Navigating the complexities of student loan repayment can be daunting. Understanding the potential consequences of default is crucial for responsible financial planning. From immediate impacts like damaged credit scores and wage garnishment to long-term repercussions affecting housing, employment, and future financial goals, the ramifications of non-payment are significant and far-reaching. This exploration delves into the various stages of default, offering insights into the legal processes, available resources, and potential strategies for recovery.

This guide provides a comprehensive overview of the potential consequences of failing to repay your student loans, covering immediate effects on credit scores and employment, long-term financial implications, legal actions, and strategies for mitigating the damage. We’ll explore various avenues for assistance and provide practical advice to help you navigate this challenging situation.

Immediate Consequences of Non-Payment

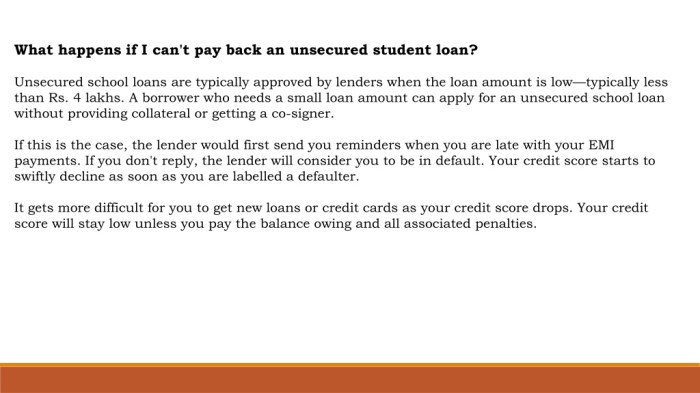

Failing to make your student loan payments triggers a chain reaction of increasingly serious consequences. These consequences can significantly impact your financial well-being and creditworthiness, making it crucial to understand the potential repercussions and explore available options for managing your debt. The immediate actions taken by lenders vary depending on the type of loan and the lender, but several common outcomes are almost certain.

Delinquency on student loans immediately impacts your credit score. Lenders report missed payments to credit bureaus, resulting in a significant drop in your credit score. This negative mark remains on your credit report for seven years, making it harder to secure loans, rent an apartment, or even get a job in certain fields. The severity of the score drop depends on the length and frequency of missed payments. For example, consistently missing payments for several months will lead to a more substantial decline than a single missed payment.

Impact on Credit Scores

A missed student loan payment will result in a negative entry on your credit report. The impact is substantial; even a single missed payment can lower your credit score by dozens of points. Repeated missed payments will lead to a more significant drop, potentially impacting your ability to obtain credit in the future. Credit scoring models consider the payment history of your loans, and consistent delinquency will be heavily weighted negatively. This could make it challenging to qualify for mortgages, auto loans, or even credit cards in the future. A low credit score can also lead to higher interest rates on any future borrowing. Recovering from a severely damaged credit score due to student loan delinquency can take years of diligent repayment and responsible credit management.

Wage Garnishment

After repeated attempts to contact you and secure payment, lenders may resort to wage garnishment. This is a legal process where a portion of your wages is automatically deducted by your employer and sent directly to the lender to satisfy the debt. The amount garnished is typically limited by law, but it can still represent a significant portion of your income, leading to financial hardship. The garnishment process can be initiated by the lender or by a collection agency working on behalf of the lender. Before wage garnishment begins, you will typically receive formal notice, allowing you to attempt to negotiate a repayment plan or explore other options. Failure to respond to these notices will likely accelerate the garnishment process.

Collection Agency Involvement

If you consistently fail to make payments, your student loans may be sold to a collection agency. Collection agencies are third-party companies that specialize in recovering outstanding debts. They employ various strategies to collect the debt, including repeated phone calls, letters, and even legal action. Some collection agencies are known for aggressive tactics, which can be stressful and overwhelming. These tactics may include contacting your family and friends, filing lawsuits, and potentially placing liens on your property. It’s important to remember that you still owe the debt, even if it’s been sold to a collection agency. Negotiating a payment plan with the agency is a possibility, but it’s crucial to document all communication and to understand your rights as a debtor. For example, a collection agency must follow the Fair Debt Collection Practices Act (FDCPA), which prohibits certain harassing or deceptive practices.

Long-Term Financial Ramifications

Defaulting on student loans casts a long shadow, extending far beyond the immediate consequences. The damage inflicted on your credit score can significantly impact your financial well-being for years to come, affecting various aspects of your life, from securing basic necessities to achieving long-term financial goals. Understanding these long-term ramifications is crucial for making informed decisions about managing student loan debt.

