Securing funding for higher education is a significant step, and understanding the application process is crucial. This guide navigates the intricacies of the Wells Fargo student loan application, providing a comprehensive overview of eligibility, interest rates, repayment options, and associated fees. We’ll compare Wells Fargo’s offerings to other lenders and explore the resources available to support applicants throughout the process.

From completing the online application and gathering necessary documentation to understanding repayment plans and potential fees, this resource aims to demystify the process and empower prospective borrowers to make informed decisions. We’ll cover everything from eligibility criteria and credit score impact to navigating customer support channels and comparing Wells Fargo loans to federal options.

Understanding Wells Fargo Student Loan Application Process

Securing a student loan can be a significant step towards financing your education. Understanding the application process, particularly with a major lender like Wells Fargo, is crucial for a smooth and successful experience. This section Artikels the key steps involved in applying for a Wells Fargo student loan, providing a clear guide to navigate the process effectively.

Steps Involved in Applying for a Wells Fargo Student Loan

The Wells Fargo student loan application process generally follows a straightforward online procedure. Applicants should expect to provide detailed personal and financial information, as well as academic details. The entire process, from initial application to final approval, can vary depending on individual circumstances and the volume of applications being processed.

Completing the Online Application: A Step-by-Step Guide

The online application typically begins with creating an account on the Wells Fargo student lending website. Following account creation, applicants will be guided through a series of forms requiring information such as personal details (name, address, date of birth, Social Security number), contact information, academic information (school name, program of study, expected graduation date), and financial information (income, assets, existing debts). Applicants will also need to choose their loan amount and repayment plan. After submitting the application, Wells Fargo will review the information and may request additional documentation. Finally, upon approval, the loan proceeds will be disbursed directly to the educational institution.

Required Documentation for a Successful Application

To ensure a smooth application process, gather necessary documentation beforehand. This typically includes proof of identity (driver’s license or passport), Social Security number verification, academic transcripts or acceptance letter from your chosen institution, and information regarding your parents’ or co-signer’s financial information if applicable. Failure to provide complete and accurate documentation can delay the approval process. Wells Fargo will clearly indicate what documents are needed during the online application process.

Comparison of Wells Fargo’s Application Process with Other Major Lenders

While the core steps of applying for a student loan are generally similar across major lenders, there can be differences in the specific requirements, online platforms, and customer service experiences. For example, some lenders may offer pre-qualification tools or streamlined application processes, while others might have stricter eligibility criteria or longer processing times. Comparing interest rates, fees, and repayment options is essential before selecting a lender. Detailed comparisons are readily available through independent financial websites and publications. Consider factors like customer reviews and the lender’s reputation when making your choice.

Flowchart Illustrating the Application Process

Imagine a flowchart with the following steps:

1. Start: Begin the application process on the Wells Fargo website.

2. Create Account: Set up an online account.

3. Complete Application: Fill out the application form with personal, academic, and financial details.

4. Document Submission: Upload supporting documents as requested.

5. Review and Approval: Wells Fargo reviews the application and supporting documents.

6. Loan Disbursement: Funds are disbursed to the educational institution upon approval.

7. End: The application process is complete.

Fees and Charges Associated with the Loan

Understanding the fees associated with your Wells Fargo student loan is crucial for effective financial planning. This section details the various charges you might encounter throughout the loan lifecycle, enabling you to budget accordingly and avoid unexpected expenses. Accurate information on these fees is readily available on the Wells Fargo website and through your loan documents.

Origination Fees

Origination fees are charges Wells Fargo assesses to cover the administrative costs of processing your student loan application. These fees are typically a percentage of the total loan amount and are deducted from the loan proceeds before you receive the funds. The exact percentage can vary depending on several factors, including the loan type and your creditworthiness. For example, a higher credit score might correlate with a lower origination fee, or a federal loan might have different fees compared to a private loan. It’s vital to confirm the specific origination fee applicable to your loan before accepting the terms. These fees are not refundable.

