Navigating the world of higher education often necessitates financial planning, and for many, this involves securing student loans. While secured loans utilize collateral, unsecured student loans present a different landscape of opportunities and risks. This guide delves into the intricacies of unsecured student loans, exploring their characteristics, application processes, potential pitfalls, and viable alternatives. Understanding the nuances of this financing option is crucial for making informed decisions about your educational journey and long-term financial well-being.

We’ll examine the eligibility criteria, interest rates, and repayment terms associated with these loans, comparing them to other financing methods. We’ll also discuss the impact on your credit score and offer strategies for responsible borrowing and debt management. Ultimately, the goal is to equip you with the knowledge necessary to make the best choices for your unique circumstances.

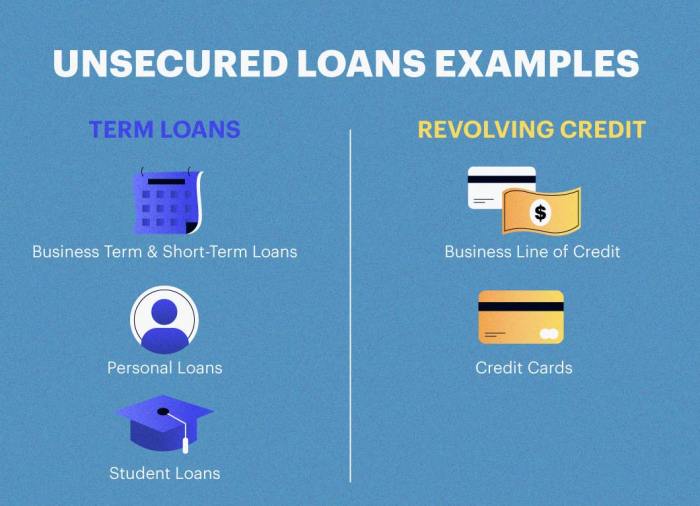

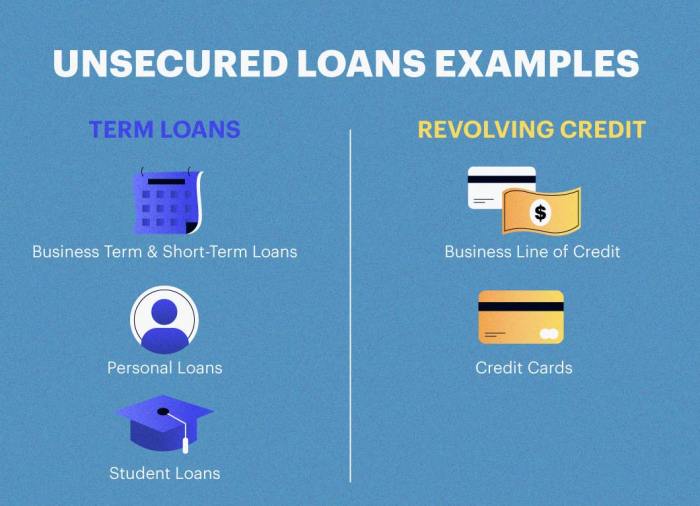

Definition and Characteristics of Unsecured Student Loans

Unsecured student loans, unlike their secured counterparts, don’t require collateral. This means the lender doesn’t have a claim on your assets (like a house or car) if you fail to repay the loan. This key difference significantly impacts the terms and conditions of the loan, as well as the borrower’s overall risk. Understanding these characteristics is crucial for making informed decisions about student financing.

Unsecured student loans are characterized by their reliance on the borrower’s creditworthiness and income potential as the primary basis for approval. Lenders assess your credit history, debt-to-income ratio, and other financial factors to determine your eligibility and the terms they’ll offer. The absence of collateral increases the risk for the lender, which is reflected in the loan’s terms.

Interest Rates and Repayment Terms

Interest rates on unsecured student loans tend to be higher than those on secured loans, such as federal student loans backed by the government. This is because the lender assumes a greater risk. Repayment terms can vary depending on the lender and the borrower’s financial profile, but generally range from 5 to 20 years. Shorter repayment periods mean higher monthly payments but less interest paid overall, while longer periods result in lower monthly payments but significantly more interest accrued over the loan’s lifespan. For example, a $10,000 unsecured student loan with a 7% interest rate over 10 years would have a significantly higher monthly payment than a similar loan spread over 15 years, but the total interest paid would be substantially lower with the shorter repayment term.

