Navigating the complexities of graduate school often involves the crucial step of securing funding. Direct PLUS loans offer a significant avenue for graduate students to finance their education, but understanding their intricacies is key to responsible borrowing. This guide delves into the specifics of Direct PLUS loans, providing a clear overview of eligibility, application processes, repayment plans, and potential long-term financial implications. We’ll explore the benefits and drawbacks, comparing them to alternative funding options to empower you with the knowledge needed to make informed decisions about your graduate studies.

From understanding the application process and required documentation to navigating interest rates and repayment options, we aim to demystify the world of Direct PLUS loans. We’ll also discuss strategies for responsible borrowing and managing your loan effectively, emphasizing the importance of budgeting and financial planning for a successful graduate school experience and beyond.

Definition of a Direct PLUS Loan for Graduate Students

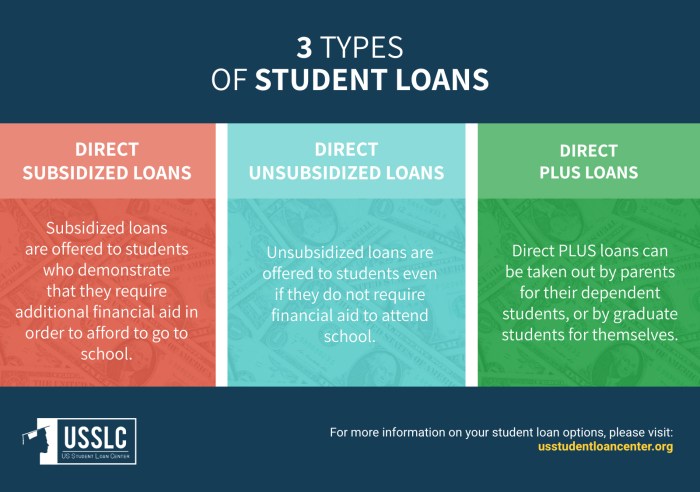

Direct PLUS loans are federal loans available to graduate students to help finance their education. Unlike other loan types, the parent or graduate student themselves is directly responsible for repaying the loan, rather than the student relying on their creditworthiness. These loans offer a crucial funding option for students who may not qualify for other federal student loan programs or need additional financial assistance beyond what grants and scholarships can provide.

The purpose of Direct PLUS loans in graduate education is to bridge the financial gap between a student’s resources and the cost of tuition, fees, and living expenses. They provide a flexible and accessible way for graduate students to pursue their advanced degrees without accumulating significant debt from private lenders who may offer less favorable terms.

Eligibility Criteria for Direct PLUS Loans

To be eligible for a Direct PLUS loan, graduate students must meet several requirements. They must be enrolled at least half-time in a graduate degree program at a participating institution. Furthermore, they must be a U.S. citizen or eligible non-citizen. Crucially, a credit check is conducted, and applicants must demonstrate creditworthiness, though there are some options for those with adverse credit history. Finally, they must complete the PLUS loan application process through the National Student Loan Data System (NSLDS). Failure to meet any of these criteria will result in loan application denial.

Comparison of Direct PLUS Loans and Other Graduate Student Loan Options

Direct PLUS loans differ significantly from other graduate student loan options. Unlike subsidized federal loans, Direct PLUS loans accrue interest from the time the loan is disbursed, meaning the total amount owed grows even before repayment begins. Compared to private loans, Direct PLUS loans generally offer fixed interest rates and a variety of repayment plans, providing greater predictability and potentially more favorable terms. However, private loans may sometimes offer lower interest rates depending on the borrower’s credit score and financial profile. Federal graduate student loans, such as Direct Unsubsidized Loans, often have lower interest rates than PLUS loans but have borrowing limits that may not cover all educational expenses. The choice between loan types depends heavily on individual financial circumstances and risk tolerance.

Key Features of Direct PLUS Loans

| Loan Type | Interest Rate | Repayment Options | Eligibility |

|---|---|---|---|

| Direct PLUS Loan | Variable; determined at loan origination and subject to change. Check the Federal Student Aid website for the current rate. | Standard, extended, graduated, and income-driven repayment plans are available. | U.S. citizen or eligible non-citizen, enrolled at least half-time in a graduate program, meets creditworthiness standards (with potential exceptions for adverse credit history). |

Application Process for Direct PLUS Loans

Applying for a Direct PLUS loan involves several steps, requiring careful attention to detail and adherence to deadlines. The process is designed to ensure responsible lending and to verify the applicant’s creditworthiness. Understanding the steps involved will help streamline the application and increase the chances of approval.

The application process begins with completing the Direct PLUS Loan application, which is accessible online through the National Student Loan Data System (NSLDS) website. This application requires accurate personal information, including your Social Security number, date of birth, and contact information. It also necessitates providing details about your graduate program, including the name of the institution and the expected cost of attendance. The process then involves a credit check and, potentially, the submission of additional documentation.

