Navigating the complexities of student loan financing can feel overwhelming, particularly when understanding the average interest rates involved. This guide provides a clear and concise overview of the factors influencing student loan interest rates, both federal and private, empowering you to make informed decisions about your educational funding.

From understanding the differences between fixed and variable rates to exploring the impact of credit scores and repayment plans, we’ll demystify the process and help you grasp the financial implications of your choices. We will examine historical trends, delve into the intricacies of interest calculations, and offer valuable resources to help you find the most up-to-date information available.

Understanding Average Student Loan Interest Rates

Understanding average student loan interest rates is crucial for prospective and current borrowers. These rates significantly impact the total cost of a student loan and the monthly payment amount. Several factors influence these rates, making it essential to carefully consider all aspects before borrowing.

Factors Influencing Average Student Loan Interest Rates

Several key factors contribute to the average interest rate you’ll receive on a student loan. These include your credit history (for private loans), the type of loan (federal or private), the loan’s repayment term, the current economic climate, and the specific lender’s policies. A strong credit history generally results in lower interest rates, while a weak history might lead to higher rates, especially for private loans. Federal student loans often have lower interest rates than private loans because they are backed by the government. Market conditions, such as prevailing interest rates, also influence loan rates. Longer repayment terms can sometimes lead to slightly higher rates.

Fixed Versus Variable Interest Rates for Student Loans

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, making it easier to budget and predict future payments. A variable interest rate fluctuates based on market conditions, potentially leading to lower payments initially but also risking higher payments later if rates rise. The choice between fixed and variable depends on individual risk tolerance and financial forecasting abilities. A borrower comfortable with some uncertainty might choose a variable rate initially, hoping for lower payments. However, those preferring predictability and stability often opt for a fixed rate.

Interest Rate Calculations for Federal and Private Student Loans

Federal student loan interest rates are set by the government and are typically lower than private loan rates. The interest rate for a federal loan depends on the loan type (subsidized, unsubsidized, graduate), the loan’s disbursement date, and sometimes the borrower’s creditworthiness. Interest accrues from the date of disbursement. Private student loans, on the other hand, have rates determined by the lender based on the borrower’s credit history, income, and other factors. These rates are often higher and more variable than federal loan rates. Both federal and private loans typically use simple interest calculations, where interest is calculated on the principal loan amount. The formula is generally:

Interest = Principal x Rate x Time

where Time is typically expressed in years.

Average Interest Rates Across Different Loan Types

The following table displays average interest rates for different types of student loans. These are approximate values and can vary depending on the lender and the borrower’s circumstances. Always check with the lender for the most current and accurate rates.

| Loan Type | Average Interest Rate (Example) | Fixed/Variable | Notes |

|---|---|---|---|

| Federal Subsidized Undergraduate | 4.5% | Fixed | Interest does not accrue while in school |

| Federal Unsubsidized Undergraduate | 5.0% | Fixed | Interest accrues while in school |

| Federal Graduate PLUS | 6.5% | Fixed | Higher rate for graduate studies |

| Private Undergraduate | 7.0% – 12.0% | Fixed or Variable | Rate varies greatly depending on creditworthiness |

Federal Student Loan Interest Rates

Federal student loan interest rates are a crucial factor influencing the overall cost of higher education for millions of Americans. Understanding how these rates are determined and how they have fluctuated over time is essential for prospective and current borrowers to effectively manage their debt. This section delves into the specifics of federal student loan interest rates, providing historical context and insights into the rate-setting process.

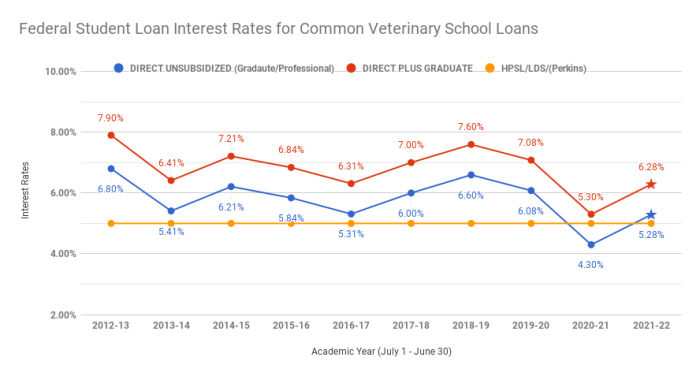

The government sets interest rates for federal student loans based on a complex interplay of economic factors and congressional legislation. Unlike private loans, which are influenced by market forces and the creditworthiness of the borrower, federal student loan interest rates are typically tied to market indices, such as the 10-year Treasury note. However, Congress also plays a significant role, setting statutory caps and occasionally intervening to adjust rates directly. This blend of market mechanisms and legislative control results in a dynamic system where interest rates can change yearly, or even mid-year in some cases.

