Navigating the world of student loans can feel overwhelming, especially when faced with terms like “unsubsidized.” Understanding the nuances of unsubsidized student loans is crucial for responsible financial planning during and after your education. This guide provides a clear and concise explanation of what unsubsidized student loans entail, covering key aspects from interest accrual to repayment strategies and long-term financial implications. We’ll demystify the process, empowering you to make informed decisions about your financial future.

This exploration will delve into the core definition of unsubsidized loans, highlighting their key differences from subsidized loans. We will examine how interest accumulates, both during your studies and afterward, and explore various repayment options available to borrowers. Furthermore, we will address eligibility criteria, application procedures, and the potential long-term impact on your credit and overall financial well-being. Finally, we’ll discuss viable alternatives to unsubsidized loans, offering a holistic perspective on financing your education.

Definition of Unsubsidized Student Loans

Unsubsidized student loans are a type of federal student loan offered to students pursuing higher education. Unlike subsidized loans, interest begins accruing on an unsubsidized loan from the moment the loan is disbursed, regardless of the student’s enrollment status. This means that the borrower is responsible for paying the accumulating interest throughout their education and after graduation. Understanding the nuances of unsubsidized loans is crucial for responsible financial planning during and after college.

An unsubsidized student loan is a loan provided by the federal government to help students pay for college expenses. Interest accrues on the loan from the time of disbursement, even while the student is still in school. The borrower is responsible for all accumulated interest.

Glossary Entry: Unsubsidized Student Loan

An unsubsidized student loan is a type of federal student loan where interest begins accruing immediately upon disbursement, regardless of the borrower’s enrollment status. The borrower is responsible for paying all accumulated interest.

Example Scenario: Unsubsidized Loan in Action

Imagine Sarah borrows $10,000 in unsubsidized student loans to attend college. The interest rate is 5% per year. Even while she’s studying, interest is accumulating on the loan. By the time she graduates four years later, the total amount she owes will be significantly more than the initial $10,000 due to accumulated interest. She will need to repay the principal loan amount plus all the accrued interest.