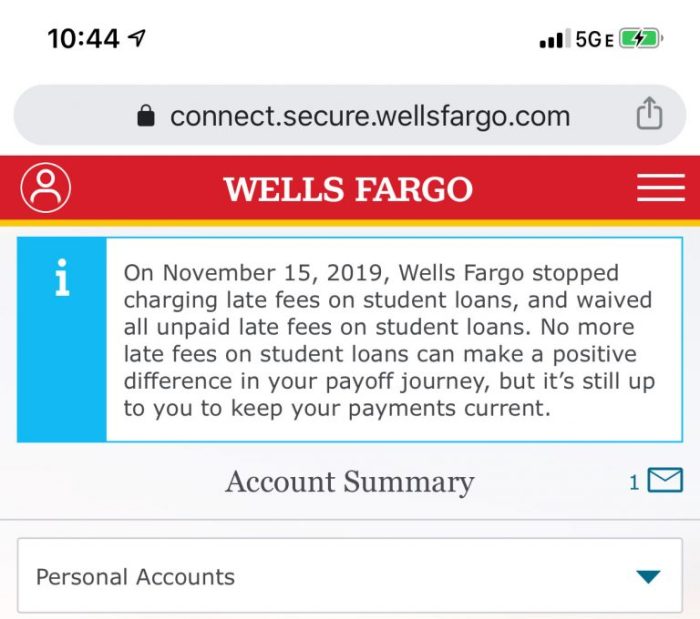

Late Payment Penalties

Late payment penalties are applied when you fail to make your monthly loan payment by the due date. The penalty amount varies, but it’s typically a percentage of the missed payment. Consistent late payments can negatively impact your credit score and potentially lead to further penalties or even loan default. Wells Fargo clearly Artikels these penalties in your loan agreement. To avoid late payment fees, it is crucial to set up automatic payments or utilize online banking tools to ensure timely payments.

Other Potential Charges

While origination and late payment fees are the most common, other charges might apply in specific circumstances. These could include returned payment fees (if a payment is rejected due to insufficient funds), fees for expedited processing (if you request faster loan disbursement), or charges associated with loan consolidation or refinancing. It’s important to review your loan documents thoroughly to understand all applicable fees and their associated terms.

Summary of Fees

| Fee Type | Description | Typical Amount |

|---|---|---|

| Origination Fee | Covers administrative costs of loan processing. | Varies; typically a percentage of the loan amount. Check your loan documents for the precise percentage. |

| Late Payment Penalty | Assessed for payments made after the due date. | Varies; typically a percentage of the missed payment. Consult your loan agreement for the exact percentage. |

| Returned Payment Fee | Charged when a payment is returned due to insufficient funds. | Varies; check your loan agreement for the exact amount. |

| Expedited Processing Fee (if applicable) | Charged for faster loan disbursement. | Varies; check your loan agreement for the exact amount. |

Avoiding Unnecessary Fees

To minimize fees, diligently track your loan payment due dates and set up automatic payments to prevent late payment penalties. Understand the origination fee upfront and factor it into your overall borrowing costs. Review your loan agreement carefully to comprehend all potential charges and adhere to the stipulated payment terms. Proactive financial management and careful attention to detail are key to avoiding unnecessary expenses associated with your Wells Fargo student loan.

Customer Support and Resources

Navigating the student loan process can sometimes feel overwhelming. Wells Fargo provides a range of support channels and resources designed to help borrowers understand their loan terms, manage their accounts, and address any questions or concerns that may arise. This section details the various avenues available for obtaining assistance and accessing helpful information.

Accessing support and resources is straightforward and designed to be convenient for borrowers. Wells Fargo offers multiple contact methods and a comprehensive online portal to ensure borrowers can find the help they need when they need it.

Contacting Wells Fargo Student Loan Customer Support

Wells Fargo offers several ways to contact their student loan customer support team. These options provide flexibility to choose the method most convenient for the borrower’s needs. This ensures prompt and efficient communication regarding loan-related inquiries.

