Navigating the world of student loans can be daunting, especially for University of Florida students facing a range of options. This guide provides a clear and concise overview of UF student loan programs, encompassing federal and private loans, application processes, and crucial financial management strategies. We’ll explore the nuances of repayment plans, the potential consequences of loan default, and valuable resources available to help you succeed.

From understanding interest rates and eligibility requirements to developing a personalized repayment plan and considering the long-term financial implications of student loan debt, this resource aims to empower you with the knowledge and tools necessary to make informed decisions about your financial future. We’ll delve into real-world scenarios, highlighting the diverse experiences of UF graduates and offering practical advice to ensure a smoother journey through the complexities of student loan repayment.

Understanding UF Student Loan Options

Securing funding for your education at the University of Florida (UF) often involves navigating the complexities of student loans. Understanding the various options available, their differences, and the application processes is crucial for making informed financial decisions. This section will provide a detailed overview of federal and private student loan programs accessible to UF students.

Federal Student Loans for UF Students

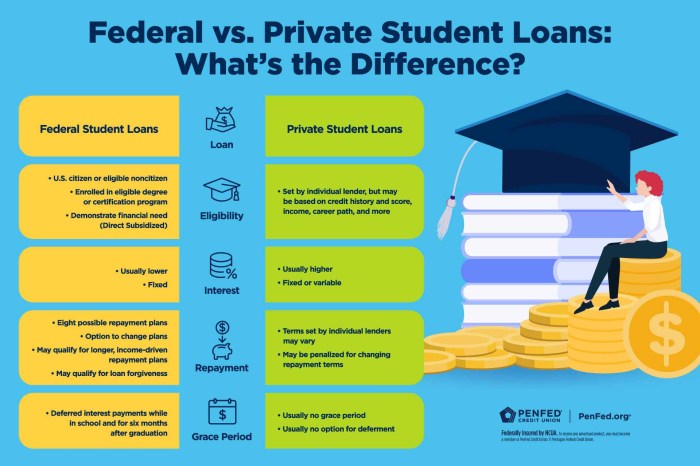

Federal student loans are government-backed loans offered through programs like the Direct Loan program. These loans generally offer more favorable terms and repayment options compared to private loans. They are often the preferred choice for students due to their borrower protections and flexible repayment plans. Eligibility is determined based on financial need and enrollment status.

Private Student Loans for UF Students

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, these loans are not backed by the government. This means that interest rates and repayment terms can vary significantly depending on the lender and the borrower’s creditworthiness. While private loans may be necessary to fill funding gaps, it’s important to carefully compare offers and understand the terms before borrowing.

Application Processes for Federal and Private Student Loans

The application process for federal student loans involves completing the Free Application for Federal Student Aid (FAFSA). This form gathers information about your financial situation and determines your eligibility for federal aid, including loans. After submitting the FAFSA, you’ll receive a Student Aid Report (SAR) outlining your eligibility. You can then accept or decline offered loans through your student portal. The application process for private student loans varies by lender but generally involves completing an online application, providing financial information, and undergoing a credit check (if you’re not a co-signer).

Comparison of Federal and Private Student Loan Options

The following table summarizes key differences between federal and private student loans for UF students. Remember that specific interest rates and terms can change, so always check the most up-to-date information from the lender or the UF Financial Aid Office.

| Loan Type | Interest Rate | Repayment Terms | Eligibility Requirements |

|---|---|---|---|

| Federal Direct Subsidized Loan | Variable; check the Federal Student Aid website for current rates. | Typically begins six months after graduation or dropping below half-time enrollment. Various repayment plans available. | Demonstrated financial need; enrollment at least half-time. |

| Federal Direct Unsubsidized Loan | Variable; check the Federal Student Aid website for current rates. | Typically begins six months after graduation or dropping below half-time enrollment. Various repayment plans available. | Enrollment at least half-time. |

| Private Student Loan | Variable; depends on creditworthiness, lender, and market conditions. Generally higher than federal loan rates. | Varies by lender; typically begins within a few months of loan disbursement. | Creditworthiness (or a creditworthy co-signer); enrollment at least half-time. |

Managing UF Student Loan Debt

Graduating from the University of Florida is a significant achievement, but it often comes with the responsibility of managing student loan debt. Successfully navigating this phase requires careful planning, understanding your repayment options, and proactive debt management strategies. This section provides practical guidance to help you effectively manage your UF student loans and avoid potential pitfalls.

