Navigating the complex world of student loans can feel overwhelming, especially when faced with the often-confusing landscape of interest rates. Understanding these rates is crucial, as they significantly impact the total cost of your education and your long-term financial well-being. This guide will demystify student loan interest rates, providing a clear and concise overview of the various factors influencing them and offering practical strategies for managing your loan debt effectively.

From federal loans with their government-set rates to private loans with their variable options, the range of interest rates and repayment plans can be daunting. This exploration will delve into the specifics of different loan types, highlighting the key differences in interest rates and providing you with the tools to make informed decisions about financing your education.

Types of Student Loans

Navigating the world of student loans can feel overwhelming, given the variety of options available. Understanding the differences between federal and private loans, and the nuances within each category, is crucial for making informed borrowing decisions. This section will clarify the key distinctions between these loan types, focusing on interest rates and repayment structures.

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. Private student loans, on the other hand, are provided by banks, credit unions, and other private lenders. The terms and conditions, including interest rates, vary significantly depending on the lender and the borrower’s creditworthiness.

Federal Student Loan Types

Federal student loans are typically categorized into several types, each with its own eligibility requirements and interest rate structure. These rates are set annually by the government and are generally lower than those offered by private lenders.

| Loan Type | Lender | Interest Rate Range (Example Rates – Subject to Change) | Repayment Options |

|---|---|---|---|

| Subsidized Federal Stafford Loan | U.S. Department of Education | Variable; Check the Federal Student Aid website for current rates | Standard, Graduated, Extended, Income-Driven Repayment (IDR) plans |

| Unsubsidized Federal Stafford Loan | U.S. Department of Education | Variable; Check the Federal Student Aid website for current rates | Standard, Graduated, Extended, Income-Driven Repayment (IDR) plans |

| Federal PLUS Loan (Graduate/Parent) | U.S. Department of Education | Variable; Check the Federal Student Aid website for current rates | Standard, Graduated, Extended, Income-Driven Repayment (IDR) plans |

| Federal Perkins Loan | Participating Colleges and Universities | Fixed; Check with the specific institution for current rates | Standard repayment plans; often have longer repayment periods |

Private Student Loan Types

Private student loans are offered by various financial institutions and their interest rates are determined by factors such as the borrower’s credit history, credit score, and co-signer (if applicable). These loans typically lack the same borrower protections as federal loans.

| Loan Type | Lender | Interest Rate Range (Example Rates – Subject to Change) | Repayment Options |

|---|---|---|---|

| Private Student Loan (Undergraduate) | Banks, Credit Unions, Online Lenders | Variable, typically higher than federal loan rates; rates vary widely based on creditworthiness. | Standard, Graduated, potentially other options depending on the lender. |

| Private Student Loan (Graduate) | Banks, Credit Unions, Online Lenders | Variable, typically higher than federal loan rates; rates vary widely based on creditworthiness. | Standard, Graduated, potentially other options depending on the lender. |

| Private Student Loan (Parent Loan) | Banks, Credit Unions, Online Lenders | Variable, typically higher than federal loan rates; rates vary widely based on creditworthiness. | Standard, Graduated, potentially other options depending on the lender. |

Interest Rate Comparison: Federal vs. Private Loans

Generally, federal student loans have lower interest rates than private student loans. This is because the government subsidizes these loans, reducing the risk for lenders. However, the specific interest rate for both federal and private loans can vary based on several factors, including the type of loan, the borrower’s credit history (for private loans), and prevailing market interest rates. For example, a student with excellent credit might secure a lower interest rate on a private loan than a student with a limited credit history. Conversely, a student who qualifies for a subsidized federal loan will likely have a lower interest rate than someone who only qualifies for an unsubsidized federal loan. It’s crucial to shop around and compare offers from multiple lenders to find the best possible terms.

Factors Influencing Interest Rates

Understanding the factors that influence your student loan interest rate is crucial for securing the best possible terms. Several key elements interact to determine the final interest rate you’ll pay, impacting your overall borrowing cost. These factors are not independent; they often influence each other, resulting in a complex calculation.

Several key factors determine the interest rate applied to your student loan. These factors interact in a dynamic way, meaning a change in one can significantly affect the overall rate.

