Securing a higher education often involves navigating the complex world of student financing. While federal student loans provide a crucial foundation, many students find themselves needing supplemental funding. This is where private student loans step in, offering a diverse range of options tailored to individual circumstances. Understanding the nuances of these loans is crucial for making informed financial decisions and avoiding potential pitfalls. This guide will explore the various types of private student loans, helping you make the best choice for your unique needs.

The private student loan market offers a variety of loan structures, each with its own set of advantages and disadvantages. These loans differ significantly from federal loans in terms of eligibility requirements, interest rates, repayment options, and borrower protections. Factors such as credit score, income, and the type of lender all play a significant role in determining the terms of your loan. A thorough understanding of these factors is essential to securing the most favorable loan terms possible and ensuring responsible borrowing practices.

Introduction to Private Student Loans

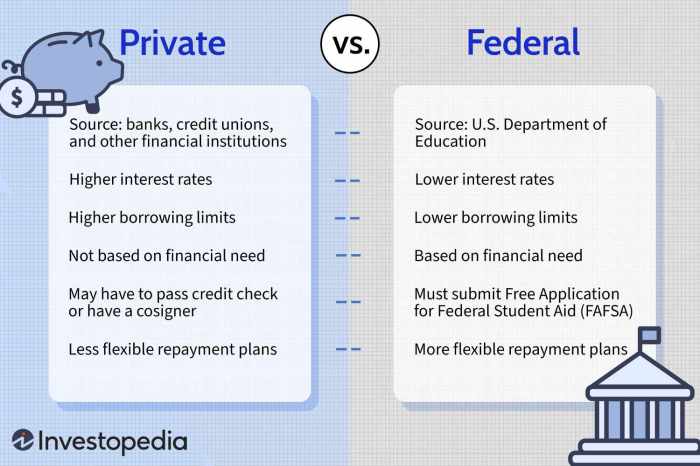

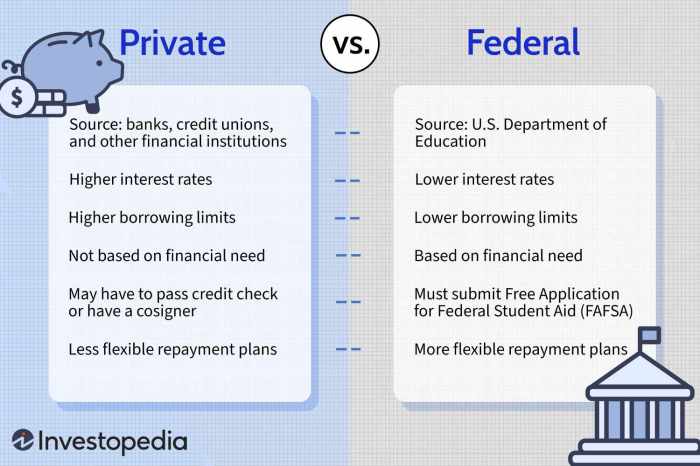

Private student loans are a crucial financing option for higher education, supplementing or sometimes replacing federal student loan programs. They represent a significant portion of the overall student loan market, offering a pathway to college for many individuals but also carrying potential risks if not managed carefully. Unlike federal loans, which are backed by the government, private student loans are offered by private lenders, such as banks and credit unions. This fundamental difference impacts various aspects, including interest rates, repayment terms, and borrower protections.

Private student loans serve the purpose of covering educational expenses not met by other funding sources, such as grants, scholarships, savings, and federal loans. These expenses can include tuition, fees, room and board, books, and other related costs. The key distinction between private and federal loans lies in the lender and the associated benefits and risks. Federal loans generally offer more borrower protections, including income-driven repayment plans and loan forgiveness programs, while private loans often have less flexible repayment options and lack such government-backed safeguards.

Typical Borrowers of Private Student Loans

Private student loans are frequently utilized by students who have exhausted their federal loan eligibility or whose financial need exceeds the amount of federal aid available. This often includes students from families with higher incomes, who may not qualify for need-based federal aid programs. Additionally, graduate students, particularly those pursuing professional degrees like law or medicine, often rely on private loans due to the higher cost of these programs and the potential for greater earning potential post-graduation. International students, who may not be eligible for federal loans, also frequently utilize private student loan options to finance their education. Borrowers should carefully consider their financial circumstances and the terms of the loan before committing to a private loan.

