Navigating the complexities of student loan repayment can feel overwhelming, especially when grappling with the often-misunderstood concept of capitalized interest. This seemingly technical term significantly impacts your overall loan cost and repayment schedule. Understanding how capitalized interest works is crucial for effective financial planning and minimizing long-term debt burden. This guide provides a clear and concise explanation, empowering you to make informed decisions about your student loan repayment strategy.

Capitalized interest, in essence, transforms accumulated unpaid interest into principal. This means that the interest that accrues on your loan while you are not making payments (or are making insufficient payments) is added to your original loan amount, increasing the principal balance. This larger principal balance then accrues further interest, leading to a snowball effect that can substantially increase your total repayment amount. This guide will break down this process, explore its implications, and offer strategies to minimize its impact.

Definition of Capitalized Interest on Student Loans

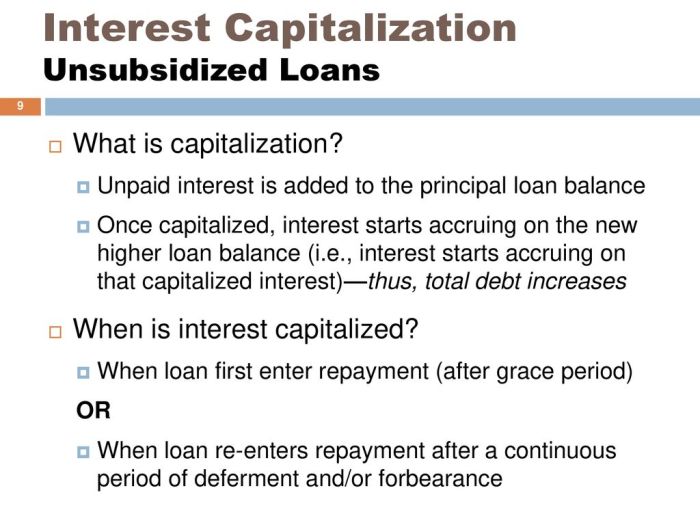

Capitalized interest on student loans refers to the process of adding accumulated unpaid interest to your principal loan balance. Essentially, it’s like transforming your interest into a new part of the loan you owe. This means you’ll then start paying interest on that previously unpaid interest, leading to a larger overall loan balance and potentially higher total payments over the life of the loan.

Capitalized interest is calculated by simply adding the total amount of accrued unpaid interest to the principal loan balance. This new, larger balance then becomes the basis for future interest calculations. For example, let’s say you have a $10,000 loan with a 5% annual interest rate. If you don’t make any payments for a year, you’ll accrue $500 in interest ($10,000 x 0.05). If this interest is capitalized, your new principal balance will be $10,500. Future interest calculations will then be based on this higher amount.

Circumstances Leading to Interest Capitalization

Interest capitalization typically occurs during periods of deferment or forbearance on your student loans. Deferment is a postponement of loan payments, often granted to students who are still in school or experiencing certain financial hardships. Forbearance is a temporary suspension of loan payments, usually granted due to temporary financial difficulties. In both cases, interest continues to accrue on the loan balance. However, if the interest isn’t paid during these periods, it’s capitalized at the end of the deferment or forbearance period. Another circumstance might be a period of grace after graduation, if the borrower doesn’t begin repayment immediately. The exact terms and conditions will depend on your loan servicer and the type of student loan you have.

Capitalized vs. Uncapitalized Interest

The key difference between capitalized and uncapitalized interest lies in how unpaid interest is handled. With uncapitalized interest, the unpaid interest remains separate from the principal balance. You only pay interest on the original principal amount. However, with capitalized interest, the unpaid interest is added to the principal, thus increasing the total amount owed and the future interest charges. This can significantly increase the overall cost of the loan over time, making capitalized interest a less favorable outcome for borrowers. The impact of capitalization can be substantial, potentially adding thousands of dollars to the total repayment amount compared to a scenario where interest is not capitalized.

Impact of Capitalized Interest on Loan Repayment

Capitalized interest significantly impacts the overall cost and repayment schedule of student loans. Understanding how it affects your loan balance and monthly payments is crucial for effective financial planning. Failing to grasp this concept can lead to a substantially higher total repayment amount than initially anticipated.

Capitalized interest, essentially added to your principal loan balance, increases the total amount you owe. This increase directly influences both the length of your repayment period and the size of your monthly payments. The longer you take to repay your loan, the more interest accrues, leading to a snowball effect where the interest compounds, adding to the principal and increasing the total interest paid over the life of the loan.

