Navigating the world of student loans can feel like traversing a complex maze. Understanding the key distinctions between federal and private student loans is crucial for making informed decisions about financing your education. This guide will illuminate the core differences, helping you choose the best path for your financial future.

From interest rates and repayment options to loan forgiveness programs and default consequences, we’ll explore the intricacies of each loan type. By the end, you’ll possess a clearer understanding of the advantages and disadvantages of both federal and private student loans, empowering you to make well-informed choices.

Lender and Repayment

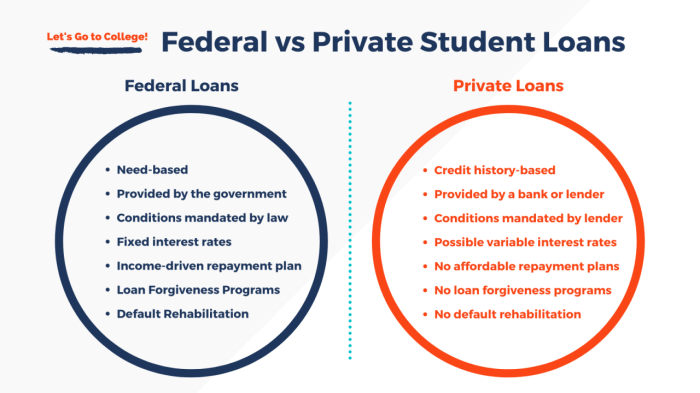

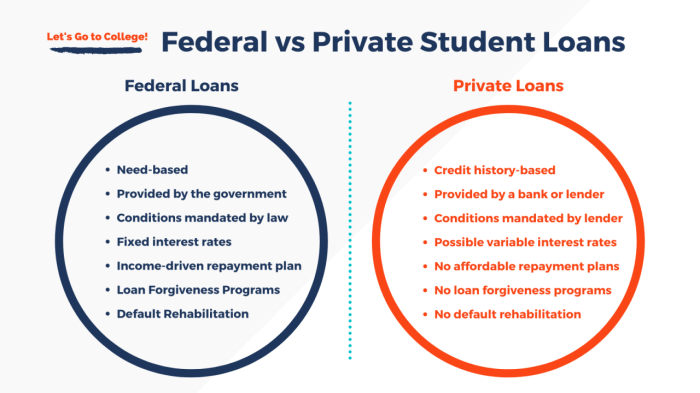

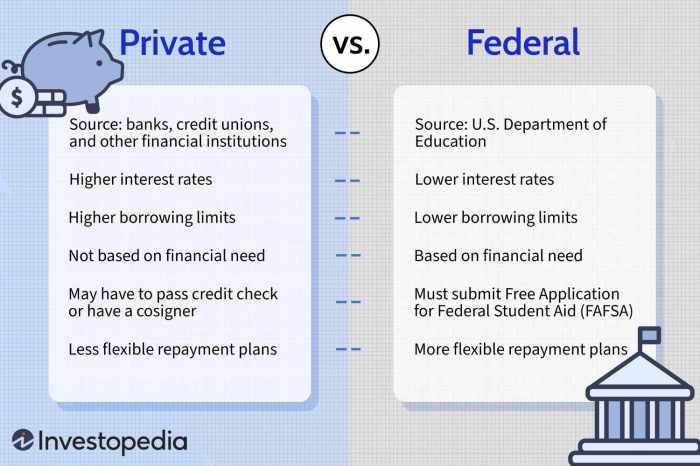

Understanding the differences in lenders and repayment options between federal and private student loans is crucial for effective financial planning. The source of the funds and the subsequent repayment terms significantly impact a borrower’s long-term financial health.

Federal Student Loan Lenders and Repayment Plans

Federal student loans are disbursed by the U.S. Department of Education. This means the government is your lender. This offers several advantages, including various repayment plans designed to accommodate different financial situations. The repayment plans are structured to balance affordability with timely repayment.

