Navigating the complexities of student loans can feel overwhelming, especially when understanding interest rates. This guide delves into the specifics of Wells Fargo student loan interest rates, providing a clear and concise overview to empower you with the knowledge needed to make informed financial decisions. We’ll explore current rates, repayment options, influencing factors, and refinancing possibilities, equipping you to confidently manage your student loan journey.

Understanding your Wells Fargo student loan interest rate is crucial for long-term financial planning. This guide will break down the intricacies of interest calculation, repayment plan impacts, and the various factors that contribute to your individual rate. We will also compare Wells Fargo’s offerings to those of competitors, allowing for a comprehensive comparison to help you make the best choice for your financial future.

Current Wells Fargo Student Loan Interest Rates

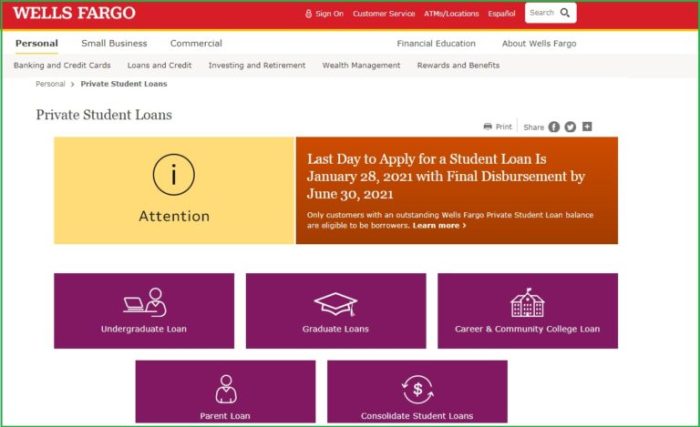

Securing a student loan involves understanding the associated interest rates, a crucial factor influencing the overall cost of your education. Wells Fargo offers various student loan options, each with its own interest rate structure. These rates can fluctuate based on several factors, making it essential to carefully review the current offerings before making a decision.

Understanding the interest rates on Wells Fargo student loans requires considering several key aspects. The rates are not static and are subject to change based on market conditions. It’s crucial to check the most up-to-date information directly with Wells Fargo before applying.

Wells Fargo Student Loan Interest Rate Comparison

The following table provides a sample comparison of potential fixed and variable interest rates for Wells Fargo student loans. Please note that these rates are illustrative and subject to change. Always confirm current rates directly with Wells Fargo or a financial advisor.

| Loan Type | Fixed Interest Rate (Example) | Variable Interest Rate (Example) | APR (Example) |

|---|---|---|---|

| Undergraduate | 6.00% | 5.50% – 7.50% | 6.25% |

| Graduate | 7.00% | 6.00% – 8.00% | 7.25% |

| Parent | 7.50% | 6.50% – 8.50% | 7.75% |

Factors Influencing Wells Fargo’s Student Loan Interest Rates

Several factors contribute to the determination of Wells Fargo’s student loan interest rates. These factors reflect the bank’s assessment of risk and the prevailing economic climate.

These include, but are not limited to: the prevailing market interest rates (the Federal Funds rate and other benchmark rates significantly impact lending rates); the applicant’s creditworthiness (a strong credit history generally leads to lower rates); the loan type (graduate loans often carry higher rates than undergraduate loans due to perceived higher risk); and the loan term (longer loan terms may result in higher rates to compensate for increased risk). Additionally, economic conditions, such as inflation, also play a role in rate adjustments.

Comparison with Major Competitors

Wells Fargo’s student loan interest rates are generally competitive with those of other major lenders. However, direct comparisons are challenging due to variations in loan terms, fees, and eligibility criteria. To obtain a precise comparison, it’s recommended to obtain quotes from multiple lenders and compare the total cost of the loan, including interest and fees, over the life of the loan. For example, a lender might offer a lower initial interest rate but charge higher fees, ultimately increasing the overall cost. A thorough comparison considering all these factors is crucial for making an informed decision.

Repayment Options and Interest Accrual

Understanding your repayment options and how interest accrues on your Wells Fargo student loan is crucial for minimizing your overall cost. Choosing the right repayment plan can significantly impact the total amount you pay over the life of your loan. Careful consideration of these factors will help you manage your debt effectively.

Choosing the right repayment plan is a significant decision impacting your long-term loan cost. Wells Fargo offers several repayment options, each with its own implications for interest accrual and total repayment amount. The best option for you will depend on your individual financial circumstances and repayment goals.

Wells Fargo Student Loan Repayment Plans and Their Impact on Interest

Wells Fargo offers a range of repayment plans designed to accommodate various financial situations. These plans differ in their monthly payment amounts, loan repayment periods, and ultimately, the total interest paid. While specific details might vary depending on the loan terms, common options include standard repayment, extended repayment, and income-driven repayment plans (if available through the federal government’s programs and applicable to your loan).

