Navigating the world of student loans can feel overwhelming, especially when confronted with varying interest rates. Understanding what constitutes a “low” interest rate is crucial for minimizing long-term debt and making informed financial decisions. This exploration delves into the factors influencing interest rates, providing a clear picture of how to secure the most favorable terms possible.

Several key elements determine whether a student loan interest rate is considered low. These include the prevailing economic climate, the type of loan (federal versus private), and the borrower’s creditworthiness. Historical context is also important, as what was considered a low rate in the past may not be so today. By understanding these factors, prospective borrowers can better position themselves to obtain the most affordable loan options available.

Defining “Low” Student Loan Interest Rate

Determining what constitutes a “low” student loan interest rate is relative and depends on several interconnected factors. It’s not a fixed number but rather a point on a spectrum influenced by prevailing economic conditions, the type of loan, and the borrower’s creditworthiness. A rate considered low in one context might be high in another.

Factors Influencing the Perception of a Low Interest Rate

Several key elements shape whether a student loan interest rate is perceived as favorable. The overall economic climate plays a significant role; during periods of low inflation and low overall interest rates, even a seemingly moderate student loan rate might be deemed acceptable. Conversely, during times of high inflation and rising interest rates, even lower rates may feel burdensome. The type of loan also matters; federal student loans typically offer lower interest rates than private loans due to government subsidies and risk mitigation strategies. Finally, a borrower’s creditworthiness heavily influences the interest rate offered. Individuals with excellent credit scores usually qualify for lower rates than those with poor credit history.

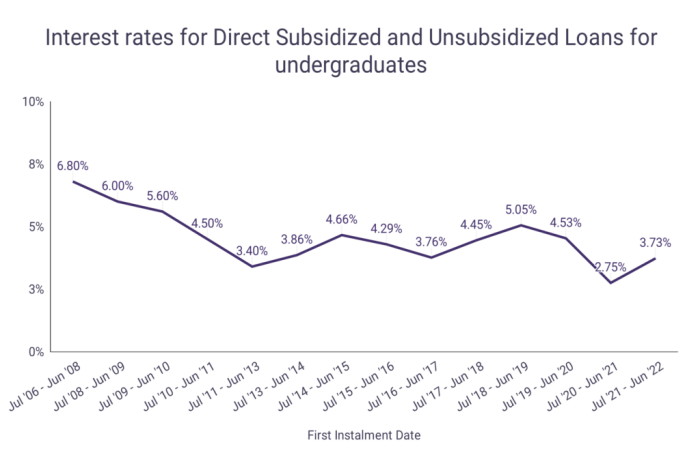

Examples of Interest Rates Considered Low in Different Historical Periods

Historical context is crucial in evaluating student loan interest rates. For example, in the early 2000s, rates around 6% for federal student loans might have been considered reasonable. However, following the 2008 financial crisis, rates dropped significantly, with some federal loans carrying interest rates below 4%. More recently, rates have fluctuated, sometimes exceeding 7% for certain private loan options. These fluctuations highlight the importance of considering the prevailing economic climate when assessing the affordability of a loan.

Comparison of Federal and Private Student Loan Interest Rates

Federal and private student loans differ significantly in their interest rate structures. Federal student loans generally offer lower and more fixed interest rates, reflecting the government’s role in supporting access to higher education. These rates are often tied to benchmark indices, such as the 10-year Treasury note. Private student loans, on the other hand, are offered by banks and other financial institutions. Their interest rates are typically variable, influenced by market conditions and the borrower’s credit profile. As a result, private loan interest rates can fluctuate significantly and may be considerably higher than federal loan rates, especially for borrowers with less-than-perfect credit.