Long-Term Effects on Total Loan Amount

The long-term effect of capitalized interest is a considerable increase in the total amount owed. Because the interest is added to the principal, subsequent interest calculations are based on a larger principal balance. This leads to a higher total interest payment over the life of the loan compared to a scenario without capitalization. This compounding effect can dramatically increase the total repayment cost, potentially extending the repayment period considerably. The longer the loan term and the higher the interest rate, the more significant this effect becomes.

Effect of Capitalized Interest on Monthly Payments

Capitalized interest directly increases the monthly payment amount. A larger principal balance, resulting from capitalized interest, necessitates higher monthly payments to repay the loan within the original repayment schedule. If the monthly payment remains the same, the repayment period will be extended, leading to even more interest accruing over a longer period. This means borrowers may need to budget for a larger monthly payment or face a significantly longer repayment timeline.

Hypothetical Repayment Scenario

Let’s illustrate the difference with a hypothetical example. Assume a $10,000 student loan with a 5% annual interest rate and a 10-year repayment plan.

| Month | Payment (No Capitalization) | Payment (With Capitalization) – Assuming interest capitalized annually | Total Paid (to date) |

|---|---|---|---|

| 1-12 | $96.56 | $96.56 (Year 1) | $1158.72 |

| 13-24 | $96.56 | $96.56 (Year 2) | $2317.44 |

| 25-36 | $96.56 | $96.56 (Year 3) | $3476.16 |

| 37-48 | $96.56 | $96.56 (Year 4) | $4634.88 |

| 49-60 | $96.56 | $96.56 (Year 5) | $5793.60 |

| 61-72 | $96.56 | $96.56 (Year 6) | $6952.32 |

| 73-84 | $96.56 | $96.56 (Year 7) | $8111.04 |

| 85-96 | $96.56 | $96.56 (Year 8) | $9269.76 |

| 97-108 | $96.56 | $96.56 (Year 9) | $10428.48 |

| 109-120 | $96.56 | $96.56 (Year 10) | $11587.20 |

Note: This table simplifies the calculation; actual payments would vary slightly due to the compounding nature of interest and daily accrual. The “With Capitalization” column assumes interest is capitalized annually. The real difference would be larger as interest is capitalized more frequently (usually monthly). A more accurate comparison would require a loan amortization schedule for each scenario. The example demonstrates the principle that capitalization increases the overall repayment cost.

Factors Affecting Capitalized Interest

Several key factors influence the amount of capitalized interest added to your student loan balance. Understanding these factors is crucial for effective loan management and minimizing the overall cost of borrowing. The longer the period of deferment or forbearance, and the higher the interest rate, the greater the impact on your final loan amount.

The amount of capitalized interest is directly tied to the outstanding interest that accrues during periods when payments aren’t required. This accumulated interest is then added to the principal loan balance, increasing the amount you ultimately owe. Several factors play a significant role in determining the final capitalized interest amount.

Factors Determining Capitalized Interest Amounts

The following factors significantly influence the amount of interest that gets capitalized:

- Length of Deferment or Forbearance: The longer you are in a deferment or forbearance period, the more interest accrues and subsequently gets capitalized. For example, a six-month deferment will result in less capitalized interest than a two-year deferment, assuming the same interest rate and initial loan balance.

- Interest Rate: A higher interest rate leads to faster interest accumulation. A loan with a 7% interest rate will accrue significantly more interest during a deferment period than a loan with a 3% interest rate, resulting in a larger capitalized interest amount.

- Loan Balance: A larger initial loan balance means more interest accrues over time. Therefore, a larger starting loan amount will lead to a higher amount of capitalized interest, all else being equal.

- Frequency of Interest Calculation: The frequency with which interest is calculated (daily, monthly, etc.) impacts the total amount accrued. Daily compounding, for example, will result in slightly more interest than monthly compounding over the same period.

Impact of Repayment Plans on Capitalized Interest

Different repayment plans can significantly affect the capitalization of interest. Understanding how each plan handles interest accrual during periods of non-payment is crucial.

- Standard Repayment Plan: Under a standard repayment plan, interest continues to accrue even during periods of deferment or forbearance. This accrued interest is typically capitalized at the end of the deferment/forbearance period, leading to a higher loan balance.

- Income-Driven Repayment Plans (IDR): While IDR plans offer lower monthly payments based on income, interest still accrues during the repayment period. However, the amount capitalized may be less than under a standard plan because the repayment period is often extended, potentially lowering the overall interest accumulation.

