Navigating the complexities of student loan repayment can feel overwhelming, but understanding Income-Based Repayment (IBR) plans can significantly ease the burden. IBR offers a lifeline to borrowers struggling with high monthly payments by basing repayment amounts on their income and family size. This guide unravels the intricacies of IBR, providing a clear understanding of its eligibility requirements, calculation methods, and potential benefits, including loan forgiveness.

We will explore the various IBR plans available, comparing them to other income-driven repayment options. Furthermore, we’ll address potential pitfalls and considerations, ensuring you’re well-equipped to make informed decisions about your student loan repayment strategy. Understanding IBR is key to managing your debt effectively and achieving long-term financial stability.

What is the Income-Based Repayment (IBR) Program?

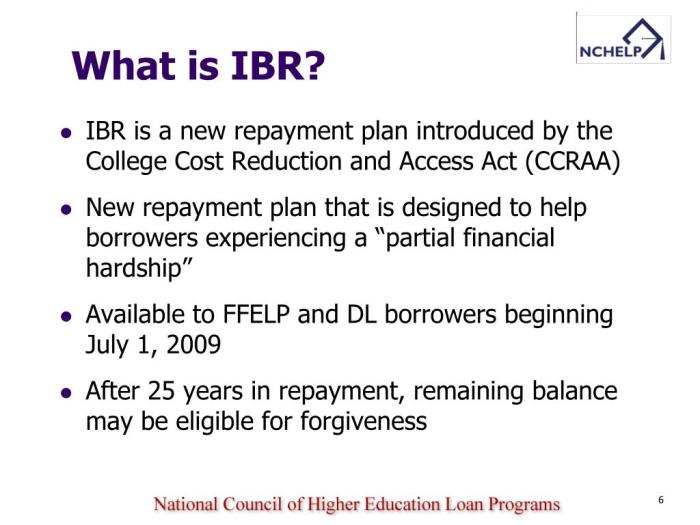

The Income-Based Repayment (IBR) program is a federal student loan repayment plan designed to make monthly payments more manageable for borrowers based on their income and family size. It works by calculating your monthly payment as a percentage of your discretionary income, offering lower payments than standard repayment plans, potentially leading to loan forgiveness after a set period of qualifying payments.

The fundamental principle of IBR is to link your monthly student loan payment to your income. This means that if your income is low, your monthly payment will also be low. Conversely, as your income rises, your monthly payment will increase accordingly. This flexibility aims to help borrowers avoid default while still making progress toward repaying their loans.

IBR Eligibility Criteria

To qualify for an IBR plan, borrowers must generally meet several criteria. These typically include having federal student loans (excluding Parent PLUS loans), demonstrating financial need based on income and family size, and completing the required application process. Specific income thresholds and eligibility requirements may vary slightly depending on the specific IBR plan chosen and the year the loan was originated. It’s crucial to check the current Department of Education guidelines for the most up-to-date information.

Applying for IBR

Applying for an IBR plan involves a straightforward process. First, you’ll need to gather necessary documentation, such as tax returns and pay stubs, to verify your income and family size. Next, you’ll need to access the StudentAid.gov website and log in to your account. Once logged in, navigate to the repayment plan section and select the IBR plan you wish to apply for. You’ll then need to complete the application form and submit the required documentation. After the Department of Education processes your application, you’ll receive confirmation of your enrollment in the IBR plan and your new monthly payment amount. This process usually takes several weeks.

Comparison of IBR Plans

Several IBR plans exist, each with its own payment calculation method, income thresholds, and loan forgiveness timeline. The specifics can be complex and change over time, so always consult the official government website for the most accurate and up-to-date information. The following table offers a general comparison; however, it is not exhaustive and should not be considered legal or financial advice.

| IBR Plan | Payment Calculation | Income Threshold | Loan Forgiveness Timeline |

|---|---|---|---|

| IBR (Original) | 15% of discretionary income | Varies based on family size and income | 20-25 years; potential forgiveness after 20-25 years of qualifying payments |

| IBR (Revised) | 10% or 15% of discretionary income (depending on loan origination date) | Varies based on family size and income | 20-25 years; potential forgiveness after 20-25 years of qualifying payments |

| PAYE | 10% of discretionary income | Varies based on family size and income | 20 years; potential forgiveness after 20 years of qualifying payments |

| REPAYE | 10% of discretionary income | Varies based on family size and income | 20 or 25 years; potential forgiveness after 20 or 25 years of qualifying payments (depending on loan origination date) |

Note: Discretionary income is calculated by subtracting 150% of the poverty guideline for your family size from your adjusted gross income. Loan forgiveness is contingent upon making timely payments for the required period and meeting all other program requirements. The details of these plans can be complex, and it is strongly recommended to consult the official Department of Education website or a financial advisor for personalized guidance.

