Navigating the world of undergraduate student loans can feel overwhelming, a complex maze of federal programs, private lenders, and repayment plans. Understanding your options is crucial for securing your education without jeopardizing your financial future. This guide provides a clear and concise overview of the various loan types available, the application processes involved, and strategies for managing your debt effectively. We’ll explore the nuances of federal versus private loans, different repayment schedules, and even options for loan forgiveness. By the end, you’ll be better equipped to make informed decisions about financing your higher education.

The path to a college degree often involves financial planning, and securing the right student loan is a significant part of that process. This guide aims to demystify the process, providing you with the knowledge to compare and contrast different loan options, understand the associated costs and benefits, and develop a responsible repayment strategy. We’ll cover everything from eligibility requirements and application procedures to managing your debt effectively and exploring alternative funding options.

Types of Undergraduate Student Loans

Securing funding for higher education often involves navigating the complexities of student loans. Understanding the different types of loans available is crucial for making informed financial decisions that align with your individual circumstances and long-term financial goals. This section will explore the key distinctions between federal and private student loans, highlighting their respective advantages and disadvantages.

Federal Student Loans

Federal student loans are offered by the U.S. government and generally come with more favorable terms than private loans. These loans are often preferred due to their borrower protections and flexible repayment options. Two main types exist: subsidized and unsubsidized.

Subsidized Federal Student Loans

Subsidized federal loans are need-based. The government pays the interest on these loans while you’re in school at least half-time, during grace periods, and during periods of deferment. This means your loan balance doesn’t grow while you’re focusing on your studies. Eligibility is determined by your financial need, as assessed through the Free Application for Federal Student Aid (FAFSA).

Unsubsidized Federal Student Loans

Unsubsidized federal loans are not need-based. Interest begins accruing on these loans from the moment they’re disbursed, regardless of your enrollment status. You are responsible for paying this interest, although you can choose to pay it while in school to reduce your overall loan balance. These loans are available to all eligible students, regardless of financial need.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. These loans often have higher interest rates and less flexible repayment options compared to federal loans. The interest rates can be either fixed or variable.

Fixed Interest Rate Private Student Loans

With a fixed interest rate, your monthly payment remains consistent throughout the loan repayment period. This predictability can make budgeting easier. However, fixed rates may not always be the lowest available rate compared to variable rates.

Variable Interest Rate Private Student Loans

A variable interest rate fluctuates based on market conditions. This means your monthly payments can change over time, potentially leading to unpredictable budgeting challenges. While initially, a variable rate might be lower than a fixed rate, it can increase significantly if market interest rates rise.

Federal vs. Private Loans: A Comparison

Federal loans generally offer significant advantages over private loans. Federal loans often provide more borrower protections, such as income-driven repayment plans and loan forgiveness programs. Private loans, while sometimes necessary to cover remaining educational costs, usually lack these benefits and may have higher interest rates. The choice between federal and private loans should be carefully considered based on individual financial circumstances and risk tolerance.

Comparison of Loan Types

| Loan Type | Interest Rate Type | Repayment Options | Eligibility Requirements |

|---|---|---|---|

| Subsidized Federal Loan | Fixed | Standard, Income-Driven, Extended | Demonstrated financial need (FAFSA) |

| Unsubsidized Federal Loan | Fixed | Standard, Income-Driven, Extended | Enrollment in eligible program |

| Private Loan (Fixed Rate) | Fixed | Varies by lender | Creditworthiness (co-signer may be required) |

| Private Loan (Variable Rate) | Variable | Varies by lender | Creditworthiness (co-signer may be required) |

Loan Eligibility and Application Process

Securing student loans, whether federal or private, involves navigating specific eligibility criteria and application procedures. Understanding these processes is crucial for successfully obtaining the financial assistance needed for higher education. This section Artikels the requirements and steps involved in applying for both federal and private student loans.

Federal Student Loan Eligibility Requirements

Eligibility for federal student loans primarily hinges on completing the Free Application for Federal Student Aid (FAFSA) form and meeting certain criteria. The FAFSA gathers information about your financial situation, family income, and tax returns to determine your eligibility for federal student aid, including loans, grants, and work-study programs. Your credit history is generally not a factor in federal loan eligibility, unlike private loans. Other requirements often include maintaining satisfactory academic progress in your studies, and being a U.S. citizen or eligible non-citizen. Specific requirements can vary slightly depending on the type of federal loan you are applying for.