- Extended Repayment Plans: These plans stretch out the repayment period, reducing monthly payments. However, this often leads to a higher total amount paid due to the extended period of interest accrual, although capitalization may occur less frequently due to longer periods between deferments/forbearances.

Strategies to Minimize Capitalized Interest

Minimizing capitalized interest on student loans requires proactive planning and a thorough understanding of your loan terms. By implementing several key strategies, borrowers can significantly reduce the overall cost of their education debt and improve their long-term financial health. This involves careful management of loan payments and a proactive approach to repayment options.

The most effective way to minimize capitalized interest is to prevent it from accruing in the first place. This means making consistent, on-time payments throughout your grace period and while in school, if possible. Any interest that accrues during these periods will be added to your principal balance, increasing the total amount you owe. Preventing this capitalization will save you significant money in the long run.

Preventing Interest Accrual During Grace Period and Deferment

Preventing interest capitalization hinges on making payments during periods when interest is accruing but not yet capitalized. This is particularly important during the grace period after graduation and during any deferment periods. During these periods, interest still accumulates, but it is not yet added to the principal balance. Consistent payments during these periods directly reduce the amount of interest that will eventually be capitalized. For example, if you make consistent payments during your grace period, even small ones, you will significantly reduce the amount of interest that is later added to your principal loan balance. The more you pay, the less you will owe overall.

Exploring Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. While these plans may result in higher overall payments over the life of the loan due to a longer repayment period, they often result in lower monthly payments, which can help borrowers avoid falling behind on payments and thus prevent further interest capitalization. For instance, an individual with a low income immediately after graduation might find an IDR plan more manageable than a standard repayment plan, preventing missed payments that lead to increased interest capitalization.

Making Extra Payments

Even small extra payments on your student loans can significantly reduce the amount of interest you pay over time. This extra money reduces your principal balance, thereby lowering the amount of interest that accrues in subsequent months. Consider it an investment in reducing your overall loan debt. For example, if you can afford an extra $50 or $100 per month, this will significantly reduce the principal balance over time and reduce the total interest you will pay.

Consolidating Loans

Consolidating multiple student loans into a single loan can simplify repayment and potentially lower your interest rate. A lower interest rate directly translates to less interest accruing over time, which reduces the potential for capitalized interest to significantly inflate your total debt. However, it’s crucial to carefully compare the terms of any consolidation loan to ensure it’s truly beneficial before proceeding. For example, a borrower with multiple federal loans at different interest rates might find a consolidated loan with a weighted average interest rate lower than their highest individual interest rate.

Government Regulations and Capitalized Interest

Government regulations significantly influence how capitalized interest affects student loan borrowers. These regulations, primarily established by the U.S. Department of Education, aim to balance the needs of borrowers with the financial realities of the federal student loan program. Understanding these regulations is crucial for borrowers to effectively manage their loan repayment.

The primary federal regulation impacting capitalized interest relates to the deferment and forbearance periods of federal student loans. During these periods, interest continues to accrue on the loan balance. When the deferment or forbearance ends, this accumulated interest is typically capitalized, meaning it’s added to the principal loan amount. This increases the total amount borrowed, ultimately leading to higher overall repayment costs. The specific conditions under which interest capitalizes and the types of deferments and forbearances that trigger capitalization are clearly defined in the federal regulations governing student loans. These regulations are periodically reviewed and updated, so borrowers should always refer to the most current information from the Department of Education.

Capitalization Triggering Events

Federal regulations specify several events that trigger the capitalization of interest on federal student loans. These events primarily involve periods of deferment or forbearance, where borrowers temporarily postpone or reduce their loan payments. For example, a borrower who enters a period of unemployment-based deferment will likely see their accrued interest capitalized at the end of the deferment period. Similarly, in-school deferments, which allow students to postpone payments while enrolled in eligible educational programs, often result in interest capitalization upon graduation or withdrawal from school. The precise details regarding which types of deferments and forbearances lead to capitalization are available in the official guidelines. It’s vital for borrowers to understand these triggers to plan for their repayment effectively.

Impact of Regulations on Borrower Repayment Strategies

The regulations surrounding capitalized interest directly influence repayment strategies. Understanding that deferments and forbearances can lead to higher total loan amounts due to capitalization encourages borrowers to explore alternative strategies. For instance, borrowers might prioritize making even minimal payments during periods of financial hardship to avoid accumulating significant capitalized interest. Alternatively, borrowers might seek to consolidate their loans to potentially lower their interest rates, thereby mitigating the impact of future capitalization. Careful planning and understanding of the regulatory landscape are crucial for making informed decisions.