Several repayment plans are available for federal student loans. These include:

- Standard Repayment: Fixed monthly payments over 10 years.

- Graduated Repayment: Payments start low and gradually increase over 10 years.

- Extended Repayment: Payments are spread over a longer period (up to 25 years), resulting in lower monthly payments but higher overall interest paid.

- Income-Driven Repayment (IDR): Monthly payments are calculated based on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically offer lower monthly payments and potentially loan forgiveness after 20-25 years, depending on the plan and income.

For example, a borrower with a $30,000 federal loan might choose the standard repayment plan with fixed monthly payments around $300, or an IDR plan resulting in significantly lower initial monthly payments, but potentially a longer repayment period.

Private Student Loan Lenders and Repayment Terms

Private student loans, unlike federal loans, are provided by private lenders such as banks, credit unions, and online lenders. These lenders assess your creditworthiness and set repayment terms based on your individual credit history and risk profile. This means repayment options can vary significantly between lenders and borrowers.

Private loan repayment options are generally less flexible than federal loan options. Typical repayment terms include:

- Fixed-rate loans: Consistent monthly payments throughout the loan term.

- Variable-rate loans: Monthly payments fluctuate based on market interest rates.

Repayment periods usually range from 5 to 15 years, although some lenders might offer longer terms. Unlike federal loans, income-driven repayment plans are generally not available for private student loans.

For instance, a borrower with a $30,000 private loan might face a fixed monthly payment of $400 over 10 years, or a higher payment if they opt for a shorter repayment period.

Repayment Flexibility Comparison

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Repayment Plans | Standard, Graduated, Extended, Income-Driven | Typically fixed or variable rate, limited options |

| Deferment/Forbearance | Available under specific circumstances | May be available, but terms vary greatly by lender |

| Loan Forgiveness | Potential for forgiveness after 20-25 years under certain IDR plans | Generally no loan forgiveness programs |

| Interest Rates | Fixed or variable, generally lower than private loans | Generally higher than federal loans, can be fixed or variable |

Interest Rates and Fees

Understanding the differences in interest rates and fees between federal and private student loans is crucial for responsible borrowing. These costs significantly impact the total amount you’ll repay over the life of your loan. Federal loans generally offer more favorable terms, but private loans can be necessary for students who need additional funding beyond what federal aid provides.

Interest rates and fees are determined differently for federal and private student loans, reflecting varying risk assessments and government regulations. Federal loans usually have fixed interest rates, while private loan rates are variable and can fluctuate with market conditions. Creditworthiness also plays a significant role in determining the interest rate offered on private loans.

Federal Student Loan Interest Rates

Federal student loan interest rates are set by the government and are typically lower than private loan rates. These rates are often fixed for the life of the loan, providing borrowers with predictable monthly payments. The specific interest rate depends on the type of federal loan (e.g., subsidized or unsubsidized Stafford Loans, PLUS Loans), the loan’s disbursement date, and the borrower’s repayment plan. For example, the interest rate on a subsidized Stafford loan might be lower than that on an unsubsidized Stafford loan because the government subsidizes the interest during periods of deferment. The government periodically adjusts these rates, usually annually.

Private Student Loan Interest Rates

Private student loan interest rates are variable and depend heavily on the borrower’s creditworthiness, including credit score, credit history, and debt-to-income ratio. Lenders assess the risk of lending to each individual borrower, resulting in a wider range of interest rates compared to federal loans. A borrower with a high credit score and a strong credit history is likely to qualify for a lower interest rate, while a borrower with a poor credit history may face significantly higher rates or even loan denial. These rates can also be fixed or variable, depending on the lender and the loan terms. A variable rate means the interest rate can change over time based on market fluctuations, potentially leading to unpredictable monthly payments.