Suitable Situations for Unsecured Student Loans

Unsecured student loans can be a suitable option for borrowers with good credit who have exhausted other financing options or need additional funding beyond what federal loans provide. For instance, a student pursuing a specialized graduate program might find that their federal loan limits are insufficient to cover the total cost of tuition and living expenses. In this case, an unsecured private student loan could bridge the funding gap. Another example would be a student who has already maxed out their federal loan eligibility and requires additional funding for unexpected educational expenses.

Comparison with Other Student Financing

Unsecured student loans differ significantly from other forms of student financing. Federal student loans, often considered the most favorable option, typically offer lower interest rates and more flexible repayment plans, but they have borrowing limits. Secured loans, like home equity loans used for education, offer lower interest rates but risk the loss of the collateral if repayment fails. Grants and scholarships are forms of non-repayable aid, making them the most desirable funding source but often highly competitive and limited in availability. Unsecured private loans occupy a middle ground, offering more flexibility than federal loans but carrying higher interest rates than secured loans. The best option depends on the individual’s financial situation and creditworthiness.

Eligibility and Application Process

Securing an unsecured student loan hinges on meeting specific eligibility criteria and navigating a structured application process. Lenders carefully evaluate applicants to assess their creditworthiness and repayment ability, ensuring a responsible lending practice. Understanding these aspects is crucial for prospective borrowers.

Eligibility criteria for unsecured student loans vary among lenders, but common factors are considered. Generally, applicants must demonstrate a certain level of creditworthiness, though this is often more flexible than for secured loans. The applicant’s academic standing and future earning potential are also key considerations.

Eligibility Criteria

Lenders typically assess several factors to determine eligibility. These include credit history (including credit score), current income or anticipated future income based on chosen field of study and projected salary, proof of enrollment in an eligible educational program, and age (generally requiring applicants to be at least 18 years old). A strong credit history, indicating responsible financial management, is often preferred, although some lenders may offer loans to students with limited or no credit history. The applicant’s debt-to-income ratio is also assessed to ensure the loan doesn’t create undue financial strain.

Application Process Steps

The application process generally involves several steps. First, the applicant researches different lenders and compares their interest rates and terms. Next, they complete an online or paper application, providing necessary personal and financial information. The lender then reviews the application and may request additional documentation. Upon approval, the loan terms are finalized, and the funds are disbursed according to the agreed-upon schedule, often directly to the educational institution.

Required Documents

A range of documents may be required during the application process. These typically include a completed application form, proof of identity (such as a driver’s license or passport), proof of enrollment in an eligible educational program (such as an acceptance letter or transcript), proof of income (such as pay stubs or tax returns), and information about existing debts. Some lenders may also require a co-signer, particularly if the applicant lacks a strong credit history. The specific documents requested will vary depending on the lender and the applicant’s individual circumstances.

Factors Considered in Loan Application Assessment

Lenders employ a thorough assessment process to evaluate loan applications. Key factors considered include the applicant’s credit score and history, their debt-to-income ratio, their academic standing and program of study, and their anticipated future earning potential. The lender also assesses the applicant’s ability to repay the loan based on their projected income and expenses. Applicants with higher credit scores and lower debt-to-income ratios are generally viewed as lower risk and are more likely to be approved for a loan with favorable terms. A strong academic record and a promising career path can also significantly influence the lender’s decision.

Risks and Responsibilities of Unsecured Student Loans

Unsecured student loans, while offering flexibility, present significant financial risks if not managed carefully. Understanding these risks and adopting responsible borrowing and repayment strategies are crucial for avoiding potential negative consequences. This section Artikels the potential pitfalls and provides practical advice for navigating the complexities of unsecured student loan debt.

The primary risk associated with unsecured student loans is the lack of collateral. Unlike secured loans, which use an asset (like a house or car) as security, unsecured loans rely solely on your creditworthiness. This means that if you default, the lender has limited recourse beyond pursuing legal action to recover the debt. This can lead to severe damage to your credit score, impacting your ability to obtain credit in the future for things like mortgages, car loans, or even credit cards.

