Navigating the world of student loans can feel overwhelming, especially when faced with the complexities of subsidized versus unsubsidized options. Understanding the nuances of unsubsidized student loans is crucial for prospective students and their families, as these loans significantly impact long-term financial planning. This guide provides a comprehensive overview, clarifying key aspects such as interest accrual, repayment options, and the potential long-term effects on credit history.

This exploration delves into the intricacies of unsubsidized federal student loans, comparing them to other federal loan programs and highlighting the importance of informed decision-making. We will examine the application process, explore strategies for managing interest, and discuss the consequences of default, equipping readers with the knowledge needed to make responsible borrowing choices.

Definition and Key Characteristics of Unsubsidized Student Loans

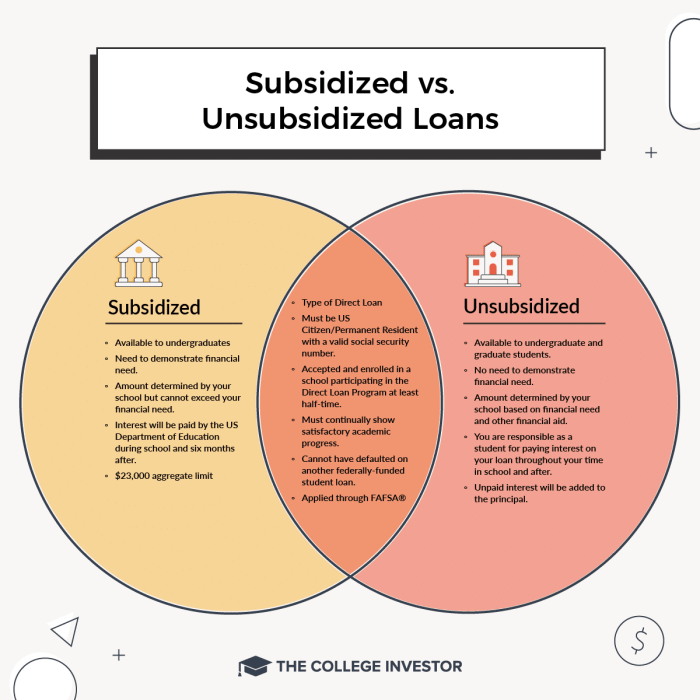

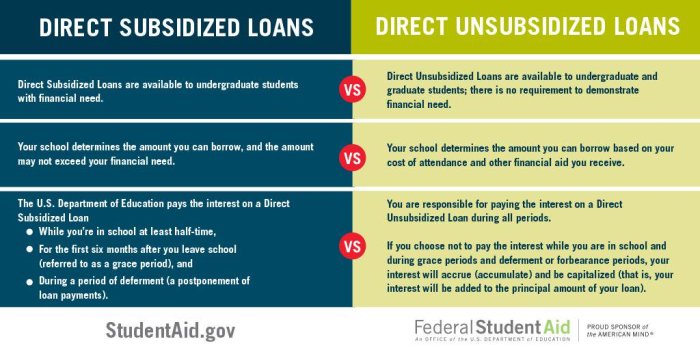

Unsubsidized student loans are a type of federal student loan offered to undergraduate and graduate students to help finance their education. Unlike subsidized loans, interest begins to accrue on unsubsidized loans from the moment the loan is disbursed, even while the student is still in school. This is a key difference that significantly impacts the total amount repaid.

Core Features of Unsubsidized Student Loans

Unsubsidized loans offer a fixed interest rate, determined at the time the loan is disbursed. This rate is set annually by the federal government and remains consistent throughout the life of the loan. Borrowers are responsible for repaying both the principal and the accumulated interest. The loan amount is determined by the student’s financial need, cost of attendance, and other factors as determined by the lender. Repayment typically begins six months after the borrower ceases at least half-time enrollment. Various repayment plans are available, offering flexibility to borrowers based on their financial circumstances.

Differences Between Subsidized and Unsubsidized Student Loans

The primary difference lies in interest accrual. With subsidized loans, the government pays the interest while the student is enrolled at least half-time and during certain grace periods. Unsubsidized loans, however, accrue interest from the moment they are disbursed, regardless of enrollment status. This means the total amount owed will be higher with an unsubsidized loan compared to a subsidized loan of the same amount, assuming other factors are equal. Eligibility criteria may also differ slightly, although both are federal loans.