Historical Trends in Federal Student Loan Interest Rates

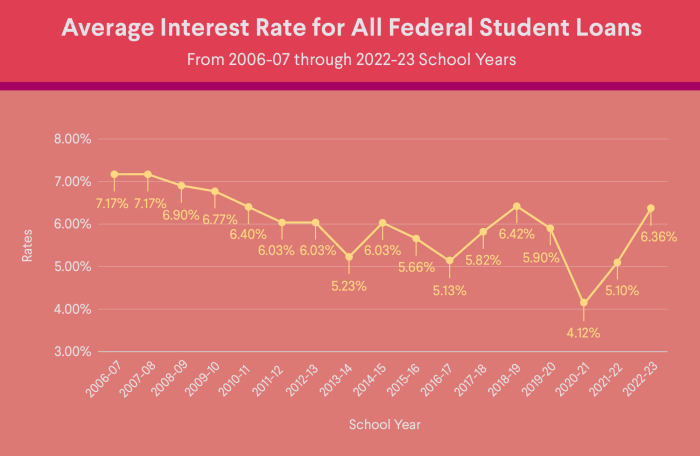

The average interest rate on federal student loans has not remained static. Over the past decade, rates have experienced both increases and decreases, reflecting broader economic conditions and policy decisions. For example, rates generally trended downward following the 2008 financial crisis, before gradually rising in subsequent years. These fluctuations directly impact the total amount borrowers ultimately repay.

A text-based representation of this trend could be visualized as follows:

Federal Student Loan Interest Rate Trends (Simplified Example):

Year | Average Interest Rate (Approximate)

2014 | 4.66%

2015 | 4.29%

2016 | 3.76%

2017 | 3.76%

2018 | 4.45%

2019 | 4.53%

2020 | 2.75%

2021 | 2.75%

2022 | 3.73%

2023 | 5.04% (as of July)

Note: These figures are simplified examples and do not represent precise historical data. Actual rates varied depending on the loan type and the borrower’s circumstances. Detailed, precise data can be obtained from the official government sources.

Undergraduate vs. Graduate Federal Student Loan Interest Rates

Generally, interest rates for graduate federal student loans tend to be higher than those for undergraduate loans. This difference reflects the higher amount borrowed for graduate studies and potentially higher repayment risk associated with graduate programs. For example, while the interest rate for a subsidized undergraduate loan might be 4%, a graduate PLUS loan might carry a rate of 7%. The specific difference in rates can vary depending on the year and the prevailing economic conditions. This variation highlights the importance of careful financial planning for both undergraduate and graduate students.

Private Student Loan Interest Rates

Private student loans, unlike federal loans, are offered by private lenders such as banks and credit unions. Their interest rates are typically variable and significantly influenced by a borrower’s creditworthiness. Understanding these rates is crucial for making informed borrowing decisions.

Private student loan interest rates are determined by a complex interplay of factors, making them less predictable than federal loan rates. The lender assesses the risk associated with lending to a particular borrower, and this risk directly impacts the interest rate offered. Lower risk translates to lower rates, and vice-versa.

Factors Determining Private Student Loan Interest Rates

Several key factors contribute to the interest rate a borrower receives on a private student loan. These factors are carefully weighed by the lender to determine the appropriate level of risk and associated interest rate. A higher risk profile generally results in a higher interest rate.

- Credit Score: A higher credit score demonstrates a history of responsible borrowing and repayment, indicating lower risk to the lender. Borrowers with excellent credit scores typically qualify for lower interest rates.

- Credit History: Length of credit history and responsible payment patterns are vital. A longer history with a consistent record of on-time payments shows financial stability and reduces the lender’s perceived risk.

- Debt-to-Income Ratio: This ratio compares a borrower’s total debt to their income. A lower ratio suggests a greater ability to manage repayments, leading to potentially lower interest rates.

- Co-signer: Including a co-signer with a strong credit history can significantly improve a borrower’s chances of securing a lower interest rate. The co-signer assumes responsibility for repayment if the primary borrower defaults.

- Loan Amount and Term: Larger loan amounts and longer repayment terms generally carry higher interest rates due to increased risk for the lender.

- Type of Loan: The type of private student loan, such as undergraduate or graduate, may also influence the interest rate offered. Graduate loans may sometimes carry higher rates due to potentially higher loan amounts.

- Current Market Conditions: Prevailing interest rates in the overall financial market influence private student loan rates. When market rates rise, private loan rates tend to follow suit.