Required Documentation for Direct PLUS Loan Applications

The required documentation for a Direct PLUS loan application may vary depending on individual circumstances and the lender’s requirements. However, some common documents often requested include proof of identity (such as a driver’s license or passport), proof of enrollment in a graduate program (acceptance letter or enrollment verification), and details about your current financial situation, potentially including tax returns or pay stubs. Providing accurate and complete documentation is crucial for a smooth and timely processing of the application. Failure to provide necessary documentation may lead to delays or denial of the loan.

Credit Check Process for Direct PLUS Loan Applicants

A credit check is an integral part of the Direct PLUS loan application process. The lender will review your credit history to assess your creditworthiness and repayment ability. This involves checking your credit score and reviewing your credit report for any negative marks, such as late payments or bankruptcies. A strong credit history significantly increases the chances of loan approval. Applicants with adverse credit history may still be eligible, but may be required to obtain an endorser, someone who agrees to repay the loan if the applicant defaults. The credit check process helps to determine the level of risk associated with lending money to the applicant. Applicants should be prepared for this evaluation and take steps to improve their credit score if necessary, well in advance of applying for the loan.

Step-by-Step Guide to Completing the Direct PLUS Loan Application

- Complete the PLUS Loan Application: Access the application through the NSLDS website and accurately fill out all required fields. This includes personal information, details about your graduate program, and your financial information.

- Submit Required Documentation: Gather and submit all necessary supporting documents as requested. This may include proof of identity, enrollment verification, and financial documentation.

- Await Credit Check Results: The lender will conduct a credit check. Be aware that this may take some time.

- Address Any Issues: If any issues arise during the credit check process, address them promptly. This may involve providing additional documentation or obtaining an endorser.

- Review Loan Terms and Disbursement: Once approved, carefully review the loan terms, including interest rates and repayment schedules. Understand the disbursement process and how the funds will be released to your institution.

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for your Direct PLUS loan is crucial for effective financial planning during and after your graduate studies. This section details the factors influencing interest rates and explains the various repayment plans available, providing examples to illustrate the differences.

Direct PLUS loan interest rates are variable and are determined by the government based on several factors. The primary factor is the prevailing market interest rate at the time the loan is disbursed. These rates are typically set at the beginning of each federal fiscal year (July 1st) and may fluctuate throughout the year. Additional factors, although less direct, include the overall economic climate and the federal government’s borrowing costs. It’s important to note that the interest rate for your loan will be fixed for the life of the loan once it’s disbursed, meaning it won’t change after you’ve received the funds, even if market rates shift.

Direct PLUS Loan Interest Rate Factors

Several economic factors influence the final interest rate applied to a Direct PLUS loan. The most significant is the overall health of the economy and the government’s cost of borrowing money. Periods of high inflation or economic uncertainty can lead to higher interest rates, while periods of low inflation and economic stability might result in lower rates. While borrowers cannot directly influence these macro-economic factors, understanding their impact helps in anticipating potential interest rate changes.

Repayment Plan Options

Several repayment plans are available for Direct PLUS loans, each offering a different balance between monthly payment amount and total repayment time. Choosing the right plan depends on your individual financial circumstances and post-graduation income expectations. The options generally include Standard, Graduated, Extended, and Income-Driven Repayment (IDR) plans, though the specific availability and terms might vary.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. For example, a $50,000 loan at 7% interest might have a monthly payment of approximately $590, resulting in a total repayment of approximately $70,800.

- Graduated Repayment Plan: Payments start low and gradually increase over time, usually over a 10-year period. This might be appealing initially but leads to significantly higher payments later. Using the same $50,000 loan example, the initial payment might be around $300, escalating to over $800 by the end of the repayment period. The total amount paid will still be around $70,800, however.

- Extended Repayment Plan: This option extends the repayment period to up to 25 years. This significantly lowers monthly payments, but increases the total interest paid over the life of the loan. A $50,000 loan at 7% interest over 25 years could result in a monthly payment of roughly $300, but the total repaid could exceed $85,000.

- Income-Driven Repayment (IDR) Plans: These plans, such as ICR, PAYE, REPAYE, and IBR, base monthly payments on your discretionary income and family size. Payments are typically lower, and any remaining balance might be forgiven after 20 or 25 years, depending on the specific plan. The total interest paid can still be significant, and forgiveness is subject to tax implications.

Interest Capitalization

Interest capitalization is the process of adding accumulated interest to the principal loan balance. This typically happens when you are in deferment or forbearance, periods where you are not required to make payments. The capitalized interest increases the total amount you owe, ultimately leading to higher overall repayment costs. For example, if you have $10,000 in accrued interest during a deferment period, this amount will be added to your principal balance, increasing your future payments and total repayment cost.

