Navigating the complexities of higher education financing can be daunting, particularly in a state as diverse as Washington. Understanding the various student loan options available, the application process, and responsible repayment strategies is crucial for prospective and current students. This guide provides a clear and concise overview of Washington State student loans, empowering individuals to make informed decisions about their educational journey and financial future.

From understanding the different types of loans offered—including federal and state programs—to mastering the FAFSA application and exploring repayment options like income-driven plans and loan forgiveness programs, we aim to equip you with the knowledge needed to successfully manage your student loan debt. We will also address common scams and provide resources to help you avoid pitfalls along the way. This guide is designed to be your one-stop resource for all things related to Washington State student loans.

Types of Washington State Student Loans

Securing funding for higher education is a crucial step for many Washington State students. Understanding the various student loan options available is essential for making informed financial decisions. This section Artikels the key types of student loans offered in Washington, detailing their eligibility requirements, interest rates, and repayment terms. It’s important to remember that specific details can change, so always refer to the official Washington Student Achievement Council (WSAC) website for the most up-to-date information.

Washington State Student Loan Programs

The Washington Student Achievement Council (WSAC) administers several student loan programs designed to help students finance their education. These programs offer varying levels of support and come with different terms and conditions. Choosing the right loan depends on individual financial circumstances and educational goals.

Eligibility Criteria for Washington State Student Loans

Eligibility for Washington State student loans typically involves meeting specific requirements related to residency, enrollment status, and financial need. These requirements can vary depending on the specific loan program. Generally, applicants must be Washington State residents, enrolled at least half-time in an eligible educational program, and demonstrate financial need through the completion of the Free Application for Federal Student Aid (FAFSA). Some programs may have additional requirements, such as maintaining a minimum GPA or pursuing a specific field of study.

Interest Rates and Repayment Terms of Washington State Student Loans

Interest rates and repayment terms for Washington State student loans vary depending on the type of loan and the borrower’s financial circumstances. Interest rates are typically fixed, meaning they remain the same throughout the loan’s life, but can vary depending on market conditions and the type of loan. Repayment terms typically range from 10 to 20 years, allowing borrowers to manage their debt effectively. Borrowers can explore options like income-driven repayment plans to adjust their monthly payments based on their income.

Comparison of Washington State Student Loan Programs

The following table summarizes key features of various Washington State student loan programs. Note that this information is for illustrative purposes and may not reflect the most current rates or terms. Always consult the WSAC website for the most accurate and up-to-date information.

| Loan Type | Eligibility | Interest Rate | Repayment Terms |

|---|---|---|---|

| (Example: Washington College Grant) | (Example: Washington State residency, enrollment in eligible program, financial need as determined by FAFSA) | (Example: Varies, check WSAC website) | (Example: Varies, check WSAC website) |

| (Example: Federal Direct Loans (available in WA)) | (Example: US Citizenship or eligible non-citizen status, enrollment in eligible program, FAFSA completion) | (Example: Varies, check Federal Student Aid website) | (Example: Varies, check Federal Student Aid website) |

| (Example: Private Student Loans (available in WA)) | (Example: Varies by lender, credit history may be a factor) | (Example: Varies significantly by lender and borrower creditworthiness) | (Example: Varies significantly by lender) |

Applying for Washington State Student Loans

Securing funding for your education in Washington State involves navigating the application process for various student loan programs. Understanding the requirements and procedures for each loan type, along with the overall FAFSA process, is crucial for a smooth application experience. This section details the steps involved, necessary documentation, and common pitfalls to avoid.

The Application Process for Washington State Student Loans

The application process varies slightly depending on the specific loan type (e.g., federal loans, state-sponsored grants, private loans). However, all generally begin with completing the Free Application for Federal Student Aid (FAFSA). This application determines your eligibility for federal student aid, which often forms the foundation of your financial aid package. Following the FAFSA, you may need to apply separately for state-specific programs or private loans through participating lenders. Each program will have its own application form and requirements. For instance, some programs may require additional essays or documentation showcasing financial need or academic merit.