Credit Score

A strong credit history significantly impacts your student loan interest rate. Lenders assess your creditworthiness based on your credit score, considering factors such as your payment history, outstanding debts, and credit utilization. A higher credit score generally indicates lower risk to the lender, leading to a lower interest rate. Conversely, a lower credit score suggests higher risk, resulting in a higher interest rate or even loan denial. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower interest rate compared to a borrower with a fair credit score (650-699).

Loan Type

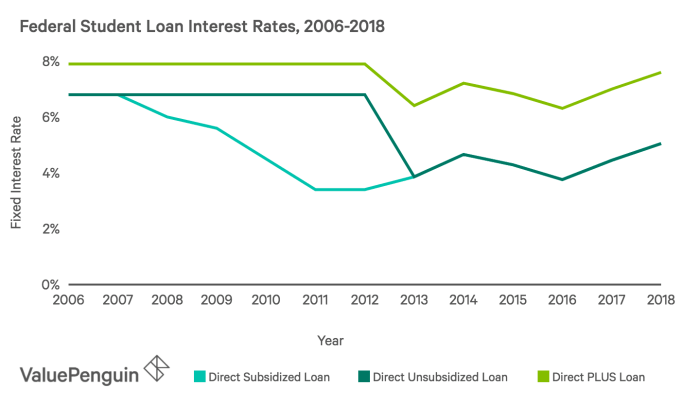

Different types of student loans carry different interest rates. Federal student loans typically have lower, fixed interest rates set by the government, while private student loans often have variable interest rates that fluctuate with market conditions. The type of federal loan also matters; subsidized loans may have lower rates than unsubsidized loans, as the government pays the interest during certain periods. For instance, a Direct Subsidized Loan will generally have a lower interest rate than a Direct Unsubsidized Loan or a private student loan.

Repayment Plan

The repayment plan you choose can indirectly influence your interest rate, although it doesn’t directly change the rate itself. Longer repayment terms, while reducing monthly payments, generally lead to paying more interest overall because interest accrues over a longer period. Shorter repayment plans, conversely, result in higher monthly payments but less total interest paid. Choosing a plan with a longer repayment period might seem attractive initially, but it increases the total amount repaid due to accumulated interest. For example, a 10-year repayment plan will typically result in less total interest paid compared to a 20-year plan, even if the interest rate remains the same.

Flowchart Illustrating Interest Rate Determination

The following flowchart depicts how the factors discussed above interact to determine the final student loan interest rate:

[Imagine a flowchart here. The flowchart would begin with a box labeled “Student Loan Application.” This would branch to three boxes: “Credit Score,” “Loan Type,” and “Repayment Plan.” Each of these boxes would then branch to a box labeled “Interest Rate Calculation.” Finally, the “Interest Rate Calculation” box would lead to a final box labeled “Final Interest Rate.” Arrows would connect the boxes to show the flow of information and influence. The flowchart would visually represent the interplay between credit score, loan type, and repayment plan in determining the final interest rate.]

Current Interest Rate Information

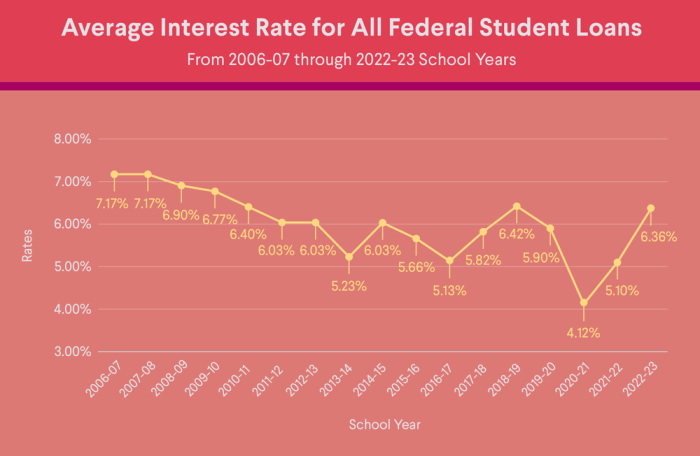

Understanding current student loan interest rates is crucial for prospective and current borrowers. These rates directly impact the total cost of your education and the repayment schedule. Fluctuations in the market and government policies significantly influence these rates, making it essential to stay informed.

The average interest rates for various student loan types vary depending on the lender, the type of loan (federal or private), and the borrower’s creditworthiness. Precise figures change frequently, reflecting broader economic trends. Therefore, it’s vital to consult the most up-to-date sources before making any borrowing decisions.

