Navigating the complexities of higher education financing can feel daunting, particularly when understanding undergraduate student loan limits. These limits, set by the federal government, significantly impact a student’s ability to afford college and shape their future financial trajectory. This guide delves into the current limits for dependent and independent students, exploring the factors influencing these restrictions and the various alternative funding options available.

We will examine the implications of these limits on students from diverse socioeconomic backgrounds, highlighting potential challenges and effective debt management strategies. Furthermore, we’ll explore the crucial role of financial aid offices in guiding students through the process and promoting responsible borrowing habits. Understanding these nuances is key to making informed decisions and securing a financially sound future.

Current Undergraduate Student Loan Limits

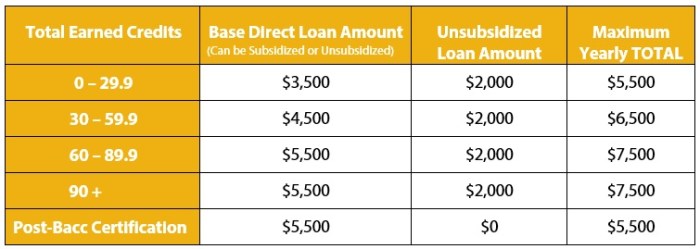

Understanding the limits on federal student loans for undergraduate students is crucial for effective financial planning during higher education. These limits vary depending on factors such as the student’s dependency status and the academic year. Knowing these limits helps students and their families make informed borrowing decisions and avoid unnecessary debt.

Federal Student Loan Limits for Undergraduate Students

Federal student loan programs offer financial assistance to eligible undergraduate students. The maximum loan amounts available depend on whether the student is classified as dependent or independent, and the student’s year in school. These limits are subject to change, so it’s essential to check the official Federal Student Aid website for the most up-to-date information.

Loan Limits by Dependency Status and Academic Year

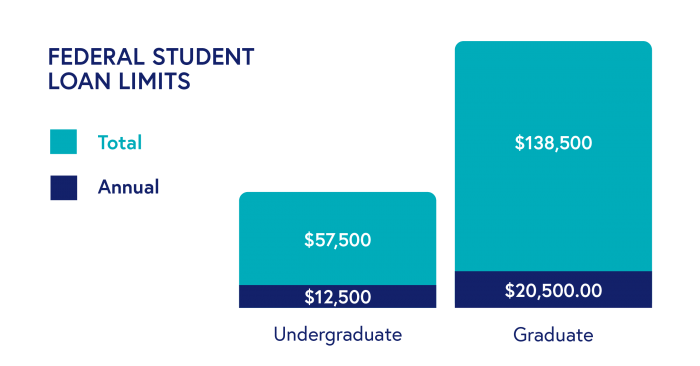

The amount a student can borrow each year depends on their dependency status and year in school. Dependent students are generally those claimed on their parents’ tax returns. Independent students are those who are not claimed as dependents. The limits are cumulative, meaning the total amount a student can borrow over their undergraduate career is capped.

| Loan Type | Dependent Student Limit | Independent Student Limit | Aggregate Limit |

|---|---|---|---|

| Subsidized Direct Loans | Varies by year in school (see below) | Varies by year in school (see below) | $31,000 |

| Unsubsidized Direct Loans | Varies by year in school (see below) | Varies by year in school (see below) | $57,500 |

Note: The specific yearly limits for subsidized and unsubsidized loans are subject to change. The table above shows general ranges and the aggregate limit. Always refer to the official Federal Student Aid website for the most current information.

Yearly Loan Limits for Subsidized and Unsubsidized Loans (Example)

It’s important to note that these are example amounts and may not reflect the current year’s limits. Actual amounts may vary slightly. Always consult the official Federal Student Aid website for the most up-to-date figures.

| Year in School | Dependent Student (Subsidized + Unsubsidized) | Independent Student (Subsidized + Unsubsidized) |

|---|---|---|

| Freshman | $5,500 – $9,500 | $9,500 – $19,000 |

| Sophomore | $5,500 – $9,500 | $9,500 – $19,000 |

| Junior | $5,500 – $9,500 | $9,500 – $19,000 |

| Senior | $5,500 – $9,500 | $9,500 – $19,000 |

Potential Changes to Loan Limits

Discussions regarding potential modifications to undergraduate student loan limits frequently occur within the context of broader higher education policy debates. Factors such as rising tuition costs and concerns about student debt burdens often influence these discussions. However, there are no currently enacted changes to the loan limits as of the time of writing. It is important to monitor official government sources for any announcements of future changes.