- Phone: Borrowers can reach a representative by calling the dedicated Wells Fargo student loan customer service number. This number is typically found on the borrower’s loan documents or the Wells Fargo student loan website.

- Online Messaging: Many banks now offer secure online messaging platforms. Through this method, borrowers can send messages to a customer service representative and receive responses within a reasonable timeframe. This is a convenient option for non-urgent inquiries.

- Mail: For formal correspondence or documents, borrowers can send mail to the Wells Fargo student loan servicing address. This address is usually provided on statements and loan documents.

Online Resources for Wells Fargo Student Loan Borrowers

Wells Fargo provides a wealth of online resources to help borrowers manage their loans effectively. These resources empower borrowers to access information and manage their accounts conveniently.

- Online Account Access: Borrowers can access their loan account information 24/7 through a secure online portal. This allows for viewing statements, making payments, and tracking loan progress.

- Frequently Asked Questions (FAQ): A comprehensive FAQ section on the Wells Fargo website addresses common questions about student loan repayment, deferment, forbearance, and other related topics.

- Educational Resources: The website often features articles, guides, and videos offering financial literacy advice and tips for managing student loan debt effectively. This can be beneficial in understanding repayment strategies and budgeting.

Addressing Loan-Related Issues

If a borrower encounters a problem with their Wells Fargo student loan, they should promptly contact customer support using one of the methods Artikeld above. Clearly explaining the issue and providing any relevant documentation will help expedite the resolution process. Wells Fargo typically has procedures in place to investigate and address borrower concerns efficiently.

- Document Preparation: Gathering relevant documents, such as loan agreements, payment confirmations, and correspondence, before contacting support can streamline the process.

- Issue Tracking: Keep records of all communications with Wells Fargo, including dates, times, and summaries of conversations. This helps maintain a clear history of the issue and its resolution.

- Escalation Process: If a satisfactory resolution isn’t reached through initial contact, borrowers can usually escalate their concern to a supervisor or a higher-level representative within Wells Fargo’s customer service department.

Comparison with Alternative Student Loan Options

Choosing the right student loan is crucial for your financial future. Understanding the differences between Wells Fargo student loans and federal student loan programs is essential for making an informed decision. This section will compare key features, highlighting advantages and disadvantages of each to help you determine the best option for your circumstances.

Federal Student Loans versus Wells Fargo Student Loans

Federal student loans and private student loans, such as those offered by Wells Fargo, differ significantly in their eligibility criteria, interest rates, repayment options, and overall benefits. Federal loans are offered by the U.S. government and generally offer more borrower protections and flexible repayment plans. Private loans, on the other hand, are offered by banks and other private lenders, and their terms and conditions vary greatly.

Interest Rates and Repayment Options

Interest rates on federal student loans are typically lower than those on private student loans like Wells Fargo’s offerings. The interest rate for federal loans is set by the government and can vary depending on the loan type and the year the loan was disbursed. Wells Fargo’s interest rates are determined by market conditions and your individual creditworthiness. This means that borrowers with strong credit histories may secure lower rates, while those with less-than-perfect credit may face higher interest rates. Repayment options also differ. Federal loans often offer income-driven repayment plans that adjust payments based on your income and family size, while private loan repayment options are typically more limited.

Key Feature Comparison: Federal vs. Wells Fargo Student Loans

The following table summarizes key differences between federal and Wells Fargo student loans. Note that specific details may vary depending on the individual loan program and borrower circumstances.

| Feature | Federal Student Loans | Wells Fargo Student Loans |

|---|---|---|

| Interest Rates | Generally lower, set by the government | Variable, based on market conditions and creditworthiness; generally higher |

| Repayment Options | Multiple options, including income-driven plans | Fewer options, typically standard repayment plans |

| Eligibility | Based on financial need and enrollment status; available to U.S. citizens and eligible non-citizens | Based on creditworthiness and income; may require a co-signer |

| Loan Forgiveness Programs | Eligible for various forgiveness programs (e.g., Public Service Loan Forgiveness) | Generally not eligible for government loan forgiveness programs |

| Deferment and Forbearance | Options available under specific circumstances | Options may be available, but terms and conditions vary |