Impact of Credit Scores on Private Student Loan Interest Rates

A borrower’s credit score is a critical factor in determining the interest rate they receive on a private student loan. Lenders use credit scores to assess the risk of default. A higher credit score generally indicates a lower risk, leading to a lower interest rate. Conversely, a lower credit score signals a higher risk, resulting in a higher interest rate or potential loan rejection. For instance, a borrower with a credit score above 750 might receive a significantly lower interest rate compared to a borrower with a credit score below 650. It is therefore beneficial for students to build a strong credit history before applying for private student loans.

Common Fees Associated with Federal and Private Student Loans

Both federal and private student loans may involve various fees. Federal loans often have minimal fees, if any, beyond the interest charged on the principal loan amount. Private loans, however, often include origination fees, which are charged upfront and reduce the amount of money the borrower actually receives. Late payment fees are also common for both federal and private loans, and can significantly increase the overall cost of borrowing. Private loans may also have prepayment penalties, though this is less common.

Comparison of Interest Rate Ranges and Fee Structures

- Federal Student Loans: Typically lower, fixed interest rates. Minimal fees, often only interest on the principal loan amount. Late payment fees may apply.

- Private Student Loans: Variable interest rates, significantly impacted by credit score. Higher interest rates compared to federal loans are common. Origination fees, late payment fees, and potentially prepayment penalties can apply. The specific fees vary considerably by lender.

Loan Forgiveness and Deferment

Navigating student loan repayment can be complex, particularly understanding the differences between federal and private loan options regarding forgiveness and deferment. Federal student loans offer a range of forgiveness programs and deferment options unavailable to borrowers with private loans. This section clarifies these distinctions.

Federal Loan Forgiveness Programs

Several federal loan forgiveness programs exist, each with specific eligibility requirements. These programs aim to reduce or eliminate student loan debt for borrowers who meet certain criteria, often related to public service or specific career paths. The availability and specifics of these programs can change, so it’s crucial to check the official government website for the most up-to-date information.

Eligibility Requirements for Federal Loan Deferment and Forbearance

Federal student loans offer deferment and forbearance options to borrowers experiencing temporary financial hardship. Deferment postpones payments and may or may not accrue interest depending on the type of loan and reason for deferment. Forbearance allows for temporary suspension of payments but typically accrues interest. Eligibility generally requires demonstrating financial hardship, such as unemployment or documented medical expenses. Specific documentation requirements vary depending on the type of deferment or forbearance requested.

Examples of Federal Loan Forgiveness Application

The Public Service Loan Forgiveness (PSLF) program, for example, forgives the remaining balance on Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. The Teacher Loan Forgiveness program cancels up to $17,500 in student loans for teachers who have taught full-time for five consecutive academic years in a low-income school or educational service agency. These are just two examples; other programs exist with different criteria.

Options for Borrowers Facing Financial Hardship with Private Student Loans

Private student loan lenders generally offer fewer options for borrowers facing financial hardship. While some may offer temporary forbearance or hardship plans, these are often less flexible and more restrictive than federal loan programs. Negotiating directly with the private lender is crucial to explore available options. It’s important to document financial hardship thoroughly and proactively communicate with the lender to avoid default.

Comparison of Federal and Private Loan Forgiveness Benefits and Drawbacks

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Loan Forgiveness Programs | Multiple programs available, such as PSLF and Teacher Loan Forgiveness, with potential for complete debt cancellation. | Limited or no loan forgiveness programs. |

| Deferment/Forbearance | Various options available for temporary payment suspension, with some deferments not accruing interest. | Fewer options, often with stricter eligibility requirements and accruing interest during forbearance. |

| Eligibility Requirements | Vary depending on the program, but often involve public service, teaching, or documented financial hardship. | Typically require demonstrating significant financial hardship and negotiation with the lender. |

| Income-Driven Repayment Plans | Several income-driven repayment plans are available, potentially lowering monthly payments. | Generally not available for private student loans. |

Default and Consequences

Defaulting on student loans, whether federal or private, carries significant consequences that can impact your financial well-being for years to come. Understanding these differences is crucial for responsible loan management. The severity of the consequences and the collection methods employed vary considerably depending on the type of loan.