Potential Risks of Unsecured Student Loans

Several significant risks are inherent in taking out unsecured student loans. These include the potential for high interest rates, the accumulation of substantial debt, and the long-term impact on creditworthiness. Furthermore, unforeseen circumstances such as job loss or illness can severely impact repayment capabilities, leading to further complications.

Responsible Borrowing and Repayment Strategies

Responsible borrowing involves careful planning and a realistic assessment of your ability to repay the loan. This includes understanding the terms and conditions, including interest rates, repayment schedules, and potential fees. Developing a robust repayment strategy is equally important. This may involve creating a detailed budget, exploring different repayment plans, and prioritizing loan payments.

Strategies for Managing Student Loan Debt Effectively

Effective debt management requires proactive steps. This includes exploring options like income-driven repayment plans, which adjust monthly payments based on your income and family size. Consolidating multiple loans into a single loan with a potentially lower interest rate can simplify repayment and reduce overall costs. Furthermore, budgeting meticulously and exploring opportunities to increase income can significantly contribute to faster debt repayment.

For example, a graduate with $50,000 in student loan debt might explore an income-driven repayment plan to lower their monthly payments, making it more manageable. Alternatively, they might consolidate their loans to obtain a lower interest rate, saving thousands of dollars over the life of the loan. Creating a detailed budget, tracking expenses, and identifying areas for potential savings can further contribute to efficient debt management.

Consequences of Defaulting on an Unsecured Student Loan

Defaulting on an unsecured student loan can have severe repercussions. These consequences include a significant drop in credit score, making it difficult to secure future loans or even rent an apartment. Wage garnishment, where a portion of your income is directly seized by the lender, is another potential outcome. Furthermore, the debt can be sent to collections, resulting in additional fees and impacting your financial standing for years to come. In some cases, the government may take further action, impacting your tax returns or passport renewal.

Comparison of Different Unsecured Student Loan Options

Choosing the right unsecured student loan can significantly impact your financial future. Understanding the nuances of different loan options from various lenders is crucial for making an informed decision. This section compares various unsecured student loan offerings to help you navigate this process.

Several factors differentiate unsecured student loans, including interest rates, repayment terms, and additional features. Lenders often tailor their offerings to specific student demographics or financial situations. Direct comparison allows for a clearer understanding of the best fit for individual circumstances.

Unsecured Student Loan Options Comparison Table

The following table provides a comparison of sample unsecured student loan options. Remember that interest rates and terms are subject to change and are based on current market conditions and individual creditworthiness. Always check directly with the lender for the most up-to-date information.

| Lender | Interest Rate (Example – Subject to Change) | Repayment Terms (Example – Subject to Change) | Special Features |

|---|---|---|---|

| Lender A | 7.5% Variable | 5-15 years | Autopay discount, deferment options |

| Lender B | 8.0% Fixed | 10-20 years | Grace period, income-based repayment plan |

| Lender C | 6.9% Fixed (for students with high credit scores) | 7-12 years | No prepayment penalty, online account management |

| Lender D | 9.2% Variable | 5-10 years | Flexible repayment options, co-signer option |

Factors to Consider When Comparing Unsecured Student Loan Options

Several key factors should be carefully weighed when comparing different unsecured student loan offers. Considering these aspects will help you choose a loan that aligns with your financial situation and repayment capabilities.

- Interest Rate: A lower interest rate translates to lower overall borrowing costs. Compare both fixed and variable rates and consider the long-term implications of each.

- Repayment Terms: Longer repayment terms result in lower monthly payments but higher overall interest costs. Shorter terms mean higher monthly payments but less interest paid over the life of the loan. Choose a term that balances affordability with minimizing total interest.

- Fees: Be aware of any origination fees, late payment fees, or other charges that can add to the overall cost of the loan.

- Special Features: Consider features like deferment options, income-based repayment plans, or autopay discounts that can offer flexibility and potential cost savings.

- Credit Requirements: Understand the lender’s credit score requirements and assess your eligibility before applying.

- Customer Service: A responsive and helpful customer service team can be invaluable if you encounter any issues during the loan process or repayment period.

- Lender Reputation: Research the lender’s reputation and check online reviews to ensure they are trustworthy and reliable.

