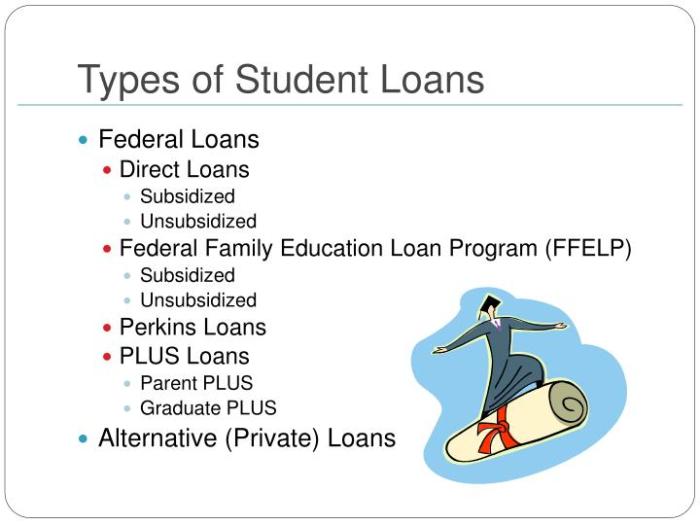

Navigating the world of student loans can feel overwhelming, especially with the various options available. Understanding the differences between federal and private loans, and the nuances within each category, is crucial for making informed decisions about financing your education. This guide breaks down the four main types of student loans, helping you choose the best path for your financial future.

From the readily available federal options—subsidized and unsubsidized loans, PLUS loans, and Perkins loans—to the more complex landscape of private loans, we’ll explore the eligibility criteria, interest rates, repayment plans, and potential risks associated with each. We will also clarify the distinctions between direct and indirect loan programs, offering a comprehensive overview to empower you with the knowledge needed to confidently manage your student loan journey.

Federal Student Loans

Federal student loans are a significant source of funding for higher education in the United States, offering various programs to meet diverse student needs. Understanding the nuances of these loans is crucial for responsible borrowing and effective financial planning. This section will delve into the specifics of federal student loan programs, including eligibility, interest rates, and repayment options.

Subsidized vs. Unsubsidized Federal Loans

The key difference between subsidized and unsubsidized federal loans lies in interest accrual. With subsidized loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, even while you are still studying. This accumulated interest can be capitalized (added to the principal loan amount), increasing the total amount you owe. Choosing between subsidized and unsubsidized loans depends on your financial need and ability to manage accruing interest.

Eligibility Requirements for Federal Student Loans

Eligibility for federal student loans hinges on several factors. Applicants must be enrolled or accepted for enrollment at least half-time in an eligible degree or certificate program at a participating institution. They must also be a U.S. citizen or eligible non-citizen, possess a valid Social Security number, and maintain satisfactory academic progress as defined by their institution. Furthermore, applicants must complete the Free Application for Federal Student Aid (FAFSA) to determine their eligibility for federal aid, including student loans. Specific eligibility criteria may vary depending on the type of federal student loan.

Interest Rates and Repayment Options for Federal Loan Programs

Interest rates for federal student loans are set annually by the government and are generally lower than private loan interest rates. The specific interest rate for a particular loan depends on the type of loan and the loan disbursement year. Repayment options for federal student loans are flexible, offering various plans to suit individual circumstances. These options typically include standard repayment, extended repayment, graduated repayment, and income-driven repayment plans. Income-driven repayment plans, in particular, are designed to make monthly payments more manageable by basing them on your income and family size. Borrowers can also explore loan consolidation to simplify repayment by combining multiple loans into a single loan with a potentially lower interest rate.

Comparison of Federal Student Loan Programs

| Loan Type | Eligibility | Interest Rates (Example – subject to change) | Repayment Options |

|---|---|---|---|

| Federal Stafford Loans (Subsidized & Unsubsidized) | Undergraduate students enrolled at least half-time; demonstrated financial need for subsidized loans. | Variable, set annually by the government. (Check the official Federal Student Aid website for current rates) | Standard, extended, graduated, income-driven |

| Federal PLUS Loans (Parent/Graduate) | Parents of dependent undergraduate students; graduate or professional students; credit check required. | Variable, set annually by the government. (Check the official Federal Student Aid website for current rates) | Standard, extended, graduated |

| Federal Perkins Loans | Undergraduate and graduate students with exceptional financial need; limited funding availability. | Fixed, typically low rate. (Check the official Federal Student Aid website for current rates) | Standard, extended |

| Grad PLUS Loans | Graduate or professional students; credit check required. | Variable, set annually by the government. (Check the official Federal Student Aid website for current rates) | Standard, extended, graduated |

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders, unlike federal student loans which are government-backed. Understanding the differences between these loan types is crucial for making informed borrowing decisions. While private loans can offer flexibility in certain situations, they often come with higher interest rates and less borrower protection compared to federal loans.