Federal Student Loan Application Process

Applying for federal student loans begins with completing the FAFSA. This form requests detailed financial information, which is then used to calculate your Expected Family Contribution (EFC). The EFC determines your eligibility for federal aid and the amount you may receive. After submitting your FAFSA, you will receive a Student Aid Report (SAR) summarizing the information provided. You then work with your school’s financial aid office to accept your loan offer and complete the necessary loan documents. The disbursement of the funds is usually directly deposited into your student account.

Step-by-Step Guide to Completing the FAFSA Application

- Gather Necessary Information: Before starting, collect your Social Security number, federal tax returns, W-2s, and other relevant financial documents for yourself and your parents (if you are a dependent student).

- Create an FSA ID: You and your parent(s) (if applicable) will need an FSA ID to access and sign the FAFSA electronically. This is a username and password combination that acts as your digital signature.

- Complete the FAFSA Online: Access the FAFSA website and begin filling out the application. The application will ask for detailed personal and financial information.

- Review and Submit: Carefully review your completed application for accuracy before submitting it. Once submitted, you cannot make changes without contacting the Federal Student Aid office.

- Receive Your SAR: After submitting, you will receive a Student Aid Report (SAR) confirming your submission and providing a summary of your provided information. Review this report carefully for any errors.

Private Student Loan Application Process

Private student loans are offered by banks and other financial institutions. Unlike federal loans, private loan eligibility often depends heavily on your credit history and credit score. A good credit score significantly increases your chances of approval and may result in a lower interest rate. If you lack a strong credit history, you may need a co-signer—an individual with good credit who agrees to repay the loan if you cannot. The application process typically involves completing an online application, providing financial information, and undergoing a credit check. The lender will review your application and notify you of their decision. The terms and conditions of private loans can vary significantly among lenders, so comparison shopping is essential.

Repayment Plans and Options

Understanding your repayment options is crucial for managing your student loan debt effectively. Choosing the right plan depends on your financial situation, income, and long-term goals. This section Artikels the various repayment plans available for federal and private student loans, highlighting their key features and implications.

Federal Student Loan Repayment Plans

The federal government offers several repayment plans designed to cater to diverse financial circumstances. Each plan differs in monthly payment amounts, loan repayment periods, and the total interest paid over the life of the loan. Careful consideration of these factors is vital for making an informed decision.

Standard Repayment Plan

The Standard Repayment Plan is a fixed monthly payment plan spread over 10 years. This plan results in the lowest total interest paid but may have higher monthly payments compared to other plans. For example, a $30,000 loan at 5% interest would have a monthly payment of approximately $317 and a total interest paid of around $6,000.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. While this makes early repayment more manageable, it leads to higher total interest paid over the loan’s lifespan compared to the Standard Plan. Using the same $30,000 loan example, initial payments might be lower, but the total interest paid would likely exceed $6,000.

Extended Repayment Plan

This plan extends the repayment period beyond 10 years, up to 25 years, leading to lower monthly payments. However, the total interest paid will be significantly higher than other plans due to the extended repayment period. The same $30,000 loan example could see significantly reduced monthly payments but a total interest exceeding $10,000.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) link monthly payments to your income and family size. These plans include plans like the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans. Monthly payments are typically lower than other plans, and remaining balances may be forgiven after 20 or 25 years, depending on the plan. However, the total interest paid can be substantial over the longer repayment period, and forgiveness may be subject to tax implications.

Private Student Loan Repayment Options

Private student loans don’t offer the same range of repayment plans as federal loans. However, borrowers can explore options like refinancing and consolidation to potentially lower monthly payments or interest rates.

Refinancing Private Student Loans

Refinancing involves replacing your existing private student loans with a new loan from a different lender, often at a lower interest rate. This can lead to lower monthly payments and reduced total interest paid. However, refinancing might extend the repayment period, and some borrowers may lose benefits associated with their original loans, such as deferment or forbearance options.

Consolidating Private Student Loans

Consolidation combines multiple private student loans into a single loan. This simplifies repayment by reducing the number of monthly payments. However, the interest rate on the consolidated loan might be higher or lower than the weighted average of your original loans, depending on your creditworthiness and the lender’s offerings.

