Navigating the complex world of undergraduate student loans can feel overwhelming. The amount you can borrow significantly impacts your college choices, future debt burden, and overall financial well-being. Understanding the intricacies of federal and state loan limits, eligibility requirements, and alternative funding options is crucial for responsible financial planning during and after your undergraduate studies. This guide provides a clear overview of these critical factors, empowering you to make informed decisions about financing your education.

From the yearly limits based on your dependent or independent status and year in school to the nuances of subsidized versus unsubsidized loans, we will explore the current landscape of student loan financing. We will also delve into how historical trends, inflation, and government policies have shaped these limits, examining the impact on student borrowing behavior and access to higher education for all socioeconomic backgrounds. Finally, we’ll discuss alternatives to federal loans, helping you create a personalized financial plan for your college journey.

Current Undergraduate Student Loan Limits in the US

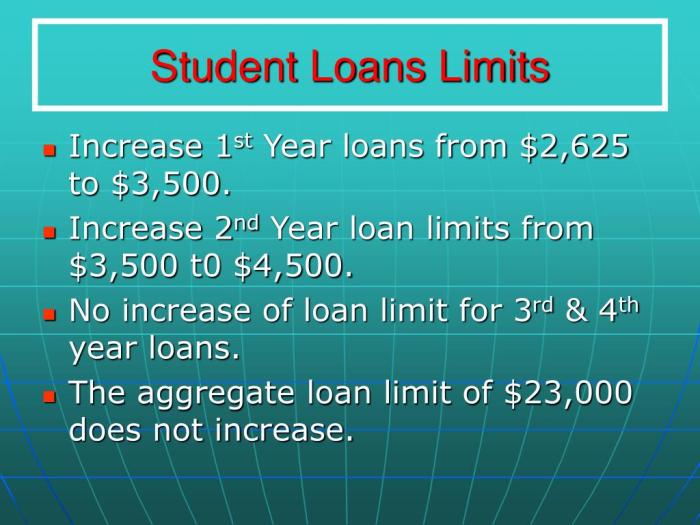

Understanding federal student loan limits is crucial for prospective undergraduate students and their families. These limits, set annually by the federal government, determine the maximum amount of federal student loan funds a student can borrow to finance their education. The limits vary depending on the student’s year in school and their dependency status.

Federal student loan limits for undergraduate students are determined by factors such as dependency status (dependent or independent) and year in school (freshman, sophomore, junior, or senior). These limits are subject to change, so it’s essential to consult the official Federal Student Aid website for the most up-to-date information.

Undergraduate Student Loan Limits by Year and Dependency Status

The following table summarizes the current federal student loan limits for undergraduate students. Note that these are aggregate limits, meaning the total amount a student can borrow across subsidized and unsubsidized loans. Actual loan amounts offered may be lower based on individual financial need and cost of attendance.

| Year | Student Status | Subsidized Loan Limit | Unsubsidized Loan Limit |

|---|---|---|---|

| Freshman | Dependent | $3,500 | $2,000 |

| Sophomore | Dependent | $4,500 | $2,000 |

| Junior & Senior | Dependent | $5,500 | $4,000 |

| Freshman | Independent | $5,500 | $9,500 |

| Sophomore, Junior & Senior | Independent | $5,500 | $10,500 |

Note: These figures are examples and may not reflect the exact current limits. Always refer to the official Federal Student Aid website for the most accurate and updated information.

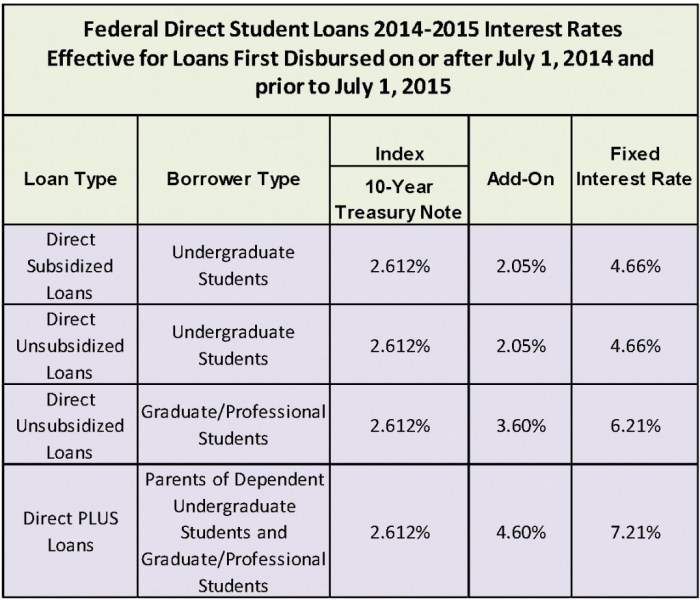

Subsidized vs. Unsubsidized Federal Student Loans

Understanding the difference between subsidized and unsubsidized federal student loans is crucial for effective financial planning. The key distinction lies in whether the government pays the interest while the student is in school.