A Brief History of the Private Student Loan Market

The private student loan market has undergone significant evolution. While private loans have always existed to some degree, their prominence increased substantially in the latter half of the 20th century. Initially, private loans played a relatively small role compared to federal programs. However, changes in federal student aid policies, including shifts in loan limits and eligibility requirements, contributed to a rise in the demand for private student loans. The growth was further fueled by the increasing cost of higher education, making it necessary for many students to supplement their federal aid with private financing. The rise of online lending platforms also facilitated increased access to private student loans, broadening the market and influencing the competitive landscape. The 2008 financial crisis significantly impacted the private student loan market, leading to tighter lending standards and a reduction in the availability of loans for some borrowers. Since then, the market has seen a degree of recovery and continued evolution, with a variety of loan products and lenders now available.

Types of Private Student Loans Based on Repayment

Choosing a private student loan often involves understanding the different repayment options available. The terms of your repayment plan significantly impact your monthly expenses and the total amount you’ll pay over the life of the loan. This section will explore the key differences between fixed-rate and variable-rate loans and analyze various repayment plan structures.

Fixed-Rate vs. Variable-Rate Private Student Loans

Fixed-rate and variable-rate loans differ fundamentally in how your interest rate is determined. A fixed-rate loan maintains the same interest rate throughout the loan’s term, providing predictable monthly payments. In contrast, a variable-rate loan’s interest rate fluctuates based on an underlying index, such as the prime rate or LIBOR (London Interbank Offered Rate), leading to potentially changing monthly payments.

Fixed-rate loans offer the stability of knowing exactly how much you’ll pay each month. This predictability allows for easier budgeting and financial planning. However, fixed rates might be slightly higher than variable rates at the loan’s inception. Variable-rate loans, on the other hand, may start with a lower interest rate, potentially saving money in the short term. However, the risk lies in the unpredictability of future interest rate changes; rates could rise significantly, resulting in substantially higher monthly payments. The choice depends on your risk tolerance and financial forecasting capabilities.

Advantages and Disadvantages of Repayment Plan Options

Several repayment plan options exist for private student loans, each with its own advantages and disadvantages. Understanding these nuances is crucial for selecting the plan that best aligns with your financial situation and long-term goals.

A standard repayment plan typically involves fixed monthly payments over a set loan term (e.g., 10 years). This offers predictability but might result in higher monthly payments, especially for larger loan amounts. A graduated repayment plan starts with lower monthly payments that gradually increase over time. This can be beneficial for recent graduates entering the workforce with lower initial incomes. However, the increasing payments can become challenging to manage as the loan term progresses. Extended repayment plans stretch the loan term over a longer period, lowering monthly payments. However, this leads to a significantly higher total interest paid over the loan’s lifetime.

Comparison of Repayment Options

The following table compares three common repayment plan options: Standard, Graduated, and Extended. The figures are illustrative examples and actual amounts will vary based on the loan amount, interest rate, and lender.

| Repayment Plan | Monthly Payment (Example) | Total Interest Paid (Example) | Loan Term (Years) |

|---|---|---|---|

| Standard | $500 | $10,000 | 10 |

| Graduated | $300 (Year 1), increasing annually | $12,000 | 10 |

| Extended | $300 | $18,000 | 20 |

Types of Private Student Loans Based on Lender

Private student loans aren’t all created equal. The lender plays a significant role in determining the terms and conditions of your loan, impacting everything from the interest rate to the application process. Understanding the different types of lenders and their approaches is crucial for securing the best possible financing for your education. This section will explore the key distinctions between various private student loan lenders.

The landscape of private student loan lenders is diverse, encompassing established financial institutions like banks and credit unions, as well as newer entrants in the form of online lenders. Each type of lender brings its own set of advantages and disadvantages, influencing the overall borrower experience. These differences often manifest in the application process, the interest rates offered, and the associated fees. It’s essential to compare offers across different lenders to find the most suitable option.