Eligibility for Unsubsidized Student Loans

Eligibility for unsubsidized loans generally requires students to be enrolled at least half-time in a degree program at a participating institution of higher education. Students must complete the Free Application for Federal Student Aid (FAFSA) and meet the basic requirements of the federal student loan program. Credit history is not typically a factor for eligibility, unlike some private loan options. Undergraduate and graduate students are both eligible to apply for unsubsidized loans.

Comparison of Federal Loan Options

| Loan Type | Interest Accrual | Eligibility | Repayment Begins |

|---|---|---|---|

| Unsubsidized Stafford Loan | Accrues while in school | Undergraduate and Graduate Students | 6 months after graduation or leaving school |

| Subsidized Stafford Loan | Does not accrue while in school (at least half-time enrollment) | Undergraduate Students with demonstrated financial need | 6 months after graduation or leaving school |

| PLUS Loan | Accrues while in school | Parents of dependent undergraduate students or graduate students | 60 days after the loan is fully disbursed |

Interest Accrual and Repayment

Unsubsidized student loans begin accruing interest from the moment the loan is disbursed, unlike subsidized loans. This means that interest charges accumulate even while you’re still in school, during grace periods, and during deferment. Understanding how this interest accrues and the various repayment options available is crucial for effective loan management.

Interest accrues daily on the principal balance of your unsubsidized loan. The interest rate is fixed and determined at the time the loan is disbursed; it doesn’t change unless you refinance. This daily interest is added to your principal balance, increasing the overall amount you owe. This is different from subsidized loans, where the government pays the interest while you’re in school (under certain conditions). The longer you delay repayment, the more interest will accrue, significantly impacting your total loan cost.

Interest Capitalization

Interest capitalization occurs when accrued but unpaid interest is added to the principal loan balance. This effectively increases the amount you owe. It typically happens at the end of your in-school period or during periods of deferment. For example, if you have $10,000 in unsubsidized loans and $1,000 in accrued interest at the end of your studies, capitalization would increase your principal to $11,000. Future interest will then be calculated on this higher principal amount, leading to a larger overall debt. Understanding this process is vital as it significantly increases the total cost of the loan over its lifetime.

Strategies for Managing Interest Accumulation While in School

Minimizing interest accumulation during your studies is a smart financial move. Several strategies can help. Making interest-only payments while in school, even small ones, can significantly reduce the total interest accrued over time. This directly reduces the amount that will be capitalized at the end of your studies. Another effective approach is to explore opportunities for subsidized loans, if eligible, to cover part of your educational expenses. By reducing the reliance on unsubsidized loans, you inherently decrease the amount of interest that will accrue. Finally, understanding your loan terms and regularly checking your loan balance online allows for proactive management and early identification of any discrepancies.

Sample Repayment Schedule

The following table illustrates a sample repayment schedule for a $10,000 unsubsidized loan with a 5% annual interest rate, demonstrating different repayment options. Note that these are simplified examples and actual repayment amounts will vary based on your specific loan terms and chosen repayment plan.

| Payment Option | Monthly Payment | Loan Term (Years) | Total Interest Paid |

|---|---|---|---|

| Standard 10-Year Plan | $106.07 | 10 | $2,728.40 |

| Extended 20-Year Plan | $60.06 | 20 | $6,728.40 |

| Aggressive Payoff (Higher Monthly Payments) | $150 | 6.6 | $1,926 |

Note that the longer the repayment period, the lower the monthly payment, but the higher the total interest paid. An aggressive payoff strategy, while requiring higher monthly payments, significantly reduces the overall interest paid. Choosing the right repayment plan depends on your individual financial circumstances and priorities.

Loan Application and Approval Process

Securing an unsubsidized student loan involves a straightforward application process, but understanding the steps and required documentation is crucial for a smooth experience. The process typically involves completing an application form, providing necessary financial information, and undergoing a credit check (for some lenders). The ultimate approval depends on various factors, including your credit history, academic standing, and the lender’s specific criteria.

The application process for unsubsidized student loans generally follows a consistent pattern across different lenders, although specific requirements might vary slightly. Understanding this process allows prospective borrowers to prepare adequately and increase their chances of approval.