- Subsidized Loans: The government pays the interest on these loans while you’re enrolled at least half-time and during grace periods. This means your loan balance doesn’t grow while you’re studying.

- Unsubsidized Loans: Interest accrues on these loans from the time the loan is disbursed, regardless of your enrollment status. This interest is added to your principal balance, increasing the total amount you owe.

Federal Student Loan Eligibility Determination

Eligibility for federal student loan programs is determined through the Free Application for Federal Student Aid (FAFSA). The FAFSA collects information about your financial situation, family income, assets, and other relevant factors. This information is used to calculate your Expected Family Contribution (EFC), which helps determine your financial need and eligibility for federal student aid, including loans.

The process involves completing the FAFSA form online, providing accurate information, and submitting it to the appropriate federal agency. Your school’s financial aid office will then use the processed FAFSA data to determine your eligibility for federal student loans and other forms of financial aid.

Factors Influencing Loan Limit Changes

Undergraduate student loan limits in the US are not static; they fluctuate based on a complex interplay of economic, political, and social factors. Understanding these influences is crucial for prospective students and policymakers alike, as these limits directly impact accessibility to higher education. This section will explore the historical trends, the effects of inflation, and the role of government policies in shaping these limits.

Historical Trends in Undergraduate Student Loan Limits

A line graph depicting undergraduate student loan limits over the past two decades would reveal a generally upward trend, though not consistently linear. The graph’s x-axis would represent the years from 2004 to 2024, and the y-axis would represent the maximum annual loan limit in US dollars. Initially, the line might show a relatively gradual increase, reflecting modest adjustments to the limits. However, around the period of the 2008 financial crisis and its aftermath, the slope of the line could show a period of slower growth or even slight decreases in some years, reflecting budgetary constraints and concerns about rising student debt. Following this period, the line might again show a steeper upward incline, possibly accelerating in recent years. The overall pattern would illustrate the interplay between economic conditions, government priorities, and the increasing cost of higher education. Precise numerical data would be required for a precise representation, but the general pattern would be one of overall growth, albeit with fluctuations reflecting broader economic and political contexts.

Inflation’s Impact on Student Loan Limits and Purchasing Power

Inflation significantly erodes the purchasing power of student loan limits. While the nominal value of the limits may increase over time, the real value—adjusted for inflation—may not keep pace with the rising cost of tuition, fees, and living expenses. For instance, a $5,000 loan limit in 2004 would have a considerably higher purchasing power than a $5,000 limit in 2024 due to inflation. This disparity means that students may need to borrow more in real terms to cover the same educational costs, potentially leading to increased debt burdens upon graduation. The impact of inflation is a critical consideration when evaluating the effectiveness and fairness of student loan limit adjustments.

Government Policies and Budgetary Considerations

Government policies and budget allocations play a decisive role in setting student loan limits. Decisions regarding federal funding for student aid programs, the overall federal budget, and broader economic priorities all directly influence the amount of money the government is willing to lend to students. For example, periods of fiscal austerity or shifts in government priorities away from education funding could lead to stagnant or reduced loan limits, despite rising tuition costs. Conversely, increased federal investment in education or initiatives aimed at improving college affordability might result in higher loan limits. The political climate and the prevailing economic conditions, therefore, are major determinants of these limits. Lobbying efforts from educational institutions and student advocacy groups also influence policy decisions in this area.

State-Specific Loan Programs and Limits

State-sponsored student loan programs offer an additional layer of financial aid to students, often complementing federal options. These programs vary significantly in availability and terms across different states, reflecting varying state budgets and priorities in higher education. Understanding these differences is crucial for students seeking to maximize their financial aid.

State programs often target specific populations or address unique state-level challenges within the higher education landscape. They can provide crucial support for students who may not qualify for, or receive sufficient aid from, federal programs. However, it’s important to note that these state programs are typically subject to their own eligibility criteria and funding limitations.