Banks as Private Student Loan Lenders

Banks, long-established players in the financial world, offer private student loans as part of their broader suite of financial products. Their application processes are typically well-defined and established, often involving extensive documentation and credit checks. Interest rates may vary depending on the applicant’s creditworthiness and the prevailing market conditions. Fees can include origination fees and late payment penalties. Some banks may offer features like variable or fixed interest rates, loan deferment options, and co-signer release programs. For example, a major national bank might offer a fixed-rate loan with a competitive interest rate for borrowers with strong credit scores, but may require a co-signer for those with limited credit history.

Credit Unions as Private Student Loan Lenders

Credit unions, member-owned financial cooperatives, often provide a more personalized approach to lending. Their application processes might be less stringent than those of large banks, potentially leading to a quicker approval process. Interest rates may be more competitive, particularly for members who maintain good standing with the credit union. Fees might be lower or even waived in some cases. Credit unions may offer features like flexible repayment options and member discounts. A local credit union, for instance, might offer a lower interest rate to its members with strong credit, potentially paired with a loyalty reward program.

Online Lenders as Private Student Loan Lenders

Online lenders have emerged as a significant force in the private student loan market, leveraging technology to streamline the application and approval process. These lenders often boast faster application turnaround times and a user-friendly online platform. Interest rates can be competitive, sometimes surpassing those of traditional lenders. However, borrowers should carefully examine the fees associated with online loans, as some may include higher origination fees or prepayment penalties. Online lenders might offer features such as autopay discounts, flexible repayment plans, and online account management tools. A well-known online lender, for example, might provide a competitive interest rate and a simplified online application process, but may charge a higher origination fee compared to a traditional bank.

Types of Private Student Loans Based on Loan Terms

Private student loans, unlike federal loans, offer a range of repayment terms, significantly impacting the overall cost of borrowing. Understanding these terms is crucial for borrowers to make informed decisions and manage their debt effectively. The length of your loan term directly correlates with the total amount of interest you’ll pay.

Loan term length directly influences the total interest paid over the life of the loan. Longer loan terms generally result in lower monthly payments, but significantly increase the total interest paid because you’re paying interest for a longer period. Conversely, shorter loan terms mean higher monthly payments, but substantially reduce the overall interest paid. Choosing the right loan term requires careful consideration of your financial situation and repayment capabilities.

Loan Term Length and Total Interest

The relationship between loan term and total interest is straightforward: longer terms mean more interest. Consider a $10,000 loan with a 7% interest rate. A 5-year loan will have considerably lower total interest than a 10-year loan, even though the monthly payments will be higher. This is because the principal is paid down faster with a shorter term, reducing the amount of time interest accrues. This concept applies to all interest-bearing loans, not just student loans.

Comparison of Loan Costs with Varying Terms and Interest Rates

The following table illustrates the total cost of a $10,000 loan under different scenarios, highlighting the impact of interest rates and loan terms. These figures are simplified examples and do not include any potential fees. Actual costs may vary depending on the lender and specific loan terms.

| Loan Amount | Interest Rate | Loan Term (Years) | Approximate Monthly Payment | Total Interest Paid (Approximate) | Total Cost (Approximate) |

|---|---|---|---|---|---|

| $10,000 | 5% | 5 | $188.71 | $1,122.60 | $11,122.60 |

| $10,000 | 5% | 10 | $106.07 | $2,356.60 | $12,356.60 |

| $10,000 | 7% | 5 | $198.03 | $1,881.80 | $11,881.80 |

| $10,000 | 7% | 10 | $116.00 | $3,759.60 | $13,759.60 |

Note: These calculations are simplified estimations and do not account for factors such as compounding interest or any additional fees that may be associated with the loan. Always consult the lender for precise figures.

Private Student Loan Eligibility and Qualification

Securing a private student loan hinges on meeting specific eligibility criteria set by the lender. These requirements are designed to assess the borrower’s creditworthiness and ability to repay the loan. Understanding these requirements is crucial for prospective borrowers to increase their chances of approval and potentially secure favorable loan terms.

Private student loan lenders typically evaluate applicants based on a combination of credit history and income. Stronger credit profiles and higher incomes generally translate to better loan offers, including lower interest rates and more favorable repayment terms. Conversely, weaker credit or lower income might result in loan denial or less advantageous terms, potentially requiring a co-signer.