Completing the Free Application for Federal Student Aid (FAFSA)

The FAFSA is a critical first step for most students seeking financial aid. Here’s a step-by-step guide:

- Create an FSA ID: You and a parent (if you are a dependent student) will need an FSA ID to access and sign the FAFSA. This is a username and password combination used to access your FAFSA information.

- Gather Required Information: Collect your Social Security number, federal tax returns (yours and your parents’, if applicable), W-2s, and other relevant financial information.

- Complete the Online Application: Access the FAFSA website (studentaid.gov) and begin the application. Answer all questions accurately and completely.

- Review and Submit: Carefully review your application for any errors before submitting. Once submitted, you will receive a Student Aid Report (SAR) summarizing your information.

- Track Your Status: Monitor your application status online to ensure it’s processed and your financial aid package is disbursed.

Required Documentation for Loan Applications

The specific documents required vary depending on the loan program. However, common documents include:

- Completed FAFSA: This is almost always a prerequisite.

- Tax Returns (Yours and Parents’): Used to verify income and financial need.

- Proof of Enrollment: Acceptance letter or enrollment verification from your college or university.

- Driver’s License or Other Identification: For verification purposes.

- Bank Statements (Sometimes): To verify bank account information for disbursement of funds.

Common Application Mistakes and How to Avoid Them

Failing to submit accurate information can lead to delays or denial of your application. Here are common mistakes and how to avoid them:

- Inaccurate Information: Double-check all information on your application, including your Social Security number, address, and financial data. Inconsistent information between your application and other documents will cause delays.

- Missing Documents: Ensure you submit all required documentation before the deadline. Organize your documents in advance to avoid last-minute rushes.

- Late Submission: Submit your application well before the deadline to avoid processing delays. Many programs have strict deadlines, so plan accordingly.

- Failure to Update Information: If your financial situation changes significantly after submitting your application, notify the appropriate agencies immediately. This may involve submitting updated tax information or providing additional documentation.

- Not Understanding Loan Terms: Carefully read all loan agreements and understand the terms and conditions before signing. This includes interest rates, repayment schedules, and any associated fees.

Repaying Washington State Student Loans

Successfully navigating the repayment of your Washington State student loans is crucial to your financial future. Understanding the available repayment options and the potential consequences of default will empower you to make informed decisions and manage your debt effectively. This section Artikels the various repayment plans, the ramifications of default, and potential avenues for loan forgiveness or consolidation.

Repayment Plan Options

Several repayment plans are designed to accommodate varying financial circumstances. Choosing the right plan can significantly impact your monthly payments and overall repayment period. Factors to consider include your income, expenses, and loan amount.

- Standard Repayment Plan: This plan involves fixed monthly payments over a standard 10-year period. It’s straightforward but may result in higher monthly payments compared to other options.

- Graduated Repayment Plan: Payments begin low and gradually increase over time, making it easier to manage in the early stages of your career when income is typically lower.

- Extended Repayment Plan: This plan extends the repayment period beyond 10 years, lowering monthly payments but potentially increasing the total interest paid over the life of the loan.

- Income-Driven Repayment (IDR) Plans: These plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base your monthly payment on your income and family size. Payments are typically lower than under standard plans, and remaining balances may be forgiven after 20 or 25 years, depending on the plan and specific circumstances. It’s important to note that forgiven amounts may be considered taxable income.

Consequences of Loan Default

Failing to make timely payments on your student loans can lead to serious consequences, including:

- Damaged Credit Score: Defaulting on loans significantly lowers your credit score, making it harder to obtain credit in the future (e.g., mortgages, auto loans, credit cards).

- Wage Garnishment: The government can garnish a portion of your wages to repay the defaulted loan.

- Tax Refund Offset: Your federal tax refund may be seized to repay the debt.