Necessary Documentation for Application

Applicants should gather all necessary documentation before initiating the application. This proactive approach minimizes delays and ensures a smoother application process. Failing to provide complete documentation can lead to processing delays or even rejection. The specific documents required may vary slightly depending on the lender, but generally include:

- Completed loan application form: This form usually requires personal information, educational details, and financial information.

- Social Security number: This is essential for verifying your identity and accessing your credit report.

- Driver’s license or other government-issued photo ID: This confirms your identity.

- Proof of enrollment or acceptance: This could be an acceptance letter from your college or university, or a current enrollment verification.

- Federal Student Aid (FAFSA) data: This provides information on your financial need and eligibility for federal aid.

- Tax returns (or parent’s tax returns, if applicable): This demonstrates your financial situation and helps the lender assess your ability to repay the loan.

- Bank statements: These provide information about your financial accounts and assets.

Factors Influencing Loan Approval

Several factors play a crucial role in determining whether a loan application is approved. Lenders carefully evaluate these factors to assess the risk associated with lending money. Understanding these factors allows applicants to improve their chances of securing a loan.

- Credit history: A strong credit history, characterized by responsible borrowing and repayment, significantly increases the likelihood of approval. A poor credit history, including defaults or bankruptcies, may result in loan denial or higher interest rates.

- Income and debt: Lenders consider your current income and existing debt to assess your ability to manage additional debt. A high debt-to-income ratio may negatively impact your chances of approval.

- Academic standing: Maintaining satisfactory academic progress is often a requirement for continued loan eligibility. Poor academic performance may lead to loan cancellation or suspension.

- Co-signer: Having a co-signer with a strong credit history can improve your chances of approval, especially if you have limited credit history or a low credit score. The co-signer assumes responsibility for repayment if you default.

- Type of loan and lender: Different lenders have different criteria and may offer various loan types with varying eligibility requirements. Some lenders might be more lenient than others.

Step-by-Step Application Guide

The application process can be broken down into a series of manageable steps. Following these steps methodically will ensure a smoother and more efficient application.

- Research and select a lender: Compare different lenders and their loan terms to find the best option for your needs.

- Gather required documentation: Collect all necessary documents as listed above.

- Complete the loan application: Fill out the application form accurately and completely.

- Submit the application: Submit your completed application and supporting documents to the lender.

- Await processing and approval: The lender will review your application and notify you of their decision.

- Review loan terms: Carefully review the loan terms and conditions before accepting the loan.

- Sign the loan documents: Once approved, sign the loan documents to finalize the loan agreement.

Impact on Credit History and Financial Aid

Unsubsidized student loans, while offering financial flexibility for higher education, have a significant impact on both a borrower’s credit history and their eligibility for other forms of financial aid. Understanding this dual influence is crucial for effective financial planning during and after college.

Unsubsidized loans directly affect credit history once repayment begins. Consistent on-time payments build positive credit history, improving credit scores. Conversely, missed or late payments negatively impact credit scores, potentially making it harder to secure loans, credit cards, or even rent an apartment in the future. The loan’s repayment history is reported to credit bureaus, becoming a permanent part of the borrower’s credit file. This impact extends beyond the repayment period, potentially influencing financial decisions for years to come.

Unsubsidized Loan Impact on Credit Scores

Consistent on-time payments on unsubsidized loans contribute to a higher credit score, while late or missed payments negatively affect the score. The length of the repayment history also influences the credit score. A longer history of responsible repayment generally leads to a better score. Credit scoring models consider several factors, and the repayment of student loans is a significant one. For example, a borrower who consistently makes on-time payments for five years will likely see a more substantial positive impact on their credit score compared to someone who only has a shorter repayment history. Conversely, a single missed payment can result in a noticeable drop in the credit score.

Relationship with Other Financial Aid

Unsubsidized loans can influence the amount of other financial aid a student receives. Some financial aid programs, such as need-based grants, consider the total amount of student loan debt when determining aid eligibility. A large unsubsidized loan balance might reduce the amount of grant money a student qualifies for. Additionally, some scholarships may have specific eligibility criteria that consider existing debt. For instance, a scholarship might prioritize students with limited existing debt, potentially reducing the likelihood of receiving the award if a student has already taken out significant unsubsidized loans. Therefore, careful planning and budgeting are essential to balance the use of unsubsidized loans with the potential impact on other aid opportunities.