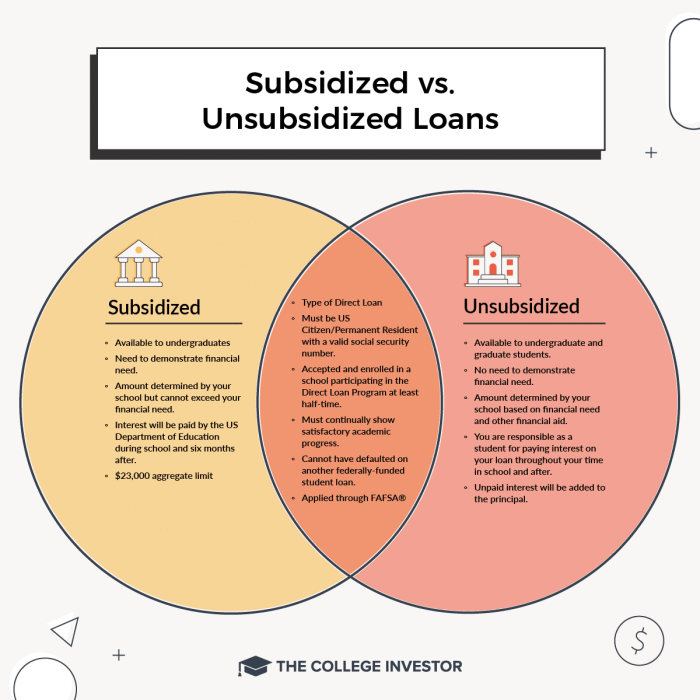

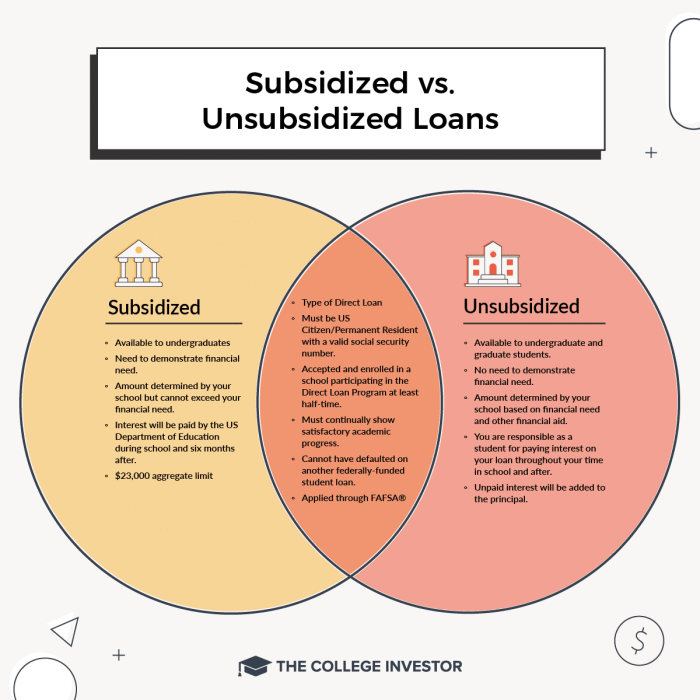

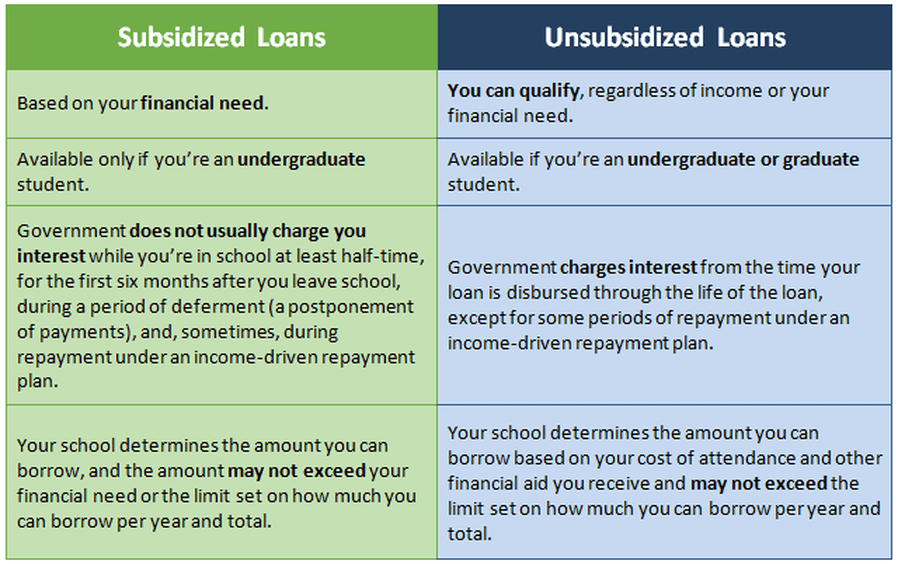

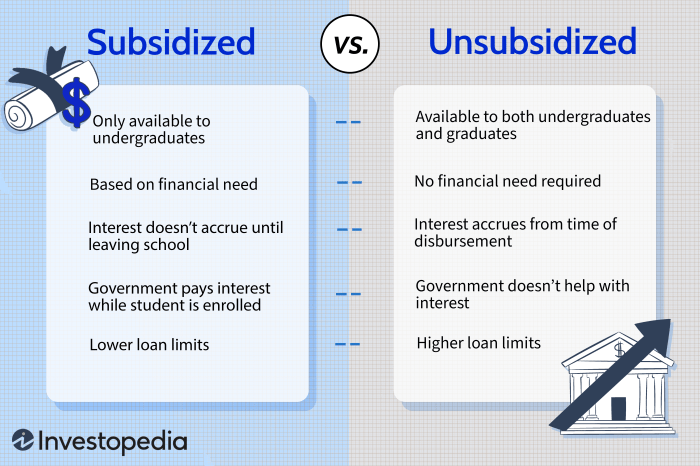

Key Differences Between Subsidized and Unsubsidized Student Loans

The primary difference between subsidized and unsubsidized student loans lies in the accrual of interest. With subsidized loans, the government pays the interest while the student is enrolled at least half-time and during certain grace periods. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, regardless of enrollment status. This means borrowers of unsubsidized loans will owe more upon graduation than the original loan amount. Eligibility for subsidized loans is also based on financial need, while unsubsidized loans are available to all eligible students regardless of their financial situation. This distinction impacts the overall cost of the loan and the repayment burden on the borrower.

Interest Accrual on Unsubsidized Loans

Unsubsidized student loans begin accruing interest from the moment the loan is disbursed, unlike subsidized loans. This means that interest charges accumulate even while you’re still in school, during grace periods, and of course, during the repayment period. Understanding how this interest accrues is crucial for managing your loan debt effectively. The longer the interest accrues, the larger the overall amount you will owe.