Standard Repayment: This plan typically involves fixed monthly payments over a set period (e.g., 10 years). While payments are higher than other plans, it leads to the lowest total interest paid due to the shorter repayment period. For example, a $30,000 loan at 7% interest with a 10-year standard repayment plan would have significantly lower total interest compared to a longer repayment period.

Extended Repayment: This option allows for lower monthly payments spread over a longer period (e.g., 20-25 years). The lower monthly payment provides immediate financial relief, but the extended repayment period results in a substantially higher total interest paid over the life of the loan. Using the same $30,000 loan example at 7% interest, a 25-year extended repayment plan would lead to significantly higher total interest costs compared to the 10-year standard plan.

Income-Driven Repayment (IDR) Plans: These plans, if available for your loan, tie your monthly payments to your income and family size. Payments are typically lower, especially during periods of lower income. However, IDR plans often extend the repayment period, leading to higher total interest paid over the long term. The exact impact on interest depends on factors such as income fluctuations throughout the repayment period. For example, a borrower with a fluctuating income might see lower monthly payments during periods of low income, but pay significantly more interest over the extended repayment period compared to a standard repayment plan.

Interest Accrual During In-School and Grace Periods

Interest accrual on Wells Fargo student loans operates differently during the in-school and grace periods. Understanding this is critical to managing your debt effectively.

In-School Period: During your in-school period, interest may or may not accrue depending on the loan type and terms. Some loans may have subsidized interest where the government pays the interest while you’re enrolled at least half-time, while others are unsubsidized, meaning interest accrues from the moment the loan is disbursed. This accrued interest is typically capitalized, meaning it’s added to the principal loan balance, increasing the amount you owe. This increases the total interest paid over the life of the loan.

Grace Period: After graduation or leaving school, you typically have a grace period (usually six months) before repayment begins. During this grace period, interest usually continues to accrue on unsubsidized loans, again often being capitalized. Making interest-only payments during this period can help reduce the total amount you ultimately repay.

Hypothetical Scenario: Long-Term Cost Comparison

Let’s consider a hypothetical scenario to illustrate the long-term cost differences between repayment plans. Suppose a student graduates with a $40,000 student loan at a 6% annual interest rate.

| Repayment Plan | Monthly Payment (approx.) | Loan Term (years) | Total Interest Paid (approx.) |

|---|---|---|---|

| Standard (10-year) | $440 | 10 | $10,500 |

| Extended (20-year) | $260 | 20 | $21,500 |

| Income-Driven (Example – 25-year) | Variable, potentially lower initially | 25 | Potentially >$25,000 |

Note: These are approximate figures and actual amounts will vary based on specific loan terms and interest rates. The income-driven repayment example illustrates the potential for higher total interest paid due to the longer repayment period. The variable nature of income-driven payments makes precise calculation difficult.

Factors Affecting Individual Interest Rates

Understanding the factors that influence your Wells Fargo student loan interest rate is crucial for securing the best possible terms. Several key elements contribute to the final interest rate you’ll receive, and being aware of these can help you prepare and potentially improve your chances of a lower rate. These factors are often interconnected, creating a complex but ultimately predictable system for determining interest.

Several factors significantly impact the interest rate offered on Wells Fargo student loans. These factors are primarily evaluated during the loan application process and are used to assess the borrower’s creditworthiness and risk.

Credit Score’s Influence on Interest Rates

Your credit score plays a dominant role in determining your interest rate. A higher credit score generally indicates a lower risk to the lender, resulting in a lower interest rate. Conversely, a lower credit score suggests a higher risk, leading to a higher interest rate. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower interest rate compared to a borrower with a fair credit score (650-699). The difference could be several percentage points, resulting in substantial savings over the life of the loan. Lenders use credit scores as a primary indicator of repayment ability.

Impact of Loan Amount and Repayment Plan

The amount you borrow also influences the interest rate. Larger loan amounts might be associated with slightly higher interest rates, reflecting the increased risk for the lender. This is not always the case, but it’s a factor considered in the overall risk assessment. Additionally, the repayment plan you choose can affect your interest rate, though this is less common with federal student loans. For example, a longer repayment term might lead to a slightly lower monthly payment, but it will likely result in paying more interest overall. Conversely, a shorter repayment term might lead to higher monthly payments but less interest paid in the long run.

Financial History’s Role in Interest Rate Determination

Your financial history, beyond your credit score, significantly impacts your interest rate. This includes factors such as your income, employment history, and existing debt. A stable income and consistent employment history demonstrate your ability to manage finances responsibly and make timely loan payments. Conversely, a history of missed payments, bankruptcies, or high debt-to-income ratios can signal a higher risk to lenders, leading to a higher interest rate. Lenders often review your entire financial picture to assess your capacity to repay the loan successfully.