Private vs. Federal Student Loans: A Detailed Description

Private student loans, such as those from Wells Fargo, are offered by private lenders and are subject to their specific terms and conditions. They often require a credit check and may necessitate a co-signer if the borrower lacks a strong credit history. Federal student loans, conversely, are offered by the government and are generally more accessible, even to borrowers with limited or no credit history. They often come with borrower protections, such as income-driven repayment plans and loan forgiveness programs, not typically available with private loans. Choosing between federal and private loans depends heavily on individual circumstances, including credit score, financial need, and long-term financial goals. For instance, a student with excellent credit might find a competitive private loan, while a student with limited credit history might rely on federal loans.

Illustrative Example of a Successful Application

This example showcases a successful Wells Fargo student loan application, highlighting the process, documentation, and timeline involved. It aims to illustrate a typical positive experience and provide a realistic understanding of what applicants can expect.

Sarah Miller, a 22-year-old senior at State University, needed a student loan to cover her final year of tuition and living expenses. She had maintained a strong academic record (3.7 GPA) and had secured a part-time job throughout her college career, demonstrating financial responsibility.

Applicant Profile and Application Steps

Sarah’s strong academic performance and part-time work history positioned her favorably for loan approval. She began by carefully reviewing the Wells Fargo student loan eligibility requirements online. Understanding the terms and conditions was crucial for her. She then proceeded to the online application portal. The portal was user-friendly, guiding her through each step with clear instructions.

Documentation Submitted

Sarah meticulously gathered all the necessary documentation. This included her completed application form, transcripts showing her academic standing, proof of enrollment at State University, her tax returns (to demonstrate her family’s financial situation), and pay stubs from her part-time job. She also provided her Social Security number and driver’s license information. All documents were uploaded digitally through the secure portal.

Application Timeline

Sarah submitted her application on March 1st. Within a week, she received an email acknowledging receipt of her application. On March 15th, Wells Fargo requested additional documentation—a copy of her student ID card. She promptly uploaded this document. On March 22nd, she received notification that her loan application had been approved for $10,000. The funds were disbursed directly to her university account on April 5th.

Navigating the Online Application Portal

The Wells Fargo online application portal is designed for ease of use. The process was intuitive, with clear sections for personal information, academic details, financial information, and document uploads. Progress bars and helpful prompts guided Sarah through each step, minimizing confusion. The portal also provided FAQs and contact information for customer support, should she need assistance. She found the entire process straightforward and efficient. The online portal provided regular updates on her application status via email, keeping her informed every step of the way. The ability to track her application online provided peace of mind.

Last Point

Successfully navigating the Wells Fargo student loan application requires careful planning and a thorough understanding of the process. By understanding the eligibility requirements, comparing interest rates and repayment options, and familiarizing yourself with the available resources, you can significantly increase your chances of a successful application. Remember to explore all available options and choose the financing solution that best aligns with your individual financial circumstances and academic goals.

Popular Questions

What is the minimum credit score required for a Wells Fargo student loan?

Wells Fargo doesn’t publicly state a minimum credit score, but a higher score generally improves approval chances and secures more favorable interest rates. A co-signer with good credit can help if your score is lower.

Can I apply for a Wells Fargo student loan if I’m an international student?

Wells Fargo’s eligibility criteria for international students may vary. It’s essential to check their specific requirements or contact their customer support directly for clarification.

What happens if I miss a student loan payment?

Missing payments will likely result in late fees and negatively impact your credit score. Contact Wells Fargo immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

How long does the Wells Fargo student loan application process take?

The application processing time can vary depending on several factors, including the completeness of your application and the verification of your information. It’s advisable to allow ample time for the process to complete.