Legal Aspects of Capitalized Interest

The legal framework surrounding capitalized interest on federal student loans is rooted in the Higher Education Act of 1965 and subsequent amendments. This legislation grants the Department of Education the authority to set the terms and conditions of federal student loan programs, including the rules governing interest capitalization. The regulations are publicly available and subject to legal challenges, although such challenges are rare. Borrowers who believe there’s been an error in the capitalization of their interest may seek redress through established administrative processes within the Department of Education. The legal precedent generally upholds the department’s authority in setting these regulations, reinforcing the importance of understanding and complying with them.

Illustrative Example

Understanding how capitalized interest impacts your loan balance can be challenging. This example visually demonstrates the compounding effect of capitalized interest over time, illustrating how a seemingly small amount can significantly increase your total debt. We will follow a simplified scenario to make the concept clear.

Let’s consider a student loan with an initial principal balance of $10,000 and an interest rate of 6% per year. Suppose the borrower defers payments for two years. During this deferment period, interest accrues but isn’t paid. At the end of the two years, this accumulated interest is capitalized, meaning it’s added to the principal balance. We’ll track the loan balance year by year to see the effect of capitalization.

Capitalized Interest Growth Over Two Years

This section details the year-by-year growth of a $10,000 student loan with a 6% interest rate, demonstrating the impact of interest capitalization after a two-year deferment period. The data provided can be used to create a bar chart or line graph illustrating the growth of the loan balance.

Year | Beginning Balance | Interest Accrued | Capitalized Interest | Ending Balance

——- | ——– | ——– | ——– | ——–

0 | $10,000 | $0 | $0 | $10,000

1 | $10,000 | $600 | $0 | $10,600

2 | $10,600 | $636 | $0 | $11,236

Capitalization | | | $1236 | $11,236

3 | $11,236 | $674.16 | $0 | $11,910.16

4 | $11,910.16 | $714.61 | $0 | $12,624.77

Year 0: The loan begins with a principal balance of $10,000. No interest is capitalized yet.

Year 1: Interest of $600 ($10,000 x 0.06) accrues. This interest is not yet capitalized.

Year 2: Interest of $636 ($10,600 x 0.06) accrues. At the end of Year 2, the total accrued interest ($600 + $636 = $1236) is capitalized.

Capitalization: The $1236 in accrued interest is added to the principal balance, resulting in a new principal balance of $11,236. This becomes the starting balance for year 3.

Year 3 and beyond: Future interest calculations are based on the increased principal balance of $11,236, resulting in even higher interest payments in subsequent years. This demonstrates the snowball effect of capitalized interest.

Visual Representation

A bar chart could effectively display this data. The x-axis would represent the year (0, 1, 2, 3, 4, Capitalization), and the y-axis would represent the loan balance. Each year would have a bar showing the beginning balance, the interest accrued that year, and the ending balance. A separate bar could represent the capitalized interest at the end of Year 2. A line graph could also be used to show the overall growth of the loan balance over time. A legend would clearly identify each component (beginning balance, interest accrued, capitalized interest, ending balance). This visual representation would clearly show the significant increase in the loan balance due to capitalization.

Ending Remarks

Effectively managing student loan debt requires a comprehensive understanding of all its components, including the often-overlooked aspect of capitalized interest. By understanding how capitalized interest works, recognizing the factors that influence it, and implementing proactive strategies, borrowers can significantly reduce their overall repayment burden and achieve financial freedom sooner. This guide has provided a framework for navigating this complex area, equipping you with the knowledge to make informed decisions and successfully manage your student loan repayment journey.

FAQ Summary

What happens if I defer my student loans?

During a deferment period, interest may still accrue on your loan, depending on the loan type. This accrued interest is typically capitalized at the end of the deferment period.

Can I prevent interest capitalization?

Yes, by making consistent payments that at least cover the accruing interest, you can prevent capitalization. Alternatively, some repayment plans may minimize capitalization.

How does capitalized interest affect my credit score?

While capitalized interest itself doesn’t directly impact your credit score, the resulting higher loan balance and potentially increased monthly payments can indirectly affect your credit utilization ratio and payment history, which are key factors in your credit score.

What are the different types of student loan repayment plans?

Several repayment plans exist, including standard, graduated, extended, and income-driven repayment. Each plan has different implications for interest capitalization and overall repayment costs. Exploring these options is crucial for minimizing your long-term debt.