Capitalization increases the principal loan amount, thus increasing the total amount of interest paid over the life of the loan.

Managing and Repaying Direct PLUS Loans

Successfully managing and repaying your Direct PLUS loan requires careful planning and proactive engagement with your loan servicer. Understanding your repayment options and potential consequences of missed payments is crucial for avoiding financial hardship. This section details strategies for responsible borrowing and repayment, Artikels the implications of default, and highlights resources available to borrowers facing challenges.

Responsible borrowing begins before you even receive the funds. Carefully consider the total amount you’re borrowing and how it will impact your future finances. Create a realistic budget that incorporates loan repayment alongside your living expenses. Explore different repayment plans to find one that aligns with your income and financial goals. Prioritize paying down high-interest debt first, and consider making extra payments whenever possible to reduce the principal balance and overall interest paid.

Consequences of Defaulting on a Direct PLUS Loan

Defaulting on a Direct PLUS loan has severe repercussions. It negatively impacts your credit score, making it harder to obtain loans, credit cards, or even rent an apartment in the future. The government can garnish your wages or tax refunds to recover the debt. Furthermore, your eligibility for future federal student aid may be jeopardized. In some cases, default can lead to legal action. The impact of default can extend far beyond the immediate financial consequences, affecting various aspects of your personal and professional life.

Resources for Borrowers Facing Repayment Difficulties

Several resources are available to help borrowers facing repayment difficulties. The National Student Loan Data System (NSLDS) provides a centralized location to view your loan information. Your loan servicer can offer various repayment options, such as income-driven repayment plans or deferment and forbearance programs. They can also provide counseling and guidance on managing your debt. Additionally, non-profit credit counseling agencies can offer free or low-cost assistance with developing a repayment plan and negotiating with your loan servicer.

Potential Consequences of Late Payments

The following table illustrates potential consequences of late payments on your Direct PLUS loan. The severity of these consequences can vary depending on the length of the delinquency and your individual circumstances.

| Action | Consequence | Impact on Credit Score | Solution |

|---|---|---|---|

| One late payment | Late payment fee assessed; negative mark on credit report | Minor negative impact; score decrease of 30-50 points | Contact your servicer immediately; explore repayment options; establish automatic payments |

| Multiple late payments | Increased late payment fees; potential referral to collections | Significant negative impact; score decrease of 100+ points | Seek credit counseling; consider an income-driven repayment plan; consolidate loans |

| 90+ days late | Loan may be considered in default; wage garnishment possible | Severe negative impact; significant difficulty obtaining credit | Seek immediate assistance from your servicer or a credit counseling agency; explore rehabilitation programs |

| Default | Legal action; wage garnishment; tax refund offset; damage to credit history | Extremely negative impact; difficulty obtaining credit for years | Seek legal advice; explore debt management options; consider bankruptcy (as a last resort) |

Potential Impact on Graduate Student Finances

Direct PLUS loans can significantly impact a graduate student’s financial well-being, both during and after their studies. Understanding the long-term implications of borrowing is crucial for responsible financial management. Careful consideration of the benefits and drawbacks, coupled with robust budgeting and financial planning, can help mitigate potential risks and maximize the positive aspects of using these loans.

The long-term financial implications of Direct PLUS loans extend far beyond graduation. The interest accrued throughout the repayment period can substantially increase the total amount owed. This can lead to a prolonged repayment schedule, potentially delaying major life milestones such as homeownership, starting a family, or investing in retirement. Furthermore, a high debt burden can affect credit scores, limiting access to future financial opportunities like mortgages or auto loans. The weight of significant loan debt can also create considerable financial stress, impacting overall mental and emotional well-being.

Benefits and Drawbacks of Direct PLUS Loans

Direct PLUS loans offer the advantage of covering educational expenses that may not be fully met by other financial aid options. This can allow students to focus on their studies without the added pressure of significant financial strain. However, the primary drawback is the accumulation of substantial debt, which can hinder financial freedom for years after graduation. The interest rates on PLUS loans are generally higher than those on subsidized federal student loans, further increasing the total repayment cost. Another potential drawback is the possibility of defaulting on the loan, which can severely damage credit scores and have significant legal ramifications.

Budgeting and Financial Planning with Direct PLUS Loans

Effective budgeting and financial planning are paramount when using Direct PLUS loans. Creating a realistic budget that incorporates loan repayment alongside living expenses is crucial. This budget should account for tuition, fees, housing, food, transportation, and other necessary expenses. It’s essential to track spending meticulously and identify areas where expenses can be reduced. Furthermore, exploring different repayment plans and exploring options for loan consolidation or refinancing can help manage debt more effectively. Regularly reviewing and adjusting the budget as circumstances change is vital to ensure long-term financial stability.