Factors Influencing Loan Limits

Undergraduate student loan limits are not arbitrarily set; rather, they are the result of a complex interplay of factors designed to balance affordability for students with the financial sustainability of the loan programs. These limits aim to ensure access to higher education while mitigating the risk of excessive student debt.

The primary considerations when establishing these limits involve a careful assessment of the cost of attendance and the expected family contribution. The cost of attendance encompasses tuition fees, room and board, books, supplies, and other essential expenses associated with pursuing a college education. This cost varies significantly depending on the type of institution (public versus private), its location, and the specific program of study. The expected family contribution (EFC), on the other hand, represents the amount a student’s family is reasonably expected to contribute towards their education based on their income, assets, and family size. The difference between the cost of attendance and the EFC is often a significant determinant of the loan amount a student is eligible to receive.

Government’s Role in Determining Loan Limits

Government agencies, such as the U.S. Department of Education, play a crucial role in setting and adjusting student loan limits. They analyze economic data, educational cost trends, and the overall financial health of the student loan system to inform their decisions. This involves extensive research and analysis to ensure that loan limits are both adequate to meet students’ needs and fiscally responsible. Government policies often reflect a balancing act between promoting access to higher education and managing the risks associated with increasing student loan debt. These limits are regularly reviewed and adjusted to account for inflation and changes in the cost of education.

Comparison of Student Loan Limit Policies

The United States and other developed nations employ varying approaches to student loan limits. For instance, comparing the US system with that of the United Kingdom reveals notable differences. In the US, loan limits are often tied to factors such as the student’s dependency status, year in school, and the type of institution attended. The UK, however, utilizes a more needs-based system, where loan amounts are determined based on individual financial circumstances and the cost of their chosen course of study. While both systems aim to make higher education more accessible, their approaches to determining loan limits differ significantly, reflecting the unique socio-economic contexts and educational financing structures of each country. This illustrates that there is no single “best” approach; rather, effective policy depends on a nation’s specific circumstances.

Flowchart Illustrating the Decision-Making Process

The flowchart would begin with a box labeled “Determine Cost of Attendance.” An arrow would then lead to a box labeled “Determine Expected Family Contribution.” From there, two arrows would branch out: one leading to a box labeled “Calculate Loan Need (Cost of Attendance – EFC),” and the other leading to a box labeled “Consider Institutional Factors (e.g., type of institution, program of study).” These two arrows would then converge at a box labeled “Apply Government-Set Loan Limits.” Finally, an arrow would lead to a box labeled “Determine Maximum Loan Amount.” This flowchart visually represents the sequential steps involved in calculating a student’s maximum eligible loan amount. The process involves careful consideration of both the student’s financial need and government-established limits.

Impact of Loan Limits on Students

The current limits on undergraduate student loans significantly affect students’ ability to access and afford higher education. These limits, while intended to prevent excessive debt, can create substantial barriers for many, particularly those from lower-income backgrounds who may rely more heavily on loans to cover tuition, fees, living expenses, and other educational costs. The interplay between loan limits and the rising cost of higher education necessitates a careful consideration of both the immediate and long-term financial implications for students.

The impact of these limits manifests in several ways. Many students find themselves unable to fully finance their education, forcing them to either reduce their course load, delaying graduation, or taking on part-time jobs that can hinder their academic performance. This can be particularly challenging for students who are already juggling family responsibilities or other commitments. For low-income students, who may lack alternative funding sources like parental support or substantial savings, the constraints imposed by loan limits can be especially restrictive, potentially limiting their access to higher education altogether. The pressure to secure sufficient funding can also lead to increased stress and anxiety, impacting their overall well-being and academic success.

Challenges Faced by Students Due to Loan Limits

Students facing loan limit restrictions often encounter significant obstacles in pursuing their education. The inability to cover all educational expenses can necessitate making difficult choices between attending a more expensive institution and attending a less expensive one with potentially fewer opportunities. Students may also be forced to forgo valuable experiences like study abroad programs or internships due to financial constraints. The increased reliance on part-time employment can lead to reduced study time and increased stress, potentially impacting academic performance and overall graduation rates. Furthermore, the need to borrow from multiple sources, such as private lenders with potentially higher interest rates, can add to the complexity of debt management and increase the overall cost of borrowing. Low-income students, in particular, may lack the familial or personal resources to offset these challenges, creating a significant disparity in access to higher education.