Impact on Credit Score and Financial Future

Taking out and repaying unsecured student loans significantly impacts your credit score and long-term financial health. Understanding these implications is crucial for responsible borrowing and effective debt management. This section will explore how student loans affect your credit, the long-term financial consequences of carrying this debt, and the importance of financial literacy in navigating this process successfully.

Credit Score Impact

Your credit score is a numerical representation of your creditworthiness, influencing your access to credit and the interest rates you’ll receive. On-time payments on your student loans demonstrate responsible credit behavior, positively impacting your credit score. Conversely, missed or late payments can severely damage your credit, potentially making it difficult to obtain loans, rent an apartment, or even secure certain jobs in the future. The impact is directly proportional to the amount of debt and the severity of payment delinquency. Consistent, timely payments build a positive credit history, ultimately leading to a higher credit score and better financial opportunities. Conversely, a history of late or missed payments will negatively impact your credit report for years. The impact is particularly pronounced with unsecured loans, as these carry a higher risk for lenders.

Long-Term Financial Implications of Student Loan Debt

Managing student loan debt can significantly influence your long-term financial well-being. High monthly payments can restrict your ability to save for retirement, purchase a home, or invest in other financial goals. The interest accrued over the loan’s lifetime can substantially increase the total amount repaid, significantly impacting your disposable income and overall financial freedom. This can lead to delayed major life milestones, like marriage, homeownership, and starting a family. The weight of significant student loan debt can also create considerable financial stress, impacting mental health and overall well-being.

Hypothetical Scenario: Repayment Strategies and Long-Term Outcomes

Consider two individuals, both graduating with $50,000 in unsecured student loan debt at a 7% interest rate. Sarah chooses the standard 10-year repayment plan, resulting in higher monthly payments but quicker debt elimination. John opts for an extended 20-year plan, leading to lower monthly payments but significantly more interest paid over the life of the loan.

After 10 years, Sarah is debt-free, allowing her to focus on saving for a down payment on a house and retirement. She may even have the financial flexibility to invest in additional assets. John, however, still owes a substantial portion of his loan, limiting his ability to save and invest aggressively. By the end of the 20-year repayment period, John will have paid significantly more in interest than Sarah, potentially delaying major life goals and impacting his overall financial security. This illustrates how different repayment strategies can have drastically different long-term financial consequences.

Importance of Financial Literacy in Managing Student Loan Debt

Financial literacy is paramount in effectively managing student loan debt. Understanding loan terms, repayment options, and the impact on your credit score are essential for making informed decisions. Developing a realistic budget, exploring different repayment plans (such as income-driven repayment), and seeking professional financial advice can significantly improve your ability to manage and ultimately eliminate your student loan debt without compromising your long-term financial goals. A strong understanding of personal finance principles enables individuals to make proactive choices that positively impact their financial future. Without this understanding, borrowers risk making decisions that could lead to long-term financial hardship.

Alternatives to Unsecured Student Loans

Securing funding for higher education can be challenging, and unsecured student loans are not always the best solution. Many alternative financing options exist, offering different advantages and disadvantages compared to borrowing. Exploring these alternatives is crucial for making informed decisions about how to finance your education. Careful consideration of your financial situation and long-term goals is essential in choosing the most suitable path.

Several alternatives to unsecured student loans provide financial assistance for higher education. These options range from government-backed programs to private initiatives, each with its own eligibility criteria and limitations. Understanding these alternatives can significantly impact your overall financial health during and after your studies.

Federal Student Aid Programs

Federal student aid programs offer grants, loans, and work-study opportunities to eligible students. These programs are administered by the U.S. Department of Education and provide a substantial source of funding for many students. Eligibility is based on financial need and other factors.

Examples of federal student aid include the Pell Grant, a grant program for undergraduate students with exceptional financial need; and the Federal Direct Loan program, which offers subsidized and unsubsidized loans with varying repayment terms. Work-study programs provide part-time employment opportunities to help students cover educational expenses.

Scholarships

Scholarships are merit-based or need-based awards that do not require repayment. Many organizations, including colleges, universities, private foundations, and corporations, offer scholarships. The application processes vary, but typically involve submitting an application and supporting documentation, such as transcripts and essays.

