Navigating the world of student loans can feel overwhelming, especially when faced with terms like “subsidized.” Understanding the nuances of subsidized student loans is crucial for prospective students and their families, as it significantly impacts long-term financial planning. This exploration delves into the definition, eligibility, benefits, and drawbacks of subsidized loans, offering a comprehensive understanding to help you make informed decisions about your educational financing.

This guide clarifies the key differences between subsidized and unsubsidized loans, highlighting how interest accrual and repayment schedules vary. We will also examine the role of financial need in eligibility, compare subsidized loans to other financial aid options, and discuss the long-term financial implications of choosing this type of loan. By the end, you’ll have a clear picture of what a subsidized student loan entails and how it can impact your financial future.

Definition of Subsidized Student Loans

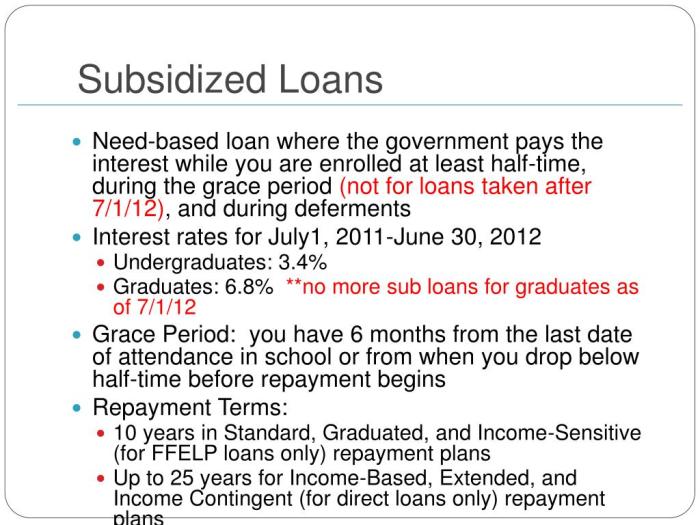

A subsidized student loan is a type of federal student loan where the government pays the interest on the loan while you’re in school and during certain grace periods. This means you don’t accrue any interest during these times, making the overall cost of the loan lower than an unsubsidized loan. Understanding the nuances of subsidized loans is crucial for responsible financial planning during and after your education.

Subsidized federal student loans are designed to help students from lower-income families afford college. Eligibility is determined by the student’s financial need, as assessed through the Free Application for Federal Student Aid (FAFSA). To qualify, a student must demonstrate financial need, be pursuing a degree at least half-time, and maintain satisfactory academic progress. The amount a student can borrow is determined by their financial need and the cost of attendance at their institution. The government sets annual and aggregate borrowing limits. Students who are not enrolled at least half-time, have defaulted on federal student loans, or have already reached their borrowing limit, are not eligible for subsidized loans. These loans are typically offered through the U.S. Department of Education and disbursed by participating lenders.

Institutions Offering Subsidized Student Loans

Subsidized student loans are not offered directly by individual colleges or universities. Instead, they are provided by the federal government through participating lenders. These lenders can be private institutions or government entities, acting as intermediaries to distribute the funds. Examples of institutions that participate in the federal student loan program, thereby indirectly offering subsidized loans, include various banks, credit unions, and the U.S. Department of Education’s own Direct Loan program. The specific lenders available will vary based on location and application timing.