Long-Term Financial Implications

Borrowing unsubsidized loans can have significant long-term financial consequences. The interest accrued on these loans, especially if not paid during the grace period, can substantially increase the total amount owed. This increased debt can impact a borrower’s ability to save for retirement, purchase a home, or achieve other long-term financial goals. For example, a $20,000 unsubsidized loan with a 5% interest rate can accumulate significant interest over 10 years, resulting in a substantially larger repayment amount. This can lead to financial strain and delayed achievement of long-term financial goals. Careful consideration of loan amounts and repayment plans is crucial to mitigate these potential long-term implications.

Incorporating Unsubsidized Loans into a Financial Plan

To successfully incorporate unsubsidized loans into a comprehensive financial plan, borrowers should create a realistic budget that accounts for loan repayments. This involves tracking income and expenses, estimating future earnings, and determining an affordable monthly payment amount. Creating a repayment plan that aligns with one’s financial capacity is crucial to avoid defaults and negative impacts on credit history. Additionally, exploring options like income-driven repayment plans or refinancing can help manage repayment burdens. For instance, a borrower can explore refinancing options after establishing a good credit history, potentially securing a lower interest rate and reducing the overall repayment amount. Proactive financial planning and consistent monitoring of loan repayment are vital to ensure long-term financial stability.

Default and its Consequences

Defaulting on an unsubsidized student loan has serious and long-lasting consequences that can significantly impact your financial well-being. Understanding these repercussions is crucial for responsible loan management and proactive steps to avoid default. The consequences extend beyond simply damaging your credit score; they can affect your ability to secure future loans, rent an apartment, and even obtain employment.

Defaulting on a federal student loan means you have failed to make payments for 270 days (nine months). This triggers a series of actions by the loan servicer and the government, ultimately leading to significant financial and legal ramifications. The severity of these consequences can vary depending on the loan amount and your individual circumstances, but the potential negative impacts are substantial and should be taken very seriously.

Consequences of Student Loan Default

Defaulting on your student loans can lead to a range of negative consequences, impacting your credit score, finances, and even your employment prospects. Your credit score will take a significant hit, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of your paycheck is seized to repay the debt, is a possibility. Furthermore, the government may take legal action, including lawsuits and even the seizure of assets. Tax refunds may also be withheld to repay the debt. In some cases, professional licenses can be revoked. These consequences can make it extremely difficult to rebuild your financial stability.

Avoiding Student Loan Default

Proactive measures are key to avoiding student loan default. Careful budgeting and planning are essential. Create a realistic budget that accounts for all your expenses and allocates sufficient funds for your student loan payments. Explore options like income-driven repayment plans, which adjust your monthly payments based on your income and family size. These plans can significantly lower your monthly payments, making them more manageable. Communicate with your loan servicer early if you anticipate difficulty making payments. They may offer forbearance or deferment, temporarily suspending or reducing your payments. Consider seeking financial counseling from a reputable non-profit organization to receive personalized guidance and support in managing your debt.

Resources for Borrowers Facing Financial Hardship

Several resources are available to assist borrowers experiencing financial difficulties. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services, providing guidance on budgeting, debt management, and exploring repayment options. The U.S. Department of Education’s website provides comprehensive information on student loan repayment options, including income-driven repayment plans and hardship programs. StudentAid.gov is a valuable resource for finding information about your loans and available assistance programs. Local non-profit organizations often offer free financial literacy workshops and one-on-one counseling to help individuals manage their finances effectively. These resources provide crucial support and guidance to borrowers navigating challenging financial situations.

Stages of Loan Default and Their Repercussions

| Stage | Timeline | Repercussions | Action to Take |

|---|---|---|---|

| Delinquency | 90 days past due | Negative impact on credit score, late payment fees | Contact your loan servicer immediately; explore repayment options. |

| Default | 270 days past due | Significant credit score damage, wage garnishment, tax refund offset, potential lawsuits | Seek immediate help from a credit counselor or government agency. |

| Debt Collection | After default | Aggressive debt collection efforts, potential legal action, asset seizure | Negotiate with the debt collector, explore debt consolidation or settlement options. |

| Judgment | After legal action | Court judgment against you, further asset seizure, impact on future credit opportunities | Consult with a legal professional to explore available options. |

Types of Unsubsidized Loans and Their Variations

While the term “unsubsidized student loan” often implies a single type of loan, the reality is slightly more nuanced. The specific terms and conditions can vary based on the lender and the type of program under which the loan is issued. Understanding these variations is crucial for borrowers to make informed decisions about their financing.