Credit and Income Requirements

Lenders assess creditworthiness using credit scores, which reflect an individual’s history of borrowing and repayment. A higher credit score indicates a lower risk of default, making the borrower more attractive to lenders. While specific requirements vary among lenders, a good credit score (generally above 670) is often preferred, though some lenders may consider applicants with lower scores. Similarly, lenders often review income documentation to ensure the borrower has sufficient resources to manage monthly loan payments. Income verification may involve providing pay stubs, tax returns, or bank statements. The required minimum income level varies depending on the loan amount and the lender’s risk assessment. For example, a borrower seeking a larger loan amount might need to demonstrate a higher income to qualify.

Situations Requiring a Co-signer

A co-signer is an individual who agrees to share responsibility for repaying the loan if the primary borrower defaults. Lenders often require a co-signer when the applicant lacks a sufficient credit history or has a low credit score. This is particularly common for students who are just starting to build their credit or have limited credit history. Other situations where a co-signer might be necessary include instances where the borrower’s income is insufficient to support the loan payments or if the borrower has experienced past financial difficulties. For instance, a recent college graduate with no credit history and a part-time job might need a co-signer to secure a private student loan. A co-signer’s strong credit history and income can significantly improve the chances of loan approval and potentially lead to better loan terms.

Impact of Credit History on Interest Rates

A borrower’s credit history significantly influences the interest rate offered on a private student loan. Individuals with excellent credit histories typically qualify for lower interest rates, reflecting the lower perceived risk to the lender. Conversely, those with poor credit histories or limited credit experience may face higher interest rates. This is because lenders view borrowers with poor credit as higher-risk, leading them to charge higher interest rates to compensate for the increased likelihood of default. For example, a borrower with a credit score of 750 might receive an interest rate of 6%, while a borrower with a score of 600 might receive a rate of 10% or higher. The difference in interest rates can significantly impact the total cost of the loan over its lifespan, underscoring the importance of maintaining a good credit history.

Understanding Fees and Interest Rates

Navigating the world of private student loans requires a clear understanding of the associated costs. These costs primarily consist of interest rates and various fees, both of which significantly impact the overall loan repayment amount. Failing to grasp these aspects can lead to unexpected financial burdens. This section clarifies the common fees and how interest rates are determined.

Private student loans, unlike federal loans, vary considerably in their fee structures and interest rates depending on factors like creditworthiness, the loan amount, and the lender. Understanding these components is crucial for making informed borrowing decisions and choosing the most suitable loan option.

Common Fees Associated with Private Student Loans

Several fees are commonly associated with private student loans. These fees can add to the overall cost of borrowing and should be carefully considered before accepting a loan. It’s vital to compare these fees across different lenders to ensure you’re getting the best possible deal.

- Origination Fees: These are one-time fees charged by the lender upon loan disbursement. They typically represent a percentage of the loan amount and are deducted from the total loan proceeds. For example, a 1% origination fee on a $10,000 loan would result in a $100 fee, meaning the borrower receives $9,900.

- Late Payment Fees: These penalties are applied when a loan payment is made after the due date. The specific amount varies by lender, but it can range from a flat fee to a percentage of the missed payment. Consistent late payments can severely damage your credit score.

- Prepayment Penalties: While less common now, some lenders may charge a penalty if you pay off your loan early. This fee is designed to compensate the lender for lost interest income. Always check the loan agreement to see if this applies.

- Returned Payment Fees: If a payment is returned due to insufficient funds, lenders typically charge a fee to cover the administrative costs associated with processing the returned payment. This can be particularly costly and damaging to your credit history.

Interest Rate Determination for Private Student Loans

Interest rates on private student loans are not fixed; they are variable and depend on several key factors. A higher interest rate means you’ll pay more in interest over the life of the loan. Understanding these factors allows for better negotiation and selection of favorable loan terms.

- Credit Score: Your credit history plays a significant role in determining your interest rate. A higher credit score generally qualifies you for a lower interest rate, reflecting lower perceived risk for the lender.

- Credit History Length: The length of your credit history also matters. A longer, positive credit history demonstrates financial responsibility and can lead to better interest rates.

