The weight of student loan debt significantly impacts the financial trajectories of millions of Americans. Understanding the intricacies of U.S. Department of Education student loans is crucial for borrowers seeking to manage their debt effectively and navigate the complex landscape of repayment options, forgiveness programs, and potential pitfalls. This guide offers a comprehensive overview of key aspects, empowering borrowers to make informed decisions and achieve financial well-being.

From exploring various repayment plans and their implications to understanding the factors influencing interest rates and the consequences of default, this resource aims to provide clarity and actionable insights. We delve into the nuances of loan forgiveness programs, borrower rights, and the broader societal impact of student loan debt, offering a holistic perspective on this critical issue.

Loan Forgiveness Programs

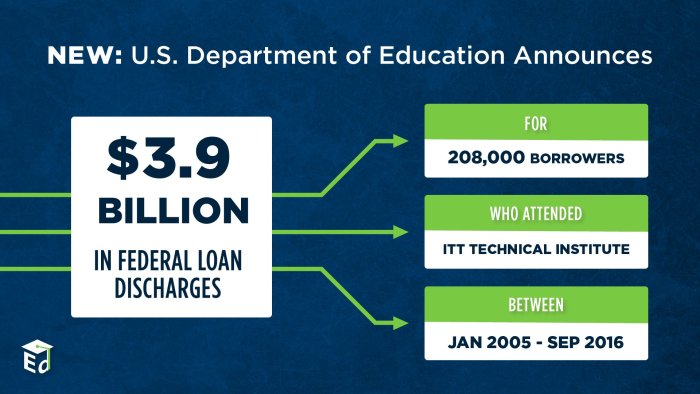

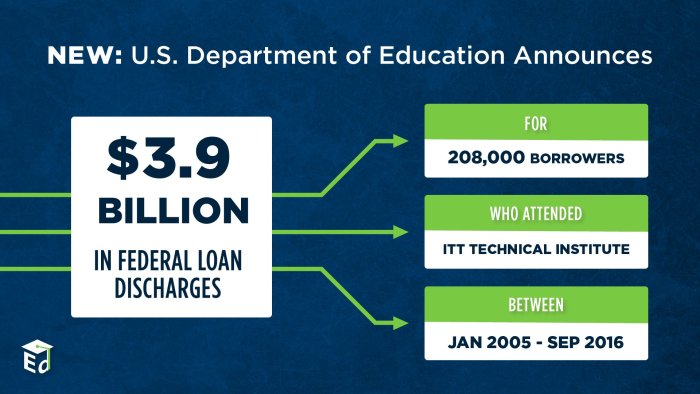

Federal student loan forgiveness programs aim to alleviate the burden of student debt for eligible borrowers. These programs have evolved significantly over time, reflecting changing economic conditions and policy priorities. Understanding their history, eligibility criteria, and various options is crucial for borrowers seeking relief.

History of Federal Student Loan Forgiveness Programs

The history of federal student loan forgiveness is relatively recent. While some limited forms of loan cancellation existed earlier, widespread programs emerged more prominently in the late 20th and early 21st centuries. Early programs often focused on specific professions, such as teaching or public service, incentivizing individuals to enter these fields. The expansion of programs has been driven by concerns about rising student debt levels and the desire to address economic inequality. Significant changes and expansions have occurred in response to economic downturns and evolving social priorities. For example, the American Recovery and Reinvestment Act of 2009 included provisions to expand loan forgiveness options.

Eligibility Requirements for Existing Programs

Eligibility requirements vary considerably across different loan forgiveness programs. Generally, borrowers must have federal student loans (not private loans), meet specific income requirements, and complete a certain amount of qualifying employment or service. For example, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Other programs, such as the Teacher Loan Forgiveness program, have different eligibility criteria based on the type of teaching position and the location of the school. Detailed requirements are available on the Federal Student Aid website.

Comparison of Forgiveness Program Options

Several federal student loan forgiveness programs exist, each with its own set of benefits and limitations. The PSLF program, for instance, offers complete loan forgiveness after 120 qualifying payments, but has stringent eligibility requirements. The Teacher Loan Forgiveness program provides forgiveness for up to $17,500 in loans, but has specific requirements related to teaching in low-income schools. Income-Driven Repayment (IDR) plans, while not strictly forgiveness programs, can lead to loan forgiveness after a certain number of years, but the remaining balance may be taxed as income. Borrowers should carefully weigh the advantages and disadvantages of each program before applying.