- Collection Agency Involvement: Your loan may be referred to a collection agency, leading to additional fees and negative impacts on your credit report.

- Inability to Access Future Federal Student Aid: Future access to federal student aid programs may be restricted.

Loan Forgiveness and Consolidation

Several programs offer opportunities for loan forgiveness or consolidation, potentially reducing your debt burden or simplifying your repayment process.

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance of federal Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Specific eligibility criteria must be met.

- Teacher Loan Forgiveness: This program may forgive a portion of your federal student loans if you meet certain teaching requirements in low-income schools or educational service agencies.

- Loan Consolidation: Combining multiple loans into a single loan can simplify repayment by providing a single monthly payment and potentially a lower interest rate. However, consolidation may not reduce the overall amount owed.

Repayment Process Flowchart

Imagine a flowchart. It begins with “Student Loan Disbursement.” The next box would be “Choose Repayment Plan” with branches leading to the various plans listed above (Standard, Graduated, Extended, IDR). Each plan branch leads to a box representing “Make Monthly Payments.” If payments are consistently made, the flowchart proceeds to “Loan Repayment Completion.” If payments are missed, a branch leads to “Default,” which then branches to the consequences listed above (damaged credit, wage garnishment, etc.). From the “Choose Repayment Plan” box, there’s also a branch to “Explore Loan Forgiveness/Consolidation Options” which leads to a box detailing the evaluation of eligibility for PSLF, Teacher Loan Forgiveness, and loan consolidation. Finally, successful application of any of these options leads back to the “Make Monthly Payments” box, while unsuccessful applications lead back to the original “Choose Repayment Plan” box.

Resources and Support for Washington State Student Loan Borrowers

Navigating student loan repayment can be challenging. Fortunately, several resources and support systems are available to Washington State student loan borrowers to help manage their debt and achieve financial well-being. These resources offer valuable guidance, counseling, and potentially financial assistance.

Numerous government agencies and non-profit organizations provide crucial support to student loan borrowers in Washington. These entities offer a range of services, from one-on-one counseling to comprehensive financial literacy programs. Understanding the resources available is a critical step in responsible debt management.

Key Organizations Offering Assistance

The following table summarizes key organizations providing assistance to Washington State student loan borrowers. It’s important to note that services and contact information may change, so always verify details directly with the organization.

| Organization Name | Contact Information | Services Offered | Website URL |

|---|---|---|---|

| Washington Student Achievement Council (WSAC) | Phone: (800) 872-9722 Email: [email protected] Mailing Address: WSAC, PO Box 43430, Olympia, WA 98504-3430 |

Information on state student aid programs, loan repayment options, and financial literacy resources. | https://www.wsac.wa.gov/ |

| Federal Student Aid (FSA) | Phone: (800) 4-FED-AID (433-243) Website: StudentAid.gov |

Information on federal student loans, repayment plans, income-driven repayment options, and loan forgiveness programs. | https://studentaid.gov/ |

| National Foundation for Credit Counseling (NFCC) | Website: Find a counselor using their website’s search tool. | Provides certified credit counselors who can offer guidance on debt management, budgeting, and financial planning. | https://www.nfcc.org/ |

| Consumer Credit Counseling Service (CCCS) | Website: Find a local office using their website’s search tool. | Offers credit counseling, debt management plans, and financial education workshops. | https://www.consumercredit.com/ |

Impact of Washington State Student Loans on Students and the Economy

Access to higher education is crucial for individual success and economic growth in Washington State. Student loans play a significant role in enabling many students to pursue post-secondary education, bridging the gap between tuition costs and available financial resources. However, the long-term implications of this reliance on borrowing warrant careful consideration.