Federal Student Loan Interest Rates

Federal student loan interest rates are set by the government and are generally lower than private loan rates. These rates are influenced by the 10-year Treasury note yield and are adjusted annually. For example, the interest rate for a Direct Subsidized Loan for undergraduate students in the 2023-2024 academic year might be 5.0%, while the rate for a Direct Unsubsidized Loan might be slightly higher. These rates are fixed for the life of the loan, providing borrowers with predictability in their repayment plans. Official interest rate information can be found on the Federal Student Aid website (studentaid.gov).

Private Student Loan Interest Rates

Private student loan interest rates are determined by individual lenders and are based on several factors, including the borrower’s credit score, credit history, and the loan amount. Unlike federal loans, these rates can be variable or fixed. Variable rates fluctuate with market conditions, while fixed rates remain constant throughout the loan term. A borrower with an excellent credit score might secure a lower interest rate compared to someone with a poor credit history. For instance, a private loan might offer an interest rate ranging from 6% to 12%, depending on the borrower’s profile and the lender’s policies. Checking the rates offered by various private lenders is crucial before committing to a loan. Individual lender websites will provide their current rates.

Interest Rate Determination and Frequency of Change

Federal student loan interest rates are primarily influenced by the 10-year Treasury note yield, which is a benchmark rate reflecting the cost of borrowing for the U.S. government. Private student loan rates, however, are more complex and are determined by a combination of factors including market interest rates, the lender’s cost of funds, the borrower’s creditworthiness, and the loan amount. Federal rates are typically adjusted annually, while private loan rates can change more frequently, sometimes even monthly, depending on the lender and the type of loan (fixed or variable).

Resources for Up-to-Date Interest Rate Information

Finding the most current interest rate information requires consulting multiple resources. It is essential to confirm the rates with the lender directly before finalizing a loan agreement.

- Federal Student Aid (studentaid.gov): This website provides comprehensive information on federal student loan interest rates.

- Individual Lender Websites: Private lenders such as Sallie Mae, Discover, and others publish their current interest rates on their websites.

- Financial Aid Offices at Educational Institutions: Colleges and universities often have financial aid offices that can provide guidance on student loan options and current rates.

- Independent Financial Advisors: A financial advisor can offer personalized advice and help you navigate the complexities of student loan financing.

Interest Rate Trends and Predictions

Understanding historical trends and projecting future changes in student loan interest rates is crucial for prospective and current borrowers. Fluctuations in these rates directly impact the overall cost of a student’s education and their long-term financial planning. Analyzing past patterns allows for informed decisions and a more realistic assessment of potential repayment burdens.