Comparison of State Student Loan Programs

The availability and structure of state-sponsored student loan programs differ considerably. Below is a comparison of programs in three states: California, Texas, and New York. It is important to note that program details are subject to change, and students should consult the official state websites for the most up-to-date information.

| State | Program Name | Loan Limit | Eligibility Criteria |

|---|---|---|---|

| California | California Student Aid Commission (CSAC) Programs (various programs exist, including Cal Grant) | Varies widely depending on the specific program and student need. Some programs offer grants rather than loans. | California residency, enrollment in eligible institution, financial need (often demonstrated through FAFSA), and other program-specific requirements. |

| Texas | Texas Grant Program, Texas Guaranteed Student Loan Program (administered through a private lender) | Varies depending on the specific program and student need. The Texas Grant is a grant, not a loan. Loan limits for the Guaranteed Student Loan program are subject to lender guidelines and federal limits. | Texas residency, enrollment in eligible institution, financial need (often demonstrated through FAFSA), and other program-specific requirements. |

| New York | HESC (Higher Education Services Corporation) programs (various programs exist, including TAP – Tuition Assistance Program) | Varies widely depending on the specific program and student need. Some programs offer grants rather than loans. | New York residency, enrollment in eligible institution, financial need (often demonstrated through FAFSA), and other program-specific requirements. |

State Programs Compared to Federal Programs

State loan programs often complement federal programs like the Federal Stafford Loan. Federal loans typically have broader availability and more consistent terms across states, while state programs often target specific populations or address unique state needs. For instance, a state program might prioritize students pursuing specific fields of study or those from low-income backgrounds. Some state programs offer grants, which do not need to be repaid, unlike loans. Students can often receive both federal and state aid, maximizing their financial resources for higher education.

State-Level Initiatives to Reduce Student Loan Debt

Many states are implementing initiatives to address the growing burden of student loan debt. These initiatives can include increased funding for state grant programs, loan forgiveness programs for specific professions (like teachers or healthcare workers), and public awareness campaigns about responsible borrowing and financial literacy. For example, some states offer loan repayment assistance programs to help graduates manage their debt, particularly those working in public service or high-need fields. These initiatives aim to make higher education more accessible and affordable, reducing the long-term financial strain on graduates.

The Impact of Loan Limits on Student Borrowing Behavior

Student loan limits significantly influence students’ decisions regarding higher education, impacting both their college attendance and the majors they pursue. The availability and amount of loan funding directly affect affordability and accessibility, shaping educational pathways for many. Understanding this impact is crucial for policymakers and students alike.

The availability of student loans, and the associated loan limits, significantly influences students’ decisions about whether to attend college at all. For many low- and middle-income students, access to higher education is directly tied to the ability to secure sufficient financial aid, including loans. Without adequate loan limits, the cost of tuition, fees, and living expenses can become insurmountable barriers. This can lead to fewer students from disadvantaged backgrounds pursuing higher education, perpetuating existing inequalities. Conversely, higher loan limits can encourage more students to enroll, potentially increasing college enrollment rates overall, though this also carries the risk of increased student debt.

College Attendance and Major Selection

Loan limits directly influence major selection. Students may be more inclined to choose majors leading to higher-paying jobs, perceived as justifying the significant investment of borrowing for education. Conversely, students might avoid majors with less predictable post-graduation income potential, even if personally more fulfilling, due to concerns about repaying substantial student loans. For example, a student might choose a lucrative but less personally engaging field like engineering or business over a humanities or arts major with potentially lower earning potential. This economic calculation can lead to a skewed distribution of students across various academic fields.

Consequences of Insufficient Loan Limits for Low-Income Students

Insufficient loan limits create significant barriers to higher education for low-income students. These students often rely more heavily on loans to cover educational costs than their higher-income peers. Limited loan access can force them to forgo college altogether, attend less expensive (and potentially lower-quality) institutions, or work excessive hours during their studies, negatively impacting academic performance. This limitation can perpetuate cycles of poverty and limit social mobility. Furthermore, these students may be more vulnerable to predatory lending practices, as they may feel compelled to take on high-interest private loans to make up for the shortfall in federal aid.

Average Undergraduate Student Loan Debt

A 2023 study by the Federal Reserve found that the average student loan debt for undergraduate borrowers who graduated in that year was approximately $37,000. This figure represents a significant increase from previous years and highlights the growing burden of student loan debt on recent graduates. The dataset used in this study comprised a nationally representative sample of borrowers, collected through surveys and administrative data from various sources, including federal loan programs and credit bureaus. The data included information on loan amounts, interest rates, repayment plans, and borrower demographics. This average, however, masks significant disparities. Debt levels vary substantially based on factors such as the type of institution attended (public vs. private), the student’s major, and family income. Students from low-income families, for instance, often graduate with significantly higher levels of debt relative to their income prospects.