Student Loan Refinancing with Wells Fargo

Refinancing your student loans with Wells Fargo can potentially lower your monthly payments and overall interest costs. This process involves replacing your existing student loans with a new loan from Wells Fargo, often at a lower interest rate. It’s crucial to carefully weigh the benefits and drawbacks before making a decision.

Wells Fargo offers student loan refinancing options to borrowers who meet specific criteria. The process involves applying online, providing necessary documentation, and undergoing a credit check. Successful applicants receive a new loan that consolidates their existing student loans into a single payment, potentially simplifying repayment and potentially reducing their overall interest burden.

Wells Fargo Student Loan Refinancing Options

Wells Fargo’s refinancing options typically include various loan terms and interest rates, tailored to the borrower’s creditworthiness and financial profile. The specific options available will depend on factors such as your credit score, income, and the type of student loans you’re refinancing.

- Fixed-rate loans: These loans offer a consistent interest rate throughout the loan term, providing predictability in monthly payments.

- Variable-rate loans: These loans have an interest rate that fluctuates based on market conditions. While they may start with a lower rate, the rate can increase over time, leading to potentially higher payments.

- Different loan terms: Wells Fargo likely offers a range of loan terms (e.g., 5, 10, 15 years) allowing borrowers to choose a repayment schedule that fits their budget. Shorter terms result in higher monthly payments but less interest paid over the life of the loan. Longer terms have lower monthly payments but result in more interest paid overall.

Student Loan Refinancing Process with Wells Fargo

The refinancing process generally involves several key steps. It’s essential to gather all required documentation beforehand to streamline the application process.

- Check Eligibility: Review Wells Fargo’s eligibility requirements, which typically include a minimum credit score, income verification, and a certain amount of student loan debt.

- Gather Documentation: Collect necessary documents, including proof of income (pay stubs, tax returns), student loan statements, and identification.

- Apply Online: Complete the online application through Wells Fargo’s website, providing accurate information and uploading required documents.

- Credit Check and Review: Wells Fargo will review your application and perform a credit check. This step is crucial in determining your eligibility and interest rate.

- Loan Approval and Closing: If approved, you’ll receive a loan offer outlining the terms and conditions. Once you accept the offer, the loan will be processed and funds disbursed.

Comparison of Wells Fargo Refinancing with Other Lenders

Comparing Wells Fargo’s refinancing options with other lenders is crucial for securing the best possible terms. Factors such as interest rates, fees, and customer service should be considered. It’s recommended to obtain quotes from multiple lenders before making a decision.

| Factor | Wells Fargo | Other Lenders |

|---|---|---|

| Interest Rates | Competitive, but vary based on creditworthiness. | Rates vary widely depending on the lender and borrower’s profile. Some lenders may offer lower rates than Wells Fargo, while others may offer higher rates. |

| Fees | May include origination fees or other charges. Check for details in the loan agreement. | Fees vary significantly among lenders. Some lenders may have no fees, while others may charge substantial fees. |

| Customer Service | Wells Fargo has a large customer service network, but experiences may vary. | Customer service quality varies greatly across different lenders. Research reviews and ratings before choosing a lender. |

| Loan Terms | Offers a range of loan terms, but the specific options depend on individual circumstances. | Loan terms vary across lenders. Some lenders may offer longer or shorter terms than Wells Fargo. |

Understanding the Fine Print

Before diving into the specifics of your Wells Fargo student loan, it’s crucial to understand the associated fees and terms to avoid unexpected costs and potential penalties. This section clarifies the less-discussed aspects of your loan agreement, ensuring transparency and empowering you to make informed decisions.

It’s important to remember that the information provided here is for general understanding and may not encompass every specific detail of your individual loan agreement. Always refer to your official loan documents for the most accurate and up-to-date information.

Fees Associated with Wells Fargo Student Loans

Wells Fargo may charge fees associated with your student loan. These fees can impact the overall cost of borrowing, so understanding them is essential for accurate budgeting and financial planning. While specific fees can vary depending on the loan type and terms, some common fees include origination fees and late payment penalties.

Origination fees are typically a percentage of your loan amount and are charged upfront. This fee covers the administrative costs associated with processing your loan application and disbursement. For example, an origination fee of 1% on a $10,000 loan would be $100. Late payment penalties are incurred when you fail to make your monthly payment by the due date. These penalties can add significantly to your total loan cost over time. The penalty amount is usually a percentage of the missed payment, and repeated late payments may result in further penalties or even damage your credit score.

