Navigating the world of higher education often involves the significant financial hurdle of student loans. Sallie Mae, a prominent player in the student loan market, offers a range of financing options to help students fund their education. Understanding the nuances of Sallie Mae loans—their types, eligibility criteria, repayment plans, and potential impact on your credit—is crucial for making informed decisions about your financial future.

This guide provides a comprehensive overview of Sallie Mae student loans, demystifying the application process, repayment strategies, and potential avenues for loan forgiveness or deferment. We’ll compare Sallie Mae options to those from other lenders, equipping you with the knowledge to choose the best path for your individual circumstances. By the end, you’ll have a clear understanding of how Sallie Mae loans can impact your financial journey and how to manage them effectively.

Applying for a Sallie Mae Student Loan

Securing a Sallie Mae student loan involves a straightforward application process, but understanding the steps and required documentation is crucial for a smooth experience. This section Artikels the process, highlighting key considerations and providing a practical checklist to guide you.

The Application Process: A Step-by-Step Guide

The Sallie Mae application process typically begins online. Applicants first create an account on the Sallie Mae website. This involves providing basic personal information such as name, address, date of birth, and Social Security number. Next, applicants will need to provide details about their educational institution, intended program of study, and estimated costs. This information allows Sallie Mae to determine the loan amount you may be eligible for. Following this, applicants will need to complete a credit check and provide financial information, which will be used to assess their creditworthiness and repayment capacity. Finally, the application is reviewed, and the applicant will receive a decision regarding loan approval. The entire process can take several weeks, depending on the volume of applications and the individual circumstances of the applicant.

Required Documentation for Loan Application

To successfully apply for a Sallie Mae student loan, you’ll need to gather several essential documents. This typically includes your Social Security number, driver’s license or other government-issued identification, proof of enrollment at an eligible educational institution (such as an acceptance letter or current enrollment verification), and information about your expected educational costs. You may also be asked to provide tax returns or other financial documentation to verify your income and assets. Providing accurate and complete information is vital to expedite the application process.

Factors Influencing Loan Approval

Several factors influence Sallie Mae’s decision to approve a student loan application. Credit history plays a significant role; applicants with a strong credit history are more likely to be approved. Your income and assets are also considered to assess your ability to repay the loan. The amount of financial aid you’ve already received, such as grants and scholarships, is factored in to determine the necessary loan amount. Finally, your academic standing and the reputation of your educational institution can also be considered.

Checklist: Before and After Applying for a Loan

Before applying, ensure you have all necessary documentation readily available, understand the loan terms and interest rates, and have carefully considered your financial capacity to repay the loan. After applying, regularly check your Sallie Mae account for updates on the application status and promptly respond to any requests for additional information. Familiarize yourself with your repayment options and plan accordingly.

Completing the Application Form: A Step-by-Step Guide

Begin by carefully reading all instructions provided on the application form. Ensure all information provided is accurate and complete, double-checking for any errors before submitting. Use a secure internet connection to protect your personal information. If you encounter any difficulties, contact Sallie Mae’s customer support for assistance. Keep a copy of the completed application form for your records. Submitting the application online is generally the most efficient method.

Repaying Sallie Mae Student Loans

Successfully navigating student loan repayment requires understanding the available options and developing a strategic plan. Choosing the right repayment plan significantly impacts your monthly budget and the total amount you’ll pay back over time. Careful consideration of your financial situation and long-term goals is crucial.

Sallie Mae offers several repayment plans, each with its own advantages and disadvantages. The best option depends on your individual circumstances, including your income, debt amount, and financial goals. Failing to understand these options can lead to unnecessary stress and potentially more debt in the long run. Let’s explore the various repayment plans available.

Sallie Mae Repayment Plan Options

Several repayment plans are designed to accommodate different financial situations. Understanding the nuances of each plan is key to making an informed decision. Consider factors such as your income, your loan amount, and your long-term financial goals when making your selection.

- Standard Repayment Plan: This is the most basic plan, requiring fixed monthly payments over a 10-year period. Pros: Predictable payments, relatively short repayment period. Cons: Higher monthly payments compared to other plans, may not be suitable for borrowers with limited income.

- Graduated Repayment Plan: Payments start low and gradually increase over time. Pros: Lower initial payments, making it easier to manage early on. Cons: Payments become significantly higher later in the repayment period, potentially leading to difficulty in later years.

- Extended Repayment Plan: This plan extends the repayment period to up to 25 years. Pros: Lower monthly payments. Cons: Significantly higher total interest paid over the life of the loan.

- Income-Driven Repayment (IDR) Plans: Payment amounts are based on your income and family size. Several IDR plans exist, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans. Pros: Affordability, potentially lower monthly payments based on income. Cons: Longer repayment periods, potentially leading to higher total interest paid.