Budgeting and Managing Repayment

Effective budgeting is crucial for successful loan repayment. Create a detailed budget that tracks all income and expenses. Categorize expenses to identify areas where you can reduce spending and allocate more funds towards loan payments. Consider using budgeting apps or spreadsheets to simplify this process. Prioritize essential expenses like housing, food, and transportation, while strategically reducing discretionary spending. Building an emergency fund is also vital; unexpected expenses can derail repayment plans if you don’t have savings to fall back on. A general rule of thumb is to aim for 3-6 months’ worth of living expenses in an emergency fund. Once established, consistently contribute to it.

Repayment Plan Options

Several repayment plans are available, each with its own advantages and disadvantages. The Standard Repayment Plan involves fixed monthly payments over 10 years. This option offers the shortest repayment period, minimizing total interest paid but potentially resulting in higher monthly payments. The Extended Repayment Plan stretches payments over a longer period (up to 25 years), reducing monthly payments but increasing overall interest paid. Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, base monthly payments on your income and family size. These plans offer lower monthly payments but may extend the repayment period significantly, leading to higher overall interest costs. Choosing the right plan depends on your individual financial situation and priorities.

Consequences of Loan Default and Default Avoidance

Loan default occurs when you fail to make payments for a prolonged period. The consequences are severe and include damage to your credit score, wage garnishment, tax refund offset, and potential legal action. To avoid default, maintain open communication with your loan servicer. Contact them immediately if you anticipate difficulty making payments. Explore options like deferment or forbearance, which temporarily suspend or reduce payments, but remember these options usually accrue interest. Consider consolidating your loans to simplify payments and potentially secure a lower interest rate. Budgeting meticulously and actively monitoring your loan status are crucial preventative measures.

Creating a Personalized Repayment Plan

Creating a personalized repayment plan involves several steps.

- List all your loans: Note the lender, loan amount, interest rate, and monthly payment for each loan.

- Calculate your monthly income and expenses: Create a detailed budget to determine how much you can afford to allocate towards loan repayment.

- Research repayment plan options: Compare the standard, extended, and income-driven repayment plans to determine the most suitable option based on your financial situation.

- Choose a repayment plan: Select the plan that best aligns with your budget and long-term financial goals.

- Set up automatic payments: Automate your loan payments to ensure consistent and timely repayments.

- Monitor your progress: Regularly review your budget and repayment progress to identify any necessary adjustments.

Following these steps will help you develop a sustainable and effective repayment strategy. Remember to regularly review and adjust your plan as your financial circumstances change.

UF Student Loan Resources and Support

Navigating the complexities of student loans can be challenging, but the University of Florida provides numerous resources to assist students in understanding and managing their financial obligations. These resources offer support ranging from personalized financial counseling to comprehensive online tools and informative workshops. Utilizing these services can significantly reduce stress and improve students’ financial well-being.

The University of Florida is committed to supporting students’ financial success. A variety of services are available to help students understand their loan options, manage their debt, and plan for their financial future. These resources are designed to empower students to make informed decisions and avoid potential pitfalls associated with student loan repayment.

On-Campus Resources

The University of Florida offers several on-campus resources dedicated to assisting students with their financial needs, including student loans. These resources provide personalized guidance, workshops, and access to valuable online tools.

- UF Student Financial Affairs: This office is the central hub for all student financial aid matters, including student loans. They can answer questions about loan eligibility, application processes, and repayment options. Their website typically provides detailed information and frequently asked questions (FAQs). Contact information is usually available on the university’s main website.