The most pervasive long-term effect of student loan default is the severe damage to your credit history. This negative mark can follow you for seven years or more, making it exceedingly difficult to obtain credit in the future. A low credit score acts as a significant barrier, impacting your ability to secure favorable terms on loans and credit cards.

Impact on Obtaining Loans and Credit Cards

A poor credit score, resulting from student loan default, drastically reduces your chances of securing loans at competitive interest rates. Lenders view individuals with damaged credit as high-risk borrowers, leading them to offer loans with significantly higher interest rates or deny loan applications altogether. This can make it incredibly expensive to borrow money for major purchases like a car or home improvements. Similarly, obtaining credit cards becomes challenging, with limited options available, often at high interest rates and with low credit limits. For example, someone with a credit score below 600 might only qualify for a secured credit card requiring a cash deposit, limiting their access to credit.

Challenges in Renting an Apartment or Buying a House

Landlords and mortgage lenders frequently conduct credit checks as part of their screening process. A poor credit history due to student loan default can make it difficult, if not impossible, to secure housing. Landlords might perceive you as a high-risk tenant, less likely to pay rent on time. Mortgage lenders will likely reject your application for a home loan, effectively barring you from homeownership. Even if you manage to find a landlord or lender willing to work with you, you’ll likely face significantly higher deposits or interest rates, making renting or buying a home financially burdensome. A real-life example would be a prospective renter facing a much larger security deposit or being forced to accept a less desirable apartment due to their credit history.

Impact on Employment Opportunities

While not directly related to your job performance, your credit history can sometimes affect your employment prospects. Some employers, particularly those in finance or handling sensitive information, conduct credit checks as part of their background screening. A poor credit score can raise concerns about your financial responsibility and potentially impact your candidacy. Although illegal in many jurisdictions, some employers may use credit reports to make hiring decisions, leading to fewer opportunities for individuals with damaged credit.

Difficulties in Obtaining Insurance

Insurance companies also consider credit history when determining premiums. A poor credit score can result in significantly higher premiums for auto, home, or health insurance. This is because individuals with poor credit are statistically more likely to file claims. The increased cost of insurance can add a considerable financial burden, further impacting your overall financial stability. For instance, someone with a low credit score might pay hundreds of dollars more annually for car insurance compared to someone with excellent credit.

Legal and Governmental Actions

Defaulting on student loans triggers a series of legal and governmental actions designed to recover the outstanding debt. These actions can have significant and lasting consequences on your credit score, financial stability, and even your ability to secure future employment. Understanding these processes is crucial for borrowers facing financial hardship.

The legal process begins when a loan enters default, typically after nine months of non-payment. The Department of Education (or the private lender) will typically attempt to contact the borrower through various methods, including phone calls, emails, and letters. If these attempts are unsuccessful, the next step may involve referring the debt to a collection agency. Collection agencies are authorized to pursue aggressive collection tactics, including repeated phone calls and letters demanding payment. In some cases, lawsuits may be filed to obtain a judgment against the borrower, allowing the lender to garnish wages, seize bank accounts, or place a lien on property. The specific legal actions and their timelines vary depending on the type of loan (federal or private) and the state in which the borrower resides.

Loan Rehabilitation and Forgiveness Programs

Several government programs exist to assist borrowers struggling with student loan repayment. Loan rehabilitation involves making nine on-time payments within 20 days of their due date over a 10-month period. Successful completion of rehabilitation can reinstate the loan to good standing, removing the default status from the credit report. However, this does not eliminate the debt itself. Forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, may eliminate the remaining debt after a specified period of qualifying employment. Eligibility requirements for these programs are stringent and vary depending on the specific program and the type of loan. For example, PSLF requires 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a government or non-profit organization. Teacher Loan Forgiveness requires five years of full-time teaching in a low-income school or educational service agency.

Tax Refund Offset

The government has the authority to offset a portion or all of a borrower’s federal tax refund to repay defaulted student loans. This means that if you owe back taxes, the IRS will intercept your refund and apply it to your outstanding student loan debt. This process occurs automatically and without prior notice, except for a letter from the Department of Treasury indicating the offset. This can leave borrowers with little or no refund, potentially creating further financial difficulties.