Comparison of Repayment Plans

| Repayment Plan | Monthly Payment | Total Interest Paid | Pros | Cons |

|---|---|---|---|---|

| Standard | High | Low | Lowest total interest, shortest repayment period | High monthly payments |

| Graduated | Low initially, increasing | Medium-High | Lower initial payments | Higher total interest, increasing payments |

| Extended | Low | High | Lowest monthly payments | Highest total interest, longest repayment period |

| Income-Driven | Variable, based on income | High | Payments adjusted to income, potential forgiveness | High total interest, complex calculations, potential tax implications on forgiveness |

Interest Rates and Fees

Understanding interest rates and fees associated with student loans is crucial for responsible borrowing and financial planning. These costs significantly impact the total amount you’ll repay, so it’s important to be well-informed before signing any loan documents. This section will detail how these rates and fees are determined and how they compare between federal and private loan options.

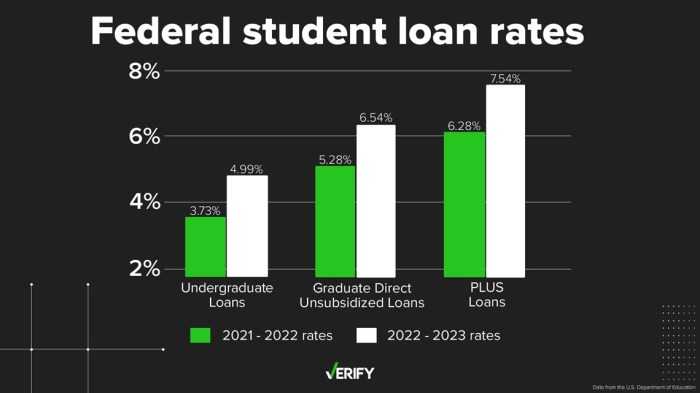

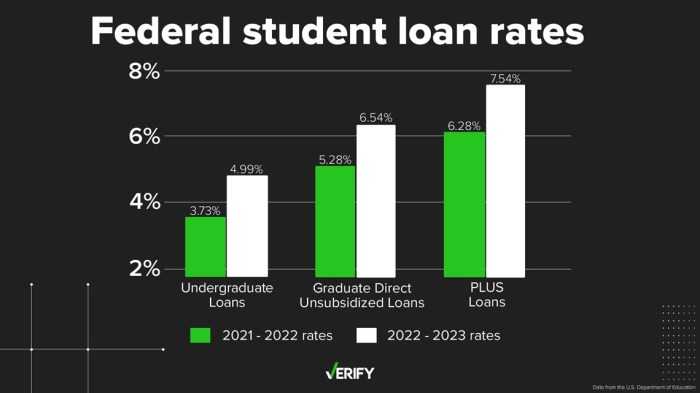

Federal Student Loan Interest Rates

Federal student loan interest rates are set by the government and generally vary depending on the loan type (e.g., subsidized, unsubsidized, PLUS loans), the borrower’s creditworthiness (though this is less of a factor for federal loans compared to private loans), and the loan disbursement date. These rates are typically fixed, meaning they remain constant throughout the life of the loan. The government announces the interest rates each year for federal student loans. For example, the interest rate for a Direct Subsidized Loan might be 4.99% for the 2024-2025 academic year, while the rate for a Direct Unsubsidized Loan for the same period might be slightly higher. These rates are significantly lower than those typically found on private loans.

Private Student Loan Interest Rates

Private student loan interest rates are set by private lenders (banks, credit unions, etc.) and are influenced by several factors, including the borrower’s credit history, credit score, income, co-signer (if applicable), the loan amount, and the prevailing market interest rates. Unlike federal loans, private loan interest rates can be either fixed or variable. Variable rates fluctuate with changes in market conditions, which can lead to unpredictable monthly payments. A borrower with a high credit score and a strong co-signer might qualify for a lower interest rate, while a borrower with a lower credit score might face a significantly higher rate. For instance, a private loan might carry an interest rate ranging from 6% to 12% or even higher, depending on the borrower’s financial profile.

Loan Fees

Several fees can be associated with student loans. Understanding these fees is vital to accurately budgeting for repayment.