- UF Counseling and Wellness Center: While not solely focused on finances, this center offers counseling services that can address the stress and anxiety associated with student loan debt. They provide a supportive environment for students to discuss their financial concerns and develop coping mechanisms.

- Career Resource Center: This center can help students explore career paths that align with their financial goals and debt management strategies. They often provide resources on salary expectations and budgeting to help students plan for loan repayment.

Financial Literacy Workshops and Counseling

The University of Florida frequently hosts financial literacy workshops designed to educate students on various aspects of personal finance, including budgeting, debt management, and credit scores. These workshops often cover topics directly relevant to managing student loan debt, such as creating a repayment plan and understanding different repayment options. Information on upcoming workshops is typically announced through the UF Student Financial Affairs website and university email announcements. Individual counseling sessions are often available by appointment through the Student Financial Affairs office or other relevant campus departments.

External Resources

Beyond the resources provided by the University of Florida, numerous external organizations offer valuable support and information regarding student loans.

- Federal Student Aid (FSA): This is the U.S. Department of Education’s website, offering comprehensive information on federal student loans, including repayment plans, loan forgiveness programs, and debt management tools. It’s a crucial resource for understanding the intricacies of federal student loan programs.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that provides free and low-cost credit counseling services, including assistance with student loan debt management. They can help students create a budget, develop a repayment plan, and explore options for debt consolidation or refinancing.

- Student Loan Borrower Assistance Program: Several non-profit organizations offer free assistance to student loan borrowers. These programs can provide guidance on navigating the complexities of repayment, exploring loan forgiveness programs, and resolving issues with loan servicers.

The Impact of UF Student Loans on Graduates

Graduating from the University of Florida is a significant achievement, but the financial burden of student loan debt can significantly impact a graduate’s future. Understanding the long-term implications of these loans is crucial for navigating post-graduate life successfully. This section explores the various ways student loan debt from UF can affect career choices, lifestyle, and major life decisions.

The weight of student loan debt can cast a long shadow over a UF graduate’s early career. The pressure to repay loans might influence career choices, potentially leading graduates to prioritize higher-paying jobs, even if those jobs aren’t their ideal career path. This can lead to career dissatisfaction and a lower overall quality of life. Additionally, the monthly loan repayments can significantly reduce disposable income, limiting the ability to save for other important financial goals, such as purchasing a home or investing in retirement.

Average Student Loan Debt of UF Graduates Compared to National Averages

Determining the precise average student loan debt for UF graduates requires accessing and analyzing data from sources like the National Center for Education Statistics (NCES) and the university’s own financial aid office. While specific numbers fluctuate yearly, a comparison to national averages reveals a general trend. For instance, the average student loan debt for a UF graduate might be higher or lower than the national average depending on factors such as the student’s chosen major, length of study, and the use of grants and scholarships. A higher-than-average debt level will naturally increase the financial pressure on graduates in the years following graduation. Access to data from reputable sources is crucial for a precise comparison.

Impact of Student Loan Debt on Major Life Decisions

Student loan debt can significantly influence major life decisions like homeownership and starting a family. The substantial monthly loan repayments reduce the amount of money available for a down payment on a house, potentially delaying or preventing homeownership. Similarly, the financial constraints imposed by student loan debt can affect the timing of starting a family, as raising children is inherently expensive. These decisions often involve careful balancing of financial responsibilities, impacting the overall timeline and life choices of graduates.

Hypothetical Scenario: Repayment Strategies and Long-Term Financial Well-being

Let’s consider a hypothetical scenario: Sarah, a UF graduate, has $50,000 in student loan debt with a 6% interest rate. We’ll compare two repayment strategies: a standard 10-year repayment plan and an income-driven repayment (IDR) plan.