Average Interest Rates Across Various Loan Types

The following table provides a simplified comparison of average interest rates across different types of student loans. Note that these are averages and actual rates can vary depending on the lender, borrower’s creditworthiness, and the specific loan terms.

| Loan Type | Average Interest Rate (Example) | Rate Type | Notes |

|---|---|---|---|

| Federal Subsidized Loan | 4.5% | Fixed | Rates vary by year and loan program |

| Federal Unsubsidized Loan | 5.0% | Fixed | Rates vary by year and loan program |

| Federal Grad PLUS Loan | 6.5% | Fixed | Higher rate due to graduate studies |

| Private Student Loan (Good Credit) | 7.0% – 10.0% | Variable or Fixed | Wide range depending on credit score and lender |

| Private Student Loan (Poor Credit) | 12.0% + | Variable or Fixed | Significantly higher rates for borrowers with poor credit |

Factors Affecting Student Loan Interest Rates

Several key factors influence the interest rate you’ll receive on your student loans. Understanding these factors can help you secure the most favorable terms possible and plan effectively for repayment. These factors interact in complex ways, so it’s beneficial to consider them holistically.

Credit Score’s Role in Determining Interest Rates

Your credit score is a significant factor in determining your student loan interest rate, particularly for private loans. Lenders use credit scores to assess your creditworthiness – essentially, your ability to repay borrowed funds. A higher credit score generally indicates a lower risk to the lender, leading to a lower interest rate. Conversely, a lower credit score suggests a higher risk, resulting in a higher interest rate or even loan denial. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower interest rate than a borrower with a fair credit score (650-699). This difference can translate into substantial savings over the life of the loan.

Loan Term’s Impact on Interest Rate

The length of your repayment period, or loan term, also plays a role in determining your interest rate. Shorter repayment periods generally come with lower interest rates because they represent less risk to the lender. The lender receives their money back quicker, reducing the chance of default or unexpected economic fluctuations impacting repayment. Conversely, longer repayment periods often come with higher interest rates to compensate the lender for the increased risk associated with a longer repayment timeframe. For instance, a 10-year loan might have a lower interest rate than a 20-year loan for the same principal amount.

Lender’s Influence on Interest Rates

The type of lender – federal government or private bank – significantly impacts interest rates. Federal student loans typically offer lower interest rates than private loans. This is because federal loans are backed by the government, reducing the lender’s risk. Private lenders, on the other hand, assess risk more individually, basing their interest rates on factors like your credit score, income, and the loan’s terms. Therefore, a student loan from the federal government will often have a more favorable interest rate compared to a similar loan from a private bank, especially for borrowers with less-than-perfect credit.

Impact of Co-signers on Securing Lower Interest Rates

Adding a co-signer to your student loan application can significantly improve your chances of securing a lower interest rate. A co-signer is an individual who agrees to be responsible for repaying the loan if you default. Their strong credit history and financial stability reduce the lender’s perceived risk, enabling them to offer a lower interest rate. This is particularly beneficial for borrowers with limited or poor credit history who might otherwise struggle to qualify for favorable loan terms. The co-signer effectively shares the responsibility and mitigates the risk for the lender.

Finding and Securing Low Interest Rates

Securing a low student loan interest rate is crucial for minimizing the overall cost of your education. Several factors influence the interest rate you’ll receive, and proactive steps can significantly improve your chances of obtaining favorable terms. This section Artikels strategies to enhance your creditworthiness, effectively compare loan offers, and utilize available resources to find the best possible rates.

Improving Creditworthiness Before Applying for Loans

Strong creditworthiness is a key determinant of the interest rate you’ll qualify for. Lenders assess your credit history to gauge your risk profile. A higher credit score typically translates to lower interest rates.

Strategies to Improve Creditworthiness

Improving your credit score takes time and consistent effort. However, even small improvements can make a difference. Focus on these key areas:

- Pay Bills on Time: Consistent on-time payments are the most significant factor influencing your credit score. Set up automatic payments to avoid missed deadlines.

- Keep Credit Utilization Low: Maintain a low credit utilization ratio (the amount of credit you use compared to your total available credit). Aim to keep it below 30%.

- Maintain a Diverse Credit Mix: A variety of credit accounts (e.g., credit cards, student loans) demonstrates responsible credit management. However, avoid opening multiple accounts in a short period.

- Check Your Credit Report Regularly: Monitor your credit report for errors and take steps to correct them promptly. You can obtain free credit reports annually from AnnualCreditReport.com.

- Consider a Secured Credit Card: If you have limited credit history, a secured credit card (requiring a security deposit) can help build credit responsibly.