Examples of Successful and Unsuccessful Loan Forgiveness Applications

Successful applications often involve meticulous documentation and adherence to all eligibility requirements. A successful example might involve a teacher working in a low-income school who meticulously documented their employment and loan payments, resulting in approval for the Teacher Loan Forgiveness program. Conversely, unsuccessful applications frequently stem from incomplete documentation, failure to meet specific employment requirements, or using the wrong repayment plan. An example of an unsuccessful application might involve a borrower who made payments under a standard repayment plan instead of an income-driven plan, thereby not qualifying for PSLF. Thorough preparation and careful adherence to the program’s guidelines are critical.

Hypothetical Loan Forgiveness Program

A hypothetical program could address current shortcomings by simplifying the application process, consolidating eligibility criteria, and providing more transparent communication. This program could use a points-based system, awarding points for factors such as years of qualifying employment, community service, and demonstrated financial need. Reaching a certain point threshold would trigger partial or complete loan forgiveness. This approach could streamline the process, making it more accessible to borrowers while still rewarding those who contribute to society and demonstrate financial hardship. This system could also incorporate automatic verification of employment and income data, reducing the burden of manual documentation.

Repayment Plans

Choosing the right repayment plan for your federal student loans is crucial for managing your debt effectively and avoiding delinquency. Understanding the various options available and their implications is key to long-term financial health. The Department of Education offers several repayment plans, each designed to cater to different financial situations and borrower needs.

Available Repayment Plans

The Department of Education provides a range of repayment plans, including standard, graduated, extended, and income-driven repayment plans. Each plan differs in its monthly payment calculation and eligibility requirements. Careful consideration of your individual circumstances is necessary to select the most suitable option.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable by basing your monthly payments on your income and family size. These plans typically offer lower monthly payments than standard repayment plans, potentially leading to loan forgiveness after a specified period (generally 20 or 25 years, depending on the plan). However, because of the lower monthly payments, you’ll likely pay more in interest over the life of the loan. The main IDR plans are Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

Comparison of Repayment Plans

| Plan Name | Monthly Payment Calculation | Eligibility Requirements | Pros and Cons |

|---|---|---|---|

| Standard Repayment | Fixed monthly payment over 10 years | All federal student loans | Pros: Fastest repayment, lowest total interest paid. Cons: Highest monthly payments, may be difficult to manage on a limited budget. |

| Graduated Repayment | Payments start low and gradually increase over 10 years | All federal student loans | Pros: Lower initial payments. Cons: Payments increase significantly over time, potentially becoming unaffordable; still higher interest paid than IDR plans. |

| Extended Repayment | Fixed monthly payments over 25 years | Loans totaling more than $30,000 | Pros: Lower monthly payments than standard. Cons: Significantly higher total interest paid over the life of the loan. |

| Income-Based Repayment (IBR) | 10-15% of discretionary income, adjusted annually | Direct Loans, FFEL Program loans consolidated into Direct Consolidation Loans | Pros: Low monthly payments based on income. Cons: Longer repayment period, potentially higher total interest paid; loan forgiveness after 20 or 25 years, but the forgiven amount is considered taxable income. |

| Pay As You Earn (PAYE) | 10% of discretionary income | Direct Loans, originated after October 1, 2007 | Pros: Low monthly payments based on income. Cons: Longer repayment period, potentially higher total interest paid; loan forgiveness after 20 years. |

| Revised Pay As You Earn (REPAYE) | 10% of discretionary income | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, FFEL Program loans consolidated into Direct Consolidation Loans | Pros: Low monthly payments based on income, includes a partial interest subsidy for eligible borrowers. Cons: Longer repayment period, potentially higher total interest paid; loan forgiveness after 20 or 25 years. |

| Income-Contingent Repayment (ICR) | 20% of discretionary income or a fixed payment amount over 12 years, whichever is less | Direct Loans, FFEL Program loans consolidated into Direct Consolidation Loans | Pros: Low monthly payments based on income. Cons: Longer repayment period, potentially higher total interest paid; loan forgiveness after 25 years. |

Real-World Examples of Borrower Experiences

A recent graduate with a low-paying job might benefit from an IDR plan like REPAYE, allowing them to manage their debt while establishing their career. Conversely, a high-earning professional might prefer a standard repayment plan to pay off their loans quickly and minimize interest. A borrower with a fluctuating income might find an IDR plan beneficial, as their payments adjust annually based on their current financial situation.

Step-by-Step Guide to Choosing a Repayment Plan

1. Assess your current financial situation: Review your income, expenses, and overall debt load.

2. Determine your eligibility: Check the eligibility requirements for each repayment plan.

3. Compare payment amounts and total interest: Use a loan repayment calculator to estimate your monthly payments and total interest paid under each plan.