How IBR Payments are Calculated

Calculating your monthly Income-Based Repayment (IBR) plan payment involves a multi-step process that considers your adjusted gross income (AGI), family size, and your total student loan debt. The specific formula and details can vary slightly depending on the type of IBR plan (IBR, PAYE, REPAYE), but the underlying principles remain consistent. The goal is to create a manageable monthly payment based on your financial circumstances.

The calculation begins with determining your Adjusted Gross Income (AGI). This is your gross income minus certain deductions allowed by the IRS. Next, your AGI is adjusted based on your family size. This is done to account for the additional financial burdens of supporting a family. This adjusted AGI is then used to calculate a payment percentage of your total student loan debt. The final step involves applying this percentage to your total loan balance to determine your monthly payment. This payment is designed to be affordable while still ensuring eventual loan repayment.

Adjusted Gross Income (AGI) Determination

The first crucial step is determining your Adjusted Gross Income (AGI). This figure is obtained from your most recent federal income tax return. It’s important to use the correct AGI as inaccuracies will lead to incorrect payment calculations. Remember that AGI is your gross income less certain allowable deductions as defined by the IRS. This might include deductions for things like contributions to retirement accounts or certain business expenses. It’s recommended to consult your tax documents or a tax professional if you have any questions about calculating your AGI.

Family Size Adjustment

Your family size directly impacts your IBR payment calculation. A larger family size generally results in a lower monthly payment because the calculation acknowledges the increased financial strain of supporting more dependents. The specific formula for incorporating family size varies depending on the specific IBR plan. However, the underlying principle remains consistent: a larger family translates to a smaller percentage of your income applied to your loan payment. The number of dependents includes your spouse and any children claimed on your tax return.

Payment Calculation Examples

Let’s consider a few examples to illustrate how income and family size affect IBR payments. These are simplified examples and do not include all potential factors. Actual calculations may be more complex and should be confirmed through official government resources.

| Example | AGI | Family Size | Total Loan Debt | Approximate Monthly Payment |

|---|---|---|---|---|

| 1 | $40,000 | 1 | $50,000 | $200-$300 (estimate) |

| 2 | $40,000 | 4 | $50,000 | $100-$200 (estimate) |

| 3 | $80,000 | 2 | $100,000 | $400-$600 (estimate) |

Note: These are simplified examples. Actual payments will vary based on the specific IBR plan, loan interest rates, and other factors.

IBR Payment Calculation Flowchart

A flowchart visually represents the calculation process.

[Description of Flowchart]

The flowchart would begin with a box labeled “Start.” The next box would be “Determine AGI from Tax Return.” This would lead to a box titled “Determine Family Size.” Then, a decision box: “Is Family Size > 1?” If yes, the process goes to a box labeled “Adjust AGI based on Family Size.” If no, it proceeds directly to the next box. The next box would be “Calculate Payment Percentage (based on AGI and plan specifics).” This feeds into the final box “Calculate Monthly Payment (Payment Percentage * Total Loan Debt).” The flowchart ends with a box labeled “End.” Each box would have arrows indicating the flow of the calculation process.

IBR and Loan Forgiveness

Income-Based Repayment (IBR) plans offer a pathway to potential student loan forgiveness after a significant period of qualifying payments. This forgiveness isn’t automatic; it hinges on several factors and involves a lengthy commitment to consistent payments. Understanding these factors and the potential tax implications is crucial for anyone considering an IBR plan.

Loan Forgiveness Process Under IBR

The IBR loan forgiveness process involves making consistent, on-time payments for a specific period, usually 20 or 25 years, depending on the specific IBR plan and when the loans were taken out. Once this timeframe is met, and other eligibility requirements are satisfied, the remaining balance of your eligible federal student loans may be forgiven. The process is not immediate; the loan servicer will review your payment history to verify eligibility, and this process can take time. After verification, the forgiveness will be applied, and you’ll receive notification.