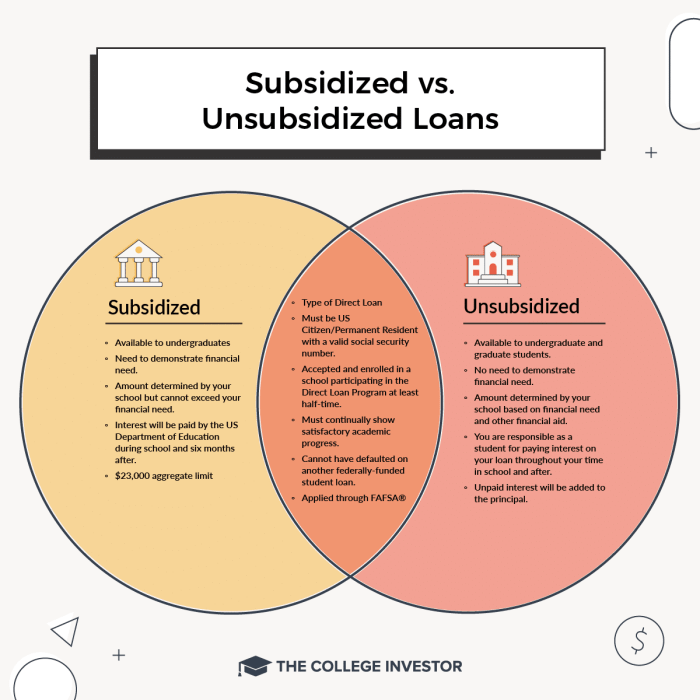

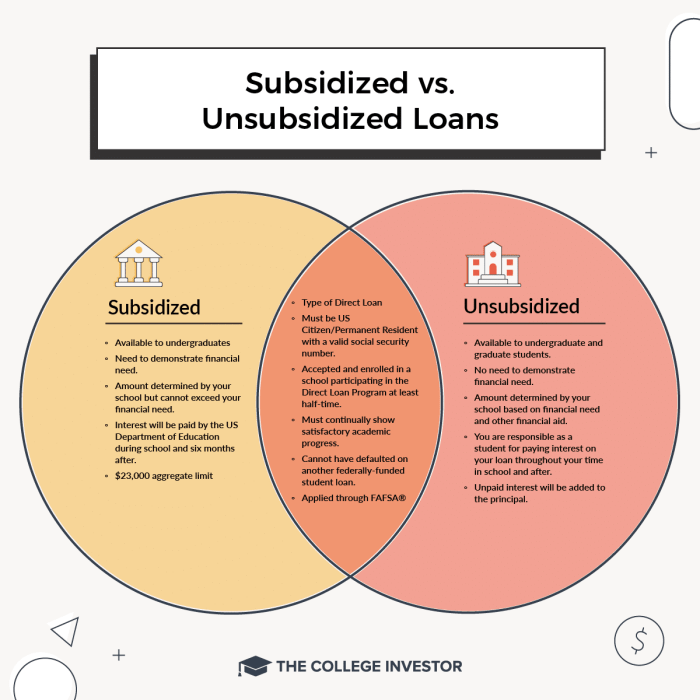

Comparison of Subsidized and Unsubsidized Loans

The following table summarizes the key differences between subsidized and unsubsidized federal student loans. Understanding these differences is vital for selecting the most appropriate loan type based on individual circumstances.

| Feature | Subsidized Loan | Unsubsidized Loan |

|---|---|---|

| Interest Accrual | Interest is not accrued while in school and during grace periods. | Interest accrues from the time the loan is disbursed. |

| Repayment | Repayment begins after a grace period (usually six months after graduation or leaving school). | Repayment begins after a grace period (usually six months after graduation or leaving school). |

| Eligibility | Based on financial need as determined by FAFSA. | Available to all students who meet other eligibility requirements, regardless of financial need. |

| Government Involvement | Directly subsidized by the government; the government pays the interest during certain periods. | Government guarantees the loan, but the borrower is responsible for all interest accrued. |

Interest Accrual and Repayment

Understanding how interest accrues on your subsidized student loan and the repayment options available is crucial for responsible financial management. This section details the interest accumulation process during different phases of your loan and Artikels the various repayment plans.

Interest accrual on subsidized student loans differs significantly depending on the loan’s status. While the government subsidizes the interest during certain periods, meaning they pay it for you, you are still responsible for repaying the principal loan amount plus any accrued interest. Let’s break down the interest accrual during key phases.

Interest Accrual During In-School and Grace Periods

During your in-school period (while you are enrolled at least half-time in an eligible degree program), the government pays the interest on your subsidized loan. This means that no interest is added to your principal loan balance during this time. However, once you leave school, a grace period typically begins. This grace period is usually six months, and during this time, interest begins to accrue on your subsidized loan. You are not required to make payments during the grace period, but the interest continues to accumulate, adding to your overall loan balance. Failing to make payments during the grace period will simply increase the total amount you owe.