Consequences of Defaulting on Federal Student Loans

Defaulting on a federal student loan triggers a cascade of negative events. The Department of Education reports the default to credit bureaus, resulting in a severely damaged credit score. This makes it difficult to obtain credit in the future, impacting your ability to secure loans for a car, house, or even a credit card. Furthermore, the government can garnish your wages, seize your tax refunds, and even suspend your professional licenses in certain fields. Your federal student aid eligibility will be revoked, meaning no further federal student loans or grants will be available. The government may also pursue legal action to recover the debt, including wage garnishment and potentially even legal judgments. The amount owed will continue to accrue interest and fees, significantly increasing the overall debt.

Consequences of Defaulting on Private Student Loans

Defaulting on a private student loan has similarly severe repercussions, though the specific consequences may vary depending on the lender and the terms of your loan agreement. Private lenders also report defaults to credit bureaus, damaging your credit score and making it difficult to obtain future credit. Collection agencies may be employed to pursue repayment, potentially resulting in phone calls, letters, and even legal action. While wage garnishment is less common with private loans than federal loans, lenders can still pursue legal action to seize assets or obtain a court judgment against you. Late fees and penalties will continue to accrue, increasing the total amount owed. The lender might also pursue other collection methods, such as selling the debt to a collection agency.

Collection Methods for Federal and Private Student Loans

The collection methods employed for federal and private student loans differ somewhat. The Department of Education handles the collection of defaulted federal student loans, often employing various strategies such as wage garnishment, tax refund offset, and legal action. Private lenders often utilize collection agencies to recover defaulted debts. These agencies employ a range of tactics, from phone calls and letters to legal action. While both federal and private lenders can pursue legal action, the legal processes and available remedies may vary. Federal loans often have more stringent collection mechanisms due to government backing.

Impact of Default on Credit Scores

Defaulting on either federal or private student loans will significantly damage your credit score. A default remains on your credit report for seven years, making it challenging to secure loans, rent an apartment, or even obtain certain jobs. The negative impact on your credit score can make it harder to obtain favorable interest rates on future loans and can significantly impact your financial life for many years. The severity of the impact depends on factors such as your existing credit history and the amount of the defaulted loan. For instance, a large defaulted student loan will have a more significant negative impact than a smaller one.

Comparison of Potential Consequences

| Consequence | Federal Student Loan Default | Private Student Loan Default |

|---|---|---|

| Credit Score Impact | Severe negative impact, reported to credit bureaus | Severe negative impact, reported to credit bureaus |

| Wage Garnishment | Possible | Less common, but possible through legal action |

| Tax Refund Offset | Possible | Generally not applicable |

| Legal Action | Possible, including lawsuits and judgments | Possible, initiated by the lender or a collection agency |

| Collection Methods | Department of Education, various methods | Lender or collection agency, varied methods |

Government Regulations and Protections

Federal and private student loans differ significantly in the level of government oversight and the protections afforded to borrowers. Understanding these differences is crucial for making informed borrowing decisions and navigating the complexities of repayment. Federal loans benefit from robust government regulations designed to protect borrowers, while private loans offer fewer safeguards.

Federal student loans are subject to extensive government regulations aimed at ensuring fair lending practices and protecting borrowers’ rights. This contrasts sharply with the limited oversight of private student loans, where the responsibility for borrower protection largely rests with individual lenders and state laws, which can vary significantly. This difference in regulatory frameworks leads to significant disparities in borrower protections and the recourse available in case of disputes.