Factors Determining Eligibility for Loan Forgiveness

Several factors determine eligibility for IBR loan forgiveness. These include:

- Type of Loan: Only certain federal student loans qualify for IBR and subsequent forgiveness. Private student loans are generally not eligible.

- Repayment Plan: You must be enrolled in a qualifying IBR plan, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), or Income-Driven Repayment (IDR).

- Payment History: Consistent, on-time payments are essential. Missed or late payments can delay or prevent forgiveness.

- Income Certification: Regular income certification is usually required to maintain eligibility. This involves providing documentation of your income annually.

- Loan Consolidation: Consolidating your federal student loans might be necessary to be eligible for certain IBR plans. This combines multiple loans into one.

It’s important to note that specific eligibility requirements can change, so staying informed about the most up-to-date information from the Department of Education is crucial.

Tax Implications of IBR Loan Forgiveness

The forgiven portion of your student loans is generally considered taxable income by the IRS. This means you may need to pay federal and state income taxes on the amount forgiven. For example, if $50,000 of your student loan debt is forgiven, you would likely need to report this as income on your tax return, potentially resulting in a significant tax liability. However, there are some exceptions and provisions available depending on your specific circumstances and the year of forgiveness. It’s advisable to consult with a tax professional to understand the potential tax implications in your individual case.

Timeline for Loan Forgiveness Under Different IBR Plans

The timeline for loan forgiveness under IBR plans varies depending on the plan and when the loans were originated. Generally, forgiveness can be achieved after 20 or 25 years of qualifying payments. For loans originated before July 1, 2014, the timeframe is typically 25 years. For loans originated after July 1, 2014, it’s usually 20 years. However, this is a general guideline, and the exact timeline might vary based on factors such as the type of loan, your income, and your repayment plan. It’s essential to check the specifics of your individual loan and repayment plan for the accurate timeline.

IBR vs. Other Repayment Plans

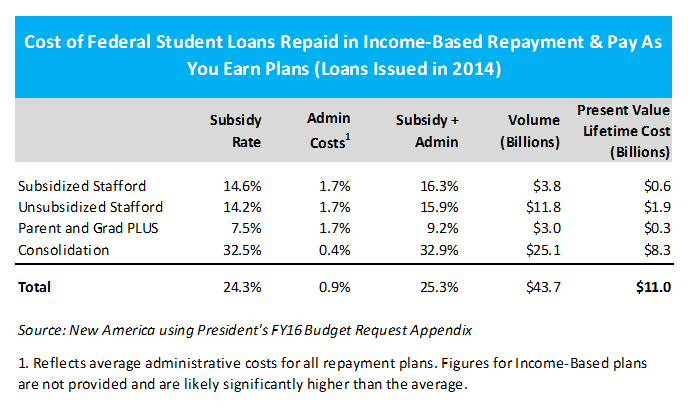

Income-Based Repayment (IBR) is just one of several income-driven repayment (IDR) plans available to federal student loan borrowers. Understanding the differences between these plans is crucial for choosing the one that best suits your individual financial circumstances. Each plan offers a unique approach to calculating monthly payments based on income and family size, ultimately impacting your total repayment amount and potential for loan forgiveness.

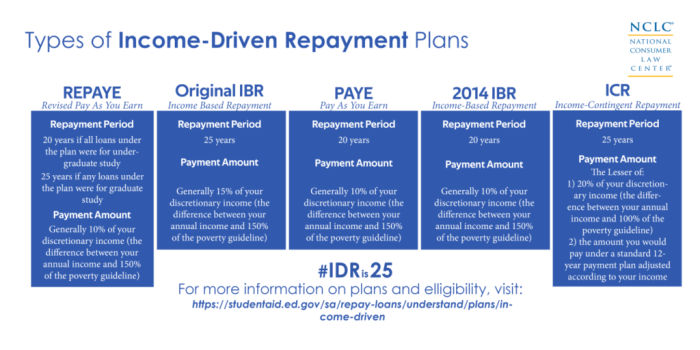

The main IDR plans—IBR, PAYE, REPAYE, and ICR—share the common goal of making student loan repayment more manageable by tying payments to your income. However, they differ in eligibility requirements, payment calculation formulas, and loan forgiveness provisions. Choosing the right plan requires careful consideration of your current financial situation and long-term financial goals.