Student loans significantly influence the higher education landscape in Washington. They allow students from diverse socioeconomic backgrounds to attend college, increasing overall enrollment and contributing to a more skilled workforce. This increased access to higher education, in turn, boosts the state’s economy through increased productivity, innovation, and economic growth. However, the increasing cost of tuition and the consequent rise in student loan debt have created significant challenges for both individual graduates and the state’s economy as a whole.

The Long-Term Effects of Student Loan Debt on Graduates

High levels of student loan debt can have profound and lasting effects on graduates’ lives. It can delay major life decisions such as homeownership, starting a family, and investing in retirement. The weight of debt can also lead to increased stress and anxiety, potentially impacting mental and physical health. Furthermore, the repayment burden can restrict career choices, potentially limiting graduates to higher-paying jobs, even if those jobs aren’t their preferred career paths. This can lead to a less fulfilling professional life and limit opportunities for personal and professional growth. For example, a graduate might choose a higher-paying but less satisfying corporate job over a lower-paying but more fulfilling role in the non-profit sector simply to manage their debt burden.

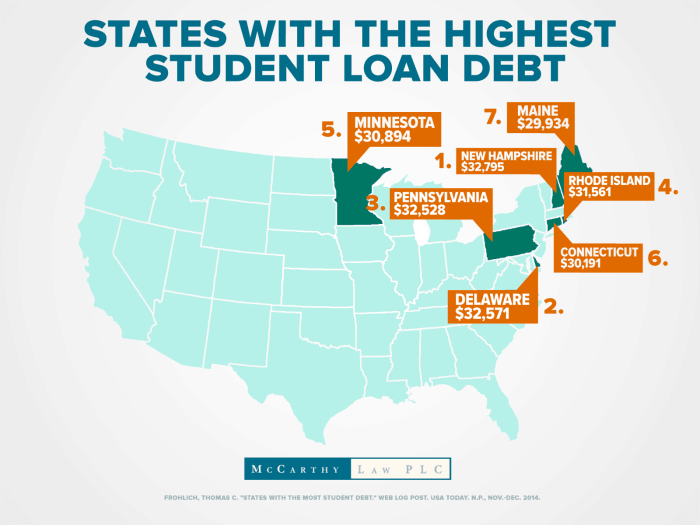

Comparison of Washington State’s Student Loan Debt Burden to Other States

While precise comparisons require access to constantly updated national datasets, it’s generally understood that Washington State’s student loan debt burden mirrors national trends. The average debt load for Washington graduates likely falls within the national average range, reflecting the escalating cost of higher education across the United States. States with significantly higher tuition costs, such as some in the Northeast, typically see higher average student loan debt. Conversely, states with more robust state funding for higher education or lower tuition rates may have lower average debt burdens. However, variations within states, based on factors like the type of institution attended (public vs. private) and the student’s field of study, can significantly impact individual debt levels. Reliable data from organizations like the National Center for Education Statistics (NCES) and the Institute for College Access & Success (TICAS) provide more detailed state-by-state comparisons.

Average Student Loan Debt for Washington State Graduates

The following is a description of a bar chart illustrating the average student loan debt for Washington State graduates. This is a hypothetical illustration for purposes and does not represent actual data. To obtain accurate data, consult reliable sources such as the NCES and TICAS.

Bar Chart Description: The horizontal axis (x-axis) represents the year of graduation, with data points for 2018, 2019, 2020, 2021, and 2022. The vertical axis (y-axis) represents the average student loan debt in US dollars. The chart would show a series of bars, one for each year, with the height of each bar corresponding to the average student loan debt for Washington graduates in that year. For example, the bar for 2018 might show an average debt of $25,000, while the bar for 2022 might show an average debt of $30,000, illustrating a general upward trend in average student loan debt over time. The chart’s title would be “Average Student Loan Debt for Washington State Graduates (2018-2022),” and a clear legend would explain the units of measurement. The chart would be visually clear and easy to understand, allowing for a quick comparison of average debt across the specified years.