Consumer Protections for Federal Student Loan Borrowers

The federal government provides numerous protections for borrowers of federal student loans. These protections are designed to prevent predatory lending practices and ensure fair treatment throughout the loan lifecycle. Key protections include fixed interest rates, which remain constant throughout the loan term, preventing unexpected increases; income-driven repayment plans, which allow borrowers to adjust their monthly payments based on their income and family size; and loan forgiveness programs, which can eliminate a portion or all of the loan balance under specific circumstances, such as working in public service. Furthermore, robust borrower protections are in place during periods of financial hardship, allowing for deferment or forbearance, temporary suspensions of payments, to prevent default. The government also actively monitors lenders and enforces compliance with regulations, providing recourse for borrowers who believe they have been treated unfairly. Finally, a comprehensive process exists for resolving disputes, including mediation and arbitration, ensuring fair resolution of any disagreements.

Limited Government Oversight of Private Student Loans

In contrast to federal loans, private student loans are subject to significantly less government regulation. The lack of a centralized regulatory body leads to inconsistencies in lending practices and borrower protections across different lenders. Private lenders are not bound by the same consumer protection laws and regulations as federal lenders, resulting in potential for higher interest rates, less flexible repayment options, and fewer avenues for dispute resolution. While some states have implemented their own regulations for private student loans, these regulations vary considerably, leading to a fragmented and less protective landscape for borrowers. This lack of uniform federal oversight means borrowers must carefully research and compare lenders to identify those with the most favorable terms and strongest consumer protections.

Comparison of Regulatory Frameworks

The regulatory frameworks governing federal and private student loans differ substantially. Federal student loans are subject to comprehensive federal regulations enforced by agencies like the Department of Education, ensuring consistent protections and recourse for borrowers. These regulations cover various aspects of the loan lifecycle, from origination to repayment, including interest rate caps, repayment plan options, and default prevention measures. Private student loans, however, are primarily governed by state laws and individual lender policies, leading to a lack of uniformity and potentially weaker consumer protections. This difference in regulatory oversight directly impacts the rights and protections afforded to borrowers.

Differences in Borrower Rights and Protections

Federal student loan borrowers enjoy a wider range of rights and protections compared to their private loan counterparts. These include access to income-driven repayment plans, loan forgiveness programs, and robust dispute resolution mechanisms. Federal loans also often come with fixed interest rates and transparent fees, offering predictability and minimizing the risk of unexpected costs. Private student loans, on the other hand, may offer less flexible repayment options, higher interest rates that can fluctuate, and limited protections against predatory lending practices. The lack of standardized regulations for private loans means borrowers bear a greater responsibility for understanding the terms and conditions of their loan agreements and carefully evaluating the lender’s reputation.

Government’s Role in Managing Federal Student Loans

The federal government plays a central role in managing and regulating federal student loans. This includes setting interest rates, establishing repayment plans, overseeing loan servicing, and enforcing borrower protections. The government also funds and administers various loan forgiveness and repayment assistance programs. Through agencies like the Department of Education, the government actively monitors lenders to ensure compliance with regulations and provides resources and support to borrowers. This direct government involvement ensures accountability and safeguards the interests of borrowers. This contrasts sharply with the limited role of the government in managing private student loans, where the responsibility for loan administration and borrower protection rests primarily with the lenders themselves.

Last Recap

Choosing between federal and private student loans requires careful consideration of your individual circumstances and financial goals. While federal loans offer significant borrower protections and flexible repayment plans, private loans might provide access to larger loan amounts. Ultimately, a thorough understanding of the key distinctions Artikeld in this guide will enable you to make a decision that aligns with your long-term financial well-being.

Question Bank

What happens if I can’t repay my private student loan?

Defaulting on a private student loan can severely damage your credit score and lead to aggressive collection efforts, including wage garnishment and lawsuits. There are fewer protections than with federal loans.

Can I consolidate my federal and private student loans?

You cannot consolidate federal and private student loans together. Federal loan consolidation is limited to federal loans only. Private loan consolidation may be possible through a private lender.

Are there income-driven repayment plans for private student loans?

No, income-driven repayment plans are only available for federal student loans. Private lenders do not typically offer such options.

What is the difference in the application process?

Federal student loan applications are typically completed through the Free Application for Federal Student Aid (FAFSA). Private loan applications require a credit check and often involve a more extensive application process.