Wells Fargo Student Loan Terms and Conditions

The terms and conditions of your Wells Fargo student loan Artikel the specific agreements between you and the lender. These terms cover various aspects of your loan, including repayment schedules, interest rates, and any associated fees. Understanding these terms is vital to ensure you can meet your repayment obligations and avoid potential penalties. Key aspects of the terms and conditions typically include the loan’s interest rate (which can be fixed or variable), the repayment period (the length of time you have to repay the loan), and the grace period (the period after graduation before you are required to begin making payments). The terms also detail the consequences of defaulting on the loan, including potential damage to your credit score and collection actions.

Scenarios Leading to Additional Fees or Penalties

Several scenarios can lead to additional fees or penalties beyond the standard origination and late payment fees. These scenarios often involve missed payments, returned payments due to insufficient funds, or failure to adhere to the terms of your loan agreement. For example, repeatedly missing payments can result in increased late payment fees and negatively impact your credit score. If a payment is returned due to insufficient funds, you might face a returned payment fee in addition to the late payment penalty. Furthermore, failure to provide accurate information during the loan application process could result in additional fees or even loan denial. Similarly, if you consolidate or refinance your loans, there might be additional fees associated with these processes. It is crucial to meticulously review your loan agreement and understand the consequences of not adhering to its stipulations.

Illustrative Examples

Understanding how various factors influence student loan interest rates is crucial for effective financial planning. The following examples illustrate how different borrower profiles can result in varying interest rates and repayment scenarios. Remember that these are hypothetical examples and actual rates may differ based on Wells Fargo’s current lending criteria.

Hypothetical Borrower Profiles and Interest Rate Variations

The table below presents three hypothetical borrowers with differing credit scores, loan amounts, and chosen repayment plans. These factors significantly impact the final interest rate offered.

| Borrower Profile | Credit Score | Loan Amount | Approximate Interest Rate (Hypothetical) |

|---|---|---|---|

| High-achieving graduate student | 780 | $50,000 | 4.5% |

| Undergraduate student with limited credit history | 680 | $25,000 | 6.0% |

| Borrower with a co-signer and fair credit | 650 | $40,000 | 5.5% |

Amortization Schedule Description

An amortization schedule for a Wells Fargo student loan visually displays the breakdown of each payment over the loan’s lifespan. It typically shows the payment number, the payment amount, the portion allocated to interest, the portion applied to principal, and the remaining loan balance. For example, in the early stages of repayment, a larger portion of the payment goes towards interest, while the principal reduction is smaller. As the loan progresses, the proportion shifts, with a greater amount applied to the principal and a smaller amount to interest. The table continues until the loan balance reaches zero. The visual representation is a clear, tabular format, easily understandable, showcasing the decreasing balance with each payment.

Potential Long-Term Savings from Extra Principal Payments

Making extra principal payments on a Wells Fargo student loan can significantly reduce the total interest paid and shorten the repayment period. For instance, consider a $30,000 loan at 6% interest over 10 years. The monthly payment would be approximately $330. By adding an extra $100 to the monthly payment, the borrower could potentially save thousands of dollars in interest and pay off the loan several years earlier. The exact savings will depend on the loan amount, interest rate, and the additional amount paid. A detailed amortization schedule, reflecting the extra payments, would clearly illustrate the accelerated payoff and interest savings.

Conclusive Thoughts

Successfully managing student loan debt requires a proactive approach and a thorough understanding of interest rates and repayment options. By carefully considering the factors influencing your Wells Fargo student loan interest rate, exploring available repayment plans, and understanding the fine print, you can create a personalized strategy for efficient debt repayment. Remember to regularly review your loan terms and consider refinancing options to potentially lower your overall cost. Armed with this knowledge, you can confidently navigate the path to financial freedom.

Essential Questionnaire

What is the difference between a fixed and variable interest rate on a Wells Fargo student loan?

A fixed interest rate remains constant throughout the loan’s term, while a variable interest rate fluctuates based on market indices, potentially leading to higher or lower payments over time.

Can I make extra payments on my Wells Fargo student loan?

Yes, making extra principal payments can significantly reduce the total interest paid and shorten the loan repayment term. Check your loan agreement for any prepayment penalties.

What happens if I miss a payment on my Wells Fargo student loan?

Missing payments will result in late fees and can negatively impact your credit score. Contact Wells Fargo immediately if you anticipate difficulty making a payment to explore options like forbearance or deferment.

Does Wells Fargo offer any hardship programs for student loan borrowers?

Wells Fargo may offer hardship programs, such as forbearance or deferment, in specific circumstances. Contact them directly to discuss your situation and explore available options.

How does my credit score affect my Wells Fargo student loan interest rate?

A higher credit score generally qualifies you for a lower interest rate, reflecting lower perceived risk to the lender. A lower credit score may result in a higher interest rate.