Comparing Student Loan Offers

Once you have several loan offers, comparing them carefully is essential to identify the best option. Consider these factors when comparing offers:

- Interest Rate: The annual percentage rate (APR) is the most important factor. A lower APR will significantly reduce your overall loan cost.

- Fees: Compare origination fees, late payment fees, and other potential charges. These can add to the total cost.

- Repayment Terms: Examine the loan repayment terms, including the loan term length and the monthly payment amount. Longer repayment terms generally result in higher total interest paid.

- Deferment and Forbearance Options: Understand the lender’s policies regarding deferment (temporary postponement of payments) and forbearance (temporary reduction in payments).

- Customer Service: Research the lender’s reputation for customer service and responsiveness. A reputable lender will provide clear communication and assistance throughout the loan process.

Resources for Researching Interest Rates and Loan Options

Several resources can help you research student loan interest rates and compare loan options.

- Federal Student Aid (FSA): The FSA website provides comprehensive information on federal student loan programs and interest rates.

- Your College or University’s Financial Aid Office: Your school’s financial aid office can provide guidance on loan options and assist with the application process.

- Independent Financial Advisors: A financial advisor can offer personalized advice on student loan financing based on your individual circumstances.

- Online Loan Comparison Tools: Several websites offer tools to compare student loan offers from different lenders.

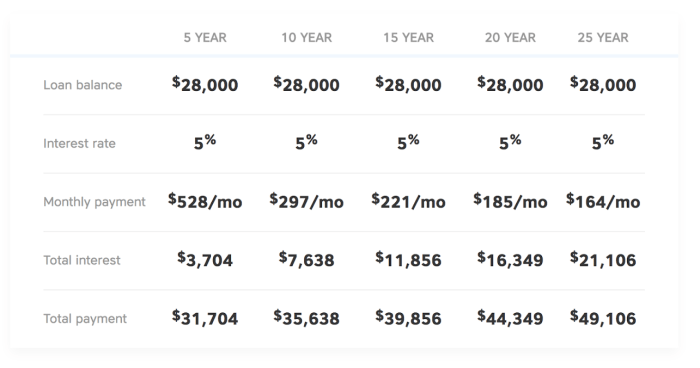

Calculating the Total Cost of a Loan

Accurately calculating the total cost of a student loan, including interest, is essential to understand the true financial commitment.

Calculating Total Loan Cost: The total cost includes the principal amount borrowed plus the accumulated interest. A simple formula for calculating the total interest paid over the life of the loan is not readily available as a single formula, but using an amortization schedule (easily found online with many free calculators) will give you the precise amount.

Total Cost = Principal + Total Interest Paid

For example, a $20,000 loan at 5% interest over 10 years will have significantly higher total interest paid than a $20,000 loan at 3% interest over the same period. Use online loan calculators to model different scenarios and understand the impact of interest rates and loan terms on your overall cost.

The Impact of Low Interest Rates on Repayment

Securing a low student loan interest rate can significantly impact the total cost of your education. A lower interest rate translates directly to less money paid in interest over the life of the loan, resulting in substantial long-term savings. Understanding this impact is crucial for making informed borrowing decisions.

Lower interest rates reduce the total amount repaid over the life of the loan by decreasing the amount of interest accrued. This means that a larger portion of your monthly payment goes towards the principal balance, leading to faster loan payoff and significant savings. The difference can be substantial, particularly for larger loan amounts and longer repayment periods.

Lower Interest Rates and Total Repayment

The effect of a lower interest rate on total repayment is most easily seen through comparison. Consider two scenarios: a $30,000 loan with a 5% interest rate and the same loan with a 3% interest rate, both repaid over 10 years. The lower interest rate will dramatically reduce the total amount paid. While the exact figures depend on the specific repayment plan, the difference in total interest paid can easily reach several thousand dollars.

Examples of Long-Term Savings

Let’s illustrate with concrete examples. Assume a $20,000 student loan. With a 7% interest rate over 10 years, the total repayment could exceed $27,000. However, with a 4% interest rate, the total repayment might be closer to $24,000. This represents a savings of approximately $3,000 simply by securing a lower interest rate. Similarly, a $50,000 loan could see even more substantial savings – potentially thousands of dollars – depending on the interest rate difference and repayment period.