Implications of Different Repayment Plans

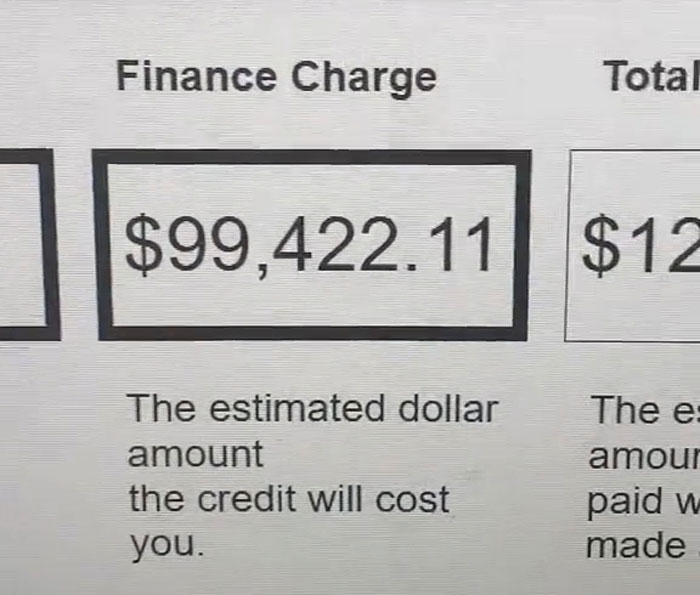

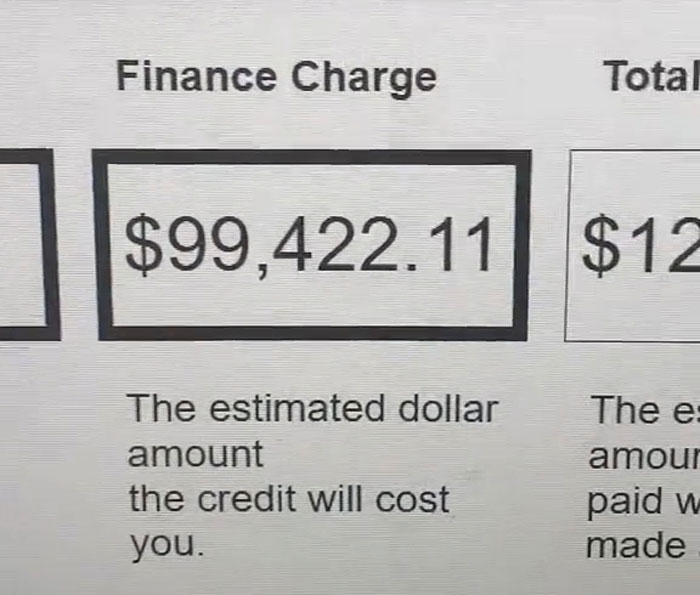

The choice of repayment plan directly impacts both your monthly payment and the total interest paid. A shorter repayment term, like the standard plan, leads to higher monthly payments but lower overall interest. Conversely, longer repayment terms, such as the extended plan or IDR plans, result in lower monthly payments but substantially higher total interest paid over the loan’s lifetime. For example, a $30,000 loan at 5% interest over 10 years (standard) would have higher monthly payments than the same loan over 25 years (extended), but the total interest paid would be significantly less on the 10-year plan.

Strategies for Managing Student Loan Debt Effectively

Effective student loan management involves proactive planning and consistent effort. Creating a budget, prioritizing loan repayment, and exploring options for reducing your debt are essential steps.

- Budgeting: Track your income and expenses to understand your financial situation and allocate funds for loan repayment.

- Prioritization: Prioritize high-interest loans to minimize the total interest paid. Consider strategies like the debt avalanche or debt snowball methods.

- Refinancing: Explore refinancing options to potentially lower your interest rate and monthly payments. This should only be considered if a lower rate is available.

- Additional Payments: Making extra payments, even small ones, can significantly reduce the total interest paid and shorten the repayment period.

Consequences of Defaulting on a Sallie Mae Student Loan

Defaulting on a Sallie Mae student loan has severe consequences. It can damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, tax refund offset, and difficulty securing future employment are also potential outcomes. It’s crucial to communicate with Sallie Mae if you’re struggling to make payments to explore options to avoid default.

Sallie Mae Loan Forgiveness and Deferment

Sallie Mae, while not directly offering loan forgiveness programs in the same way as government-sponsored programs, does provide options for deferment and forbearance, which can offer temporary relief from loan payments. Understanding the distinctions between forgiveness and deferment/forbearance is crucial for borrowers navigating their repayment journey. It’s important to note that Sallie Mae’s programs are subject to change, so checking their official website for the most up-to-date information is always recommended.