Private student loans can be a valuable financial tool, but only under specific circumstances. They are generally not the first choice for financing education due to their potential drawbacks. A careful comparison of federal and private loan options is necessary before committing to either.

Advantages and Disadvantages of Private Student Loans Compared to Federal Loans

Private student loans sometimes offer higher borrowing limits than federal loans, potentially covering expenses that federal aid doesn’t. However, this advantage is often offset by significantly higher interest rates and a lack of the extensive borrower protections offered by federal loans, such as income-driven repayment plans and loan forgiveness programs. Private loans typically require a creditworthy co-signer, which can be a barrier for some students. Federal loans, on the other hand, often have more lenient eligibility requirements. The repayment terms and options for private loans are generally less flexible than those for federal loans.

Situations Where a Private Student Loan Might Be Suitable

A private student loan might be a suitable option when a student has exhausted all federal loan options and still needs additional funding to cover educational expenses. This might occur when the student’s financial need is exceptionally high, or if they are attending a particularly expensive private institution. Another scenario where a private loan might be considered is when a student needs to refinance existing federal loans at a lower interest rate (though this carries its own risks). It’s important to note that careful consideration of the potential risks and drawbacks is crucial before pursuing this route.

Typical Requirements and Application Process for Private Student Loans

The application process for private student loans typically involves completing an online application, providing personal and financial information, and undergoing a credit check. Lenders often require a creditworthy co-signer, especially for students with limited or no credit history. The required documentation may include proof of enrollment, transcripts, and tax returns. The lender will assess the applicant’s creditworthiness, income, and debt-to-income ratio before making a loan decision. Interest rates and terms will vary depending on the lender and the applicant’s credit profile.

Factors Lenders Consider When Assessing a Student Loan Application

Lenders consider several factors when evaluating a student loan application. This assessment aims to gauge the applicant’s ability and willingness to repay the loan.

- Credit Score and History: A higher credit score generally leads to more favorable loan terms. A co-signer with a good credit history can significantly improve the chances of approval.

- Debt-to-Income Ratio: This ratio compares a borrower’s monthly debt payments to their monthly income. A lower ratio suggests a greater capacity to repay the loan.

- Income and Employment History: Stable income and employment history demonstrate the applicant’s ability to make regular loan payments.

- Co-signer’s Creditworthiness (if applicable): The creditworthiness of a co-signer plays a crucial role in the approval process, especially for applicants with limited credit history.

- School and Program of Study: The lender may consider the reputation of the educational institution and the program of study.

Direct vs. Indirect Loans

Direct and indirect student loans represent two distinct pathways for financing higher education. Understanding their differences is crucial for students seeking financial aid, as each type involves unique disbursement processes, repayment terms, and overall management. The key distinction lies in the source of the funds and the relationship between the lender and the borrower.

Direct loans, as the name suggests, are disbursed directly from the government (in the US, this is primarily through the federal government’s programs). Indirect loans, conversely, are facilitated through third-party lenders, such as banks or credit unions, who then provide the funds to the student. This fundamental difference impacts various aspects of the loan process, including interest rates, repayment options, and overall loan management.

Disbursement and Management Differences

Direct loans are generally managed by the government agency responsible for student aid. This often means a more streamlined application process and consistent regulations regarding interest rates, repayment plans, and loan forgiveness programs. Repayment is typically made directly to the government. Indirect loans, on the other hand, involve a third-party lender, leading to potentially more varied application processes, interest rates that can fluctuate based on market conditions, and potentially less flexible repayment options. Repayment is made to the private lender. The management of the loan also differs; direct loans may offer more government-backed protections and support in case of financial hardship. Private lenders may have less stringent guidelines.