Origination Fees

Origination fees are charged by the lender to cover the administrative costs of processing the loan. For federal student loans, these fees are typically deducted from the loan disbursement amount, meaning the borrower receives less money than the total loan amount. Private lenders may also charge origination fees, but the amount and method of deduction can vary. For example, a federal loan might have an origination fee of 1.057% of the loan amount, while a private loan might have a fee of 1% to 4%, or even higher depending on the lender and the loan terms.

Late Payment Fees

Late payment fees are penalties imposed for failing to make a loan payment by the due date. Both federal and private lenders charge these fees, and the amount varies depending on the lender and the loan agreement. Consistent on-time payments are crucial to avoid incurring these extra costs. Late payment fees can range from a fixed dollar amount (e.g., $25) to a percentage of the missed payment. These fees can add up significantly over time, impacting the total cost of borrowing.

Interest Rate Comparison

Generally, federal student loans offer lower interest rates than private student loans. This is because federal loans carry less risk for the lender due to government backing. However, it’s essential to compare rates from multiple lenders to find the best possible terms for your individual situation, even if you are eligible for federal loans.

Visual Representation of Interest Accrual

Imagine a bar graph. The horizontal axis represents time (in years), and the vertical axis represents the total loan amount. Let’s consider three scenarios:

Scenario 1: $10,000 loan at 5% interest. The bar for year 1 would show a slightly increased total amount due to accrued interest. Each subsequent year would show a progressively taller bar, reflecting the compounding effect of interest.

Scenario 2: $20,000 loan at 5% interest. This graph would show similar growth in the total loan amount over time as Scenario 1, but the bars would be twice as tall, reflecting the larger principal amount.

Scenario 3: $10,000 loan at 10% interest. This graph would show a steeper increase in the total loan amount over time compared to Scenario 1, illustrating the significant impact of a higher interest rate on the overall cost. The bars would grow taller at a faster rate than in Scenario 1. This visual clearly demonstrates how both the principal loan amount and the interest rate contribute to the total cost of the loan over time.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and consistent effort. Understanding repayment strategies, budgeting effectively, and avoiding default are crucial for long-term financial well-being. This section Artikels practical strategies to manage and reduce your student loan burden.

Budgeting and Financial Planning for Repayment

Creating a realistic budget is paramount to successful student loan repayment. This involves tracking your income and expenses to identify areas where you can save money and allocate funds towards your loan payments. Consider using budgeting apps or spreadsheets to monitor your spending and create a clear picture of your financial situation. Prioritizing essential expenses, such as housing and food, while minimizing non-essential spending, will free up more resources for loan repayment. Regularly reviewing and adjusting your budget as your income or expenses change ensures you remain on track. For example, a recent graduate might allocate a significant portion of their starting salary towards loan payments while tracking expenses like rent, groceries, and transportation to ensure sufficient funds remain for repayment.

Strategies for Reducing Student Loan Debt

Several strategies can help reduce your student loan debt. One effective approach is to explore options for refinancing your loans, potentially securing a lower interest rate and reducing your overall repayment cost. Consolidating multiple loans into a single loan can simplify repayment and potentially lower your monthly payment. Another strategy involves making extra payments whenever possible. Even small additional payments can significantly reduce the principal balance and shorten the repayment period, saving you money on interest. For instance, an extra $100 per month could substantially reduce the loan term and the total amount paid over the life of the loan.

Avoiding Loan Default and its Consequences

Loan default, failing to make timely payments, has severe consequences. It can damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Default can also lead to wage garnishment, where a portion of your earnings is directly deducted to repay the debt. Furthermore, default can result in the loan being sent to collections, which can further harm your credit and lead to additional fees. To avoid default, maintain open communication with your loan servicer, explore options like forbearance or deferment if facing financial hardship, and proactively create a repayment plan that you can consistently adhere to. A clear understanding of your repayment schedule and proactive communication are crucial to prevent default.