Key Differences Between Private and Federal Student Loan Interest Rate Structures

The primary difference lies in the rate setting mechanism. Federal student loan interest rates are often set by the government and are generally fixed for the life of the loan, offering predictability. Private student loan rates, however, are set by the lender and are often variable, meaning they can fluctuate over time based on market conditions. This variability adds an element of uncertainty to repayment planning. Furthermore, federal loans often offer more favorable interest rates, particularly for students with limited or no credit history.

Examples of Credit Scores and Co-signers Affecting Interest Rates

Let’s consider two hypothetical scenarios:

Scenario 1: A borrower with a 750 credit score might qualify for a private student loan with an interest rate of 6%.

Scenario 2: A borrower with a 600 credit score might face an interest rate of 10% or higher, or might require a co-signer to secure a more favorable rate. With a co-signer possessing a 750 credit score, the interest rate could potentially drop to 7%. The co-signer’s excellent credit mitigates the risk associated with the borrower’s lower credit score.

Common Terms and Definitions Related to Private Student Loan Interest Rates

Understanding these terms is essential for navigating the complexities of private student loan financing.

- Fixed Interest Rate: An interest rate that remains constant throughout the loan term.

- Variable Interest Rate: An interest rate that fluctuates based on market conditions.

- Annual Percentage Rate (APR): The annual cost of borrowing, including interest and fees.

- Interest Capitalization: The process of adding unpaid interest to the principal loan balance, increasing the total amount owed.

- Default: Failure to make loan payments as agreed upon.

- Co-signer: An individual who agrees to share responsibility for loan repayment.

Impact of Interest Rates on Repayment

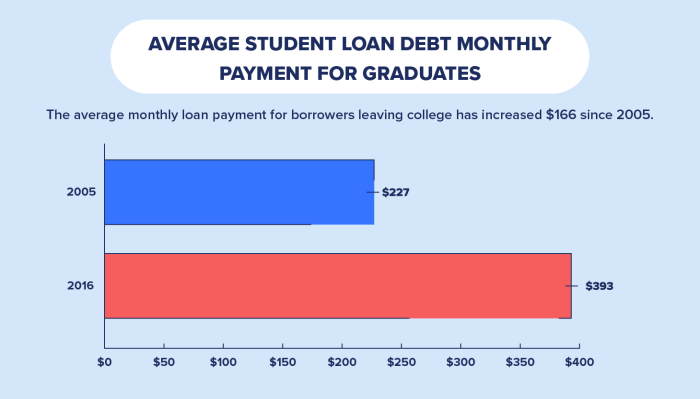

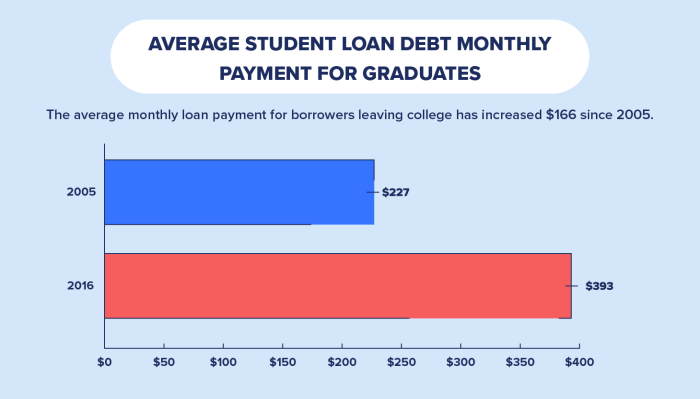

Understanding how interest rates affect your student loan repayment is crucial for effective financial planning. Higher interest rates significantly increase the total amount you’ll pay back, while lower rates lead to substantial savings over the life of the loan. This section will explore the relationship between interest rates and repayment, highlighting various repayment plans and the impact of loan capitalization.

Interest rates directly influence the total cost of your student loans. The higher the interest rate, the more you’ll pay in interest charges over the life of the loan. This is because interest is calculated on the outstanding principal balance, meaning that as you make payments, the interest portion remains a significant component, especially in the early stages of repayment. Conversely, a lower interest rate reduces the total interest accrued, ultimately saving you money.

Repayment Plans and Interest Rate Influence

Different repayment plans affect your monthly payments and the total interest paid. Standard repayment plans typically involve fixed monthly payments over a set period (usually 10 years). Income-driven repayment (IDR) plans, on the other hand, adjust your monthly payments based on your income and family size. While IDR plans often result in lower monthly payments, they usually extend the repayment period, potentially leading to higher total interest paid due to the longer repayment timeframe. Interest rates play a significant role in determining the monthly payment amount for any given plan. A higher interest rate will result in higher monthly payments for a standard plan and may even increase the payment amount for IDR plans, despite income-based adjustments.