4. Consider your long-term financial goals: Factor in your career aspirations and expected income growth.

5. Choose the plan that best aligns with your needs: Select the plan that provides the most manageable monthly payments while minimizing the total interest paid.

6. Monitor your payments and adjust as needed: Life circumstances can change, so regularly review your plan and consider making adjustments if necessary. You can switch plans once per year.

Interest Rates and Fees

Understanding the interest rates and fees associated with your federal student loans is crucial for effective financial planning and responsible repayment. These factors significantly impact the total cost of your education and the length of time it takes to repay your debt. This section will clarify the key aspects of interest rates and fees for federal student loans.

Factors Influencing Federal Student Loan Interest Rates

Several factors determine the interest rate applied to your federal student loans. The most significant is the loan type. Subsidized loans, for example, typically have lower interest rates than unsubsidized loans because the government pays the interest while you’re in school (under certain conditions). The interest rate is also fixed at the time the loan is disbursed, meaning it won’t change over the life of the loan, unlike some private loan options. The specific interest rate for each loan type is set annually by the government and can vary based on market conditions and government policy. Finally, your credit history is generally not a factor for federal student loan interest rates, unlike private student loans.

Types of Fees Associated with Federal Student Loan

While federal student loans are generally more affordable than private loans, there are still fees associated with them. One common fee is the loan origination fee. This fee is a percentage of the loan amount and is deducted from the total loan disbursement, meaning you receive less money than you were initially approved for. The origination fee varies depending on the type of loan and the year in which the loan was disbursed. It is important to note that this fee is typically small, and it’s crucial to be aware of its existence when planning your finances. There may also be late payment fees if you fail to make your payments on time, which can significantly impact the total cost of borrowing.

Comparison of Interest Rates Across Various Loan Types

Federal student loans are generally categorized into several types, each with its own interest rate. Direct Subsidized Loans, typically for undergraduate students demonstrating financial need, usually carry lower interest rates compared to Direct Unsubsidized Loans, which are available to both undergraduate and graduate students regardless of financial need. Direct PLUS Loans, designed for graduate students and parents of undergraduate students, often have higher interest rates. The exact interest rates for each loan type vary from year to year, and it’s essential to check the current rates published by the U.S. Department of Education. For example, in a recent year, Direct Subsidized Loans may have had a rate of 4%, while Direct Unsubsidized Loans were at 5%, and Direct PLUS Loans were at 7%. These numbers are for illustrative purposes only and are subject to change.

Visual Representation of Interest Accrual Over Time

A graph illustrating interest accrual would show a line graph with time on the x-axis and total loan amount (principal + accumulated interest) on the y-axis. Multiple lines would represent different loan amounts ($10,000, $20,000, $30,000 for example) and/or repayment plans (Standard, Extended, Income-Driven). The lines would show a steeper upward slope for larger loan amounts and for loans with longer repayment periods due to the longer time for interest to accumulate. For instance, a $30,000 loan on a standard repayment plan would show a significantly steeper incline compared to a $10,000 loan on the same plan. Similarly, a $20,000 loan on an extended repayment plan would show a gentler slope initially but would ultimately surpass the total amount of a $20,000 loan on a standard plan over a longer time horizon. The visual would clearly demonstrate how both the initial loan amount and the repayment plan significantly influence the total amount repaid.

Impact of Interest Capitalization on the Total Loan Amount

Interest capitalization occurs when unpaid interest is added to the principal loan balance. This increases the principal amount, resulting in higher future interest charges. For example, if you have unpaid interest of $500, this amount would be added to your principal, and future interest calculations would be based on this increased principal. This snowball effect can significantly increase the total amount you owe over the life of the loan, especially if you’re not making payments while in school (for unsubsidized loans) or during periods of deferment. Understanding interest capitalization is critical to planning your repayment strategy and minimizing the overall cost of your student loans.

Default and its Consequences

Defaulting on your federal student loans is a serious matter with significant and lasting repercussions. Understanding the process and the potential consequences is crucial for responsible loan management. This section details the steps leading to default, the penalties involved, and resources available to avoid or mitigate the impact of default.

The process of student loan default begins when you fail to make your scheduled payments for 270 days (nine months). This period of non-payment triggers the loan to be considered in default. The Department of Education (ED) will typically send multiple notices prior to this point, reminding you of your overdue payments and offering options to avoid default. However, continued non-payment will ultimately lead to default status.

Consequences of Federal Student Loan Default

Defaulting on federal student loans has severe consequences that can significantly impact your financial well-being for years to come. These consequences extend beyond simply damaging your credit score.