Conditions for Loan Deferment and Forbearance

Sallie Mae offers deferment and forbearance options under specific circumstances. Deferment temporarily suspends your loan payments, while forbearance reduces or temporarily suspends payments. Both typically involve interest accrual (meaning interest continues to accumulate on your loan balance), though some deferment options may temporarily suspend interest accrual. Eligibility often depends on factors like unemployment, enrollment in school, or documented financial hardship. Specific documentation will be required to support your application.

Situations Qualifying for Deferment or Forbearance

Several situations may qualify a borrower for Sallie Mae loan deferment or forbearance. These include:

- Unemployment: Loss of employment, verified through documentation such as a layoff notice or unemployment benefits paperwork.

- Economic Hardship: Demonstrable financial difficulties, requiring supporting documentation like bank statements showing reduced income or increased expenses.

- Enrollment in School: Returning to school at least half-time, provided you are enrolled in a degree program.

- Military Service: Active duty military service may qualify for deferment under certain conditions, requiring verification of service status.

- Death or Disability: In the event of the borrower’s death or disability, deferment or other options may be available. Documentation will be necessary.

Applying for Loan Deferment or Forbearance

The application process generally involves submitting a request through the Sallie Mae website or by contacting their customer service department. You’ll need to provide supporting documentation to verify the reason for your request, such as proof of unemployment, enrollment verification, or documentation of economic hardship. Sallie Mae will review your application and notify you of their decision. The approval process may take several weeks.

Impact on Credit Score

While deferment or forbearance can provide temporary relief, they can negatively impact your credit score. Missed or delayed payments are reported to credit bureaus, potentially lowering your credit score. The severity of the impact depends on the length of the deferment/forbearance period and your overall credit history. It’s crucial to understand that this is a temporary impact and your credit score will likely recover once you resume regular payments. It is recommended to proactively communicate with Sallie Mae to avoid further negative impacts on your credit report.

Applying for Loan Deferment or Forbearance: A Flowchart

The following describes a flowchart illustrating the application process. Imagine a flowchart with boxes and arrows.

[Start] –> [Gather Required Documentation (Proof of unemployment, enrollment verification, etc.)] –> [Submit Application Online or via Phone] –> [Sallie Mae Reviews Application] –> [Approval/Denial Notification] –> [If Approved: Deferment/Forbearance Granted] –> [If Denied: Review Denial Reasons and Consider Re-application or Alternative Options] –> [End]

Understanding Sallie Mae’s Customer Service and Resources

Navigating the world of student loans can be challenging, and having access to reliable and responsive customer service is crucial. Sallie Mae offers a variety of ways to connect with their representatives and access helpful resources to manage your student loan accounts effectively. Understanding these options can significantly improve your experience and help you address any issues promptly.

Sallie Mae Customer Service Channels

Sallie Mae provides several avenues for borrowers to access customer support. These channels cater to different preferences and levels of urgency. Choosing the most appropriate method depends on the nature of your inquiry and your preferred communication style.

- Phone Support: Sallie Mae offers a dedicated phone number for borrowers to speak directly with a representative. This option is ideal for complex issues or when immediate assistance is needed.

- Online Chat: A live chat feature on the Sallie Mae website allows for real-time interaction with customer service agents. This provides a convenient alternative to phone calls, especially for less urgent inquiries.

- Email: Borrowers can submit inquiries via email through a designated contact form on the Sallie Mae website. This method is suitable for non-urgent questions or situations where detailed information needs to be provided.

- Mail: For formal correspondence or situations requiring physical documentation, Sallie Mae provides a mailing address for written communication. This is generally the slowest method of contact.

Contacting Sallie Mae for Loan-Related Issues

The method you choose to contact Sallie Mae will depend on the specific issue you’re facing. For example, if you need to make a payment immediately, a phone call might be the most efficient approach. If you have a question about your loan terms, email might suffice. Remember to have your loan information readily available, such as your loan number and social security number, to expedite the process.

Examples of Common Customer Service Issues and Their Solutions

Many common issues faced by Sallie Mae borrowers have straightforward solutions. Understanding these common problems and their solutions can prevent unnecessary stress and delays.

- Missed Payment: If you miss a payment, contact Sallie Mae immediately to explore options like a forbearance or deferment. Failing to communicate could negatively impact your credit score.

- Incorrect Billing Amount: If you believe your billing statement is inaccurate, contact Sallie Mae’s customer service to request a review of your account. They can investigate the discrepancy and provide a corrected statement.

- Difficulty Accessing Online Account: If you’re experiencing trouble logging into your online account, contact customer service for assistance resetting your password or troubleshooting login issues.