State-Specific Legal Repercussions

The legal ramifications of student loan default can vary significantly by state. While federal laws govern many aspects of student loan collection, state laws can influence specific actions like wage garnishment limits or the types of assets that can be seized. The following table provides a simplified comparison, and it’s crucial to consult state-specific legal resources for accurate and up-to-date information.

| State | Legal Action | Timeframe | Impact |

|---|---|---|---|

| California | Wage garnishment, bank levy | Varies, often after judgment | Significant financial hardship, potential impact on credit |

| Texas | Wage garnishment, property lien | Varies, dependent on collection agency and court procedures | Significant financial hardship, potential loss of assets |

| New York | Wage garnishment, tax refund offset | Can begin relatively quickly after default | Significant financial hardship, potential impact on credit and tax refund |

| Florida | Wage garnishment, bank levy, lawsuit | Varies, depending on the lender and legal process | Significant financial hardship, potential impact on credit and assets |

Impact on Future Financial Goals

Defaulting on student loans casts a long shadow over your financial future, significantly hindering your ability to achieve long-term stability and reach key milestones. The immediate consequences, as previously discussed, are severe, but the ripple effects extend far beyond the initial penalties. These long-term implications can profoundly impact your ability to save, invest, and build a secure financial foundation.

The inability to manage student loan debt effectively creates a domino effect that impacts various aspects of financial planning. The constant stress of collections, wage garnishment, and damaged credit scores can significantly divert resources and mental energy from achieving other financial goals.

Impact on Retirement Savings

Defaulting on student loans makes saving for retirement incredibly challenging. The reduced income resulting from wage garnishment or difficulty finding employment directly impacts the amount that can be contributed to retirement accounts. Furthermore, a damaged credit score can limit access to favorable interest rates on retirement investments, reducing the potential for growth. For example, an individual facing wage garnishment might only be able to contribute a small fraction of their income to their 401(k) or IRA, severely impacting their retirement nest egg. This contrasts sharply with someone who diligently manages their student loans, allowing for greater contributions and potentially higher returns.

Impact on Investing

Investing in the future, whether it’s for a down payment on a house, starting a business, or simply building wealth, becomes exceedingly difficult when burdened by defaulted student loans. Lenders are significantly less likely to approve loans to individuals with poor credit, limiting access to capital for investments. Even if loans are approved, the interest rates will likely be substantially higher, increasing the overall cost of borrowing and diminishing returns. Consider the scenario of someone trying to secure a mortgage; a defaulted student loan will likely prevent them from obtaining a favorable interest rate, making homeownership a distant dream.

Difficulties in Achieving Long-Term Financial Stability

Long-term financial stability is essentially unattainable when weighed down by defaulted student loans. The constant threat of legal action, wage garnishment, and the persistent damage to credit scores creates a cycle of financial instability. This makes it difficult to secure better-paying jobs, obtain credit for necessary purchases, and build a solid financial foundation. For instance, an individual with a defaulted loan might struggle to secure a rental agreement, face difficulty in obtaining car insurance, or be denied opportunities for career advancement that require a credit check. This continuous struggle creates a significant barrier to achieving long-term financial security.

Steps to Recover Financially After a Student Loan Default

Recovering from a student loan default requires a proactive and disciplined approach. The process is challenging, but not insurmountable.

It’s crucial to first understand the current status of your loans and the available options for rehabilitation. Contacting your loan servicer directly to explore possibilities like loan rehabilitation or consolidation is the first step. Developing a realistic budget and sticking to it is vital to manage expenses and free up funds for loan repayment. Exploring debt management options, such as credit counseling, can provide guidance and support in navigating the repayment process. Finally, rebuilding credit takes time and effort; consistently paying bills on time and monitoring credit reports are essential steps in this process. It is important to remember that while the road to recovery may be long, consistent effort and adherence to a sound financial plan can lead to a more secure future.

Alternative Solutions and Resources

Facing difficulty in repaying student loans is a significant challenge, but several resources and strategies can help alleviate the burden and prevent further financial distress. Understanding available options and proactively seeking assistance is crucial for navigating this situation effectively. This section will explore various avenues for managing student loan debt, emphasizing practical solutions and their eligibility requirements.

Many resources exist to help individuals struggling with student loan repayment. These range from government programs and non-profit organizations offering counseling and guidance to lenders themselves, who often have various repayment plans available. The key is to actively explore these options and find the best fit for your individual circumstances. Ignoring the problem will only exacerbate the situation.

Available Repayment Plans

Different repayment plans cater to varying financial situations. Understanding the differences is essential for selecting the most suitable option. For instance, a standard repayment plan involves fixed monthly payments over a 10-year period, while an extended repayment plan stretches payments over a longer timeframe, resulting in lower monthly payments but higher overall interest paid. Income-driven repayment plans (discussed in more detail below) adjust payments based on income and family size. Finally, graduated repayment plans start with lower payments that gradually increase over time. The choice depends on your current income, expenses, and long-term financial goals.