Interest accrual on unsubsidized loans during the in-school period operates on a simple principle: interest is calculated daily on the outstanding principal balance. This daily interest is then added to the principal, increasing the amount on which future interest is calculated. This process is called compounding interest. The interest rate for your loan is fixed, determined at the time you take out the loan and remains the same throughout the loan’s life.

Interest Accrual Calculation Example

Let’s say you have a $10,000 unsubsidized student loan with a 5% annual interest rate. To calculate the interest accrued during one year, we first determine the daily interest rate: 5% per year / 365 days = 0.0137% per day (approximately). If we assume a simple calculation ignoring compounding for this example, the daily interest is $10,000 * 0.000137 = $1.37 per day. Over a year, this amounts to $1.37/day * 365 days = $500 approximately. However, it’s important to note that this is a simplified calculation; the actual interest accrued would be slightly higher due to daily compounding. Real-world calculations would use more complex formulas, usually handled automatically by loan servicers.

Interest Accrual During Different Loan Periods

The following table compares interest accrual during different phases of an unsubsidized student loan:

| Loan Period | Interest Accrual | Impact on Loan Balance | Payment Required |

|---|---|---|---|

| In-school | Accrues daily on the principal balance | Increases the principal balance | Generally not required |

| Grace Period | Accrues daily on the principal balance | Increases the principal balance significantly | Generally not required |

| Repayment | Accrues daily on the principal balance | Increases the principal balance, but payments reduce it | Monthly payments are required |

Factors Affecting Interest Accumulation

Understanding the factors that influence how much interest accumulates on your unsubsidized loan is vital for effective financial planning.

- Loan Amount: A larger loan balance results in higher interest charges because the interest is calculated as a percentage of the principal.

- Interest Rate: A higher interest rate directly translates to a greater amount of interest accrued over time.

- Loan Term: Longer loan repayment terms mean more time for interest to accrue, leading to higher total interest paid over the life of the loan.

- Capitalization of Interest: In some cases, unpaid interest during the in-school or grace period might be added to the principal balance. This is called capitalization and significantly increases the total amount owed.

Repayment of Unsubsidized Loans

Repaying unsubsidized student loans is a crucial step after graduation or leaving school. Understanding the available repayment plans and their implications is essential to managing your debt effectively and avoiding potential financial hardship. The process involves choosing a plan that aligns with your financial situation and diligently making payments according to the terms.

Several repayment plans are available for unsubsidized federal student loans, each offering different benefits and drawbacks. The best option depends on your income, financial goals, and overall debt burden. Careful consideration is needed to choose a plan that minimizes long-term costs and aligns with your personal circumstances.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. This plan offers predictable payments, allowing for consistent budgeting. However, the relatively short repayment period may lead to higher monthly payments compared to other plans. For example, a $30,000 loan at a 5% interest rate would have a monthly payment of approximately $317 under this plan.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years, resulting in lower monthly payments. This is beneficial for borrowers with lower incomes or higher debt burdens. However, the longer repayment period leads to significantly higher total interest paid over the life of the loan. Using the same $30,000 loan example, a 25-year extended repayment plan would lower monthly payments, but the total interest paid would be substantially higher.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This can be helpful for borrowers anticipating income growth. However, it is important to understand that payments will increase substantially over the 10-year repayment period. The initial low payments may provide temporary relief, but the increasing payments can become challenging later on.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base your monthly payments on your income and family size. These plans include the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans. IDR plans offer lower monthly payments, often making them more manageable, especially during periods of low income. However, they typically extend the repayment period beyond 10 years, leading to higher total interest paid. The remaining balance may be forgiven after 20 or 25 years, depending on the plan, but this forgiveness is considered taxable income.

Consequences of Loan Default

Failing to make timely payments on your unsubsidized student loans can lead to serious consequences. These include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Defaulting on student loans can significantly impact your financial future, making it difficult to buy a house, rent an apartment, or secure employment in certain fields. It’s crucial to contact your loan servicer immediately if you anticipate difficulty making your payments to explore options like deferment or forbearance.

Applying for Loan Repayment Options

Applying for different repayment plans usually involves the following steps:

- Contact your loan servicer: Identify the company managing your loans and contact them through their website or phone number.

- Gather necessary documents: You may need to provide tax returns, pay stubs, or other documentation to verify your income and family size, particularly for income-driven repayment plans.

- Complete the application: Your loan servicer will guide you through the application process, which may involve completing an online form or submitting paperwork.