Interest Accrual After the Grace Period

Once the grace period ends, you are officially required to begin making loan repayments. Interest continues to accrue on your unpaid principal balance. This means that the longer you delay payments, the more interest will be added to your loan, leading to a higher total repayment amount. It is highly recommended to begin repayment promptly after the grace period concludes to minimize the impact of interest.

Repayment Options for Subsidized Student Loans

Several repayment plans are available for subsidized student loans, each offering varying payment schedules and terms. The best option depends on your individual financial circumstances and repayment goals.

Choosing a repayment plan involves carefully considering factors like your monthly budget, income, and long-term financial projections. Each plan has its own pros and cons, and you might need to weigh them carefully before selecting one.

Comparison of Repayment Plans for Subsidized and Unsubsidized Loans

While the repayment options are largely similar for subsidized and unsubsidized loans, the key difference lies in the interest accrual during the in-school and grace periods. For subsidized loans, the government covers the interest during these periods, whereas for unsubsidized loans, interest accrues from the moment the loan is disbursed, regardless of your enrollment status. This means that the total amount you ultimately repay on an unsubsidized loan will likely be higher than for a subsidized loan of the same amount.

| Feature | Subsidized Loan | Unsubsidized Loan |

|---|---|---|

| Interest during in-school | Government pays | Accrues |

| Interest during grace period | Accrues | Accrues |

| Repayment plans | Standard, Extended, Graduated, Income-Driven | Standard, Extended, Graduated, Income-Driven |

| Total repayment amount | Generally lower | Generally higher |

Step-by-Step Guide to the Loan Repayment Process

Navigating the loan repayment process can feel overwhelming, but breaking it down into steps simplifies the task.

- Understand your loan terms: Review your loan documents to understand your loan amount, interest rate, repayment schedule, and repayment plan.

- Choose a repayment plan: Select a repayment plan that aligns with your financial capabilities. Explore the options available and choose the one that best suits your needs.

- Make your first payment: Make your first payment on time to avoid late fees and negative impacts on your credit score.

- Monitor your payments: Track your payments regularly and ensure they are processed correctly. Keep records of all transactions related to your student loan.

- Explore options if you struggle: If you encounter financial difficulties, contact your loan servicer to discuss options like deferment or forbearance.

Eligibility Requirements

Eligibility for subsidized federal student loans hinges on several key factors, primarily focusing on the student’s demonstrated financial need and enrollment status. The process aims to ensure that federal funds are directed towards students who genuinely require financial assistance to pursue higher education. Understanding these requirements is crucial for prospective borrowers to determine their chances of receiving a subsidized loan.

Financial need plays a central role in determining eligibility. The government assesses a student’s financial need based on their family’s income, assets, and the cost of attendance at their chosen institution. This assessment is typically done using the Free Application for Federal Student Aid (FAFSA). Students with greater financial need are more likely to qualify for subsidized loans. The amount of the loan offered will also be influenced by the demonstrated need, with those in greater need potentially receiving larger loan amounts.

Factors Determining Eligibility

Several factors contribute to the overall eligibility determination. These factors are carefully considered to ensure fair and equitable distribution of federal student aid funds. It’s important to note that eligibility criteria can change, so it’s always advisable to check the latest guidelines from the U.S. Department of Education.

- U.S. Citizenship or Eligible Non-Citizen Status: Applicants must be U.S. citizens or eligible non-citizens to qualify for federal student aid.

- High School Diploma or GED: Generally, a high school diploma or its equivalent is required for eligibility.

- Enrollment Status: Students must be enrolled at least half-time in an eligible degree or certificate program at a participating institution.

- Satisfactory Academic Progress: Maintaining satisfactory academic progress (SAP) is a crucial requirement. This typically involves meeting minimum grade point average (GPA) and course completion requirements set by the institution.

- Financial Need: As previously mentioned, demonstrating financial need through the FAFSA is paramount. This involves providing detailed information about family income, assets, and the cost of attendance.

- Selective Service Registration (for Male Students): Male students between the ages of 18 and 25 are generally required to register with Selective Service.

- No Default on Previous Federal Student Loans: A history of defaulting on previous federal student loans will typically disqualify an applicant.