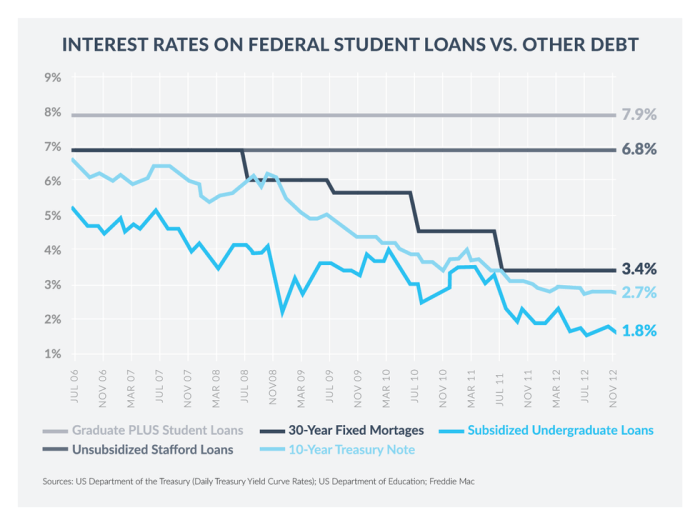

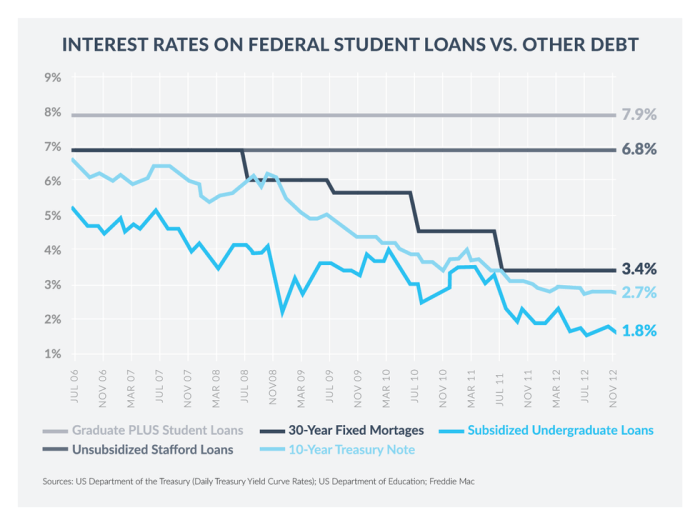

Interest rates on federal student loans are significantly influenced by the broader economic climate and government policy. Historically, these rates have shown a degree of correlation with overall market interest rates, though government intervention and legislative changes often introduce volatility. For example, periods of economic expansion have sometimes, but not always, coincided with higher interest rates, while recessions or periods of economic uncertainty may lead to lower rates as the government seeks to stimulate borrowing and spending.

Historical Trends in Student Loan Interest Rates

Federal student loan interest rates have fluctuated considerably over the past few decades. In the early 2000s, rates were relatively low, but they increased substantially leading up to the 2008 financial crisis. Following the crisis, rates saw a period of relative stability before rising again in recent years. This volatility reflects changes in government policy and broader economic conditions. For instance, the 2008 financial crisis resulted in a temporary reduction of interest rates on federal student loans as a stimulus measure. Conversely, periods of economic growth have sometimes been associated with increases in these rates, though the relationship is not always straightforward due to other intervening factors like changes in government subsidies and loan programs.

Projected Future Interest Rate Changes

Predicting future interest rate changes involves considerable uncertainty. However, several factors can be considered to make a reasoned projection. Current economic conditions, inflation rates, and anticipated Federal Reserve actions are key indicators. If inflation remains elevated, the Federal Reserve might increase interest rates to curb inflation, which could lead to a rise in student loan interest rates as well. Conversely, a period of economic slowdown or recession might lead to lower interest rates across the board, including those on student loans. Furthermore, government policies, such as changes to student loan programs or subsidies, can significantly impact the rates. For example, a government decision to increase subsidies for student loans could lead to a reduction in interest rates, while the opposite could cause rates to increase.

Graphical Representation of Interest Rate Trends

A line graph depicting historical and projected student loan interest rates would show the following: The x-axis would represent time (in years, perhaps spanning the last two decades), and the y-axis would represent the interest rate (as a percentage). The graph would display a fluctuating line, reflecting the historical volatility discussed earlier. Key data points would include significant peaks and troughs corresponding to economic events like the 2008 financial crisis and periods of high inflation. The line would extend into the future, representing a projection based on the aforementioned factors. This projection might show a gradual increase if inflation remains high or a plateau or even a slight decrease if economic conditions weaken. The line would be labeled clearly to distinguish historical data from the projected future rates, possibly using different colors or line styles to enhance clarity. For example, a solid line could represent historical data, while a dashed line could represent the projected future rates. The graph would also include a legend clearly defining each line and its corresponding data. A potential scenario is that the line shows a gradual upward trend from 2000 to 2007, a sharp drop in 2008-2009, a period of relative stability with slight increases until 2015, and a more pronounced increase from 2015 to the present day. The projected future line might show a continuation of this upward trend, but the slope of the line would depend on the assumed economic conditions and government policies.

Impact of Interest Rates on Repayment

Understanding the impact of interest rates on your student loan repayment is crucial for effective financial planning. Higher interest rates significantly increase the overall cost of borrowing, leading to larger monthly payments and a substantially higher total repayment amount over the life of the loan. Conversely, lower interest rates result in lower monthly payments and a reduced total repayment amount.

The effect of different interest rates compounds over time, meaning that even small differences in interest rates can lead to significant variations in the total amount paid back. This is because interest is calculated not only on the principal loan amount but also on the accumulated interest itself. This compounding effect accelerates the growth of the total debt, making it critical to consider the interest rate when choosing a student loan and developing a repayment strategy.