- Debt-to-Income Ratio: Lenders assess your debt relative to your income. A higher debt-to-income ratio may result in a higher interest rate as it indicates a greater financial burden.

- Co-signer: Having a co-signer with a strong credit history can significantly improve your chances of securing a lower interest rate, as the co-signer shares responsibility for repayment.

- Loan Amount and Term: The amount you borrow and the length of the repayment term can influence the interest rate. Larger loan amounts and longer terms may come with higher rates due to increased risk for the lender.

- Market Interest Rates: The prevailing interest rates in the overall financial market also impact private student loan rates. When market rates are high, loan interest rates tend to be higher as well.

Comparison with Federal Student Loans

Choosing between federal and private student loans requires careful consideration of several key factors. While both can help finance your education, they differ significantly in their terms, protections, and potential consequences of default. Understanding these differences is crucial for making an informed decision that aligns with your financial situation and risk tolerance.

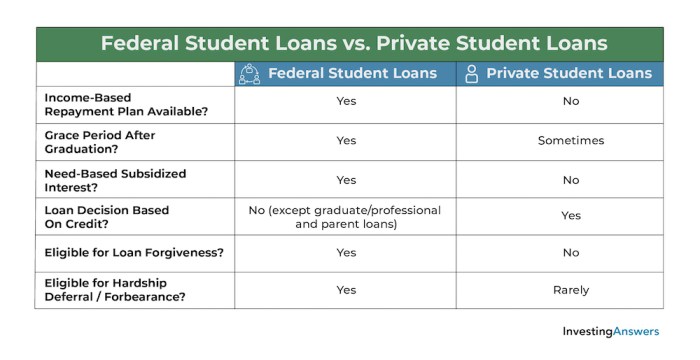

Federal and private student loans diverge significantly in interest rates, repayment options, and borrower protections. Federal loans generally offer lower, fixed interest rates and a range of income-driven repayment plans, designed to make monthly payments more manageable. In contrast, private loan interest rates are typically variable and often higher, reflecting the lender’s assessment of the borrower’s creditworthiness. Repayment options for private loans are usually less flexible than those available for federal loans.

Interest Rates and Repayment Options

Federal student loans typically have lower, fixed interest rates compared to private student loans. For example, a federal subsidized loan might carry a 4% interest rate, while a comparable private loan could have a 7% or higher variable rate. This difference can significantly impact the total cost of borrowing over the life of the loan. Federal loans also provide various repayment options, including income-driven repayment plans that adjust monthly payments based on income and family size. Private loans often offer fewer repayment options, typically sticking to a standard repayment schedule.

Borrower Protections

Federal student loans offer substantial borrower protections unavailable with private loans. These protections include deferment and forbearance options, allowing borrowers to temporarily suspend or reduce payments during times of financial hardship. Federal loans also benefit from consumer protection laws that limit lender practices and provide avenues for dispute resolution. Private loans offer fewer such protections, leaving borrowers more vulnerable to aggressive collection practices in case of default.

Default Consequences

The consequences of defaulting on a federal student loan differ significantly from those of defaulting on a private student loan. Defaulting on a federal loan can lead to wage garnishment, tax refund offset, and damage to credit score. However, federal loan programs often provide rehabilitation and consolidation options to help borrowers get back on track. Defaulting on a private loan can also severely damage credit scores and lead to aggressive collection efforts, including lawsuits and wage garnishment. However, unlike federal loans, there are typically fewer options for rehabilitation or restructuring private student loan debt.

Benefits and Drawbacks

A hypothetical scenario illustrates the differences. Imagine two students, both needing $20,000 for tuition. Student A takes out federal loans at a fixed 4% interest rate with flexible repayment options and borrower protections. Student B takes out private loans at a variable 7% interest rate with fewer repayment options and limited borrower protections. Over the loan’s life, Student A will pay significantly less in interest and has several options if they encounter financial difficulties. Student B faces higher interest costs and limited options should they struggle to repay. Student A’s federal loans also provide a safety net of consumer protections, unlike Student B’s private loans. This highlights the importance of understanding the distinct advantages and disadvantages of each loan type before borrowing.