Loan Capitalization and Interest Accumulation

Loan capitalization is the process of adding unpaid interest to the principal balance of your loan. This typically occurs when you’re in deferment or forbearance, periods where you’re not required to make payments. Capitalizing your interest increases the principal amount, resulting in higher future interest charges and ultimately a higher total repayment cost. For example, if you have $10,000 in outstanding loan principal and $1,000 in accumulated interest, capitalization would increase your principal to $11,000. Future interest calculations will then be based on this higher amount, leading to a snowball effect of increasing interest charges. The impact of capitalization is exacerbated by higher interest rates, as the interest accumulating during deferment or forbearance will be greater.

Scenario: 5% vs. 7% Interest Rate

Let’s consider a scenario with a $20,000 student loan. Under a standard 10-year repayment plan, a 5% interest rate would result in a total repayment cost significantly lower than a 7% interest rate. While precise figures depend on the specific repayment plan and compounding frequency, the difference can be substantial. For instance, a loan with a 5% interest rate might have a total repayment cost around $25,000, while a 7% interest rate could lead to a total cost closer to $28,000 or even more, depending on the exact terms. This illustrates the significant impact even a seemingly small difference in interest rates can have on the overall cost of repayment. The extra $3,000 or more in interest paid under the higher rate represents a considerable financial burden over the repayment period.

Resources for Finding Interest Rate Information

Securing accurate and up-to-date information on student loan interest rates is crucial for prospective and current borrowers. Understanding these rates allows for informed decision-making regarding loan selection and repayment strategies. Several reliable sources provide this critical information.

Finding the precise interest rate for your student loan requires checking several sources, as rates vary depending on the type of loan, lender, and your creditworthiness. This information is usually readily available but requires knowing where to look.

Government Websites Providing Student Loan Interest Rate Information

The federal government is a primary source for information on federal student loan interest rates. These rates are set by law and are typically published annually. Finding this information is generally straightforward.

- Federal Student Aid (FSA): The FSA website, studentaid.gov, offers comprehensive details on federal student loan programs, including current and historical interest rates. They provide clear explanations of the various loan types and their associated rates, often with interactive tools to help estimate costs.

- National Student Loan Data System (NSLDS): NSLDS, accessible through studentaid.gov, allows borrowers to access their loan information, including the interest rate for each loan they hold. This is a secure portal providing personalized details.

Reputable Financial Institutions Offering Student Loan Information

While government websites provide information on federal loans, private lenders also offer student loan options. These institutions usually publish their current interest rate ranges on their websites. It is important to compare offers from multiple lenders to find the best terms.

- Major Banks and Credit Unions: Many large financial institutions offer student loans. Their websites often include sections dedicated to student loan products, listing interest rate ranges and associated terms and conditions. These rates are usually variable and depend on the applicant’s credit score and other financial factors.

- Specialized Student Loan Lenders: Several companies focus exclusively on student loans. These lenders may offer competitive rates or cater to specific student populations (e.g., graduate students, medical students). Their websites usually feature details on their current interest rate offerings.

Information Found on a Student Loan Disclosure Statement

A student loan disclosure statement, provided before you accept a loan, is a critical document containing all the essential terms and conditions of the loan agreement. It provides a detailed breakdown of the loan’s financial aspects.

The disclosure statement will clearly state the interest rate (fixed or variable), the interest rate calculation method (simple or compound interest), and the annual percentage rate (APR). The APR incorporates the interest rate and other loan fees, offering a comprehensive representation of the total borrowing cost. Additionally, the statement will specify the loan’s repayment terms, including the monthly payment amount, the loan’s total repayment period, and any associated fees or charges. It is crucial to carefully review this document before signing any loan agreement.

Final Review

Ultimately, understanding the average interest rate on student loans is crucial for responsible financial planning. By comprehending the various factors at play—loan type, credit history, and repayment options—you can make informed decisions that minimize long-term costs and pave the way for a smoother repayment journey. Remember to utilize the resources provided to stay abreast of current rates and explore options that best suit your individual circumstances.

FAQ Explained

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and certain deferment periods. Unsubsidized loans accrue interest throughout your entire loan term.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing can potentially lower your interest rate, but it often involves switching from federal to private loans, potentially losing federal protections.

How does my credit score affect my private student loan interest rate?

A higher credit score generally qualifies you for lower interest rates on private student loans. A lower score may result in higher rates or even loan denial.

What is loan forgiveness?

Loan forgiveness programs, often tied to public service or specific professions, can eliminate portions or all of your student loan debt under certain conditions. Eligibility criteria vary widely.