Benefits of Creating and Sticking to a Repayment Plan

Developing a comprehensive repayment plan provides structure and clarity to the repayment process. A well-defined plan allows you to track your progress, stay motivated, and adjust your strategy as needed. It also helps you prioritize loan repayment within your overall financial goals. Sticking to your repayment plan minimizes the risk of default and helps you achieve financial freedom sooner. A personalized plan, tailored to your financial situation and repayment capacity, is crucial for long-term success. For example, a repayment plan could involve prioritizing high-interest loans first to minimize the total interest paid or focusing on making larger payments during periods of higher income.

Alternatives to Student Loans

Securing funding for undergraduate education doesn’t solely rely on student loans. A range of alternative financing options exist, each with its own set of advantages and disadvantages. Exploring these alternatives can significantly reduce reliance on loans and potentially alleviate future financial burdens. Careful consideration of these options is crucial for effective financial planning during your college journey.

While student loans provide readily accessible funds, they come with the obligation of repayment, often with accumulating interest. Alternative funding sources, such as scholarships, grants, and work-study programs, offer a chance to finance education without incurring debt. This section will delve into these alternatives, comparing them to student loans and providing guidance on how to locate and secure this funding.

Scholarships and Grants

Scholarships and grants represent non-repayable forms of financial aid. Scholarships are typically merit-based, awarded based on academic achievement, athletic prowess, or other talents. Grants, on the other hand, are often need-based, allocated to students demonstrating financial hardship. Both can significantly reduce the overall cost of education.

Researching and applying for scholarships and grants requires dedication and organization. Numerous resources exist, including online scholarship databases, college financial aid offices, and professional organizations related to your field of study. Each application will have specific requirements, deadlines, and essay prompts, so careful attention to detail is paramount. A well-crafted application highlighting your achievements and financial need significantly increases your chances of success.

Work-Study Programs

Work-study programs provide part-time employment opportunities to undergraduate students, allowing them to earn money while attending college. These programs are often need-based and coordinated through the college’s financial aid office. The earnings can contribute directly towards tuition, fees, or living expenses, lessening the need for substantial loans.

Participating in a work-study program offers valuable practical experience alongside financial assistance. The nature of the work can vary widely, ranging from administrative tasks to research assistance, providing opportunities to develop skills relevant to your chosen career path. While the earnings might not cover the entire cost of education, they can substantially lessen the financial burden and reduce reliance on loans.

Comparison of Funding Options

The following table summarizes the key features of different funding options for undergraduate education:

| Funding Option | Eligibility Requirements | Application Process | Advantages | Disadvantages |

|---|---|---|---|---|

| Student Loans | Enrollment in an eligible educational program; creditworthiness (often co-signer required) | Complete a FAFSA, apply through lender | Readily accessible funds; flexible repayment options | Accumulating interest; debt burden; impact on credit score |

| Scholarships | Academic achievement, athletic ability, specific talents, community involvement, etc. | Vary widely; often involve essays, transcripts, recommendations | Non-repayable; can significantly reduce overall cost | Competitive; requires extensive research and application effort |

| Grants | Demonstrated financial need; enrollment in an eligible program | Complete a FAFSA | Non-repayable; based on financial need | Limited availability; competitive |

| Work-Study | Demonstrated financial need; enrollment in an eligible program | Complete a FAFSA; apply through college’s financial aid office | Earn money while studying; valuable work experience | Limited earnings; may require balancing work and studies |

Final Wrap-Up

Securing funding for your undergraduate education is a pivotal step, and understanding the landscape of student loan options is key to a successful and financially responsible journey. By carefully considering the advantages and disadvantages of federal and private loans, crafting a suitable repayment plan, and exploring alternative funding sources, you can confidently navigate the complexities of financing your higher education. Remember, responsible planning and proactive management are crucial to minimizing debt and maximizing your academic and financial success. This guide serves as a starting point; further research and consultation with financial advisors can further enhance your understanding and planning.

FAQ Summary

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or while you’re in deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my federal student loans?

Yes, you can refinance federal student loans with a private lender. However, this will mean losing federal protections and benefits.

What happens if I default on my student loans?

Defaulting on student loans can have serious consequences, including wage garnishment, tax refund offset, and damage to your credit score.

How long does it take to get approved for a private student loan?

The approval process for private student loans varies by lender, but generally takes a few days to a few weeks.

What is a co-signer, and why is it needed for some loans?

A co-signer is someone who agrees to repay your loan if you cannot. Lenders often require co-signers for borrowers with limited or poor credit history.