Potential Risks and Considerations

Private student loans, while offering a potential solution for financing higher education, come with inherent risks that borrowers must carefully consider. Understanding these risks and taking proactive steps to mitigate them is crucial for responsible borrowing and avoiding potential financial hardship. Failing to do so can lead to significant long-term financial consequences.

Private student loans often carry higher interest rates than federal student loans, leading to a larger overall debt burden. Furthermore, unlike federal loans, private loans generally lack the same robust borrower protections, such as income-driven repayment plans or loan forgiveness programs. This means that if you encounter financial difficulties, your options for managing your debt may be more limited. The absence of government oversight also means that lenders may have less stringent eligibility requirements, potentially leading to borrowers taking on more debt than they can comfortably repay.

High Interest Rates and Debt Burden

High interest rates significantly increase the total cost of borrowing. A seemingly small difference in interest rates can translate to thousands of dollars more in interest paid over the life of the loan. For example, a $20,000 loan at 8% interest will accrue substantially more interest than the same loan at 5% interest over a 10-year repayment period. This increased cost can impact a borrower’s ability to save for other financial goals, such as purchasing a home or investing. Careful comparison shopping among lenders is crucial to secure the lowest possible interest rate.

Lack of Borrower Protections

Unlike federal student loans, private student loans generally do not offer the same level of borrower protections. Federal loans often include options like income-driven repayment plans, which adjust monthly payments based on income, and loan forgiveness programs for certain professions. Private loans typically lack these safety nets, leaving borrowers vulnerable to financial hardship if their circumstances change unexpectedly. For instance, a job loss or unexpected medical expenses could severely impact a borrower’s ability to repay their private student loans without the support of federal loan programs.

Responsible Borrowing and Budgeting for Repayment

Responsible borrowing and careful budgeting are paramount when considering private student loans. Before taking out any private loan, borrowers should meticulously assess their financial situation, including their current income, expenses, and expected future earnings. Creating a realistic repayment budget that accounts for all loan payments is essential to avoid default. This includes considering the total loan amount, interest rate, repayment period, and the potential impact on their overall financial health. It is also advisable to explore alternative financing options, such as scholarships, grants, and part-time employment, to minimize reliance on private loans.

Advice for Students Considering Private Student Loans

It’s vital to approach private student loans with caution and thorough planning. Before committing to a loan, consider the following:

- Exhaust Federal Loan Options First: Federal student loans generally offer more favorable terms and greater borrower protections than private loans. Maximize your eligibility for federal loans before exploring private options.

- Compare Lenders and Interest Rates: Shop around and compare offers from multiple lenders to secure the most competitive interest rate and loan terms. Don’t settle for the first offer you receive.

- Understand the Repayment Terms: Carefully review the loan agreement and understand the repayment schedule, including the monthly payment amount, total repayment period, and any prepayment penalties.

- Create a Realistic Budget: Develop a comprehensive budget that accounts for all expenses, including loan payments, to ensure you can comfortably afford the monthly payments.

- Consider the Total Cost of Borrowing: Don’t just focus on the monthly payment; consider the total amount you will pay back, including interest, over the life of the loan.

- Explore Alternative Funding Sources: Explore scholarships, grants, and part-time employment to reduce your reliance on loans.

Summary

Choosing the right type of private student loan is a critical step in financing your education. By carefully considering the various options available—from fixed versus variable interest rates to different repayment plans and lender types—you can make an informed decision that aligns with your financial situation and long-term goals. Remember to thoroughly research lenders, compare interest rates and fees, and understand the potential risks involved before signing any loan agreement. Proactive planning and responsible borrowing habits are key to successfully managing your student loan debt and achieving your educational aspirations.

FAQ Guide

What is the difference between a co-signer and an endorser on a private student loan?

While both share responsibility for repayment, a co-signer is equally liable with the borrower, while an endorser’s liability may be secondary. The exact implications depend on the lender’s specific agreement.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, be aware that refinancing may lengthen your loan term and impact your overall interest paid.

What happens if I default on a private student loan?

Consequences can include damage to your credit score, wage garnishment, and legal action by the lender. The lack of federal protections for private loans makes default particularly severe.

Are there any government programs to help with private student loan repayment?

No, government programs generally focus on federal student loans. However, some non-profit organizations may offer assistance or counseling for managing private student loan debt.