- Review your options: Once your application is processed, review the details of your chosen repayment plan and ensure it aligns with your financial situation.

- Make timely payments: Once enrolled in a repayment plan, make consistent and timely payments to avoid default.

Eligibility and Application Process

Obtaining an unsubsidized student loan involves meeting specific eligibility requirements and navigating an application process. Understanding these aspects is crucial for prospective students seeking financial aid for their education.

Eligibility for unsubsidized federal student loans primarily hinges on factors related to the student’s enrollment status and financial need (although need is not a direct requirement for unsubsidized loans). The application process itself is largely streamlined through the Free Application for Federal Student Aid (FAFSA).

Eligibility Criteria for Unsubsidized Student Loans

To be eligible for an unsubsidized federal student loan, applicants must generally meet the following criteria:

- Be a U.S. citizen or eligible non-citizen.

- Have a valid Social Security number.

- Be enrolled or accepted for enrollment at least half-time in an eligible degree or certificate program at a participating institution.

- Maintain satisfactory academic progress as defined by the institution.

- Complete the FAFSA and meet any other requirements set by the institution and/or the federal government.

It’s important to note that while unsubsidized loans don’t require demonstrated financial need, the amount a student can borrow is often capped based on their year in school and overall dependency status. Specific requirements may vary slightly depending on the institution and the type of loan program.

Application Process for Unsubsidized Student Loans

The application process for unsubsidized federal student loans primarily involves completing the FAFSA. Here’s a step-by-step overview:

- Complete the FAFSA: This online application gathers information about your financial situation and educational goals. Accurate and complete information is essential for a smooth process.

- Submit the FAFSA: Once completed, submit your FAFSA electronically. You’ll receive a Student Aid Report (SAR) summarizing your information.

- Receive your Student Aid Report (SAR): Review the SAR carefully for accuracy. Contact the FAFSA help desk if you need assistance or find any errors.

- Accept your loan offer: Your school will notify you of your eligibility for federal student aid, including unsubsidized loans. You will need to accept the loan offer through your school’s financial aid portal.

- Complete Master Promissory Note (MPN): This legally binding document confirms your understanding of the terms and conditions of your loan.

- Loan disbursement: The loan funds will be disbursed directly to your school to cover tuition, fees, and other educational expenses. Disbursement timing varies by school and semester.

Required Documentation for Loan Application

The primary document required for the application is the completed FAFSA. However, depending on your circumstances, additional documentation may be requested. This might include tax returns, W-2 forms, or proof of income for your parents (if you are considered a dependent student). Your school’s financial aid office will provide guidance on any supplementary documentation needed.

Examples of Ineligibility

Several situations can lead to ineligibility for unsubsidized student loans. For instance, a student who fails to meet the satisfactory academic progress requirements set by their institution may be ineligible. Similarly, a student who provides false or misleading information on the FAFSA application will be ineligible. Students who have defaulted on previous federal student loans may also face ineligibility for new loans. Finally, students who are not enrolled at least half-time in an eligible program are generally not eligible for unsubsidized loans.

Impact of Unsubsidized Loans on Overall Finances

Unsubsidized student loans, while offering access to higher education, carry significant long-term financial implications that extend beyond the immediate cost of tuition. Understanding these implications is crucial for responsible financial planning and avoiding potential pitfalls. Careful consideration of interest accrual, repayment strategies, and the overall impact on creditworthiness is essential for navigating the complexities of unsubsidized loan debt.

The long-term financial implications of unsubsidized student loans are substantial. The interest that accrues from the moment the loan is disbursed adds significantly to the principal amount over time, leading to a larger total debt burden upon graduation. This increased debt can delay major life milestones like homeownership, starting a family, or investing for retirement. Moreover, high levels of student loan debt can negatively impact credit scores, potentially limiting access to other forms of credit such as mortgages or auto loans in the future. Careful financial planning and budgeting are vital to mitigate these risks.

Credit Score Impact

Unsubsidized student loans can significantly impact credit scores, both positively and negatively. Responsible repayment behavior, demonstrated through consistent on-time payments, will positively influence credit scores, showing lenders a history of reliable financial management. Conversely, late or missed payments can severely damage credit scores, potentially leading to higher interest rates on future loans and credit applications. For example, a consistently low credit score could result in higher interest rates on a mortgage, increasing the overall cost of homeownership by thousands of dollars over the life of the loan. Maintaining a good credit history through diligent repayment is crucial for long-term financial health.