- Questions Regarding Loan Consolidation: If you’re considering consolidating your Sallie Mae loans, contact customer service to discuss the process, eligibility requirements, and potential benefits.

Sallie Mae Website Resources

The Sallie Mae website is a treasure trove of information for borrowers. It contains a wealth of resources, including FAQs, guides, and tools to help manage your loans effectively. These resources are designed to empower borrowers with the knowledge and tools to navigate their loan journey successfully.

Sallie Mae Contact Information and Helpful Resources

This guide provides essential contact information and links to helpful resources on the Sallie Mae website. Always verify this information on the official Sallie Mae website as contact details may change.

| Contact Method | Details |

|---|---|

| Phone | [Insert current Sallie Mae phone number here] |

| Website | [Insert current Sallie Mae website address here] |

| [Insert instructions on how to find the email contact form on the website here] | |

| Mailing Address | [Insert current Sallie Mae mailing address here] |

Sallie Mae and Your Credit Score

Managing your Sallie Mae student loans responsibly has a significant impact on your credit score, a crucial factor influencing your financial future. Your credit score is a numerical representation of your creditworthiness, affecting your ability to secure loans, credit cards, and even rental agreements. Understanding this relationship is key to building a strong financial foundation.

Your Sallie Mae student loan repayment history directly influences your credit score. Credit bureaus, such as Experian, Equifax, and TransUnion, track your payment activity. Consistent on-time payments demonstrate financial responsibility, leading to a higher credit score. Conversely, missed or late payments can negatively affect your credit score, potentially making it harder to obtain favorable credit terms in the future.

Impact of Responsible Loan Management on Credit Rating

Responsible loan management is paramount to maintaining a healthy credit score. This includes making timely payments, keeping your loan balance low relative to your credit limit (if applicable), and avoiding defaults. Each on-time payment contributes to building a positive credit history. For example, consistently making on-time payments for three years could significantly improve your credit score, potentially increasing your credit limit on existing accounts or enabling you to qualify for better interest rates on future loans. Conversely, consistently late payments can lead to a significant drop in your credit score.

Tips for Maintaining a Good Credit Score While Repaying Student Loans

Building and maintaining a good credit score while repaying student loans requires diligent planning and execution. This includes creating a realistic budget that prioritizes loan repayments, exploring options like income-driven repayment plans if necessary, and monitoring your credit report regularly for accuracy. Furthermore, consider diversifying your credit profile by responsibly managing other credit accounts, such as a credit card used for small, manageable purchases and consistently paid in full each month. This demonstrates responsible credit management across various financial instruments.

Consequences of a Poor Credit Score Due to Student Loan Mismanagement

Mismanaging your Sallie Mae student loans can have serious repercussions. A poor credit score resulting from late or missed payments can lead to higher interest rates on future loans, making it more expensive to borrow money for a car, a house, or even a business. It can also impact your ability to secure a rental agreement or even certain jobs that require a credit check. In extreme cases, debt collection agencies may become involved, potentially leading to further damage to your credit and financial well-being.

Relationship Between On-Time Payments and Credit Score Improvement

Let’s consider a hypothetical example: Imagine Sarah, who had a credit score of 650. She consistently made on-time payments on her Sallie Mae loan for two years. As a result, her credit score increased to 720. This improvement reflects the positive impact of consistent, responsible repayment on creditworthiness. Conversely, if Sarah had consistently missed payments, her credit score could have dropped significantly, making it harder to obtain favorable credit terms in the future. This demonstrates the direct correlation between timely payments and credit score improvement.

Last Point

Securing a student loan is a significant step, and choosing the right lender and understanding the terms are paramount. Sallie Mae offers various loan options catering to diverse needs, but careful consideration of interest rates, repayment plans, and long-term financial implications is essential. By leveraging the resources provided and understanding your individual circumstances, you can effectively navigate the complexities of Sallie Mae student loans and pave the way for a financially sound future after graduation. Remember, proactive planning and responsible loan management are key to success.

FAQ

What is the difference between a subsidized and unsubsidized Sallie Mae loan?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Can I refinance my Sallie Mae student loans?

Yes, you can refinance your Sallie Mae loans with Sallie Mae or another lender, potentially lowering your interest rate.

What happens if I miss a Sallie Mae loan payment?

Missing payments can negatively impact your credit score and may lead to late fees and collection actions.

Does Sallie Mae offer income-driven repayment plans?

While Sallie Mae itself doesn’t directly offer income-driven repayment plans, you might be eligible through the federal government’s programs if your loans are federal.

How can I contact Sallie Mae customer service?

You can contact Sallie Mae through their website, phone, or mail. Contact information is available on their official website.