Strategies for Effective Debt Management

Effective debt management is crucial for students navigating the complexities of loan limits. It’s essential to develop a comprehensive financial plan that includes budgeting, careful tracking of expenses, and proactive strategies to minimize borrowing.

- Prioritize Financial Literacy: Understanding interest rates, repayment plans, and the long-term implications of debt is crucial. Many institutions offer financial literacy workshops or resources.

- Explore Alternative Funding Sources: Consider scholarships, grants, and work-study programs to supplement loans and reduce the overall borrowing need.

- Budgeting and Expense Tracking: Create a detailed budget that tracks all income and expenses to identify areas for potential savings.

- Minimize Unnecessary Expenses: Reduce discretionary spending to maximize funds available for educational expenses.

- Consider Affordable Housing Options: Explore cost-effective housing options to minimize living expenses.

- Explore Income-Driven Repayment Plans: Familiarize yourself with available repayment plans to better manage debt after graduation.

Long-Term Financial Consequences of Exceeding Loan Limits

Exceeding loan limits can have significant long-term financial repercussions. Borrowing beyond the established limits often necessitates seeking private loans, which typically come with higher interest rates and less favorable repayment terms. This can lead to a substantially larger overall debt burden, potentially impacting future financial decisions like homeownership, saving for retirement, or starting a family. The extended repayment period associated with higher debt can also delay achieving financial independence and may lead to ongoing financial stress. For example, a student who exceeds their loan limit by $20,000 at a 7% interest rate could face tens of thousands of dollars in additional interest payments over the life of the loan. This significant financial burden could severely limit their future opportunities and financial stability.

Alternatives to Federal Student Loans

Securing funding for undergraduate education often extends beyond federal student loans. A diverse range of alternative financing options exists, each with its own set of advantages and disadvantages. Understanding these alternatives is crucial for students aiming to minimize their reliance on federal loans and potentially reduce their overall debt burden. Careful consideration of eligibility requirements and application processes is vital in navigating these options effectively.

Several key alternatives to federal student loans offer pathways to fund undergraduate education. These include scholarships, grants, and private loans, each presenting unique benefits and drawbacks compared to federal options. Effective research and a strategic approach are essential to maximizing the chances of securing funding from these sources.

Scholarships

Scholarships represent a form of financial aid that doesn’t require repayment. They are typically awarded based on merit, academic achievement, talent, or demonstrated financial need. Many scholarships are offered by colleges and universities, while others are provided by private organizations, corporations, and community groups. The application processes vary widely, ranging from simple online forms to extensive essays and interviews. Securing scholarships often requires diligent research and proactive application.

Grants

Similar to scholarships, grants are forms of financial aid that do not need to be repaid. However, grants are typically awarded based on demonstrated financial need, assessed through the Free Application for Federal Student Aid (FAFSA). Federal grants, such as the Pell Grant, are a common example, but state and institutional grants also exist. The eligibility criteria for grants are usually stricter than those for scholarships, focusing on the applicant’s financial circumstances.

Private Loans

Private loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, private loans often come with higher interest rates and less favorable repayment terms. Eligibility for private loans depends on creditworthiness, income, and co-signer availability. It’s crucial to carefully compare interest rates, fees, and repayment options from multiple lenders before accepting a private loan. Borrowers should also be aware of the potential for significantly higher overall costs compared to federal loans.

Comparison of Funding Sources

The following table summarizes the key aspects of each funding source, allowing for a direct comparison to aid in decision-making.

| Funding Source | Application Process | Eligibility Requirements | Potential Drawbacks |

|---|---|---|---|

| Federal Student Loans | Complete the FAFSA; may involve additional forms depending on the loan type. | US citizenship or eligible non-citizen status; enrollment in an eligible program; demonstrated financial need (for some loans). | Accumulation of debt; interest accrual; potential for difficulty in repayment. |

| Scholarships | Varies widely; may involve essays, transcripts, recommendations, and interviews. | Varies widely; based on merit, academic achievement, talent, or financial need. | Competitive application process; limited availability; may require significant time investment in applications. |

| Grants | Complete the FAFSA. | Demonstrated financial need; US citizenship or eligible non-citizen status; enrollment in an eligible program. | Limited availability; stringent eligibility requirements; may not fully cover educational expenses. |

| Private Loans | Application through a lender; often requires credit check and may necessitate a co-signer. | Good credit score (or a co-signer with good credit); sufficient income; enrollment in an eligible program. | Higher interest rates than federal loans; less favorable repayment terms; potential for significant debt accumulation. |