Examples of Situations Affecting Eligibility

Several scenarios can impact a student’s eligibility for subsidized loans. Understanding these potential roadblocks can help students proactively address any challenges and increase their chances of approval.

- High Family Income: Students from families with high incomes may not meet the financial need requirements, reducing their chances of receiving subsidized loans. For example, a family earning significantly above the national median income might not qualify.

- Failure to Maintain Satisfactory Academic Progress: If a student’s GPA falls below the institution’s minimum requirement, or if they fail to complete a sufficient number of credits, their eligibility for further aid, including subsidized loans, could be jeopardized.

- Previous Loan Default: Having defaulted on a previous federal student loan will almost certainly disqualify a student from receiving additional subsidized loans. This highlights the importance of responsible loan management.

- Incomplete or Inaccurate FAFSA Information: Providing inaccurate or incomplete information on the FAFSA can lead to delays or denial of financial aid. Accuracy and completeness are crucial.

Benefits and Drawbacks of Subsidized Loans

Subsidized student loans offer significant advantages for students, primarily by reducing the overall cost of higher education. However, like any financial product, they come with limitations that borrowers should carefully consider before accepting them. Understanding both the benefits and drawbacks is crucial for making informed decisions about financing your education.

Advantages of Subsidized Student Loans

The primary benefit of a subsidized federal student loan is that the government pays the interest that accrues while you are enrolled in school at least half-time, during grace periods, and during periods of deferment. This means your loan balance doesn’t grow while you’re focused on your studies. This can lead to significant savings over the life of the loan, especially for longer programs. Furthermore, subsidized loans generally have lower interest rates than unsubsidized loans or private loans, making them a more affordable option for many students. This lower interest rate translates directly to lower monthly payments and less overall interest paid over the repayment period.

Disadvantages of Subsidized Student Loans

While subsidized loans offer substantial benefits, they are not without limitations. The most significant drawback is the eligibility requirements. These loans are only available to undergraduate students who demonstrate financial need, limiting access for some students. The amount a student can borrow is also capped, meaning it might not fully cover the cost of tuition, fees, and living expenses. Additionally, if you are not enrolled at least half-time, the interest will begin to accrue, adding to your loan balance. Finally, while the interest is subsidized during certain periods, it will eventually need to be repaid, contributing to the overall cost of your education.

Comparison with Other Forms of Student Financial Aid

Subsidized loans offer a distinct advantage over unsubsidized loans because of the interest subsidy. Compared to grants, which do not need to be repaid, subsidized loans require repayment but offer a more accessible source of funding for those who do not qualify for sufficient grant money. Private loans, on the other hand, often come with higher interest rates and less favorable repayment terms than federal subsidized loans. Therefore, subsidized loans often represent a middle ground: they require repayment, but the government assistance makes them more manageable than other options.

Pros and Cons of Subsidized Student Loans

| Pros | Cons |

|---|---|

| Lower interest rates than unsubsidized or private loans | Eligibility requirements based on financial need |

| Government pays interest during certain periods (enrollment, deferment) | Loan amount may not cover all education expenses |

| Can significantly reduce overall loan cost | Interest accrues if not enrolled at least half-time |

| More affordable than many private loan options | Requires repayment, unlike grants |

Subsidized Loans vs. Other Financial Aid Options

Choosing the right financial aid for college can feel overwhelming. Understanding the differences between subsidized loans, unsubsidized loans, grants, and scholarships is crucial for making informed decisions about financing your education. This section will clarify these differences, focusing on how subsidized loans compare to other options.

Subsidized Loans Compared to Unsubsidized Loans

Subsidized and unsubsidized loans are both federal student loans, but they differ significantly in how interest is handled. With subsidized loans, the government pays the interest while you’re in school (at least half-time), during grace periods, and during periods of deferment. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This means you’ll owe more overall with an unsubsidized loan, even if you make no payments while in school. The application process is largely the same, with both requiring the FAFSA (Free Application for Federal Student Aid), but eligibility for subsidized loans is need-based, unlike unsubsidized loans which are available to all eligible students.