The most immediate consequence is the negative impact on your credit report. A default will be recorded, substantially lowering your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment. This credit damage can persist for seven years or more, significantly hindering your ability to secure favorable financial terms in the future. For example, a low credit score could mean paying significantly higher interest rates on mortgages or car loans, adding thousands of dollars to the total cost over the life of the loan.

Actions Taken by the Department of Education Against Defaulters

The Department of Education employs several strategies to recover defaulted loans.

These actions can include wage garnishment, where a portion of your paycheck is automatically deducted to repay the loan; tax refund offset, where your federal tax refund is applied to your debt; and even the seizure of federal benefits such as Social Security payments. In addition, the ED may refer your debt to a collection agency, which will further impact your credit report and potentially lead to aggressive collection tactics. For instance, a borrower who defaulted on a $20,000 loan could face wage garnishment of a substantial portion of their income, making it challenging to meet their living expenses.

Resources Available to Borrowers Facing Loan Default

Several resources are available to help borrowers avoid or resolve default.

The ED offers various repayment plans designed to make payments more manageable, including income-driven repayment plans that base your monthly payment on your income and family size. Borrowers can also explore loan rehabilitation programs, which involve making a series of on-time payments to reinstate their loans in good standing. Furthermore, federal student loan counseling services provide guidance and support to help borrowers navigate their options and create a sustainable repayment plan. These services can be especially helpful for individuals who are struggling financially or are unsure about their repayment options. For example, a borrower facing default could contact a federal student loan counselor to explore income-driven repayment options or loan rehabilitation, potentially avoiding the severe consequences of default.

Long-Term Financial Implications of Student Loan Default

The long-term financial impact of student loan default is substantial and far-reaching.

Beyond the immediate consequences of damaged credit and wage garnishment, default can create a cycle of debt and financial instability. The difficulty in obtaining credit and the added costs associated with poor credit can make it challenging to achieve long-term financial goals such as buying a home, saving for retirement, or even securing employment in certain fields. The persistent negative impact on creditworthiness can significantly limit future financial opportunities, creating a lasting burden that extends well beyond the initial loan amount. For instance, someone who defaulted on their student loans might find it extremely difficult to qualify for a mortgage, delaying or preventing homeownership, a significant milestone for many individuals.

Borrower Rights and Protections

Federal student loan borrowers are afforded significant rights and protections designed to ensure fair and equitable treatment throughout the loan lifecycle. Understanding these rights is crucial for navigating the complexities of repayment and resolving potential issues. This section Artikels key protections and the processes available to borrowers facing challenges.

Federal Student Loan Borrower Rights

Federal student loan borrowers have several key rights. These include the right to accurate and timely information regarding their loan terms, repayment options, and rights; the right to fair and impartial treatment from loan servicers and the Department of Education; the right to due process in cases of default or other adverse actions; and the right to access to complaint resolution mechanisms and ombudsman services. These rights are designed to protect borrowers from unfair practices and ensure transparency in the loan process.

Appealing a Loan Denial or Adverse Action

The process for appealing a loan denial or other adverse action typically involves submitting a formal written appeal to the relevant agency or servicer. This appeal should clearly state the reason for the appeal, provide supporting documentation, and request a specific remedy. Borrowers should meticulously document all communication and actions taken throughout the appeal process. The Department of Education provides detailed instructions and forms on its website for filing appeals. Denial appeals often involve providing evidence to support the borrower’s eligibility for the loan, such as updated financial information or documentation of extenuating circumstances.

The Role of the Department of Education’s Ombudsman

The Department of Education’s Federal Student Aid Ombudsman’s office serves as an independent resource for borrowers experiencing difficulties with their federal student loans. The Ombudsman acts as a neutral third party, investigating complaints, mediating disputes, and recommending solutions. They cannot directly resolve every issue, but they can facilitate communication between the borrower and the relevant agency or servicer, and advocate for fair treatment. The Ombudsman’s office provides valuable assistance in navigating complex processes and understanding borrower rights.

Options for Borrowers Facing Unfair Treatment

Borrowers who believe they have been treated unfairly have several options available to them. In addition to appealing adverse actions and contacting the Ombudsman, they can file a complaint with the Consumer Financial Protection Bureau (CFPB), a federal agency responsible for protecting consumers from unfair, deceptive, or abusive financial practices. They can also seek legal counsel to explore potential legal remedies. Documentation of all interactions with loan servicers and the Department of Education is essential in pursuing these options.

Protecting Your Rights: A Checklist

Maintaining thorough records is crucial. Before initiating any action, borrowers should gather all relevant documentation, including loan agreements, communication with servicers, and any evidence supporting their claim. This checklist provides a structured approach:

- Keep detailed records of all communications with your loan servicer and the Department of Education.

- Understand your loan terms and repayment options.