The Role of Financial Aid Offices

Financial aid offices serve as crucial resources for undergraduate students navigating the complexities of student loan financing. They provide essential guidance, support, and resources to help students understand loan limits, manage their debt, and make informed borrowing decisions. Their role extends beyond simply processing applications; they act as advisors, educators, and advocates for students’ financial well-being.

Financial aid offices assist students in understanding and navigating student loan limits by providing comprehensive information on federal and private loan programs, eligibility requirements, and the implications of different borrowing amounts. They clarify the nuances of loan terms, interest rates, repayment plans, and the potential long-term impact of student loan debt. This support is vital, as the information surrounding student loans can be dense and confusing for students unfamiliar with financial terminology and processes.

Resources and Services Offered by Financial Aid Offices

Financial aid offices typically offer a range of resources and services designed to help students manage their loans effectively. These may include individual counseling sessions with financial aid advisors, workshops on financial literacy and responsible borrowing, online resources such as loan calculators and repayment planning tools, and access to external financial planning resources. They often facilitate the completion of the Free Application for Federal Student Aid (FAFSA) and assist students in exploring alternative funding options, such as scholarships, grants, and work-study programs. The aim is to equip students with the knowledge and tools to make informed choices about their financial future.

Best Practices for Supporting Informed Borrowing Decisions

Best practices for financial aid offices involve proactive engagement with students throughout their academic journey. This includes early intervention, such as providing introductory sessions on financial literacy during orientation or freshman year. Regular communication, perhaps through email newsletters or workshops, keeps students updated on relevant information and changes in loan programs. Personalized financial aid advising allows advisors to assess individual student needs and create tailored financial plans. Furthermore, fostering collaboration with academic advisors and career services helps provide a holistic approach to financial planning, considering students’ academic goals and future career prospects. A key best practice is to encourage students to borrow only what is absolutely necessary, emphasizing the importance of maximizing grant aid and scholarships before resorting to loans.

Proactive Education on Responsible Borrowing Habits

Financial aid offices play a crucial role in fostering responsible borrowing habits. This involves educating students about the long-term implications of student loan debt, including the potential impact on their credit scores, future financial goals (like homeownership), and overall financial well-being. They can incorporate interactive budgeting exercises, simulations demonstrating the effects of different repayment plans, and case studies illustrating both successful and unsuccessful debt management strategies. By emphasizing the importance of understanding loan terms, creating realistic repayment plans, and seeking help when needed, financial aid offices empower students to make responsible financial decisions and avoid future financial hardship. The goal is not just to provide access to loans but to cultivate a culture of financial responsibility among students.

Conclusive Thoughts

Securing a higher education requires careful financial planning, and understanding undergraduate student loan limits is a crucial first step. While federal loan limits provide a foundational framework, students should explore all available resources, including scholarships, grants, and alternative financing options, to minimize debt accumulation. Proactive engagement with financial aid offices and responsible borrowing habits are essential for navigating the complexities of higher education financing and achieving long-term financial well-being.

Common Queries

What happens if I borrow more than the undergraduate student loan limit?

Exceeding the limit may necessitate seeking private loans, which typically come with higher interest rates and less favorable repayment terms. It’s crucial to avoid this situation by exploring alternative funding options.

Are there any exceptions to the undergraduate student loan limits?

While exceptions are rare, certain circumstances, such as documented exceptional educational expenses, might warrant consideration by the financial aid office on a case-by-case basis. It’s best to discuss any unique circumstances directly with your financial aid office.

How often are undergraduate student loan limits reviewed and adjusted?

Loan limits are periodically reviewed and adjusted based on factors like inflation and the rising cost of higher education. It’s advisable to check the official government websites for the most up-to-date information.

Can I appeal a decision regarding my student loan limit?

Yes, you can typically appeal a decision regarding your student loan limit by providing additional documentation to your financial aid office to support your case. Be prepared to thoroughly explain your circumstances.