Key Features Comparison of IDR Plans

The following table summarizes the key features of IBR, PAYE, REPAYE, and ICR. Note that eligibility criteria and specific payment calculations can be complex and are subject to change, so it’s vital to consult the official Federal Student Aid website for the most up-to-date information.

| Feature | IBR | PAYE | REPAYE | ICR |

|---|---|---|---|---|

| Payment Calculation | 10% or 15% of discretionary income, depending on loan origination date | 10% of discretionary income | 10% or 15% of discretionary income, depending on loan origination date | Based on a formula considering income, family size, and loan amount |

| Loan Forgiveness | After 20 or 25 years of payments, depending on loan origination date | After 20 years of payments | After 20 or 25 years of payments, depending on loan origination date | After 25 years of payments |

| Eligibility | Generally available to borrowers with direct loans | Generally available to borrowers with direct loans | Generally available to borrowers with direct and FFEL loans | Generally available to borrowers with direct and FFEL loans |

| Interest Accrual | Interest may accrue if your payment doesn’t cover it | Interest may accrue if your payment doesn’t cover it | Interest may accrue if your payment doesn’t cover it | Interest may accrue if your payment doesn’t cover it |

Advantages and Disadvantages of Each Repayment Plan

Each IDR plan presents both advantages and disadvantages. The optimal choice depends heavily on individual circumstances.

IBR: A potential advantage is the lower payment amount compared to standard repayment, making it more manageable for those with lower incomes. However, a disadvantage is the potential for longer repayment periods and therefore more interest paid over the life of the loan, especially if your income remains low. The forgiveness period also varies based on loan origination date.

PAYE: This plan’s advantage lies in its simpler payment calculation (10% of discretionary income). A disadvantage is its relatively stricter eligibility requirements compared to REPAYE.

REPAYE: REPAYE offers a broader eligibility compared to PAYE and a payment calculation similar to IBR, potentially leading to lower monthly payments. However, the longer repayment period and potential for accruing interest remain potential drawbacks.

ICR: ICR considers family size in its payment calculation, potentially leading to lower payments for larger families. The disadvantage is the potentially longer repayment period (25 years) compared to other plans, resulting in potentially higher total interest paid.

Potential Pitfalls and Considerations of IBR

While Income-Based Repayment (IBR) plans offer significant benefits to borrowers struggling with student loan debt, it’s crucial to understand the potential drawbacks. Navigating IBR successfully requires careful planning and a thorough understanding of its intricacies. Failure to do so can lead to unexpected financial challenges and long-term consequences.

IBR plans, while designed to make payments manageable, aren’t without their complexities. Several factors can impact your experience, and overlooking them can lead to unforeseen difficulties. Understanding these potential pitfalls is essential for making informed decisions about your repayment strategy.

Impact of IBR on Credit Scores

IBR plans, like any other repayment plan, can impact your credit score. While making on-time payments is crucial for maintaining a good credit score, the fact that your monthly payments may be lower than under a standard repayment plan can sometimes affect your credit utilization ratio. This ratio compares your total debt to your available credit. A lower monthly payment might not significantly reduce your overall debt as quickly, potentially keeping your utilization ratio higher for a longer period, which could negatively affect your credit score. However, consistently making on-time payments under an IBR plan is generally viewed more favorably by lenders than missing payments under a standard plan, so the net impact on credit score can vary depending on the individual’s financial situation and payment history. Furthermore, the length of time it takes to pay off the loans under IBR, often extended to 20 or 25 years, can also play a role in credit score calculations.

Understanding IBR Terms and Conditions

Thoroughly understanding the specific terms and conditions of your chosen IBR plan is paramount. These plans have varying eligibility criteria, payment calculation methods, and forgiveness provisions. For example, some plans require annual recertification of income, which involves providing updated financial information to determine your payment amount. Failure to recertify on time can result in penalties or adjustments to your repayment schedule. Additionally, the income thresholds and forgiveness terms vary among the different IBR plans (IBR, PAYE, REPAYE). Misunderstanding these details can lead to inaccurate payment estimations, missed deadlines, and potential difficulties accessing loan forgiveness. Careful review of the plan’s documentation and consultation with a financial advisor can help prevent such issues.