Alternatives to Federal Student Loans

Securing funding for undergraduate education often involves exploring options beyond federal student loans. A diverse range of financial aid resources can significantly reduce the reliance on borrowing, potentially leading to lower overall debt and improved financial stability after graduation. Understanding these alternatives is crucial for making informed decisions about financing your education.

Several avenues exist to finance undergraduate education without solely relying on federal student loans. These alternatives offer varying degrees of flexibility and accessibility, requiring careful consideration of individual circumstances and financial needs.

Scholarships and Grants

Scholarships and grants represent a significant source of non-repayable funding for higher education. They are often merit-based, need-based, or a combination of both, and can significantly reduce the overall cost of tuition and fees. Securing these awards can substantially lessen the need for student loans.

- Merit-based scholarships: Awarded based on academic achievement, athletic ability, artistic talent, or other exceptional skills. Examples include academic scholarships offered by universities, athletic scholarships for college athletes, and scholarships sponsored by private organizations recognizing specific talents.

- Need-based grants: Awarded based on demonstrated financial need, often determined through the Free Application for Federal Student Aid (FAFSA). Examples include Pell Grants, which are federal grants for students with exceptional financial need, and state-specific grants offered by individual states based on residency and financial circumstances.

- Employer-sponsored scholarships: Many companies offer scholarships to employees’ children or dependents as a benefit. These can be substantial and are often overlooked as a funding source.

- Community-based scholarships: Local organizations, community groups, and even individual donors often provide scholarships to students within their communities. These scholarships frequently have specific eligibility requirements, often related to community involvement or academic focus.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lending institutions. These loans often require a creditworthy co-signer, particularly for students with limited or no credit history. While they can fill funding gaps, they usually come with higher interest rates and less favorable repayment terms than federal loans.

- Advantages: Can provide additional funding beyond federal loan limits. Some private lenders offer specialized programs for students pursuing specific fields of study.

- Disadvantages: Typically have higher interest rates than federal loans. May require a creditworthy co-signer. Lack the same borrower protections as federal loans, such as income-driven repayment plans and loan forgiveness programs.

Comparison of Federal and Private Loans

A direct comparison highlights the key differences between federal and private student loan options. Understanding these distinctions is crucial for making informed borrowing decisions.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower | Generally higher |

| Repayment Options | Multiple options, including income-driven repayment | Fewer options, often less flexible |

| Borrower Protections | Stronger borrower protections | Weaker borrower protections |

| Credit Check | Generally not required (for subsidized loans) | Usually required, often needs a co-signer |

Hypothetical Scenario: Choosing Funding Options

Imagine Sarah, a prospective undergraduate student, needs $20,000 annually for tuition and living expenses. After completing the FAFSA, she receives a $5,500 Pell Grant and a $3,000 state grant. She also wins a $2,000 merit-based scholarship. This leaves a gap of $9,500 per year. Sarah could borrow this amount through federal student loans, which offer lower interest rates and flexible repayment options. However, she could also explore private loans to supplement her funding, but must carefully weigh the higher interest rates and less favorable repayment terms. If she finds additional scholarships or part-time work, she could potentially reduce or eliminate the need for private loans entirely.

End of Discussion

Securing funding for your undergraduate education requires careful consideration of various factors. While federal student loan limits provide a significant source of financial aid, understanding their complexities and exploring alternative funding options is key to making informed decisions. By weighing the pros and cons of different loan types and considering additional financial resources, you can create a comprehensive plan that minimizes your long-term debt burden and maximizes your educational opportunities. Remember to thoroughly research your options and seek professional financial advice when needed to navigate this important process effectively.

Expert Answers

What happens if I don’t use all of my allotted loan amount?

Any unused portion of your loan remains available for future academic years, up to your maximum borrowing limit.

Can I get a student loan if I have bad credit?

Federal student loans generally do not require a credit check. Private loans, however, often do and may be more difficult to obtain with poor credit.

What is the difference between a grace period and deferment?

A grace period is a short period after graduation before loan repayment begins. Deferment is a postponement of repayment due to specific circumstances (e.g., unemployment, return to school).

How do I apply for a state-sponsored student loan?

Application processes vary by state. Check your state’s higher education website for specific instructions and eligibility requirements.