- Contact your loan servicer promptly if you encounter any problems.

- Explore available repayment plans and options for hardship.

- File a formal appeal if you are denied a loan or experience an adverse action.

- Contact the Department of Education’s Federal Student Aid Ombudsman if you are unable to resolve your issue.

- Consider seeking legal counsel if necessary.

Impact on Higher Education

The pervasive influence of student loan debt significantly shapes the landscape of higher education in the United States, impacting affordability, enrollment trends, career choices, and ultimately, the long-term societal well-being. The rising cost of tuition, coupled with increasing reliance on borrowing, creates a complex interplay with far-reaching consequences.

Student loan debt’s impact on college affordability is undeniable. The escalating cost of tuition and fees has outpaced inflation for decades, forcing many students to rely heavily on loans to finance their education. This reliance creates a system where the cost of college is effectively deferred, but the burden is substantial and long-lasting, making higher education less accessible to low- and middle-income families. The increasing debt burden acts as a significant barrier to entry for many prospective students, limiting opportunities based on financial constraints rather than academic merit or potential.

Student Loan Debt and College Enrollment Rates

The relationship between student loan debt and college enrollment rates is multifaceted. While increased access to loans might initially boost enrollment, the growing awareness of the substantial debt burden can deter potential students. Studies have shown a correlation between high levels of student loan debt and decreased enrollment, particularly among students from lower socioeconomic backgrounds who may be more risk-averse to taking on large loans. The fear of overwhelming debt can lead prospective students to pursue alternative, potentially less lucrative, career paths or forgo higher education altogether. This effect is particularly pronounced in fields with lower earning potential, where the return on investment in a college education may seem less appealing when weighed against significant debt. For example, a student considering a career in the arts might be less likely to pursue a degree if they anticipate substantial debt and a potentially less lucrative career path compared to a field like engineering.

Impact of Student Loan Debt on Post-Graduate Career Choices

Student loan debt significantly influences post-graduate career choices. The pressure to repay loans often leads graduates to prioritize high-paying jobs, even if those jobs aren’t aligned with their passions or long-term career goals. This can lead to a sense of dissatisfaction and a less fulfilling career path. The need to quickly secure employment to begin repayment also limits the exploration of alternative career options, such as starting a business or pursuing further education, that might require a period of lower income. For instance, a recent graduate with significant student loan debt might accept a high-paying corporate job immediately after graduation, even if they aspire to be a writer or artist, because of the immediate financial pressure.

Student Loan Debt Burdens Across Different Demographics

The burden of student loan debt is not evenly distributed across different demographics. Minority students and students from low-income families disproportionately carry higher levels of debt compared to their white and wealthier counterparts. This disparity is often linked to lower access to financial aid, higher reliance on loans, and potentially lower earning potential after graduation. This creates a cycle of inequality, where disadvantaged students face greater financial hurdles in pursuing higher education and achieving economic mobility. For example, a Black student from a low-income background may need to borrow significantly more than a white student from a wealthy family to attend the same college, leading to a much larger debt burden after graduation.

Long-Term Societal Impact of Rising Student Loan Debt

The long-term societal impact of rising student loan debt is significant and far-reaching. High levels of student loan debt can hinder economic growth by reducing consumer spending and delaying major life milestones like homeownership and starting a family. It can also contribute to increased inequality, as individuals burdened by debt struggle to achieve financial stability and upward mobility. Furthermore, the potential for widespread defaults could have a destabilizing effect on the financial system. For example, a significant increase in loan defaults could negatively impact the economy by reducing lending and investment, potentially leading to a recession. The long-term effects on societal well-being include increased stress levels, delayed family formation, and a potential reduction in overall economic productivity.

Final Summary

Successfully managing U.S. Department of Education student loans requires proactive engagement and a thorough understanding of the available resources and options. By carefully considering repayment strategies, exploring potential forgiveness programs, and understanding borrower rights, individuals can effectively navigate this complex system and work towards a debt-free future. Remember to utilize the resources provided by the Department of Education and seek professional advice when needed to ensure optimal financial outcomes.

FAQ Insights

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

Can I consolidate my federal student loans?

Yes, consolidation combines multiple federal loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment but may not always lower your overall cost.

How do I apply for student loan forgiveness?

Eligibility requirements vary by program. Visit the Federal Student Aid website (studentaid.gov) for detailed information and application procedures for each program.

What is interest capitalization?

Interest capitalization is when unpaid interest is added to your principal loan balance, increasing the total amount you owe. This increases the overall cost of your loan.

Where can I find my loan servicer information?

You can find your loan servicer information on the National Student Loan Data System (NSLDS) website.