Interest Rate Impact on Monthly Payments and Total Repayment

The following table demonstrates how varying interest rates and loan amounts affect monthly payments and total repayment over a standard 10-year repayment period. These calculations assume a fixed interest rate and consistent monthly payments. Note that actual repayment amounts may vary based on the specific loan terms and repayment plan chosen.

| Loan Amount | Interest Rate | Monthly Payment | Total Repayment |

|---|---|---|---|

| $20,000 | 4% | $190.96 | $22,915.20 |

| $20,000 | 7% | $202.76 | $24,331.20 |

| $40,000 | 4% | $381.92 | $45,830.40 |

| $40,000 | 7% | $405.52 | $48,662.40 |

Comparison of Repayment Plans

Different repayment plans can significantly influence the total interest paid over the life of the loan. For example, a standard repayment plan typically involves fixed monthly payments over a 10-year period. However, income-driven repayment plans adjust monthly payments based on your income and family size, potentially resulting in lower monthly payments but a longer repayment period and higher total interest paid. Extended repayment plans, while offering lower monthly payments, often lead to significantly higher total interest costs due to the longer repayment timeframe. Choosing the right repayment plan depends on individual financial circumstances and priorities. Careful consideration of the trade-off between lower monthly payments and higher total interest costs is essential.

Understanding Loan Terms and Conditions

Navigating the world of student loans requires a thorough understanding of the terms and conditions associated with your loan agreement. Failing to grasp these details can lead to significant financial consequences down the line, impacting your repayment schedule and overall financial well-being. It’s crucial to carefully review all documentation before signing any loan agreements.

Understanding the specific terms and conditions of your student loan is paramount to responsible borrowing and repayment. Key aspects like interest capitalization, deferment options, and repayment plans directly influence the total cost of your education and the long-term financial implications. Ignoring these details can lead to unexpected increases in your loan balance, extended repayment periods, and higher overall interest payments.

Interest Capitalization

Interest capitalization occurs when accumulated interest on your loan is added to your principal balance. This effectively increases the amount you owe, leading to higher future interest charges. For example, if you have a $10,000 loan and accrue $1,000 in interest during a deferment period, capitalization would increase your principal to $11,000. Subsequently, interest will then be calculated on this larger amount, resulting in a higher overall repayment cost. Understanding when and how capitalization occurs is essential for managing your loan effectively.

Deferment and Forbearance Options

Deferment and forbearance are temporary pauses in your loan repayment. Deferment typically requires you to meet specific eligibility criteria, such as returning to school or experiencing unemployment. Forbearance is generally granted at the lender’s discretion and may not require meeting specific criteria. However, interest may continue to accrue during both deferment and forbearance periods, potentially leading to interest capitalization. It is vital to understand the conditions and implications of each option before utilizing them. Careful consideration should be given to the potential impact on the overall loan repayment amount.

Key Terms Related to Student Loan Interest Rates

Understanding the following terms is crucial for managing your student loan debt effectively:

- Principal: The original amount of money borrowed.

- Interest Rate: The percentage of the principal charged as interest over a period of time, usually annually.

- Fixed Interest Rate: An interest rate that remains constant throughout the loan term.

- Variable Interest Rate: An interest rate that fluctuates based on market conditions.

- Annual Percentage Rate (APR): The annual cost of borrowing, including interest and other fees.

- Interest Capitalization: The process of adding accumulated interest to the principal balance.

- Deferment: A temporary postponement of loan payments, often with specific eligibility requirements.

- Forbearance: A temporary postponement of loan payments, typically granted at the lender’s discretion.

- Loan Term: The length of time you have to repay the loan.

- Repayment Plan: The schedule outlining your monthly payments.

Closing Summary

Securing a higher education is a significant investment, and understanding the financial implications is paramount. By carefully considering the factors influencing student loan interest rates, comparing different loan options, and actively managing your repayment plan, you can effectively navigate the complexities of student loan debt and achieve your financial goals. Remember, informed decision-making is key to minimizing your long-term financial burden and maximizing the return on your educational investment.

General Inquiries

What is the difference between fixed and variable interest rates for student loans?

Fixed interest rates remain constant throughout the loan’s life, while variable rates fluctuate based on market conditions. Fixed rates offer predictability, while variable rates might offer lower initial rates but carry more risk.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it usually involves replacing your existing federal loans with private loans, which may come with different terms and conditions. Carefully compare offers before refinancing.

What happens if I don’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in wage garnishment or tax refund offset. Contact your lender immediately if you anticipate difficulties making payments.

How can I reduce my student loan interest payments?

Consider income-driven repayment plans to lower monthly payments, explore loan forgiveness programs, and make extra payments whenever possible to reduce the principal and total interest paid.