Repayment Plans and Interest Rate Effects

Different repayment plans, such as standard, graduated, and extended repayment, influence monthly payments and total interest paid. A lower interest rate benefits all plans. For instance, with a standard repayment plan, a lower rate reduces the monthly payment, making it more manageable. With a graduated plan, the lower rate reduces the overall interest paid, even though early payments might be lower. Extended repayment plans benefit from lower rates by minimizing the total interest accumulated over the longer repayment period.

Comparison of Total Repayment Amounts at Varying Interest Rates

The following table illustrates the difference in total repayment amounts for a $25,000 loan repaid over 10 years with varying low interest rates. Note that these are simplified examples and actual figures may vary slightly depending on the lender and specific repayment plan.

| Interest Rate | Monthly Payment (approx.) | Total Interest Paid (approx.) | Total Repayment (approx.) |

|---|---|---|---|

| 3% | $250 | $2,600 | $27,600 |

| 4% | $260 | $3,900 | $28,900 |

| 5% | $270 | $5,200 | $30,200 |

| 6% | $280 | $6,600 | $31,600 |

Illustrative Scenarios

Understanding the impact of interest rates on student loan repayment requires examining real-world examples. The following scenarios illustrate how different borrower profiles and loan terms can lead to significantly varying interest rates and overall repayment costs.

Scenario: Low Interest Rate

A borrower, Sarah, a 24-year-old software engineer with an excellent credit score (780) and a stable income, applied for a federal student loan to pursue a master’s degree in data science. Due to her strong credit history and the favorable terms of the federal Direct Unsubsidized Loan program, she secured a low interest rate of 3.76%. This rate reflects her responsible financial management and the government’s aim to offer competitive rates to creditworthy borrowers. The loan amount was $30,000, and the repayment period was 10 years.

Scenario: Higher-Than-Average Interest Rate

In contrast, David, a 22-year-old recent college graduate with a limited credit history and a part-time job, faced a different situation. He needed a private student loan to cover remaining undergraduate expenses. Because of his thin credit file and less stable income, he was offered a higher interest rate of 9.5% on a $25,000 private loan with a 10-year repayment term. This higher rate reflects the increased risk perceived by the private lender due to David’s financial profile. The lender compensated for the higher risk by charging a higher interest rate.

Comparison of Total Interest Paid

The following illustrates the significant difference in total interest paid over a 10-year period between a loan with a 3% interest rate and a loan with a 7% interest rate, both for a $30,000 loan principal. This is a simplified illustration and does not include factors like compounding frequency which can slightly alter the final amounts.

- 3% Interest Rate Loan: A visual representation would show a relatively small area representing the total interest paid. This would be significantly less than the area representing the principal amount. Let’s assume, for illustrative purposes, a total interest paid of approximately $4,500 over 10 years.

- 7% Interest Rate Loan: A visual representation would show a much larger area dedicated to the total interest paid, a significantly larger portion compared to the principal amount. In this example, the total interest paid could be approximately $10,500 over the same 10-year period. This demonstrates how a seemingly small difference in interest rates can lead to a substantial increase in the overall cost of the loan.

Final Conclusion

Securing a low student loan interest rate requires proactive planning and a thorough understanding of the lending landscape. By improving credit scores, carefully comparing loan offers, and utilizing available resources, borrowers can significantly reduce their overall repayment burden. Remember, a seemingly small difference in interest rates can translate into substantial savings over the life of the loan, impacting financial well-being for years to come. The effort invested in securing a low rate is an investment in your future financial health.

FAQ

What is the average student loan interest rate?

The average interest rate varies depending on the loan type (federal or private), the borrower’s creditworthiness, and the current economic climate. There’s no single “average” that applies universally.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it involves replacing your existing loan with a new one. Carefully compare offers and ensure the new terms are beneficial before refinancing.

What happens if I miss a student loan payment?

Missing payments can severely damage your credit score, leading to higher interest rates on future loans and potential collection actions. Contact your lender immediately if you anticipate difficulty making payments.

How long does it take to repay student loans?

Repayment periods vary depending on the loan type and repayment plan chosen. Standard repayment plans typically last 10 years, but other options may extend the repayment period.