply if you need an extension. Importantly, while interest may not accrue on subsidized loans during deferment, it will still accumulate on unsubsidized loans. This means that the total amount you owe will likely increase even with deferment.

Forbearance Eligibility and Conditions

Forbearance is a more flexible option than deferment, available for a broader range of circumstances. These can include temporary financial difficulties, medical emergencies, or natural disasters. Unlike deferment, forbearance is often granted at the discretion of the lender. The length of forbearance can vary, but it’s typically shorter than deferment periods. Forbearance typically leads to interest accruing on both subsidized and unsubsidized loans, increasing the total amount owed over time. The accrued interest can be capitalized, meaning it’s added to your principal balance, leading to even higher payments later.

Drawbacks of Deferment and Forbearance

While deferment and forbearance provide temporary relief, they have potential drawbacks. The most significant is the accumulation of interest, which can substantially increase the total amount you owe. This can extend the repayment period and lead to higher overall costs. Furthermore, deferment and forbearance can negatively impact your credit score if your payments are not made as scheduled. This can make it more difficult to secure loans or other financial products in the future. Another important point to consider is that extending your repayment timeline through these options can mean you’ll pay more in interest overall. Finally, some deferment and forbearance plans may have limitations on the number of times they can be used.

Illustrative Representation of Deferment/Forbearance Impact

Imagine a graph with time on the x-axis and loan balance on the y-axis. A typical repayment schedule would show a steadily decreasing line as payments are made. With deferment or forbearance, the line would temporarily flatten or even slightly increase (due to accruing interest) during the deferment/forbearance period. After the deferment/forbearance period ends, the line would resume its downward slope, but it would start at a higher point than if payments had continued without interruption, illustrating the increased total cost due to accumulated interest. The steeper the slope of the increase during the deferment/forbearance period, the higher the unsubsidized loan interest rate or the longer the deferment/forbearance period.

Final Review

Successfully managing student loan debt requires proactive planning and a comprehensive understanding of available resources. By implementing the strategies Artikeld in this guide, you can gain control of your finances, avoid potential pitfalls, and confidently navigate the path towards financial independence. Remember, seeking assistance when needed is a sign of strength, not weakness. Empower yourself with knowledge and take charge of your student loan journey.

Essential FAQs

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, which has serious consequences including wage garnishment.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan, potentially simplifying repayment. However, it may not always lower your interest rate.

What is the difference between interest and principal?

Principal is the original amount borrowed. Interest is the cost of borrowing that money, calculated as a percentage of the principal.

Are there any tax benefits associated with student loan interest?

You may be able to deduct the interest you paid on student loans from your federal income taxes, subject to certain limitations and income thresholds. Consult a tax professional for details.