Washington State Student Loan Scams and Fraud Prevention

Protecting yourself from student loan scams is crucial to ensure your financial well-being. Scammers often prey on students facing the stress and uncertainty of financing their education. Understanding common tactics and implementing preventative measures can significantly reduce your risk.

Scammers employ various deceptive methods to target Washington State residents seeking student loans. These range from fraudulent loan offers promising unrealistically low interest rates or easy approval to phishing emails impersonating legitimate lenders or government agencies. Other tactics involve upfront fees for loan processing or loan forgiveness schemes that are too good to be true.

Common Student Loan Scams Targeting Washington Residents

Several types of scams frequently target Washington State students. One common approach involves unsolicited emails or phone calls promising guaranteed loan approval with minimal documentation. These offers often require upfront payments for application processing or other fees, which are never legitimate in the case of federal or state-backed student loans. Another prevalent scam involves fake loan forgiveness programs, promising to erase existing student loan debt in exchange for a fee. These programs are almost always fraudulent. Finally, identity theft is a significant concern, with scammers using stolen personal information to apply for loans in a student’s name without their knowledge.

Recognizing and Avoiding Student Loan Scams

Several key indicators can help you identify potential scams. Always be wary of unsolicited offers promising unusually favorable terms, particularly those requiring upfront payments. Legitimate lenders will never demand money before approving a loan. Verify the identity of any lender or representative by independently contacting the organization using information found on their official website, not through links provided in emails or text messages. Never share your personal information, including your Social Security number, bank account details, or login credentials, unless you are absolutely certain of the recipient’s legitimacy and the security of the communication channel. If something feels too good to be true, it probably is. Thoroughly research any loan offer before committing to it.

Reporting Suspected Fraudulent Activity

If you suspect you’ve encountered a student loan scam, report it immediately. Contact the Washington State Attorney General’s Office, the Federal Trade Commission (FTC), and your local law enforcement. Provide as much detail as possible, including communication records, website addresses, and any financial transactions involved. Filing a report helps protect yourself and others from becoming victims of similar scams.

Warning Signs of Potential Loan Scams

It’s essential to be aware of the warning signs that could indicate a potential loan scam.

- Unsolicited offers of loans with unusually low interest rates or easy approval.

- Requests for upfront payments or fees for loan processing or application.

- Promises of loan forgiveness or debt elimination in exchange for a fee.

- High-pressure sales tactics or threats of negative consequences if you don’t act immediately.

- Communication through unusual channels, such as text messages or social media, rather than official channels.

- Websites or emails with poor grammar, spelling errors, or unprofessional design.

- Lenders who are unwilling or unable to provide verifiable contact information or licensing details.

- Requests for personal information before you’ve been formally approved for a loan.

Final Summary

Securing a higher education is a significant investment, and understanding the intricacies of Washington State student loans is paramount to success. By carefully considering the loan types, application processes, repayment plans, and available resources, students can effectively manage their debt and pave the way for a brighter future. Remember to always be vigilant against scams and utilize the resources provided to make informed decisions throughout your educational journey and beyond. Proactive planning and informed choices will lead to a more manageable and ultimately successful experience with student loans.

Expert Answers

What is the difference between federal and state student loans in Washington?

Federal student loans are offered by the U.S. government and generally have more flexible repayment options and protections for borrowers. State loans, while potentially less common, may offer specific benefits to Washington residents.

Can I consolidate my Washington State student loans?

Yes, loan consolidation can simplify repayment by combining multiple loans into a single payment. Check with your loan servicer or a financial advisor for details on eligibility and the process.

What happens if I default on my Washington State student loans?

Defaulting on your loans can have severe consequences, including damage to your credit score, wage garnishment, and potential tax refund offset. It is crucial to contact your loan servicer immediately if you are struggling to make payments.

Where can I find free credit counseling services in Washington State?

Several non-profit organizations offer free or low-cost credit counseling services. Contact the National Foundation for Credit Counseling or your state’s attorney general’s office for referrals.