Subsidized Loans Compared to Grants and Scholarships

Grants and scholarships represent “free money” for college, meaning they don’t need to be repaid. Subsidized loans, on the other hand, are borrowed money that must be repaid with interest. Grants are typically awarded based on financial need, determined through the FAFSA, while scholarships can be merit-based, need-based, or both. The application processes differ considerably. Grants are usually awarded automatically based on your FAFSA information, while scholarships often require separate applications through individual institutions, organizations, or companies. The amount you can receive from grants and scholarships is generally limited, while subsidized loan amounts are determined based on your cost of attendance and financial need.

Application Processes: Subsidized Loans and Other Financial Aid

The primary application for subsidized loans, as well as many grants, is the FAFSA. This application collects information about your income, assets, and family size to determine your eligibility for federal student aid. Once your FAFSA is processed, your school will determine your eligibility for subsidized loans and any federal grants you qualify for. Scholarship applications are far more varied. Some are simple online forms, while others require essays, transcripts, and letters of recommendation. There’s no single application process for scholarships; each opportunity has its own requirements.

Decision-Making Process: Subsidized Loans vs. Alternative Financial Aid

The following flowchart Artikels a simplified decision-making process for choosing between subsidized loans and other financial aid options:

[Imagine a flowchart here. The flowchart would begin with a box labeled “Need Financial Aid for College?”. A “Yes” branch would lead to a diamond labeled “Have you exhausted all grant and scholarship opportunities?”. A “Yes” branch from the diamond would lead to a box labeled “Consider subsidized loans”. A “No” branch from the diamond would lead to a box labeled “Apply for grants and scholarships”. A “No” branch from the initial question would lead to an end point. Each box and diamond would be clearly labeled with appropriate yes/no branches.]

This flowchart illustrates the prioritization of grants and scholarships due to their non-repayable nature. Subsidized loans should be considered only after exhausting other free financial aid options. The actual process may be more complex, involving multiple applications and financial aid offers.

Impact on Long-Term Financial Planning

Subsidized student loans, while offering immediate financial relief for higher education, carry significant long-term financial implications. Understanding these implications and proactively managing the debt is crucial for achieving long-term financial stability. Failure to do so can lead to considerable financial strain, impacting major life goals such as homeownership, starting a family, and retirement planning.

The most immediate impact is the monthly loan repayment. This consistent outflow of funds can restrict spending on other important areas, potentially delaying significant purchases or investments. The total amount repaid, including interest, often significantly exceeds the initial loan amount, highlighting the importance of strategic repayment planning. Moreover, the length of the repayment period influences the total interest paid, with longer repayment plans resulting in higher overall costs. A comprehensive understanding of these factors is essential for informed financial decision-making.

Student Loan Debt Management Strategies

Effective management of student loan debt requires a proactive approach. This involves creating a realistic budget that incorporates loan repayments, exploring various repayment plans offered by loan servicers, and considering income-driven repayment options. Prioritizing high-interest loans for early repayment can significantly reduce the overall interest burden. Additionally, actively monitoring loan accounts and maintaining open communication with lenders is vital to prevent unforeseen complications. Budgeting apps and financial planning tools can prove invaluable in tracking expenses and progress towards loan repayment goals. For example, using a budgeting app to track expenses and allocate funds towards loan repayments can help visualize progress and stay motivated.

Impact on Credit Scores and Future Borrowing

Student loan debt significantly influences credit scores. Consistent and timely repayments positively impact creditworthiness, while missed or late payments can severely damage credit scores. A strong credit score is crucial for securing favorable interest rates on future loans, such as mortgages or auto loans. Conversely, a poor credit score due to mismanagement of student loan debt can result in higher interest rates, limiting access to credit and increasing the overall cost of borrowing. For instance, a person with a poor credit score due to delinquent student loan payments might face significantly higher interest rates on a mortgage, potentially adding tens of thousands of dollars to the overall cost of the home.