Scholarships can significantly reduce the overall cost of education and alleviate the need to borrow. Some scholarships are specific to particular fields of study, while others are more general. A diligent search for available scholarships can unearth numerous opportunities.

Grants

Grants, like scholarships, are forms of financial aid that do not need to be repaid. They are typically awarded based on financial need, and the eligibility criteria vary depending on the granting organization. Federal grants, such as the Pell Grant, are a common example, but many state and local governments, as well as private organizations, also offer grants.

Grants can help reduce the burden of educational expenses and can be particularly beneficial for students from low-income backgrounds. Similar to scholarships, a comprehensive search is necessary to identify available grant opportunities.

Comparison of Alternatives

The table below compares the advantages and disadvantages of these alternatives to unsecured student loans:

| Financing Option | Advantages | Disadvantages |

|---|---|---|

| Federal Student Aid Programs (Grants & Loans) | Government-backed, potentially lower interest rates on loans, grants don’t need repayment. | Requires completing the FAFSA, may still require borrowing, eligibility criteria. |

| Scholarships | Don’t need repayment, can significantly reduce costs. | Competitive, requires application process, may not cover all costs. |

| Grants | Don’t need repayment, can ease financial burden. | Competitive, specific eligibility criteria, may not cover all costs. |

| Unsecured Student Loans | Quick access to funds, may be necessary to cover costs not covered by other options. | High interest rates, impacts credit score, debt burden. |

Illustrative Scenarios and Case Studies

Understanding the potential outcomes of managing an unsecured student loan is crucial for responsible borrowing. Examining both successful and unsuccessful scenarios provides valuable insights into the importance of careful planning and diligent repayment.

Successful Management of an Unsecured Student Loan

Sarah, a diligent engineering student, secured an unsecured student loan to cover her tuition and living expenses. Before applying, she meticulously researched different lenders, comparing interest rates, repayment terms, and fees. She chose a lender offering a competitive interest rate and a repayment plan that aligned with her anticipated post-graduation income. Throughout her studies, Sarah budgeted carefully, tracking her expenses and prioritizing loan repayments. After graduation, she secured a well-paying job in her field and immediately began making consistent, on-time payments. By proactively managing her loan and adhering to her repayment plan, Sarah successfully repaid her loan within the stipulated timeframe, avoiding any negative impact on her credit score. Her disciplined approach allowed her to establish a strong financial foundation for her future.

Consequences of Irresponsible Borrowing and Loan Default

In contrast, Mark, a student with less financial planning skills, borrowed heavily through multiple unsecured student loans without fully understanding the repayment implications. He failed to create a realistic budget, leading to consistent missed payments. As his debt accumulated, he struggled to find a suitable job after graduation, further exacerbating his financial difficulties. Consequently, Mark defaulted on his loans. This resulted in significant damage to his credit score, making it difficult to obtain credit for essential needs like housing or a car. Furthermore, the defaulted loans impacted his ability to secure employment in certain fields and his overall financial stability. He faced wage garnishment, collection agency harassment, and the inability to secure future loans, impacting his quality of life significantly. His story serves as a stark reminder of the potential repercussions of irresponsible borrowing and the importance of responsible financial management.

Epilogue

Securing an unsecured student loan can be a powerful tool for accessing higher education, but it’s essential to approach it with careful consideration. By understanding the associated risks, exploring alternative financing options, and implementing responsible borrowing and repayment strategies, you can mitigate potential challenges and pave the way for a financially sound future. Remember that thorough research and financial planning are key to successfully navigating the complexities of student loan debt.

Quick FAQs

What happens if I can’t repay my unsecured student loan?

Failure to repay can result in negative impacts on your credit score, potential wage garnishment, and collection agency involvement. It’s crucial to contact your lender immediately if you anticipate difficulties in repayment to explore options like deferment or forbearance.

Are there any tax benefits associated with unsecured student loans?

Tax benefits for student loan interest vary depending on your country and tax laws. It’s recommended to consult a tax professional to determine your eligibility for any applicable deductions or credits.

How do unsecured student loans affect my ability to get other loans in the future?

Consistent on-time payments demonstrate responsible borrowing and positively impact your credit score, making it easier to secure future loans. Conversely, defaults can significantly hinder your ability to obtain credit.