Under the 10-year plan, Sarah’s monthly payment would be approximately $550, resulting in a total repayment of approximately $66,000. While this plan offers quicker debt elimination, it necessitates a larger monthly commitment, potentially limiting savings and impacting her ability to purchase a home or invest early in her career. Conversely, an IDR plan might lower her monthly payment, allowing for more financial flexibility in the short term. However, the repayment period will likely extend beyond 10 years, leading to a higher total interest paid over the life of the loan. In this scenario, Sarah must weigh the immediate financial relief of an IDR plan against the long-term cost of increased interest.

This comparison illustrates the importance of carefully considering different repayment options and their long-term implications. Financial planning and budgeting, coupled with seeking guidance from financial advisors, can greatly assist graduates in navigating these crucial financial decisions.

Illustrative Examples of UF Student Loan Scenarios

Understanding the diverse experiences of UF students with student loans provides valuable insight into effective financial planning and responsible debt management. The following case studies illustrate the varying outcomes possible, highlighting the impact of different choices and circumstances.

These examples are illustrative and do not represent every possible scenario. Individual experiences will vary based on numerous factors including chosen major, living expenses, scholarship opportunities, and post-graduation employment prospects.

Case Study 1: Minimal Debt Upon Graduation

This case study examines a student who graduated with minimal student loan debt. Factors contributing to this success are detailed below.

- Financial Situation: Sarah, a diligent and frugal student, secured a merit-based scholarship covering a significant portion of her tuition. She lived at home to minimize living expenses, worked part-time throughout college, and carefully tracked her spending.

- Loan Choices: Sarah only borrowed the minimum amount necessary to cover her remaining tuition and essential living costs. She prioritized federal loans due to their favorable repayment options.

- Outcome: Sarah graduated with only $5,000 in federal student loans. Her diligent financial planning allowed her to secure a job in her field upon graduation and she was able to comfortably repay her loans within a few years.

Case Study 2: Struggling with Repayment

This case study focuses on a student who faces significant challenges in repaying their student loans. This section analyzes the factors that contributed to their difficulties.

- Financial Situation: John, a student pursuing a demanding medical degree, faced high tuition costs and significant living expenses. He relied heavily on loans to cover these costs and had limited opportunities for part-time work due to his rigorous academic schedule.

- Loan Choices: John took out both federal and private loans, accumulating substantial debt. He chose private loans due to the higher loan amounts available, but these came with higher interest rates.

- Outcome: John graduated with over $200,000 in student loan debt. He is currently struggling to make monthly payments and is exploring options such as income-driven repayment plans to manage his debt burden.

Case Study 3: Successful Utilization of Loan Forgiveness Programs

This case study highlights a student who successfully utilized a loan forgiveness program to alleviate their debt burden. The details of this scenario are Artikeld below.

- Financial Situation: Maria, a passionate teacher, pursued a career in public service. She accumulated significant student loan debt during her undergraduate and graduate studies.

- Loan Choices: Maria primarily utilized federal student loans, aware of the potential for loan forgiveness programs. She worked in a qualifying public service position after graduation.

- Outcome: After ten years of working in a qualifying public service position, Maria qualified for the Public Service Loan Forgiveness (PSLF) program, resulting in the forgiveness of a significant portion of her remaining federal student loan debt.

Ultimate Conclusion

Successfully managing UF student loans requires careful planning, proactive engagement with available resources, and a clear understanding of your financial situation. By understanding the various loan options, employing effective budgeting strategies, and utilizing the support systems available at UF and beyond, you can navigate the complexities of student loan debt and pave the way for a financially secure future. Remember, proactive planning and informed decision-making are key to minimizing long-term financial burdens and maximizing your post-graduation success.

Expert Answers

What happens if I can’t make my loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

Can I consolidate my UF student loans?

Yes, you can consolidate federal student loans into a single loan with a new interest rate and repayment schedule. This may simplify payments but could potentially affect your overall interest paid.

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or during deferment. Unsubsidized loans accrue interest from the time they are disbursed.

Are there loan forgiveness programs for UF graduates?

Several loan forgiveness programs exist, often tied to specific professions (e.g., public service). Eligibility criteria vary, so research programs carefully.