The primary distinction lies in the source of the loan: federal versus private. Federal unsubsidized loans offer significant advantages, primarily in terms of borrower protections and repayment options. Private unsubsidized loans, on the other hand, are offered by banks and other financial institutions and typically carry more risk for borrowers.

Federal Unsubsidized Stafford Loans

Federal unsubsidized Stafford loans are the most common type of unsubsidized federal student loan. These loans are available to undergraduate and graduate students who meet certain eligibility requirements, regardless of financial need. The interest rate is fixed for the life of the loan, and the amount a student can borrow is determined by their year in school and their school’s cost of attendance. Repayment typically begins six months after graduation or leaving school.

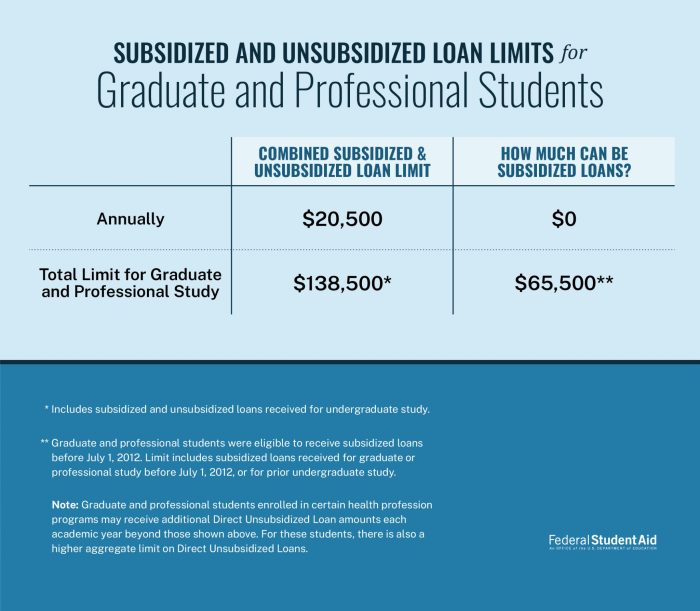

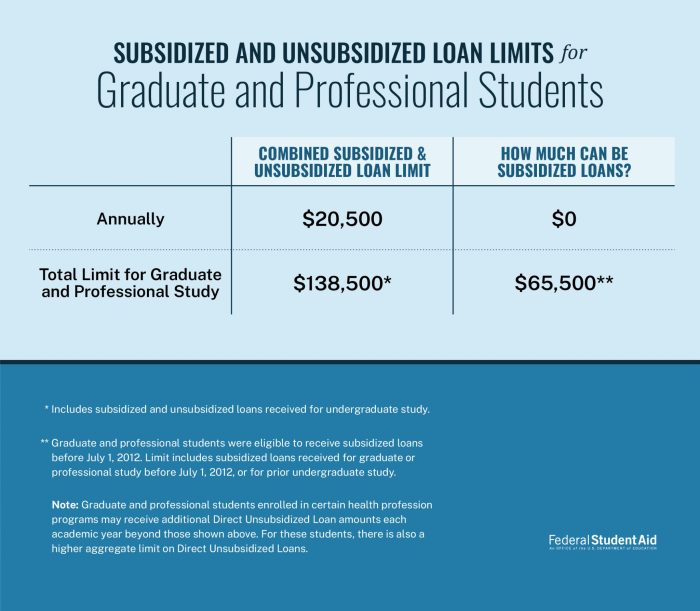

- Loan Limits: Annual and aggregate loan limits exist, varying based on the student’s year in school and dependent status.

- Interest Rate: The interest rate is fixed and determined annually by the government.

- Repayment Options: Several repayment plans are available, including standard, graduated, extended, and income-driven repayment.

- Deferment and Forbearance: Options exist to temporarily postpone payments under certain circumstances, such as unemployment or financial hardship.

Federal Unsubsidized Grad PLUS Loans

Graduate students and professional degree students can apply for Grad PLUS loans. These loans are also unsubsidized, meaning interest accrues from the time the loan is disbursed. Credit checks are performed, and borrowers must meet specific creditworthiness requirements. There are higher borrowing limits compared to undergraduate Stafford loans.