Budgeting Effectively with Unsubsidized Loan Debt

Effective budgeting is essential for managing unsubsidized loan debt. A comprehensive budget should include all income sources, expenses, and loan repayment amounts. Prioritizing loan repayments alongside essential expenses like housing and food can help minimize the long-term impact of interest accrual. Consider exploring different repayment plans offered by your loan servicer, such as income-driven repayment plans, to find an option that aligns with your financial situation. For example, creating a detailed monthly budget that allocates a specific amount towards loan repayment, even if it’s a small amount, can build good financial habits and contribute to consistent, on-time payments. Tracking expenses and identifying areas for potential savings can free up additional funds for debt reduction.

Illustrative Example of Interest Impact

Imagine a $20,000 unsubsidized student loan with a 6% annual interest rate. Without any payments, the interest accrues daily. After one year, the interest alone would add approximately $1200 to the principal, increasing the total debt to $21,200. After five years, assuming no payments, the interest would accumulate significantly more, resulting in a total amount substantially higher than the initial $20,000. A visual representation would show a graph with time on the x-axis and the total loan amount on the y-axis. The line would start at $20,000 and curve sharply upwards over time, demonstrating the exponential growth of the debt due to compounded interest. This clearly illustrates how quickly interest can inflate the overall loan amount, highlighting the importance of timely repayment.

Alternatives to Unsubsidized Loans

Securing funding for higher education can be a significant challenge, and unsubsidized loans are often a prominent option considered. However, exploring alternatives can lead to more favorable financial outcomes. Understanding the advantages and disadvantages of different funding sources is crucial for making informed decisions about financing your education. This section will examine several alternatives to unsubsidized loans, highlighting their key features and suitability in various circumstances.

Numerous options exist beyond unsubsidized loans to fund higher education. These alternatives range from merit-based and need-based grants and scholarships to savings plans and part-time employment. Carefully weighing the pros and cons of each option is essential to crafting a personalized financial strategy for college.

Comparison of Unsubsidized Loans with Other Financial Aid Options

The following table compares unsubsidized loans with scholarships and grants, highlighting key differences to assist in decision-making. The selection of the most suitable funding option depends heavily on individual circumstances, including financial need, academic merit, and future earning potential.

| Feature | Unsubsidized Loan | Scholarship | Grant |

|---|---|---|---|

| Source of Funds | Federal or private lender | Organizations, institutions, or individuals | Government or institution |

| Requirement | Creditworthiness (often co-signer needed for students) | Academic merit, talent, or specific criteria | Financial need demonstrated through FAFSA |

| Repayment | Required with interest accruing from disbursement | No repayment required | No repayment required |

| Impact on Future Finances | Increases debt burden; affects credit score | No impact on future finances | No impact on future finances |

| Example | A student borrows $10,000 and repays $12,000 over 10 years due to accrued interest. | A student receives a $5,000 scholarship from a university based on academic excellence. | A student receives a $2,000 Pell Grant based on demonstrated financial need. |

Scenarios Where Alternative Financing Might Be More Suitable

Alternative financing options can be more beneficial in specific situations. For instance, a high-achieving student with strong academic credentials might prioritize seeking scholarships to minimize or eliminate the need for loans altogether. Conversely, a student with limited financial resources might focus on applying for grants and exploring work-study programs to supplement their funding. A family that has diligently saved for college through a 529 plan might utilize those funds before considering loans.

Last Point

Securing a higher education is a significant investment, and understanding the financial landscape is paramount. Unsubsidized student loans, while offering access to funding, require careful consideration of their implications. By understanding how interest accrues, exploring diverse repayment plans, and considering alternative funding sources, you can navigate the complexities of unsubsidized loans effectively. Remember, proactive planning and informed decision-making are key to managing your student loan debt responsibly and achieving long-term financial success.

Question & Answer Hub

What happens if I don’t repay my unsubsidized student loan?

Failure to repay your unsubsidized student loan can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action.

Can I refinance my unsubsidized student loan?

Yes, refinancing options exist, potentially allowing you to lower your interest rate or consolidate multiple loans. However, carefully compare offers before refinancing.

Are there any penalties for early repayment of an unsubsidized loan?

Generally, there are no penalties for early repayment of unsubsidized federal student loans.

How does an unsubsidized loan affect my credit score?

On-time payments positively impact your credit score, while missed payments negatively affect it. Consistent repayment demonstrates responsible financial behavior.