Loan Consolidation and Refinancing

Loan consolidation combines multiple student loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment by reducing the number of payments and potentially lowering the monthly payment amount, though it might not always reduce the total interest paid. Refinancing involves replacing existing loans with a new loan from a different lender, often at a lower interest rate, which can save money over the life of the loan. However, refinancing might eliminate certain federal loan benefits, such as income-driven repayment plans, so careful consideration is necessary.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans tie monthly payments to a percentage of your discretionary income. Eligibility typically requires federal student loans and meeting certain income requirements. These plans offer lower monthly payments, and any remaining balance might be forgiven after 20 or 25 years, depending on the specific plan (Public Service Loan Forgiveness (PSLF) is a separate program with additional eligibility requirements). Examples of IDR plans include Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE). The specific terms and conditions vary depending on the plan and the lender. It’s crucial to carefully review the requirements and potential implications before enrolling in an IDR plan. For example, while the lower monthly payments offer immediate relief, the extended repayment period will likely lead to paying more interest overall.

Illustrative Examples of Financial Hardship

Defaulting on student loans can lead to a devastating cycle of financial hardship, impacting various aspects of an individual’s life. Understanding the consequences through real-life scenarios helps illustrate the severity of the situation and the importance of proactive repayment strategies.

Case Study: Sarah’s Financial Struggle

Sarah, a 32-year-old single mother, graduated with a bachelor’s degree in nursing five years ago. She accumulated $70,000 in student loan debt. Initially, she made consistent payments, but a job loss due to unforeseen circumstances and subsequent medical bills for her young child forced her to fall behind. She quickly became overwhelmed by the mounting debt, interest accumulating rapidly, and collection agencies began contacting her. Her monthly income of $3,500 is now barely covering rent, childcare, and essential living expenses. The student loan payments, which were previously $1,200 per month, are now impossible to manage. She has exhausted her savings and is considering selling her car to cover immediate expenses. Her credit score has plummeted, making it difficult to secure new loans or even rent an apartment in the future. She is now facing wage garnishment and potential legal action.

Cumulative Financial Impact of Student Loan Default Over 10 Years

The following visual representation describes the cumulative financial impact of a student loan default over a 10-year period. It highlights the escalating financial difficulties experienced by an individual.

- Year 1: Initial missed payments, late fees accumulate, credit score drops significantly.

- Year 2-3: Debt increases exponentially due to compounded interest, collection agencies become more aggressive. Credit score continues to decline, making it difficult to obtain loans or credit cards.

- Year 4-5: Wage garnishment begins, severely impacting disposable income. Difficulty securing new employment due to poor credit.

- Year 6-7: Bankruptcy becomes a serious consideration. Potential loss of assets, such as a car or home, to satisfy debt.

- Year 8-10: Continued financial instability. Limited access to credit, difficulty renting, and significant stress on personal relationships.

Emotional and Psychological Stress Associated with Student Loan Default

Defaulting on student loans creates significant emotional and psychological distress. The constant pressure of debt collection, the fear of wage garnishment and legal action, and the feeling of failure can lead to anxiety, depression, and feelings of hopelessness. The inability to meet financial obligations can strain personal relationships and negatively impact mental health. The constant worry about finances can affect sleep, appetite, and overall well-being. Individuals may experience shame and embarrassment about their financial situation, leading to social isolation. The long-term impact on mental health can be severe, affecting both personal and professional life.

Wrap-Up

Defaulting on student loans carries severe and lasting consequences, impacting credit scores, employment prospects, and future financial stability. While the path to recovery can be challenging, understanding the potential ramifications and exploring available resources like repayment plans and government programs are crucial first steps. Proactive planning and seeking assistance when needed are vital in mitigating the long-term effects of student loan default. Remember, responsible financial management and early intervention can significantly improve your chances of a positive outcome.

Essential Questionnaire

Can I negotiate a lower payment amount with my lender?

Yes, many lenders are willing to work with borrowers facing financial hardship. Contact your lender directly to discuss options like income-driven repayment plans or forbearance.

What is the statute of limitations on student loan debt?

The statute of limitations on student loans varies by state and loan type. However, it’s crucial to note that federal student loans generally do not have a statute of limitations, meaning the debt can be pursued indefinitely.

Will defaulting on student loans affect my ability to get a security clearance?

Yes, a history of student loan default can negatively impact your ability to obtain a security clearance, as it reflects poorly on your financial responsibility and trustworthiness.

Can I file for bankruptcy to discharge my student loans?

Discharging federal student loans through bankruptcy is extremely difficult and requires demonstrating undue hardship. This is a high bar to meet and requires legal counsel.