Consequences of Missing IBR Payments

Missing IBR payments carries significant consequences. Late payments can damage your credit score, potentially making it harder to secure loans, credit cards, or even rent an apartment in the future. Furthermore, missed payments can lead to accruing interest, increasing your overall debt burden. In some cases, repeated missed payments can result in your loan being sent to collections, which can have serious repercussions on your financial standing. Delinquency can also jeopardize your eligibility for loan forgiveness programs, potentially eliminating the long-term benefits of the IBR plan. It’s vital to prioritize timely payments even if the monthly amount seems manageable, as a lapse in payment can have far-reaching and potentially severe consequences.

Resources and Further Information

Understanding Income-Based Repayment (IBR) plans requires accessing reliable information and knowing where to turn for assistance. This section provides resources to help borrowers navigate the complexities of IBR and find answers to their questions. It also Artikels the process for appealing decisions related to IBR eligibility or payment calculations.

Finding the right information about IBR can feel overwhelming. Fortunately, several government agencies and non-profit organizations offer comprehensive resources and support. These resources can help clarify eligibility requirements, explain payment calculations, and provide guidance on the appeal process. It is crucial to use official sources to avoid misinformation.

Reliable Resources for Borrowers

The following websites offer valuable information on IBR and student loan repayment:

- Federal Student Aid (FSA): The official website of the U.S. Department of Education’s office of Federal Student Aid. This site provides comprehensive information on all federal student loan programs, including IBR, with detailed explanations of eligibility criteria, payment calculations, and frequently asked questions. It’s the primary source for accurate and up-to-date information.

- StudentAid.gov: This website is the main portal for accessing your federal student loan information, including your repayment plan options, payment history, and contact information for your loan servicer.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that offers free and low-cost credit counseling services. They can provide guidance on managing student loan debt and choosing the right repayment plan.

- Your Loan Servicer: Your loan servicer is the company responsible for managing your student loans. They can answer specific questions about your account, including your IBR payment amount and eligibility.

Contact Information for Relevant Agencies

For direct assistance, you can contact the following:

- Federal Student Aid (FSA) Customer Service: 1-800-4-FED-AID (1-800-433-3243)

- StudentAid.gov (Online Help): The StudentAid.gov website offers online help resources and frequently asked questions.

Frequently Asked Questions about IBR

Understanding IBR involves addressing common questions borrowers often have. The following list clarifies some key points:

- What is the income verification process for IBR? The process involves submitting tax documents and other relevant financial information to your loan servicer annually to verify your income and family size.

- How often are IBR payments recalculated? IBR payments are typically recalculated annually, based on your updated income and family size.

- What happens if I lose my job or experience a significant decrease in income? You may be eligible for a temporary reduction in your monthly payment or other hardship options. Contact your loan servicer immediately to discuss your situation.

- Can I switch from IBR to another repayment plan? Yes, you can usually switch repayment plans once per year, though there may be restrictions depending on your specific loan type and circumstances.

- What are the potential consequences of not making my IBR payments? Failure to make your IBR payments can lead to delinquency, default, and damage to your credit score.

Appealing IBR Decisions

If you disagree with a decision regarding your IBR eligibility or payment calculations, you can file an appeal. The process generally involves submitting a written appeal to your loan servicer, providing documentation to support your claim. The servicer will review your appeal and issue a decision. If you are still unsatisfied, you may have additional recourse through the Department of Education. Detailed instructions on how to file an appeal are typically available on your loan servicer’s website and the FSA website. It’s important to carefully document all communication and keep copies of all submitted documentation.

Last Point

Ultimately, the decision of whether or not to pursue an Income-Based Repayment plan for your student loans is a personal one, requiring careful consideration of your individual financial circumstances. By weighing the potential benefits—like lower monthly payments and eventual loan forgiveness—against the potential drawbacks—such as a longer repayment timeline and potential tax implications—you can develop a repayment strategy that aligns with your long-term financial goals. Remember to thoroughly research all available options and consult with a financial advisor if needed.

Q&A

What happens if my income changes during my IBR repayment plan?

You can typically update your income annually to reflect changes. This will adjust your monthly payment accordingly.

Can I switch from another repayment plan to IBR?

Yes, you can usually switch to IBR from other repayment plans. However, there may be specific eligibility requirements and timelines to consider.

Does IBR affect my credit score?

Making on-time payments under any repayment plan, including IBR, is crucial for maintaining a good credit score. Consistent late payments can negatively impact your score.

What if I lose my job and can’t afford my IBR payments?

There are options available, such as forbearance or deferment, to temporarily suspend or reduce your payments. Contact your loan servicer to discuss your options.