Responsible Borrowing and Repayment Planning

Responsible borrowing and repayment planning for subsidized student loans starts with careful consideration of the loan amount and its potential long-term impact. It’s crucial to borrow only the necessary amount and explore all available financial aid options before taking out loans. Creating a detailed repayment plan before graduation, which incorporates realistic budget projections and potential income levels, is essential. Understanding the terms and conditions of the loan, including interest rates, repayment schedules, and potential penalties for late payments, is equally crucial. Furthermore, actively researching and utilizing available resources, such as government websites and financial literacy programs, can enhance understanding and improve decision-making. For example, thoroughly researching various repayment plans and comparing their implications before committing to one can save significant amounts of money in the long run.

Government Programs and Regulations

The government plays a central role in the subsidized student loan program, acting as both the lender and the regulator. This involvement ensures access to higher education for a broader range of students while also managing the risk associated with lending large sums of money. The complexities of this system are reflected in a web of regulations designed to protect both borrowers and the government’s financial interests.

The federal government, primarily through the Department of Education, establishes and administers the subsidized student loan program. Regulations cover eligibility criteria, interest rates, repayment plans, and default procedures. These policies aim to balance the need for affordable higher education with responsible fiscal management. Key regulations include income limits for eligibility, restrictions on loan amounts, and stipulations for loan forgiveness programs. Compliance with these regulations is crucial for both lending institutions and borrowers. Failure to comply can result in penalties, including fines and legal action.

Subsidized Student Loan Regulations and Policies

Regulations surrounding subsidized student loans are multifaceted and constantly evolving. They dictate who qualifies for subsidized loans, how much can be borrowed, and the terms of repayment. These regulations are intended to prevent abuse of the system while maximizing the program’s benefits for students. For instance, specific criteria determine eligibility, such as demonstrated financial need and enrollment status at an eligible institution. Loan limits are set based on factors like the student’s dependency status and year of study. Repayment plans are designed to be manageable, with options like income-driven repayment to accommodate varying financial circumstances. The government also establishes the interest rate, which can fluctuate based on market conditions.

Recent Changes and Updates to Government Programs

Recent changes to government programs related to subsidized student loans have primarily focused on increasing accessibility and affordability. For example, there have been efforts to simplify the application process, expand eligibility criteria, and introduce new income-driven repayment plans. These changes reflect a continuing government commitment to making higher education more attainable. However, specific details about these changes are subject to ongoing political and economic factors and can vary based on legislation. It’s recommended to consult official government websites for the most up-to-date information.

Timeline of Government Involvement in Subsidized Student Loans

A timeline illustrating the evolution of government involvement in subsidized student loans would show a gradual increase in federal participation over time. Initially, there was limited government involvement in student financing. However, as the cost of higher education rose and access to private loans became limited, the government’s role expanded significantly. The creation of specific programs, like the Higher Education Act, marked key milestones. Subsequent legislative actions and policy changes have further shaped the program’s structure, eligibility requirements, and repayment options. This evolution reflects a shift in policy from a primarily market-driven approach to one with increased government regulation and intervention. Significant expansions and reforms occurred during periods of economic growth and recession, reflecting the government’s attempts to balance access to education with economic realities. Tracking these changes over time provides insight into the complex interplay between educational policy and economic considerations.

Final Summary

Securing a subsidized student loan can be a significant step towards achieving higher education, but it’s vital to approach it with careful consideration. Understanding the eligibility requirements, interest accrual, repayment options, and long-term financial implications is paramount. By weighing the benefits against potential drawbacks and comparing subsidized loans to other financial aid, you can make an informed decision that aligns with your financial goals and long-term well-being. Remember to thoroughly research your options and seek professional advice if needed to ensure responsible borrowing and effective debt management.

Question Bank

What is the grace period for subsidized student loans?

A grace period is typically six months after graduation or leaving school before repayment begins. The exact length might vary depending on the loan program.

Can I lose my subsidized loan eligibility?

Yes, eligibility can be affected by factors such as exceeding the maximum loan amount, failing to maintain satisfactory academic progress, or changes in your financial situation.

How does a subsidized loan affect my credit score?

On-time payments positively impact your credit score; late or missed payments can negatively affect it. Consistent repayment demonstrates responsible financial behavior.

What happens if I don’t repay my subsidized loan?

Failure to repay can lead to consequences such as default, negatively impacting your credit score and potentially leading to wage garnishment or tax refund offset.