Hypothetical Graduate Student Budget

Let’s consider a hypothetical graduate student, Sarah, pursuing a Master’s degree in engineering. Her annual tuition is $20,000, and she receives $10,000 in scholarships. She needs a Direct PLUS loan to cover the remaining $10,000. Her estimated annual living expenses, including rent, food, transportation, and healthcare, are $15,000. Therefore, her total annual budget is $25,000 ($10,000 loan + $15,000 living expenses). To manage this budget effectively, Sarah could explore part-time employment opportunities to supplement her income and reduce her reliance on the loan. She should also actively monitor her spending habits and create a repayment plan to minimize the long-term financial impact of the loan. This proactive approach to budgeting and financial planning will help Sarah navigate her graduate studies and minimize future financial stress.

Alternatives to Direct PLUS Loans

Securing funding for graduate school can be a significant undertaking. While Direct PLUS loans offer a readily available option, they come with their own set of drawbacks, including accruing interest from the moment of disbursement. Exploring alternative funding sources is crucial for graduate students aiming to minimize their debt burden and optimize their financial situation. This section will compare Direct PLUS loans with other funding options, highlighting their advantages and disadvantages to help you make an informed decision.

Several alternatives to Direct PLUS loans exist, each with its own eligibility criteria and application process. Carefully weighing the pros and cons of each option is essential for finding the best fit for your individual circumstances and financial goals. A balanced approach, often combining several funding sources, is usually the most effective strategy.

Comparison of Funding Sources

The following table compares Direct PLUS Loans with other common graduate funding sources. Remember that eligibility criteria and available amounts can vary depending on the institution, program, and individual applicant.

| Funding Source | Application Process | Eligibility | Amount |

|---|---|---|---|

| Direct PLUS Loan | Online application through the Federal Student Aid website; credit check required. | Graduate student status; credit history review. | Varies; up to the full cost of attendance minus other aid received. |

| Scholarships | Varies widely depending on the scholarship; may involve essays, transcripts, and recommendations. | Academic merit, extracurricular activities, demonstrated financial need, or specific demographics. | Varies widely; can range from a few hundred dollars to full tuition coverage. |

| Grants | Application through the institution or external granting agencies; often requires documentation of financial need. | Financial need, academic merit, specific program requirements, or demographic criteria. | Varies widely; can range from a few hundred dollars to full tuition coverage. |

| Graduate Assistantships | Application through the department or program; typically requires strong academic record and relevant skills. | Academic excellence, research skills, teaching experience (depending on the type of assistantship). | Varies widely; often includes tuition remission and a stipend. |

Examples of Alternative Funding Options

Several avenues exist beyond Direct PLUS loans for financing graduate education. Understanding these alternatives can significantly impact your overall financial plan.

- Scholarships: These are merit-based or need-based awards that do not require repayment. Examples include university-sponsored scholarships, externally funded scholarships (e.g., from professional organizations or private foundations), and scholarships based on specific academic achievements or demographic factors. The application processes for scholarships vary widely.

- Grants: Similar to scholarships, grants are typically need-based and do not need to be repaid. Federal Pell Grants, for instance, are need-based and available to undergraduate and some graduate students. Other grants might be offered by government agencies, private foundations, or professional organizations, often focusing on specific fields of study or research areas.

- Assistantships: These are employment opportunities offered by universities to graduate students in exchange for teaching, research, or administrative assistance. They typically include a stipend (salary) and often tuition remission or waivers. The level of support and the nature of the work vary depending on the type of assistantship (teaching assistantship, research assistantship, etc.).

Ending Remarks

Securing funding for graduate school is a significant undertaking, and Direct PLUS loans can be a valuable tool when used responsibly. By carefully weighing the advantages and disadvantages, understanding the application process, and implementing effective repayment strategies, graduate students can leverage these loans to achieve their educational goals without compromising their long-term financial well-being. Remember to explore all available funding options and create a comprehensive financial plan to ensure a successful and sustainable path through graduate studies.

FAQ Resource

What happens if I can’t repay my Direct PLUS loan?

Defaulting on a Direct PLUS loan has serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Explore options like deferment or forbearance if you face repayment difficulties.

Can I consolidate my Direct PLUS loan with other federal student loans?

Yes, you can consolidate your Direct PLUS loan with other federal student loans through a Direct Consolidation Loan. This can simplify repayment by combining multiple loans into one.

Are there any fees associated with Direct PLUS loans?

Yes, there is typically an origination fee, which is deducted from the loan amount at disbursement. The exact amount varies.

What is the difference between a Direct PLUS loan and a Direct Unsubsidized loan?

A Direct PLUS loan is a loan taken out by the parent or graduate student themselves, while a Direct Unsubsidized loan is a loan for the student, with interest accruing from disbursement.