- Credit Check Requirement: A credit check is required, and borrowers with adverse credit history may be denied.

- Higher Loan Limits: Loan amounts are generally higher than undergraduate Stafford loans to cover the increased cost of graduate education.

- Endorser Option: If a borrower is denied due to credit history, they may be able to obtain a co-signer or endorser to secure the loan.

Private Unsubsidized Student Loans

Private unsubsidized student loans are offered by banks, credit unions, and other private lenders. These loans are not subject to the same regulations as federal loans and can have varying interest rates, fees, and repayment terms. Borrowers should carefully compare offers from multiple lenders before selecting a loan. Creditworthiness plays a significant role in loan approval and interest rates.

- Variable or Fixed Interest Rates: Interest rates can be fixed or variable, impacting the total cost of the loan over time.

- Higher Interest Rates: Interest rates are generally higher than federal student loan interest rates.

- Fewer Borrower Protections: These loans often lack the same borrower protections and repayment options as federal loans.

- Co-signer Requirement: A co-signer may be required if the borrower’s credit history is weak.

Illustrative Examples of Loan Scenarios

Understanding the nuances of unsubsidized student loan repayment requires examining concrete examples. The following scenarios illustrate how interest accrual, repayment plans, and interest rates impact the total cost of borrowing.

Let’s consider a student, Sarah, who borrows $20,000 in unsubsidized federal student loans at a fixed interest rate of 5% to complete her undergraduate degree. Her loan repayment begins six months after graduation (the grace period).

Sarah’s Loan Repayment Journey

Sarah’s loan begins accruing interest immediately. During her four years of study, the interest adds up. Let’s assume, for simplicity, that the interest compounds annually. By the time she graduates, the principal amount will have increased. This increased amount will be her loan balance at the start of repayment. She chooses a standard 10-year repayment plan. The monthly payment is calculated based on the loan amount and interest rate. Over the ten years, she’ll make consistent monthly payments, gradually reducing her loan balance. Each month, a portion of the payment goes towards the principal, and the rest goes towards interest. Early in the repayment process, a larger portion goes towards interest. As she pays down the principal, a greater portion of her payment goes towards the principal. Her final payment will eliminate her remaining balance. The total amount she pays back will be significantly higher than the original $20,000 due to accumulated interest. The exact figures would depend on the precise calculation of monthly payments based on standard amortization schedules.

Impact of Different Repayment Plans

The choice of repayment plan significantly impacts the total cost of the loan. If Sarah had opted for a shorter repayment plan, say a 5-year plan, her monthly payments would be higher, but she would pay less interest overall and repay the loan faster. Conversely, a longer repayment plan, such as a 20-year plan, would result in lower monthly payments, but significantly more interest paid over the life of the loan, ultimately increasing the total cost.

Visual Representation of Loan Debt Growth

Imagine three lines on a graph representing loan balance over time. The horizontal axis represents time in years, and the vertical axis represents the loan balance. Line A represents a 3% interest rate. This line would show a relatively slow upward curve, indicating a gradual increase in the loan balance over time. Line B represents a 5% interest rate, showing a steeper upward curve than Line A. Line C represents a 7% interest rate, displaying the steepest upward curve, indicating a rapid increase in loan balance. The difference in the slopes of these lines visually demonstrates how a higher interest rate dramatically accelerates the growth of loan debt.

Final Review

Ultimately, securing an education shouldn’t come at the cost of insurmountable debt. By understanding the specifics of unsubsidized student loans – from interest accrual during schooling to the various repayment plans available – students can make informed choices that align with their financial capabilities and long-term goals. Proactive planning and a clear understanding of the terms and conditions are paramount to successfully managing these loans and ensuring a positive financial future.

Detailed FAQs

What happens if I don’t repay my unsubsidized student loans?

Failure to repay your loans can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action.

Can I refinance my unsubsidized student loans?

Yes, refinancing options exist, but be aware that refinancing federal loans into private loans might mean losing federal protections.

How do unsubsidized loans affect my credit score?

Missed or late payments on unsubsidized loans will negatively impact your credit score, potentially affecting your ability to secure loans or credit cards in the future.

Are there income-driven repayment plans for unsubsidized loans?

Yes, several income-driven repayment plans are available for federal student loans, including unsubsidized loans, which adjust your monthly payments based on your income and family size.