Comparison of Direct and Indirect Student Loans

The following table summarizes the key advantages and disadvantages of direct and indirect student loans:

| Feature | Direct Loans | Indirect Loans |

|---|---|---|

| Source of Funds | Government (e.g., Federal Student Aid) | Private lenders (banks, credit unions, etc.) |

| Interest Rates | Generally fixed and often lower than private loans. | Variable or fixed, typically higher than federal loans; subject to market fluctuations. |

| Repayment Options | Various income-driven repayment plans and forgiveness programs often available. | Fewer repayment options; often less flexible. |

| Application Process | Generally simpler and more standardized. | Can be more complex and require a credit check. |

| Pros | Lower interest rates, flexible repayment options, government protections. | Potentially higher loan amounts, may be easier to qualify for with poor credit. |

| Cons | Loan amounts may be limited. | Higher interest rates, less flexible repayment options, no government protections. |

| Examples of Institutions | U.S. Department of Education (Federal Student Aid) | Sallie Mae, Discover Student Loans, private banks and credit unions. |

Parent PLUS Loans

Parent PLUS Loans are federal loans available to parents of dependent undergraduate students to help cover their child’s education expenses. These loans offer a way for parents to contribute financially to their child’s higher education, supplementing other financial aid sources. Unlike other loan types, the parent, not the student, is responsible for repayment.

Parent PLUS loans are designed to fill the gap between a student’s financial aid package and the total cost of attendance. They are not intended to cover the full cost, but rather to bridge the remaining financial need. Eligibility is determined by the parent’s credit history and financial standing.

Parent PLUS Loan Eligibility Criteria

To be eligible for a Parent PLUS loan, a parent must be a U.S. citizen or eligible non-citizen, have a Social Security number, and not have adverse credit history. Adverse credit history is generally defined as a history of serious delinquencies, bankruptcies, or defaults on previous loans. The Department of Education will conduct a credit check to determine eligibility. Parents who are denied a PLUS loan may be able to obtain a loan with an endorser or by providing documentation to mitigate the credit risk. This process ensures responsible lending and helps protect both the borrower and the lending institution.

Responsibilities of Parents with Parent PLUS Loans

Parents who take out Parent PLUS loans are solely responsible for repaying the loan. This includes making timely monthly payments, understanding the terms of the loan, and managing the loan account. Failure to repay the loan can result in serious consequences, including damage to credit scores and potential wage garnishment. It is crucial for parents to carefully consider their financial situation before applying for a Parent PLUS loan and to create a realistic repayment plan. Understanding the loan terms, interest rates, and repayment schedule is essential for responsible financial management.

Interest Rates and Repayment Terms of Parent PLUS Loans

Parent PLUS loans typically carry a higher interest rate compared to other federal student loans, such as subsidized and unsubsidized loans. The interest rate is fixed for the life of the loan, meaning it will not change over time. Repayment typically begins within 60 days of the loan disbursement. While standard repayment plans are available, parents may also be eligible for income-driven repayment plans, which can adjust monthly payments based on income and family size. These plans, however, often extend the repayment period, potentially leading to higher overall interest paid. The specific interest rate and repayment terms are determined at the time of loan disbursement and are subject to change based on market conditions.

Impact of Parent PLUS Loans on Family Finances

Taking out a Parent PLUS loan can significantly impact a family’s financial situation. The monthly payments can strain a household budget, especially if the family has other financial obligations, such as a mortgage, car payments, or other debts. It’s important for families to carefully budget for these payments and to factor them into their overall financial planning. Failure to manage these payments effectively can lead to financial difficulties and potentially negatively impact the family’s credit score. For example, a family struggling to manage multiple debts, including a large Parent PLUS loan, might face difficulties saving for retirement or other long-term financial goals. Thorough planning and responsible borrowing are crucial to mitigate these potential risks.

Ending Remarks

Securing funding for higher education is a significant step, and choosing the right student loan type can significantly impact your financial well-being. By carefully weighing the advantages and disadvantages of federal versus private loans, understanding the intricacies of direct and indirect lending, and considering the implications of Parent PLUS loans, you can create a tailored repayment strategy. Remember to thoroughly research each option and seek professional financial advice to make the most informed decisions for your specific circumstances.

Essential FAQs

What happens if I don’t repay my student loans?

Failure to repay student loans can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Contact your lender immediately if you are experiencing difficulties making payments to explore options like deferment or forbearance.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, refinancing federal loans into private loans may mean losing federal protections like income-driven repayment plans.

What is the difference between a grace period and deferment?

A grace period is a temporary period after graduation where you don’t have to make payments. Deferment is a postponement of payments due to specific circumstances, such as unemployment or enrollment in school.

How do I apply for a student loan?

For federal loans, you’ll complete the FAFSA (Free Application for Federal Student Aid). Private loan applications vary by lender and typically require a credit check and co-signer.